Germany Ophthalmic Spectacle Lenses and Equipment Market Size, Share, Trends, Industry Analysis Report

By Product (Ophthalmic Spectacle Lenses, Ophthalmic Spectacle Equipment), By Lens Type, By Lens Material, By Usage, By Equipment– Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6167

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

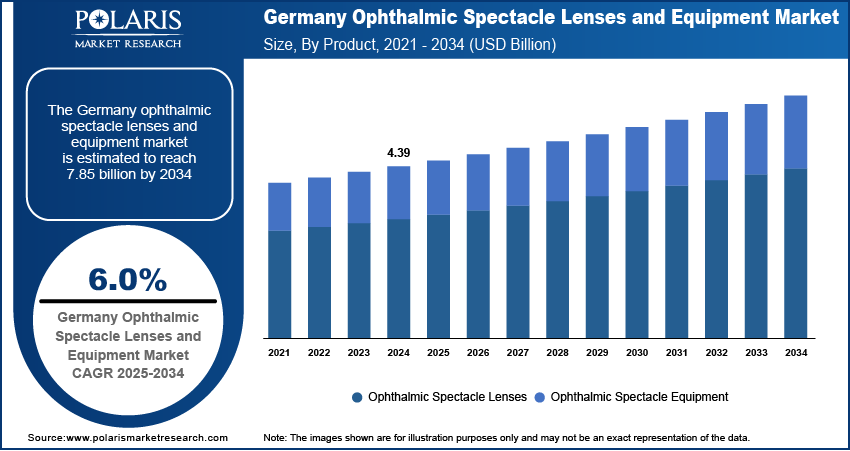

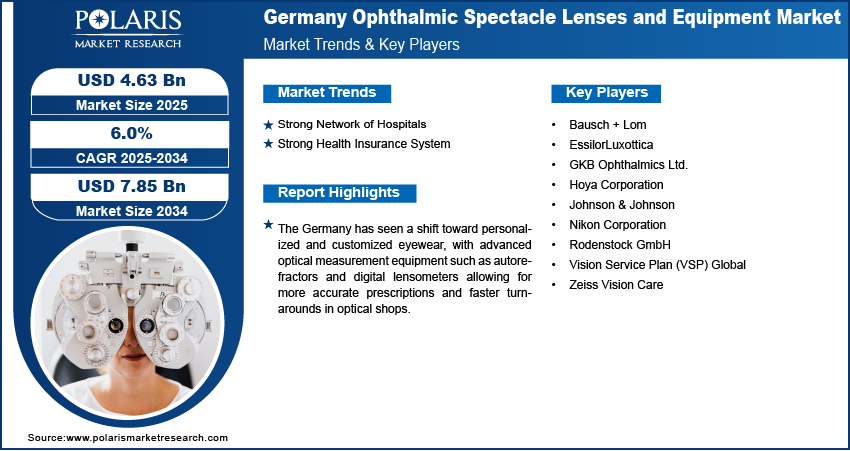

The Germany ophthalmic spectacle lenses and equipment market was valued at USD 4.39 billion in 2024 and is expected to register a CAGR of 6.0% from 2025 to 2034. The market growth is driven by the expanded network of hospitals and strong health insurance system.

Key Insights

- The ophthalmic spectacle lenses segment accounted for 82.35% regional share in 2024, driven by a strong focus on eye health, regular eye check-ups, and the country’s trusted optical industry

