Decarbonization Market Share, Size, Trends & Industry Analysis Report

By Technology (Electric Vehicles, Renewable Energy Technologies, Carbon Removal Technologies, Energy Efficiency Solutions, Carbon Capture and Storage (CCS)); By Deployment Type; By Service Type; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Aug-2025

- Pages: 130

- Format: PDF

- Report ID: PM4306

- Base Year: 2024

- Historical Data: 2020 - 2023

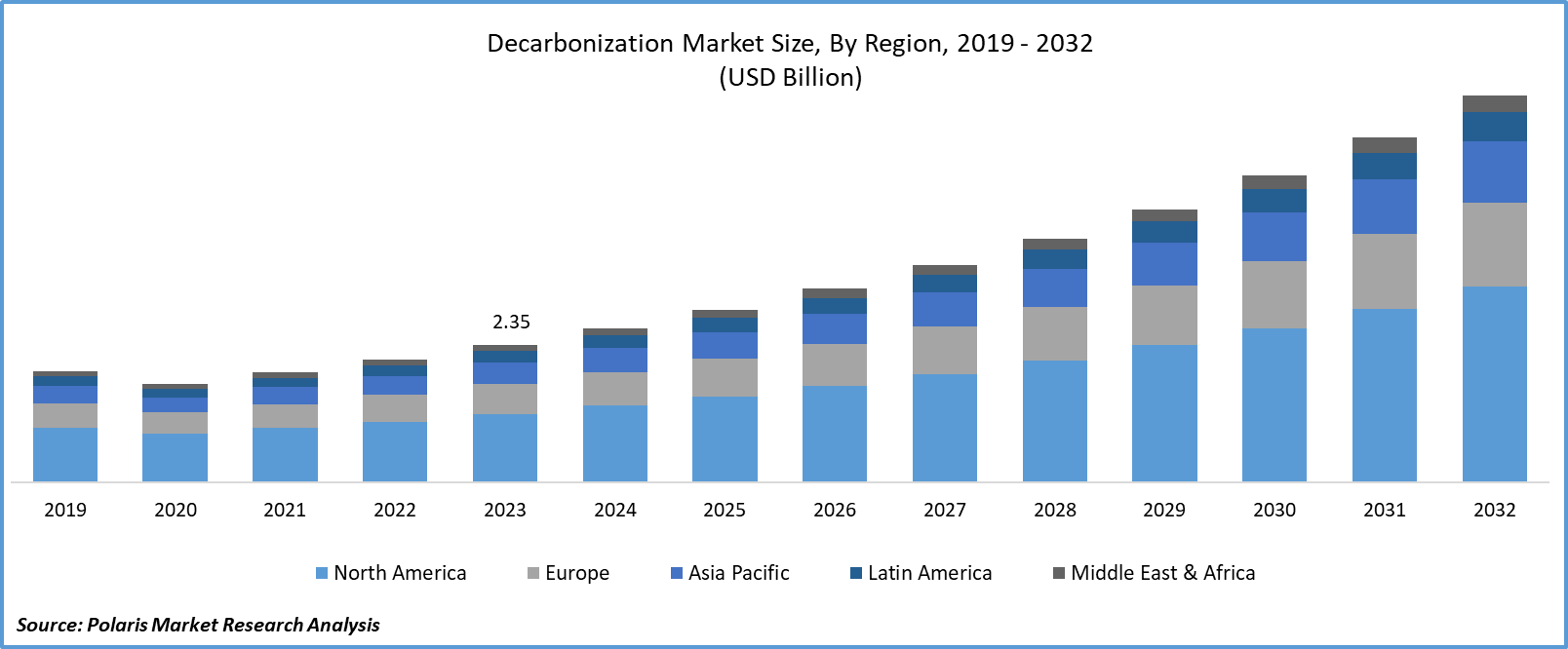

The global Decarbonization Market was valued at USD 1.8 Trillion in 2024 and is anticipated to grow at a CAGR of 15.40% from 2025 to 2034. Escalating climate change concerns, regulatory mandates, and corporate sustainability goals are accelerating investments in clean energy and carbon reduction technologies.

The research report offers a quantitative and qualitative analysis of the decarbonization market to enable effective decision-making. It covers the key trends and growth opportunities anticipated to have a favorable impact on the market. Besides, the study covers segment and regional revenue forecasts for market assessment.

