Multi-Cloud Networking Market Size, Share, Trends, & Industry Analysis Report

By Component (Solution and Services), By Enterprise Size, By Deployment Mode, End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6121

- Base Year: 2024

- Historical Data: 2020-2023

Overview

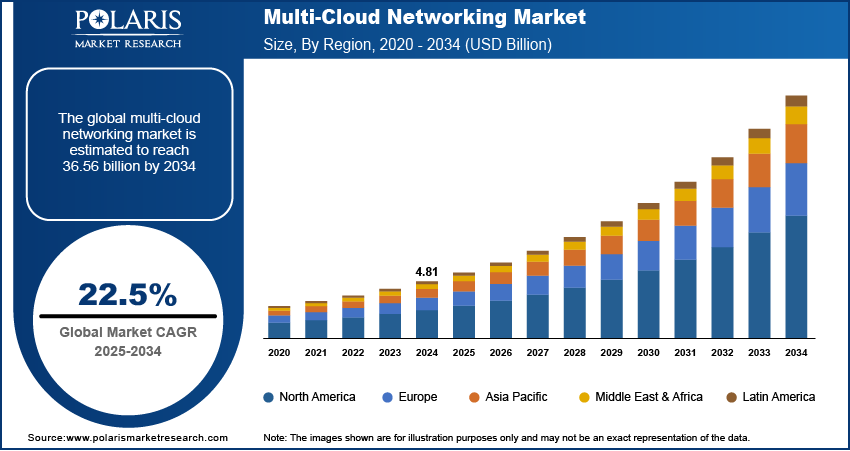

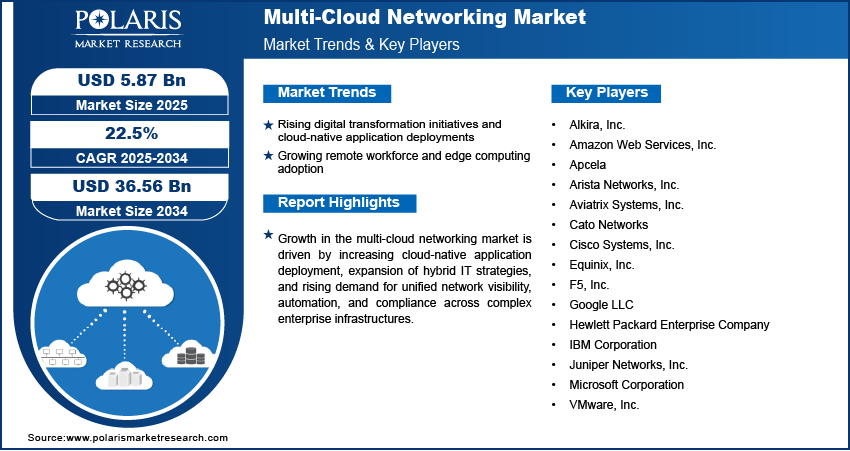

The global multi-cloud networking market size was valued at USD 4.81 billion in 2024, growing at a CAGR of 22.5% from 2025–2034. Surge in digital transformation initiatives along with growing adoption of cloud-native applications, remote workforce models and edge computing is driving demand for scalable and secure multi-cloud networking solutions.

Key Insights

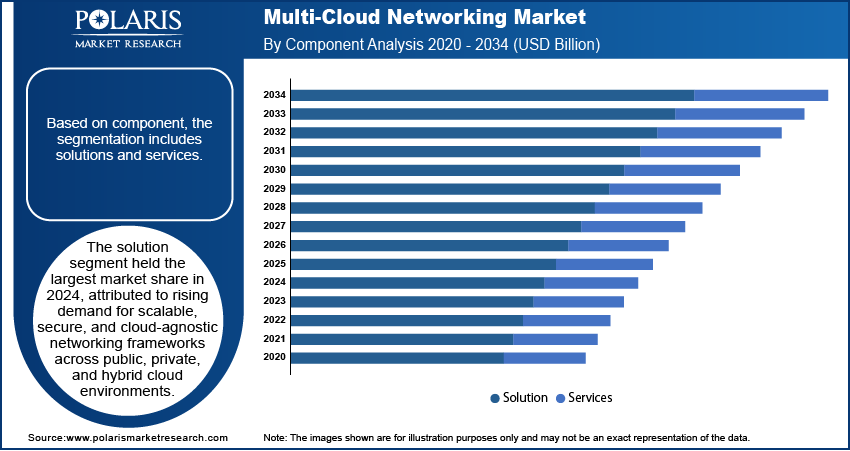

- The solution segment dominated the multi-cloud networking market share in 2024.