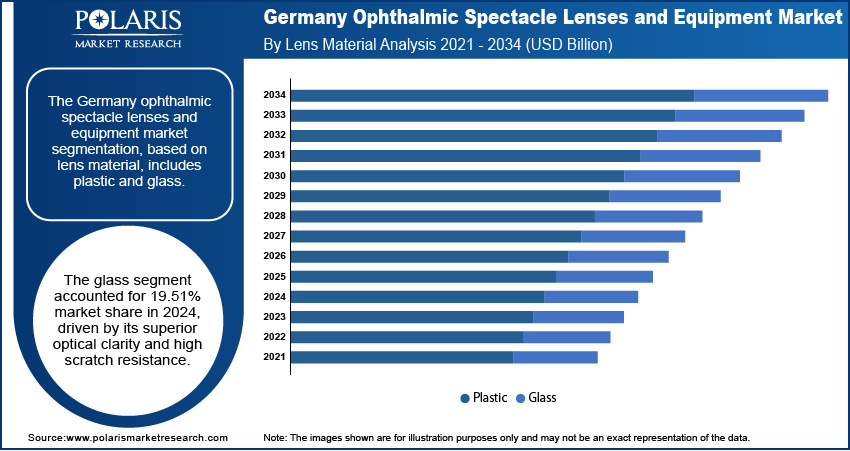

- The glass segment accounted for 19.51% regional market share in 2024, driven by their superior optical clarity and high scratch resistance. Some consumers, particularly those with strong or complex prescriptions, value the sharper vision offered by glass lenses.

Industry Dynamics

- The expanded network of hospitals fuels the industry growth in Germany.

- Strong health insurance system in Germany propels the adoption of ophthalmic spectacle lenses and equipment.

- Rising shift toward personalized and customized eyewear is boosting the growth.

- The high costs of advanced lenses and equipment, limited insurance coverage, and intense market competition limit the growth.

Market Statistics

- 2024 Market Size: USD 4.39 billion

- 2034 Projected Market Size: USD 7.85 billion

- CAGR (2025–2034): 6.0%

To Understand More About this Research: Request a Free Sample Report

Ophthalmic spectacle lenses are vision-correcting lenses that are prescribed for hyperopia, astigmatism, and myopia and presbyopia treatment. These lenses are fitted into eyeglass frames and may include advanced features, including anti-reflective optical coatings, photochromic tinting, or blue light filtering. Ophthalmic equipment refers to the tools and devices used by eye care professionals for eye exams, lens manufacturing, and fitting, including refractors, lens edgers, and diagnostic imaging systems.

The Germany ophthalmic spectacle lenses and equipment market is experiencing growth, largely driven by the strong presence of major industry players and their strategic business activities. Germany's position as a hub for optical innovation is strengthened by these companies' continuous investment in research and development, leading to the introduction of advanced lens technologies and optical equipment. In October 2024, ZEISS launched ophthalmic equipment with AI capabilities for surgical solutions. These launches are expanding product availabilities and accessibilities by raising the adoption rate, thereby driving the market in Germany.

The dynamic is amplified by regular mergers and acquisitions within the industry. These strategic partnerships and consolidations allow companies to combine their technological expertise, expand their product portfolios, and strengthen their market presence. In April 2024, ZEISS Vision acquired the Dutch Ophthalmic Research Center. These acquisitions often result in improved research and development capabilities, thereby driving the ophthalmic spectacles lenses and equipment industry innovation in Germany.

Drivers & Opportunities

Strong Network of Hospitals: The industry in Germany is driven by its extensive network of hospitals and healthcare facilities. Germany boasts one of Europe's highest densities of hospitals, with numerous specialized eye care departments and ophthalmology centers. According to the Statistisches Bundesamt, as of 2023, Germany consists of 1,874 hospitals with a bed occupancy rate of 71.2%. This widespread availability of medical facilities ensures that Germans have easy access to eye care services, leading to increased diagnosis of vision problems and subsequent demand for spectacle lenses and equipment. These hospitals employ a large number of eye care specialists who regularly perform eye examinations and prescribe corrective eyewear. The high concentration of healthcare facilities also means shorter waiting times for appointments, encouraging people to seek regular eye check-ups. Many German hospitals are further teaching institutions, contributing to the continuous training of eye care professionals and the adoption of new optical technologies.

Strong Health Insurance System: Germany’s universal healthcare system covers routine eye exams and, in many cases, provides financial support for prescription lenses and treatments. Patients have better access to ophthalmic care with both public (statutory) and private health insurance schemes available. The inclusion of vision services in insurance coverage encourages regular check-ups and promotes early detection of eye issues. This consistent access to care leads to higher use of ophthalmic equipment and a regular replacement cycle for spectacle lenses. The supportive reimbursement environment continues to fuel growth and modernization in Germany ophthalmic spectacle lenses and equipment market.