The substantial surge in renewable energy adoption is propelling market expansion. The shift towards low-carbon fuels, coupled with stringent environmental regulations in developed nations, has notably propelled the renewable energy industry. In recent years, the energy generation market has witnessed a rise in installed renewable capacity due to heightened environmental consciousness and the urgency to mitigate the adverse effects of Greenhouse Gases (GHG). This trend has been instrumental in advancing the solar and wind energy sectors.

To Understand More About this Research: Request a Free Sample Report

The development of green bonds, sustainable investment funds, and carbon offset markets are avenues for financing decarbonization initiatives. Dependence on fossil fuels for energy renders economies susceptible to price fluctuations and geopolitical instabilities. Shifting towards renewable energy sources bolsters energy security by broadening the spectrum of energy resources and diminishing reliance on finite reserves.

- For instance, in September 2023, A.P. Moller-Master's A/S and CMA CGM opted to collaborate on various aspects of decarbonization, ensuring full adherence to all applicable laws and regulations.

However, while the long-term benefits of decarbonization are substantial, the initial investment costs can be a significant barrier for businesses, especially smaller enterprises. Upfront expenses for renewable energy installations, energy-efficient technologies, and emissions reduction measures can be daunting.

Additionally, many industries, particularly those reliant on heavy manufacturing or fossil fuels, have extensive existing infrastructure designed around carbon-intensive processes. Retrofitting or transitioning away from these established systems can be a complex and costly endeavor. Thus, these factors hamper the growth of the decarbonization market.

Growth Drivers

Increasing consumer demand and social awareness are projected to spur product demand.

Growing public awareness of environmental issues and climate change is driving consumer preferences towards sustainable products and services. This demand is prompting businesses to adopt environmentally friendly practices, pushing them towards decarbonization. Furthermore, governments worldwide are enacting policies and regulations to encourage decarbonization initiatives. These encompass carbon pricing frameworks, mandates for renewable energy adoption, targets for emissions reduction, and fiscal incentives for clean technologies. Such measures offer distinct signals to businesses and investors, compelling them to adopt sustainable practices.

Report Segmentation

The market is primarily segmented based on technology, deployment type, service type, end-Use, and region.

|

By Technology |

By Deployment Type |

By Service Type |

By End-Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

The Electric Vehicle segment is expected to witness the fastest CAGR during the forecast period.

The electric vehicle segment is expected to witness the fastest CAGR during the forecast period. This surge is fueled by a collective global commitment to reduce carbon emissions and combat climate change. Technological advancements have led to improved battery efficiency and range, alleviating range anxiety and bolstering consumer confidence in EVs. Government incentives, subsidies, and stringent emissions regulations further incentivize the shift towards electric mobility. Major automotive manufacturers are heavily investing in EV research and development, expanding their product offerings to cater to burgeoning market demand.

Additionally, a burgeoning infrastructure of charging stations is rapidly developing, addressing concerns about charging accessibility. As the momentum builds, the electric vehicle segment is poised to play a pivotal role in achieving a sustainable and decarbonized transportation future.

By Deployment Type Analysis

On-premises segment accounted for the largest market share in 2024

The on-premises segment accounted for the largest market share in 2024 and is likely to retain its market position throughout the forecast period. A strategic shift towards localized sustainability efforts drives this surge. Organizations recognize the need for immediate action to reduce their carbon footprint and are increasingly investing in on-premises solutions. These solutions empower businesses to implement tailored strategies, addressing emissions at the source within their facilities or operations.

Advancements in renewable energy systems, energy-efficient technologies, and carbon capture methods have made on-premises decarbonization solutions more accessible and cost-effective. Government incentives and regulatory frameworks further incentivize businesses to adopt localized carbon reduction measures. As a result, the on-premises segment is poised for continued expansion, playing a vital role in advancing sustainable practices within various industries.

By Service Type Analysis

Sustainable transportation services segment held a significant revenue share in 2024

In 2024, the sustainable transportation services segment held a significant revenue share. An escalating global emphasis on eco-friendly mobility solutions propels this surge. Governments and consumers alike are prioritizing low-emission transportation options to combat climate change. Electric vehicles (EVs), public transit enhancements, and shared mobility services are becoming integral components of sustainable transportation strategies. Technological advancements in EV batteries and charging infrastructure are addressing range anxiety and enhancing convenience.

Additionally, the development of cleaner fuels and the adoption of alternative propulsion systems are further catalyzing the growth of sustainable transportation services. With regulatory support and growing consumer demand, this segment is poised for continued expansion, revolutionizing the way we move towards a more environmentally conscious future.