- The services segment is projected to grow at the fastest CAGR, driven by rising demand for cloud optimization, orchestration, and network performance management.

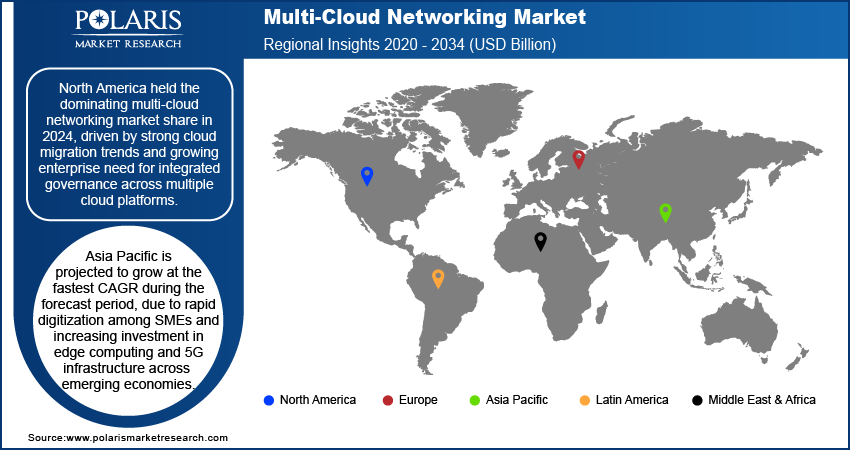

- The North America multi-cloud networking market dominated the global market share in 2024.

- The US multi-cloud networking market held the largest regional share of the North America market in 2024, fueled by early adoption of hybrid cloud frameworks and increasing demand for secure inter-cloud connectivity.

- The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period, owing to accelerated digital transformation among SMEs and expanding hyperscale data center investments.

- The China market is expanding steadily, driven by rapid deployment of cloud-native infrastructures, government-backed digital economy initiatives and rising enterprise adoption of multi-cloud and hybrid networking models.

Industry Dynamics

- Surge in digital transformation initiatives and increasing deployment of cloud-native applications are driving the adoption of multi-cloud networking to ensure consistent connectivity, policy enforcement and workload mobility across diverse cloud environments.

- Growth in remote workforce models and rising edge computing adoption are accelerating the demand for distributed networking architectures that enable secure and low-latency data access and centralized control.

- Integration of AI-based traffic management and observability tools is creating opportunities for enterprises to optimize application performance, enforce compliance and automate routing across multi-cloud infrastructures.

- High deployment costs and the complexity of integrating multi-cloud networking platforms with existing legacy systems are limiting adoption among small and mid-sized enterprises.

Market Statistics

- 2024 Market Size: USD 4.81 billion

- 2034 Projected Market Size: USD 36.56 billion

- CAGR (2025-2034): 22.5%

- North America: Largest market in 2024

Multi-cloud networking is rapidly adopted across enterprises to improve operational flexibility, ensure business continuity and optimize application performance. The rising demand for this is due to the growing use of hybrid and multi-cloud environments that require consistent connectivity, policy enforcement and workload management across multiple cloud providers.

Rapid digital transformation and distributed workloads are driving organizations to invest in cloud-agnostic networking platforms that ensure visibility, security and seamless data exchange. In addition, increasing adoption of SaaS applications such as education technology SaaS tools and edge computing is contributing to the deployment of centralized control frameworks and automated policy-based routing across multi-cloud infrastructures.

Regulatory frameworks such as the General Data Protection Regulation (GDPR), Cloud Security Alliance (CSA) standards, and ISO/IEC 27017 are pushing enterprises to adopt multi-cloud networking solutions with built-in compliance, encryption and governance capabilities. This shift is driven by the need to maintain data sovereignty and operational transparency across multiple jurisdictions. Enterprises are extensively investing in cloud observability tools and network behavior analytics to detect anomalies and enforce policies across diverse environments. According to new research from the Cloud Industry Forum (CIF), 62% of organizations are still migrating their applications to the cloud, while 14% completed the migration and are now using cloud services to support their AI strategy. In addition, increasing vendor partnerships between networking solution providers and cloud infrastructure platforms are enabling co-developed service integrations that enhance agility, security and workload portability.

