Optical Coatings Market Share, Size, Trends, Industry Analysis Report

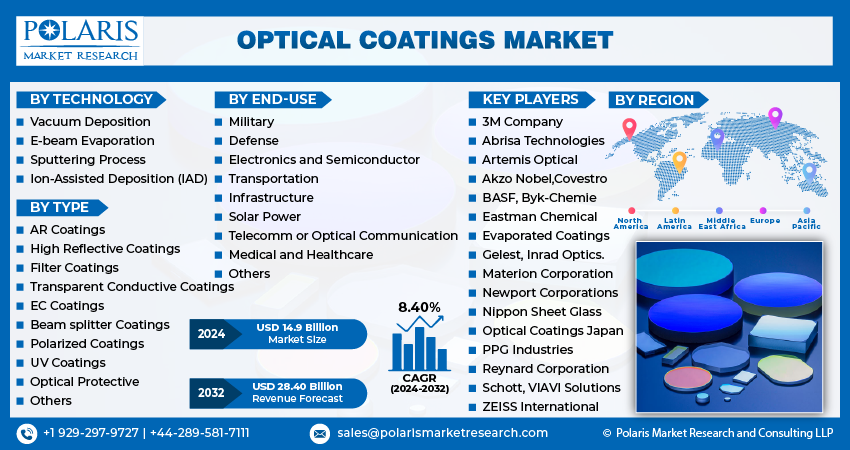

By Technology (Vacuum Deposition, E-beam Evaporation, Sputtering Process, and Ion-Assisted Deposition (IAD)); By Type; By End-Use; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM3844

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

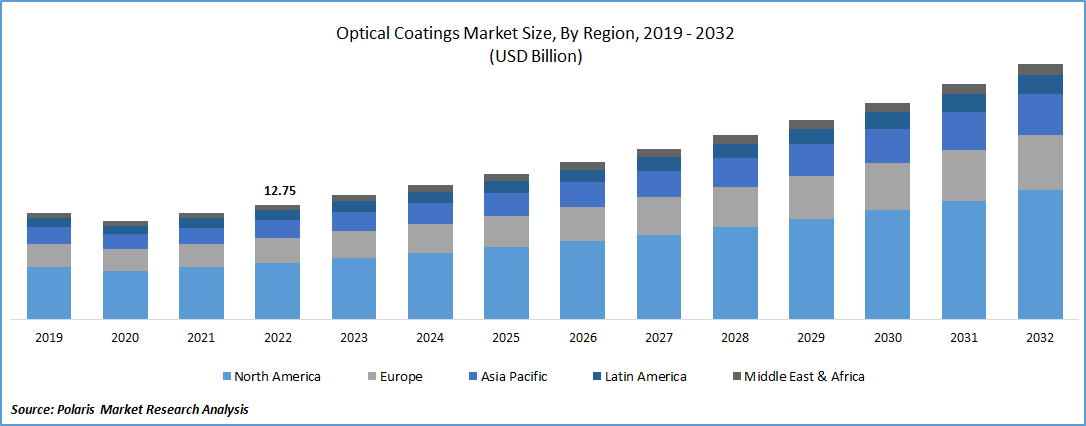

The global optical coatings market was valued at USD 13.78 billion in 2023 and is expected to grow at a CAGR of 8.40% during the forecast period.

The market is being pushed for several reasons, including increased demand for high-performance optical elements across a wide range of industries, as well as a growing acceptance of cutting-edge technologies such as 5G, artificial intelligence, and autonomous automobiles.

To Understand More About this Research: Request a Free Sample Report

Optical coatings are employed to modify an optical component's exchange, reflection, or polarisation properties. The thriving consumer electronics, which includes smartphones, tablets, TVs, and laptops, places a high value on optical coatings, which enhance screen clarity, minimize glare, as well as enhance overall user experience. As the demand for high-quality displays grows, so does the demand for improved optical coatings.