By End-Use Analysis

The oil and gas segment is expected to witness the highest growth during the forecast period.

The oil and gas segment is expected to witness the highest growth during the forecast period and experience a transformative shift within the market. Traditionally associated with high emissions, this industry is now actively working towards sustainable practices. Major players are investing heavily in renewable energy sources like solar, wind, and biofuels, diversifying their portfolios. Carbon capture technologies and methane emission reduction strategies are also gaining prominence to mitigate environmental impacts. Additionally, advancements in hydrogen production from renewable sources hold promise for cleaner energy solutions.

Furthermore, there is a growing trend towards circular economy models within the oil and gas sector, involving the repurposing and recycling of resources. It reduces waste and minimizes environmental footprint. With mounting pressure from stakeholders and increasing regulatory frameworks, oil and gas companies are aligning their strategies with decarbonization goals. Overall, the oil and gas segment is on a trajectory toward sustainability, recognizing the imperative to play a pivotal role in global efforts to combat climate change.

Regional Insights

North America region accounted for the largest market share in 2024

In 2023, the North American region accounted for the largest market share and is expected to maintain its dominance over the anticipated period. The growth of the segment market is largely attributed to stringent environmental regulations and ambitious government targets for emissions reduction are driving significant investments in renewable energy, energy-efficient technologies, and sustainable transportation solutions. The synergy of regulatory support, technological innovation, and heightened environmental awareness is positioning North America at the forefront of the global decarbonization movement.

The Asia-Pacific region, notably in India, Japan, and China, is poised to experience the fastest CAGR over the forecast period. This surge is attributed to a heightened awareness of environmental safety across various industrial sectors. Organizations in these countries are increasingly prioritizing sustainable technology and information systems, driving significant market expansion through improved knowledge and understanding in this domain.

Key Market Players & Competitive Insights

The decarbonization market is anticipated and fragmented to witness competition due to several players' existence. Significant service providers in the market are continuously upgrading their technologies to stay ahead of the competition and to provide efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- ABB Ltd.

- BP plc

- Chevron Corporation

- Enel S.p.A.

- General Electric Company

- Hitachi, Ltd.

- Mitsubishi Heavy Industries, Ltd.

- NextEra Energy, Inc.

- Orsted A/S

- Siemens AG

- TotalEnergies SE

- Ørsted A/S

Recent Developments

- In April 2025 – Rio Tinto signs MOU with AMG Metals & Materials to explore low‑carbon aluminium production in India

- In October 2023, Stargate Hydrogen and NextHeat, entered into their strategic collaboration. Together, they aim to create pioneering solutions for decarbonizing the industrial sector by substituting natural gas with green hydrogen for industrial heat processes.

- In October 2023, AMG, a prominent collaborator with independent investment management firms worldwide, disclosed its acquisition of the minority equity stake in Ara Partners, formerly owned by Capital Constellation. This investment platform is overseen by Wafra Inc., along with some of its associated investment entities.

Decarbonization Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 2.07 Trillion |

|

Revenue forecast in 2034 |

USD 7.079 Trillion |

|

CAGR |

15.40% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD Trillion and CAGR from 2025 to 2034 |

|

Segments covered |

By Technology, By Deployment Type, By Service Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Gain profound insights into the 2025 decarbonization market with meticulously compiled statistics on market share, size, and revenue growth rate by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into historical trends but also unfolds a roadmap with a market forecast extending to 2034. Immerse yourself in the comprehensive nature of this industry analysis through a complimentary PDF download of the sample report.

Browse Our Top Selling Reports

Solar Control Window Films Market Size, Share 2024 Research Report

Medical Gas Market Size, Share 2024 Research Report

Coffee Creamer Market Size, Share 2024 Research Report

Veterinary Scales Market Size, Share 2024 Research Report

Antidote Market Size, Share 2024 Research Report

FAQ's

key companies in decarbonization market are BP plc, Chevron Corporation, Enel S.p.A., General Electric Company

The global decarbonization market is expected to grow at a CAGR of 15.40% during the forecast period.

The decarbonization market report covering key segments are technology, deployment type, service type, end-Use, and region.

key driving factors in decarbonization market are increasing consumer demand and social awareness is projected to spur the product demand

The global decarbonization market size is expected to reach USD 7.079 trillion by 2034