Drivers & Opportunities

Rising Digital Transformation Initiatives and Cloud-Native Application Deployments: The enterprises are accelerating digital transformation to improve operational scalability, enhance customer delivery models and support data-centric decision-making. This shift is increasing the deployment of cloud-native applications that require secure, consistent and scalable networking across multiple cloud platforms. Multi-cloud networking solutions are adopted to manage traffic distribution, ensure high application availability and enable centralized control across hybrid and public cloud environments. Moreover, the rise of microservices, DevOps workflows and container orchestration tools is fueling the need for agile network infrastructure that supports dynamic workload movement and policy enforcement. As an example, in May 2023, IBM introduced Hybrid Cloud Mesh to streamline connectivity and governance across multicloud environments, enhancing network visibility and control for DevOps and CloudOps teams. This solution supports dynamic, policy-driven networking to improve application performance and security across hybrid and multi-cloud infrastructures.

Growing Remote Workforce and Edge Computing Adoption: The expansion of remote and hybrid working models is creating strong demand for secure user access and unified networking across cloud-based resources. Enterprises are deploying multi-cloud networking architectures to ensure seamless connectivity, enforce identity-based access control and maintain data integrity across distributed endpoints. At the same time, edge computing is rapidly adopted to process data closer to the source, which requires low-latency communication and reliable integration with core cloud infrastructure. In addition, enterprises are leveraging centralized orchestration and observability tools to monitor performance and manage network policies across edge, on-premise, and multi-cloud systems.

Segmental Insights

Component Analysis

Based on component, the segmentation includes solutions and services. The solution segment dominated the market in 2024, driven by growing enterprise demand for unified network management, secure inter-cloud routing, and automated traffic control across multiple cloud environments. These platforms support consistent policy enforcement and workload optimization, which are essential for hybrid and multi-cloud operations. In March 2024, Cloudflare entered the multi-cloud networking market with a new platform designed to simplify and secure connectivity across multiple cloud providers. This solution enables businesses to unify network management, improve visibility, and reduce operational complexity across diverse cloud environments. Moreover, increasing cloud-native application deployment and the need for visibility across environments are further strengthening solution adoption across large-scale enterprises.

In terms of component, the services segment is projected to grow at the fastest CAGR during the forecast period, due to the rising need for consulting, integration, and managed network services. Organizations are increasingly relying on external service providers to navigate complex multi-cloud environments and implement scalable network infrastructure. In addition, growing demand for cloud security, compliance advisory, and network optimization is fueling the growth of multi-cloud networking services across sectors such as BFSI and healthcare.

Enterprise Size Analysis

By enterprise size, the segment includes large enterprises and small and medium enterprises (SMEs). The large enterprise segment dominated the market in 2024, driven by complex IT infrastructures and a greater need for workload distribution across multiple cloud providers. These enterprises require scalable solutions for governance, traffic control, and access management across hybrid deployments. Moreover, larger IT budgets and existing cloud maturity are contributing to higher adoption of multi-cloud networking solutions in this segment.

In terms of enterprise size, the small and medium enterprises (SMEs) segment is projected to grow at the fastest CAGR during the forecast period, due to rising awareness of multi-cloud benefits such as cost control, vendor flexibility, and business continuity. SMEs are investing in lightweight and subscription-based networking platforms that provide centralized control with minimal operational complexity. In addition, growing digitization among SMEs in retail, healthcare, and manufacturing is driving segment growth.

Deployment Mode Analysis

Based on deployment mode, the segmentation includes public cloud and private cloud. The public cloud segment dominated the market in 2024, driven by increasing adoption of public cloud services for SaaS, PaaS, and IaaS applications across diverse industries. Enterprises prefer public cloud environments for their scalability, cost-efficiency, and simplified provisioning. Multi-cloud networking solutions in this segment are enabling consistent performance, dynamic routing, and secure connectivity across multiple public cloud providers.