Increased income levels in the worldwide market premises are projected to drive an increase in demand for automotive electronics in the conveyance end-use industry. With the introduction of intelligent transportation systems and a significantly growing demand to minimize environmental pollution, there has been a growing demand for a secure and accessible drive. The growth of communication technology and entertainment platform features, as well as the appearance of sophisticated driver assistance, have all been identified as offering opportunities for the optical coatings market to expand throughout the projection period.

However, the availability of alternative technologies for various technologies is the factor that is restraining the market growth. Also, the manufacture of optical coatings involves high capital investments to apply coatings, which necessitate expensive equipment, cleanroom conditions, and expert operators. As a result, companies in this industry face significant capital and operational costs, limiting their ability to scale and satisfy rising demand.

Since the emergence of the COVID-19 pandemic, there have been numerous changes in the way people live their lives, in the way the corporate world functions, and in the way companies and market units function and meet the needs of the specific population. The pandemic has raised demand for medical equipment, such as diagnostic imaging machines and surgical instruments, which require high-quality optical components. Another beneficial effect of COVID-19 on the optical coating market is the increased demand for optical elements used in remote communication technologies. As more organizations and entities adopt remote work and study, the need for webcams, as well as additional optical components, has skyrocketed.

Industry Dynamics

Growth Drivers

Increasing Use of Optical Coatings in Semiconductors

The optical coatings market is growing because of its increasing use of optical coatings in semiconductors, as well as other industries such as high-temperature lamp tubing, telecommunications, optics, and microelectronics. According to the Semiconductor Industry Association, the global semiconductor sector sales were $40.0 billion in April 2023, a 0.3% increase over the March 2023 total of $39.8 billion and a 21.6% decrease over the April 2022 total of $50.9 billion. The rising semiconductor industry has increased the demand for optical coatings.

Optical coatings are also employed in the electronics and semiconductor industries, where they must endure high-temperature gradients as well as high rates of transference of heat in rapid thermal processing. These procedures and techniques are commonly used in printed circuit board (CB) coating, as well as ICs and wafers, to assist in modifying their attributes. Optical coatings are known to enable certain sections of a semiconductor to endure wafer processing at high temperatures.

Additionally, the increasing popularity of smartphones, as well as internet adoption and other electronic gadgets equipped with touchscreens and displays, have boosted the requirement for high-quality, persistent optical coatings. As per the ITU data, in 2022, the Internet will be used by 66% of the world's population or 5.3 billion individuals. The desire to increase the efficiency and long-term reliability of these devices through the use of effective optical coatings is driving this demand. As a result, the increasing global prevalence of smartphones is predicted to fuel the market expansion of optical coatings, which are utilized in smartphone display coating.

Report Segmentation

The market is primarily segmented based on technology, type, end-use, and region.

|

By Technology |

By Type |

By End-Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

AR Coatings Segment is Expected to Witness the Fastest Growth During Forecast Period

Consumers are looking for coatings that reduce reflections, enhance clarity, as well as enhance visual experiences. Its significant market share is motivated by reasons such as the increasing demand for anti-reflective coatings in photovoltaic solar panels, automotive displays, windows, and GPS navigational systems. Consumers are growing more aware of the benefits of adopting anti-reflective coatings in everyday life. They choose anti-reflective cellphones, computers, and televisions, which reduce eye strain and improve the viewing experience.

Furthermore, people in the healthcare field are increasingly opting for anti-reflective coatings on their eyeglasses as they enhance clarity and reduce glare from strong lights. The desire for higher optical performance in a range of applications, such as spectacles, a pair of sunglasses, and professional lens coatings for cameras, is driving these developments.

By End Use Analysis

The Medical and Healthcare Segment Accounted for the Significant Market Share in 2022

The healthcare industry controls the market for optical coatings. The healthcare business relies on advanced optical systems for diagnostic and surgical procedures, which necessitate high-quality, trustworthy, and long-lasting optical devices. In the healthcare industry, there is a rising need for high-quality eyeglasses with anti-reflective coatings, which improve clarity while minimizing reflection. Furthermore, optical systems used in diagnostic and surgical operations must be reliable, durable, and high-performing, which has resulted in a surge in the usage of coatings with anti-reflective properties in the healthcare business.

