Green Premium Products Market Size, Share, Trends, Industry Analysis Report

: By Product Type (Organic & Sustainable Food, Eco-Friendly Packaging Materials, Green Building Materials, Sustainable Apparel & Textiles, and Others), Consumer Type, Distribution Channel, Certification, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5590

- Base Year: 2024

- Historical Data: 2020-2023

Green Premium Products Market Overview

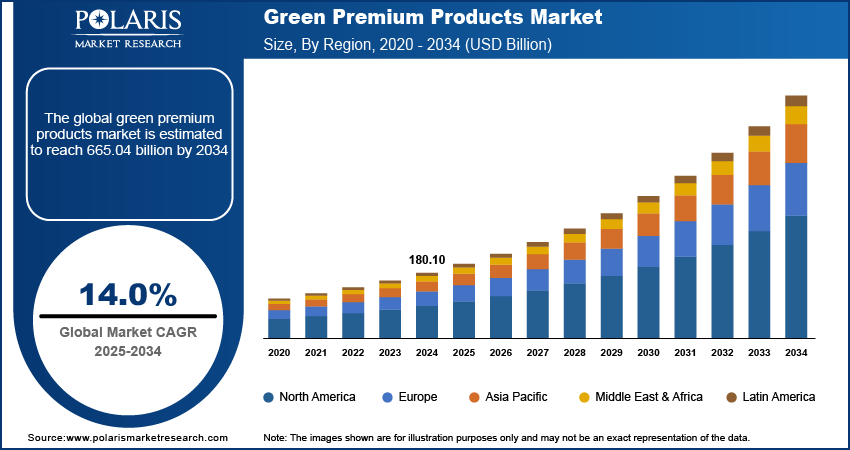

The global green premium products market size was valued at USD 180.10 billion in 2024 and is expected to reach USD 204.51 billion by 2025 and USD 665.04 billion by 2034, exhibiting a CAGR of 14.0% during 2025–2034.

The green premium products market refers to the segment of goods and services that are environmentally sustainable, ethically produced, and often carry a higher price point known as the “green premium” compared to conventional alternatives. These products appeal to consumers willing to pay more for reduced environmental impact, enhanced energy efficiency, or eco-conscious materials. The market spans sectors such as food and beverage, apparel, personal care, consumer electronics, and building materials, where sustainable practices and clean technologies are embedded across production, packaging, and distribution processes. Increasing concern over climate change, carbon emissions, and plastic pollution is shifting consumer preferences toward sustainable alternatives, which is further contributing to the green premium products market demand.

To Understand More About this Research: Request a Free Sample Report

Businesses integrating sustainability into their supply chains and branding strategies are boosting green product availability and credibility. Additionally, an expanding segment of ethically driven consumers is showing an increased willingness to pay a premium for verified eco-friendly goods, fueling green premium products market expansion.

Green Premium Products Market Dynamics

Government Regulations & Incentives

Stringent environmental regulations and proactive policy frameworks are significantly contributing to demand for green premium products. In October 2023, The EU implemented CBAM (Carbon Border Tax), imposing tariffs on the imports of steel, cement, aluminum, and other products based on their carbon footprint. This pushes companies to adopt low-carbon alternatives, boosting demand for green premium products in manufacturing. Government initiatives such as carbon pricing, green tax benefits, extended producer responsibility (EPR), and mandatory eco-labeling are incentivizing manufacturers to adopt sustainable practices. Public procurement policies favoring eco-certified products are amplifying demand, particularly in construction, electronics, and consumer goods. Regulatory alignment with sustainability standards such as Energy Star, LEED, and Fair Trade is enhancing transparency and consumer trust. This policy-driven momentum is facilitating compliance and also stimulating green premium products market growth across both developed and emerging economies.

Advancements in Sustainable Materials

Advancements in sustainable material science are improving cost-efficiency, scalability, and product performance. Government initiatives for carbon neutralization are driving manufacturers to adopt bio-based polymers, biodegradable packaging, recycled textiles, and low-emission composites to meet changing sustainability benchmarks. For instance, in January 2024, the US Department of Energy allocated USD 200 million in funding for research and development of bio-based materials. The initiative aims to advance the development of carbon-negative construction materials and enhance the functionality and recyclability of plastics. Moreover, reduced lifecycle emissions and improved recyclability of materials are directly addressing consumer concerns over environmental impact. These material innovations are eliminating previous trade-offs between sustainability and quality, driving wider integration across industries such as fashion, electronics, and construction. The shift toward circular design principles and green manufacturing is unlocking new green premium products market opportunities while strengthening environmentally conscious brand positioning.