In terms of deployment mode, the private cloud segment is projected to grow at the fastest CAGR during the forecast period, due to rising data privacy requirements and growing adoption in regulated sectors such as finance and healthcare. Organizations are implementing private cloud networking frameworks to gain greater control over data, enforce compliance policies, and support latency-sensitive workloads. In addition, hybrid models that integrate private cloud with public cloud infrastructure are accelerating segment expansion.

End User Analysis

By end user, this segment includes BFSI, IT and telecom, retail and e-commerce, healthcare, manufacturing, energy and utilities, media and entertainment, and other end users. The BFSI segment dominated the market in 2024, driven by the growing need for secure, compliant, and highly available cloud connectivity for digital banking, transaction processing, and customer services. Financial institutions are deploying multi-cloud networking platforms to manage workloads across multiple data centers and cloud providers. Moreover, the demand for real-time data access and resilience in financial services is driving segment growth.

In terms of end user, the healthcare segment is projected to grow at the fastest CAGR during the forecast period, due to increasing adoption of telehealth, cloud-based EHR systems, and AI-powered diagnostics. Healthcare providers are leveraging multi-cloud networking solutions to ensure secure and uninterrupted data exchange across cloud environments. In addition, the need to comply with data protection regulations such as HIPAA is fueling the adoption of centralized network control frameworks in this segment.

Regional Analysis

North America multi-cloud networking market dominated the global market in 2024. This is due to the strong presence of global cloud service providers and widespread enterprise cloud adoption across the US and Canada. In addition, the growing investment in hybrid IT infrastructure and rapid deployment of cloud-native applications among Fortune 500 companies are fueling market expansion. Moreover, rising demand for secure and compliant networking frameworks in regulated industries such as BFSI and healthcare is accelerating platform adoption across this region.

The US Multi-Cloud Networking Market Insight

The US held largest market share in the North America multi-cloud networking landscape in 2024, fueled by the widespread digital transformation across BFSI, retail and government sectors. Enterprises in the US are prioritizing multi-cloud strategies to improve resilience, reduce vendor dependency and streamline operations across hybrid environments. For instance, in January 2024, Equinix expanded its multicloud networking portfolio to simplify and optimize how enterprises connect applications across multiple cloud environments. The enhancements are designed to improve performance, reduce complexity, and support seamless interoperability across hybrid and multicloud infrastructures. Moreover, rapidly increasing cloud migration driven by investments in data center modernization and workload orchestration tools is contributing to the deployment of advanced multi-cloud networking platforms.

Asia Pacific Multi-Cloud Networking Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is witnessed due to the expanding cloud investments across Japan, South Korea, India, and China. Rapid digitalization initiatives among SMEs and increasing government cloud-first policies are driving the deployment of multi-cloud networking solutions. In addition, the growing rollout of 5G and edge infrastructure is creating demand for distributed networking models across manufacturing, telecom and public sector applications. According to GSMA’s Mobile Economy report, Asia’s mobile operators are expected to invest USD 370 billion in 5G network deployment between 2018 and 2025, with 24 markets projected to launch 5G by 2025. The technology is forecast to contribute nearly USD 900 billion to the Asia Pacific economy over the next 15 years. This large-scale 5G investment across Asia is expected to accelerate multi-cloud networking adoption by enabling faster and low-latency connectivity across distributed cloud environments.

China Multi-Cloud Networking Market Overview

The market in China is expanding due to the strong government support for cloud infrastructure development and increasing enterprise cloud adoption across the manufacturing and technology sectors. Rising investments in smart city programs and AI-based cloud applications are boosting the demand for flexible and scalable networking frameworks. In addition, growing local enterprises are adopting multi-cloud models to maintain compliance with domestic data regulations while improving cross-cloud traffic management and visibility.

Europe Multi-Cloud Networking Market

The multi-cloud networking landscape in Europe is projected to hold a substantial share in 2034. This is owing to the stringent data protection laws such as the General Data Protection Regulation (GDPR), which are pushing enterprises to adopt network solutions with built-in compliance controls. Increasing focus on sovereign cloud strategies among EU nations is further boosting the adoption of multi-cloud frameworks with centralized control and data residency features. In July 2025, eu-LISA announced the adoption of sovereign cloud solutions to enhance data protection and regulatory compliance across public sector digital systems. This reflects a broader shift toward multi-cloud networking, where governments leverage interconnected cloud environments to balance data sovereignty, operational flexibility and cross-border digital service delivery. Furthermore, rising cross-border business operations and reliance on multiple cloud vendors are driving demand for secure inter-cloud connectivity across this region.