Additionally, the market for optical coatings is mainly driven by the aerospace, defense, and automotive industries' desire for energy-efficient illumination solutions and better aesthetics. The automotive sector is seeing considerable growth in demand for high-quality, long-lasting optical coatings to improve vehicle durability and aesthetic appeal. Furthermore, optical coatings are becoming increasingly important in the aerospace and defense industries for optimizing light transmission and reducing reflections in a range of applications.

By Technology Analysis

Vacuum Deposition Sector is Expected to Hold the Significant Revenue Share During Forecast Period

The vacuum deposition process adds specific functionality to optical lenses, flat panels, electronics displays, and other substrates, such as anti-reflective protective coatings, conductive coatings, and high refractive index coatings. Vacuum deposition is an important market technique that entails the competitive deposition of thin-film coatings onto a substrate by vaporizing the appropriate coating substance inside a vacuum chamber. The growing need for high-quality Optical Coatings, particularly from the automobile and healthcare industries, is propelling the global vacuum deposition segment forward. This approach guarantees outstanding optical performance and endurance, making it an appealing alternative for producers who want high-quality optical components.

By Regional Analysis

The Demand in North America is Expected to Witness Significant Growth over the Forecasted Period

The North American region holds the largest share across the various regions due to various sectors, such as innovation and technological improvement. The US government spends heavily on research and development programs across a wide range of industries, including technology. Startups in innovation and technology usually obtain significant venture capital funding, which pushes their expansion and success. Investors are ready to back bold and unique ideas that have the potential to disrupt existing markets.

The growing economies of APAC and Europe are forecasting high demand and are, hence important drivers of the optical coatings industry. The rise of developing nations has raised the need for healthcare services, which has increased the use of advanced optical systems. The total number of hospitals, clinics, and healthcare institutions in China and India has expanded, increasing the need for modern optical systems.

The adoption of anti-reflective coatings is expanding due to the economic growth of emerging economies. High economic development in countries like China, India, and Brazil is propelling the growth of industries like electronics, healthcare, and automotive. These businesses make use of complex optical equipment that requires anti-reflective coatings to function properly. Hence, these factors boost the growth of the region at a rapid rate.

Competitive Insight

The Optical Coatings market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include

- 3M Company

- Abrisa Technologies

- Akzo Nobel

- Artemis Optical

- BASF

- Byk-Chemie

- Covestro

- Eastman Chemical

- Evaporated Coatings

- Gelest

- Inrad Optics.

- Materion Corporation

- Newport Corporations

- Nippon Sheet Glass

- Optical Coatings Japan

- PPG Industries

- Reynard Corporation

- Schott

- VIAVI Solutions

- ZEISS International

Recent Developments

- In June 2022, PPG Industries & Meta Materials established a collaboration to develop multi-functional, portable, and high-index sophisticated lenses for eyewear, making an important contribution to the optical coating market.

Optical Coatings Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 14.9 billion |

|

Revenue Forecast in 2032 |

USD 28.40 billion |

|

CAGR |

8.40% from 2024 - 2032 |

|

Base year |

2023 |

|

Historical data |

2019 - 2022 |

|

Forecast period |

2024 - 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

3M Company, Abrisa Technologies Inc., Akzo Nobel N.V., Artemis Optical Limited, Byk-Chemie GmbH, BASF SE, Covestro AG, Eastman Chemical Company, Evaporated Coatings Inc., I. du Pont de Nemours and Company, Gelest Inc., Inrad Optics Inc., Materion Corporation, Newport Corporations, Nippon Sheet Glass Co. Ltd., Optical Coatings Japan, PPG Industries Ohio Inc., Reynard Corporation, Schott AG, VIAVI Solutions Inc., and ZEISS International. |

FAQ's

key companies in optical coatings market are 3M Company, BASF, Newport Corporations, PPG Industries.

The global optical coatings market is expected to grow at a CAGR of 8.4% during the forecast period.

The optical coatings market report covering key segments are technology, type, end-use, and region.

key driving factors in industrial optical coatings market are increasing use of optical coatings in semiconductors.

The global Optical Coatings market size is expected to reach USD 28.40 billion by 2032