Green Premium Products Market Segment Insights

Green Premium Products Market Assessment by Product Type Outlook

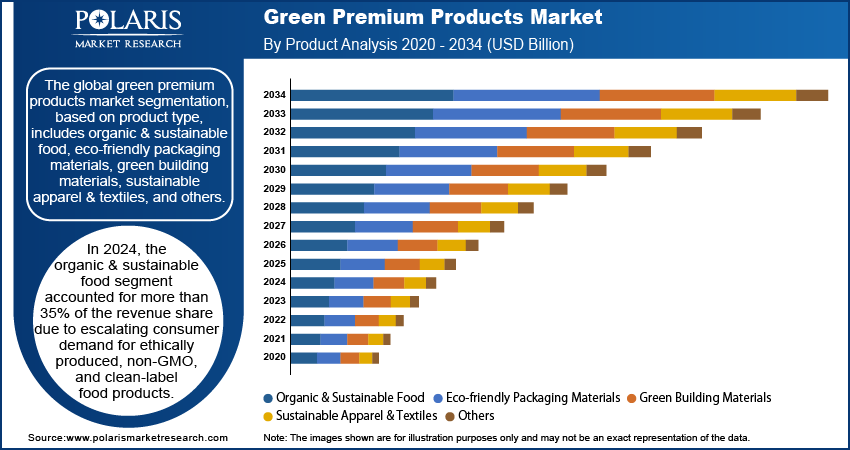

The global green premium products market segmentation, based on product type, includes organic & sustainable food, eco-friendly packaging materials, green building materials, sustainable apparel & textiles, and others. In 2024, the organic & sustainable food segment accounted for more than 35% of the green premium products market revenue share due to the rising consumer demand for ethically produced, non-GMO, and clean-label food products. Consumers are increasingly inspecting sourcing methods, carbon footprints, and ingredient integrity, prompting retailers and brands to upscale offerings that meet organic certifications and sustainability benchmarks. Supply chain digitization and blockchain traceability have further strengthened buyer confidence, enabling price premiums and market loyalty. Retail partnerships and omnichannel retail solutions are amplifying reach, solidifying this segment’s position in overall market dynamics and making it the largest contributor to market revenue in 2024.

The eco-friendly packaging materials segment is expected to witness the highest CAGR over the forecast period due to heightened regulatory scrutiny around single-use plastics and mounting pressure on brands to demonstrate environmental accountability. Innovations in compostable bioplastics and biopolymer, molded fiber, and cellulose-based films are enabling scalable adoption without compromising functionality. Brand differentiation through low-impact packaging has become a strategic imperative, especially in consumer goods, food, and e-commerce sectors. Manufacturers are also leveraging life cycle analysis (LCA) and recyclability indices to improve environmental performance metrics. These evolving dynamics are positioning the eco-friendly packaging materials segment as the fastest-growing contributor to the market.

Green Premium Products Market Evaluation by Consumer Type Outlook

The global green premium products market segmentation, based on consumer type, includes individual consumers, businesses & institutions, government, and others. According to the green premium products market statistics, the individual consumers segment accounted for more than 54% of the revenue share in 2024. Shifting lifestyle values toward sustainability, wellness, and ethical consumption led to an upsurge in individual-level adoption of green premium products. Millennials and Gen Z cohorts, in particular, are displaying strong brand allegiance to companies that embody environmental and social responsibility, fueling direct-to-consumer sales models. Subscription boxes, e-commerce platforms, and targeted influencer marketing are accelerating product penetration in personal care, food, and fashion categories. Enhanced awareness of climate impact and growing access to eco-certified alternatives are reinforcing the purchasing power of this demographic, establishing individual consumers as the dominant force in shaping green premium products market demand in 2024.

The freelancers & creators segment is expected to register the highest CAGR over the forecast period. Increasing pressure to align with environmental, social, and governance (ESG) criteria is pushing businesses and institutions to integrate green premium products into gaining strategies. Corporations are redesigning supply chains, sourcing sustainable materials, and adopting green-certified infrastructure to meet internal decarbonization goals and stakeholder expectations. Green office supplies, low-emission construction materials, and sustainable uniforms are gaining traction across sectors including hospitality, education, and finance. Institutional mandates and public reporting standards are also compelling large buyers to transition from conventional to environmentally responsible alternatives. These systemic shifts are catalyzing rapid growth in the B2B segment of the market.