Key Players & Competitive Analysis Report

The multi-cloud networking is moderately competitive, with key players focusing on enhancing platform capabilities through automation, observability, and cloud-agnostic networking features. Leading companies are prioritizing strategic partnerships, compliance with regional data regulations, and the integration of AI-driven network optimization to strengthen their market presence. In addition, rising enterprise demand for hybrid cloud infrastructure and increasing investments in distributed cloud services are pushing collaborations between cloud providers, managed service firms, and network solution vendors, boosting long-term scalability and competitive differentiation in the global multi-cloud networking landscape.

Major companies operating in the multi-cloud networking industry include Cisco Systems, Inc., VMware, Inc., F5, Inc., Aviatrix Systems, Inc., Juniper Networks, Inc., Arista Networks, Inc., Alkira, Inc., Hewlett Packard Enterprise Company, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., IBM Corporation, Equinix, Inc., Apcela, and Cato Networks.

Key Players

- Alkira, Inc.

- Amazon Web Services, Inc.

- Apcela

- Arista Networks, Inc.

- Aviatrix Systems, Inc.

- Cato Networks

- Cisco Systems, Inc.

- Equinix, Inc.

- F5, Inc.

- Google LLC

- Hewlett Packard Enterprise Company

- IBM Corporation

- Juniper Networks, Inc.

- Microsoft Corporation

- VMware, Inc.

Industry Developments

- April 2025: DigitalOcean launched Partner Network Connect, offering secure and high-performance multi-cloud connectivity for businesses through its partner ecosystem. This initiative enables seamless integration across cloud platforms, driving improved scalability and performance for modern application deployments.

- September 2024: Oracle expanded its multicloud capabilities by enabling customers to deploy Oracle database services across AWS, Google Cloud, and Microsoft Azure through a unified experience. This integration allows enterprises to run workloads seamlessly across multiple cloud environments while maintaining high performance, security, and flexibility.

Multi-Cloud Networking Market Segmentation

By Component Outlook (Revenue, USD Billion, 2020–2034)

- Solution

- Multi-cloud Management

- Other Solutions

- Services

- Training and Support

- Integration and Implementation

- Consulting

By Enterprise Size Outlook (Revenue, USD Billion, 2020–2034)

- Large Enterprises

- Small and Medium Enterprises (SMEs)

By Deployment Mode Outlook (Revenue, USD Billion, 2020–2034)

- Public Cloud

- Private Cloud

By End User Outlook (Revenue, USD Billion, 2020–2034)

- BFSI

- IT and Telecom

- Retail and E-Commerce

- Healthcare

- Manufacturing

- Energy and Utilities

- Media and Entertainment

- Other End Users

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Multi-Cloud Networking Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 4.81 Billion |

|

Market Size in 2025 |

USD 5.87 Billion |

|

Revenue Forecast by 2034 |

USD 36.56 Billion |

|

CAGR |

22.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 4.81 billion in 2024 and is projected to grow to USD 36.56 billion by 2034.

The global market is projected to register a CAGR of 22.5% during the forecast period.

North America dominated the market in 2024, driven by the early adoption of hybrid cloud strategies and growing demand for secure inter-cloud connectivity across BFSI, government, and technology sectors.

A few of the key players in the market are Cisco Systems, Inc., VMware, Inc., F5, Inc., Aviatrix Systems, Inc., Juniper Networks, Inc., Arista Networks, Inc., Alkira, Inc., Hewlett Packard Enterprise Company, Google LLC, Microsoft Corporation, Amazon Web Services, Inc., IBM Corporation, Equinix, Inc., Apcela, and Cato Networks.

The solution segment dominated the market in 2024, driven by increasing enterprise adoption of centralized traffic control, dynamic routing, and policy automation across multi-cloud environments.

The healthcare segment is projected to grow at the fastest CAGR, due to rising demand for secure cloud connectivity fueling EHR systems, telehealth platforms, and diagnostic data exchange.