Segmental Insights

Product Analysis

The ophthalmic spectacle lenses segment accounted for 82.35% regional share in 2024, driven by a strong focus on eye health, regular eye check-ups, and the country’s trusted optical industry. German consumers often prefer high-quality lenses that improve clarity and provide added comfort. Customization is common, with many opting for features such as anti-glare, photochromic, or blue light protection. Additionally, the strong presence of well-known German lens manufacturers further strengthens the demand. The need for reliable, everyday vision correction solutions grows as digital lifestyles continue to grow, thereby driving the segment growth.

By Lens Material Analysis

The glass segment accounted for 19.51% regional market share in 2024 driven by their superior optical clarity and high scratch resistance. Some consumers, particularly those with strong or complex prescriptions, value the sharper vision that glass lenses offer. Additionally, older adults or traditional users may prefer glass for its durability and stability over time. The German preference for high-precision materials supports continued, selective demand for glass lenses in certain use cases. This segment benefits further from Germany’s long-standing trust in durable and high-quality optical products.

Key Players & Competitive Analysis

The Germany ophthalmic spectacle lenses and equipment market is highly competitive, featuring a mix of global giants and strong domestic players. Key international brands such as EssilorLuxottica, Hoya Corporation, Johnson & Johnson, Nikon Corporation, and Bausch + Lomb compete on innovation, advanced lens technologies, and wide product portfolios. German companies such as Zeiss Vision Care and Rodenstock GmbH hold a dominant local presence due to their reputation for precision optics and trusted quality. These firms invest heavily in research and development to stay ahead in lens design and diagnostic equipment. Additionally, companies like TOKAI Optical and GKB Ophthalmics focus on niche solutions and customized lenses. Vision Service Plan (VSP) Global enhances competition through integrated care and retail services. The market thrives on technological innovation, brand loyalty, and growing consumer demand for premium, customized eyewear. Collaborations with opticians and expansion of digital platforms further intensify the competitive environment across the German market.

Key Players

- Bausch + Lom

- EssilorLuxottica

- GKB Ophthalmics Ltd.

- Hoya Corporation

- Johnson & Johnson

- Nikon Corporation

- Rodenstock GmbH

- TOKAI OPTICAL Co., Ltd.

- Vision Service Plan (VSP) Global

- Zeiss Vision Care

Germany Ophthalmic Spectacle Lenses and Equipment Industry Developments

January 2024: ZEISS launched the Light 2 lenses as part of its SmartLife portfolio, offering progressive and digital lenses with fast adaptation and enhanced comfort. The new design targeted first-time wearers and supported eye care professionals with effective upselling strategies.

Germany Ophthalmic Spectacle Lenses and Equipment Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Ophthalmic Spectacle Lenses

- Ophthalmic Spectacle Equipment

By Lens Type Outlook (Revenue, USD Billion, 2020–2034)

- Single-Vision Lens

- Multifocal Lenses

- Progressive Lenses

- Bifocal Lenses

- Trifocal Lenses

- Others

By Lens Material Outlook (Revenue, USD Billion, 2020–2034)

- Plastic

- Polycarbonate

- CR-39 Plastic

- Others

- Glass

By Usage Outlook (Revenue, USD Billion, 2020–2034)

- Prescription Spectacle Lenses

- Non-prescription Spectacle Lenses

By Equipment Outlook (Revenue, USD Billion, 2020–2034)

- Lens Fabrication Equipment

- Lens Generators

- Edging Machines

- Others

- Lens Coating Equipment

- Anti-Reflective Coating Machines

- Hard Coating Equipment

- UV Coating Equipment

- Others

- Optical Measurement Equipment

- Refractors & Autorefractors

- Lensometer

- Others

- Others

Germany Ophthalmic Spectacle Lenses and Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.39 Billion |

|

Market Size in 2025 |

USD 4.63 Billion |

|

Revenue Forecast by 2034 |

USD 7.85 Billion |

|

CAGR |

6.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 4.39 billion in 2024 and is projected to grow to USD 7.85 billion by 2034.

The market is projected to register a CAGR of 6.0% during the forecast period.

A few of the key players in the market are Bausch + Lomb; EssilorLuxottica; GKB Ophthalmics Ltd.; Hoya Corporation; Johnson & Johnson; Nikon Corporation; Rodenstock GmbH; Vision Service Plan (VSP) Global; and Zeiss Vision Care.

The ophthalmic spectacles segment dominated the market share in 2024.

The glass segment is expected to witness the fastest growth during the forecast period.