Green Premium Products Market Regional Analysis

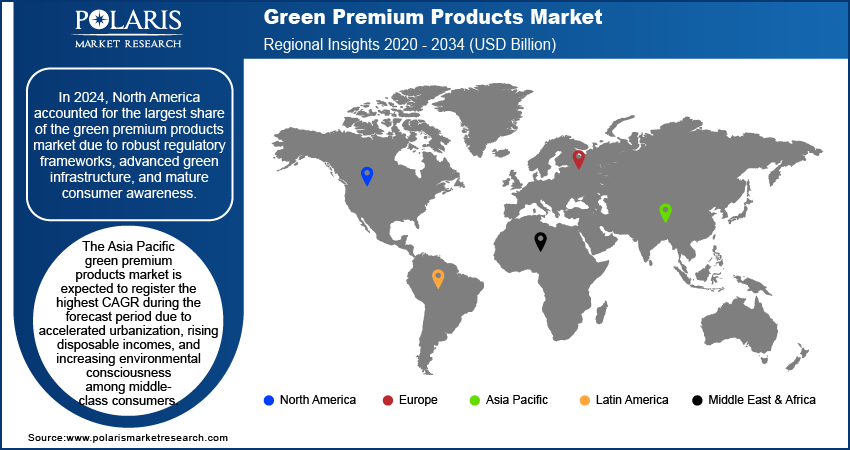

By region, the study provides green premium products market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, North America dominated the green premium products market share due to robust regulatory frameworks, advanced green infrastructure, and mature consumer awareness. Widespread institutional adoption of ESG mandates, coupled with strong sustainability commitments from corporations, has elevated demand across various sectors, including food, packaging, construction, and apparel. Furthermore, high per capita spending on eco-labeled and ethically sourced goods, supported by a thriving e-commerce ecosystem, is driving product accessibility and brand engagement. Government-backed incentives such as LEED certifications, clean energy subsidies, and tax credits are supporting regional leadership, while investor pressure on sustainability disclosures continues to influence corporate procurement strategies. In July 2024, the Biden-Harris Administration expanded the Federal Buy Clean Initiative, requiring federal projects to use low-carbon construction materials such as steel, concrete, and asphalt. Such government initiatives drive demand for green premium building products.

The Asia Pacific green premium products market is expected to register the highest CAGR during the forecast period due to accelerated urbanization, rising disposable incomes, and increasing environmental consciousness among middle-class consumers. Rapid growth in green construction projects, government mandates to phase out single-use plastics, and the proliferation of local sustainability-focused startups are fueling green premium products market expansion. Countries such as China, India, and Japan are implementing aggressive circular economy policies and green manufacturing incentives that are pushing businesses to transition toward sustainable inputs. For instance, in April 2023, India’s Extended Producer Responsibility Rules for E-Waste stated that electronics firms are required to recycle 70% of waste by 2025, driving demand for modular/repairable devices. Moreover, consumer preferences are also shifting, with younger demographics prioritizing health, ethical sourcing, and environmental impact, generating sustained demand for green premium products across food, fashion, and lifestyle segments.

Green Premium Products Market – Key Players & Competitive Analysis Report

The green premium products market exhibits a dynamic and highly competitive landscape characterized by continuous innovation, strategic alliances, and strong brand positioning. Key players are engaging in joint ventures and strategic investments to expand product offerings and secure sustainable supply chains. Mergers and acquisitions, such as Nestlé’s acquisition of organic brands and Danone’s investment in plant-based portfolios, are reshaping competitive boundaries while enabling post-merger integration of eco-centric capabilities. Strategic alliances between retailers and green product manufacturers are enhancing visibility and consumer access across global markets. Product mapping remains a critical tactic as companies seek to align offerings with shifting consumer priorities such as biodegradability, cruelty-free standards, and carbon neutrality. Both multinational corporations and small and medium-sized businesses (SMBs) are innovating across packaging, apparel, and clean food segments. Firms such as Tesla and Interface are redefining industry standards through premium, sustainability-driven design, while brands such as Allbirds and The Honest Company are leveraging direct-to-consumer models to drive differentiation. Increased ESG scrutiny is pushing companies to demonstrate traceability and sustainability across their operations, often leading to green labeling strategies and transparency frameworks.

Patagonia, Inc., established in 1973, is engaged in the design and retail of outdoor recreation clothing, equipment, and food. The company specializes in providing durable and functional apparel tailored for activities such as climbing, surfing, and camping. Its product portfolio includes outdoor clothing, camping food under its Patagonia Provisions division, and gear for various sports. Patagonia operates stores in over 10 countries and sources products from factories located across 16 countries. The company also offers repair services for its apparel through its Worn Wear program and helps circular economy practices by creating new products from used materials. Patagonia has a significant presence in North America, Europe, and parts of Asia Pacific.

Tesla, Inc., founded in 2003, is an American company engaged in the design, development, and manufacturing of electric vehicles (EVs), energy storage systems, and solar energy products. The company specializes in sustainable energy solutions with a focus on reducing reliance on fossil fuels. The company’s product portfolio includes electric cars such as the Model S, Model 3, Model X, and Model Y; energy storage products such as Powerwall and Powerpack; and solar panels integrated with energy solutions. Tesla also provides services such as EV charging through its Supercharger network and software updates for vehicle performance enhancements. The company has a global presence with manufacturing facilities in the US, China, and Germany and sales operations spanning North America, Europe, Asia-Pacific, and other regions.

List of Key Companies in Green Premium Products Market

- Apple

- Allbirds, Inc.

- Danone S.A.

- Ecoalf

- Ecover

- Ikea

- Lush Ltd.

- Natura &Co

- Nestlé S.A.

- Patagonia, Inc.

- Seventh Generation, Inc.

- Tesla, Inc.

- The Hain Celestial Group, Inc.

- The Honest Company, Inc.

- Unilever PLC

Green Premium Products Market Developments

In January 2025, IKEA launched the "ÅBÄCKEN" kitchen line, crafted from 100% recycled wood and renewable materials. This initiative reflects a commitment to sustainability by utilizing reclaimed resources to create functional and stylish kitchen solutions, aligning with environmental standards and circular economy principles.

In April 2023, Apple announced that it is committed to utilizing exclusively recycled cobalt in its battery production by 2025.

In July 2021, Unilever advanced its "Clean Future" initiative by introducing a new line of plant-based cleaning formulations. This expansion encompasses products under the Sunlight brand as well as innovative Eco Refills for Cif, aimed at reducing environmental impact while maintaining effective cleaning performance.

Green Premium Products Market Segmentation

By Product Type Outlook (Revenue – USD Billion, 2020–2034)

- Organic & Sustainable Food

- Eco-friendly Packaging Materials

- Green Building Materials

- Sustainable Apparel & Textiles

- Others

By Consumer Type Outlook (Revenue – USD Billion, 2020–2034)

- Individual Consumers

- Businesses & Institutions

- Government

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Online Retail

- Specialty Stores

- Supermarkets/Hypermarkets

- Others

By Certification Outlook (Revenue – USD Billion, 2020–2034)

- Residential Certified Organic

- LEED-certified

- Energy Star

- Fair Trade

- FSC-certified

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Green Premium Products Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 180.10 billion |

|

Market Size Value in 2025 |

USD 204.51 billion |

|

Revenue Forecast in 2034 |

USD 665.04 billion |

|

CAGR |

14.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion, and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global green premium products market size was valued at USD 180.10 billion in 2024 and is projected to grow to USD 665.04 billion by 2034.

The global market is projected to register a CAGR of 14.0% during the forecast period.

In 2024, North America accounted for the largest market share due to robust regulatory frameworks, advanced green infrastructure, and mature consumer awareness.

A few of the key players in the market are Apple; Allbirds, Inc.; Danone S.A.; Ecoalf; Ecover; Ikea; Lush Ltd.; Natura &Co; Nestlé S.A.; Patagonia, Inc.; Seventh Generation, Inc.; Tesla, Inc.; The Hain Celestial Group, Inc.; The Honest Company, Inc.; and Unilever PLC

In 2024, the organic & sustainable food segment accounted for more than 35% of the market revenue share due to escalating consumer demand for ethically produced, non-GMO, and clean-label food products.

• In 2024, the individual consumers segment accounted for more than 54% of the revenue share due to shifting lifestyle values toward sustainability, wellness, and ethical consumption.