Medical Gas Market Share, Size, Trends & Industry Analysis Report

By Type (Oxygen, Nitrous Oxide, Medical Air, Carbon Dioxide, Others); By End-User; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 119

- Format: PDF

- Report ID: PM4179

- Base Year: 2024

- Historical Data: 2020-2023

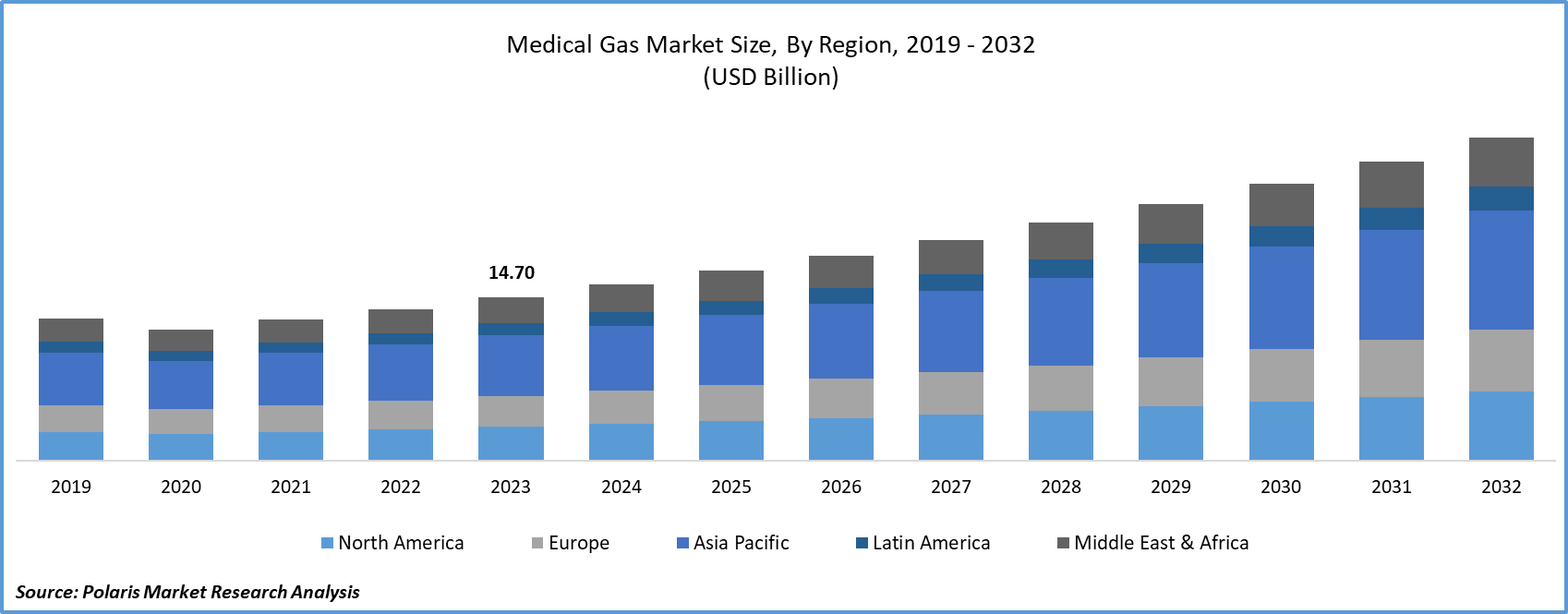

The global Medical Gas Market was valued at USD 15.02 billion in 2024 and is forecasted to grow at a CAGR of 7.00% from 2025 to 2034. Growth is attributed to rising hospital infrastructure development, increased home healthcare usage, and growing demand for oxygen therapy due to respiratory disease prevalence.

The need for medical gases in various healthcare applications is becoming more crucial due to the rising incidence of chronic diseases. These gases play a vital role in therapeutic and diagnostic procedures, making them indispensable in the modern healthcare setting. Governments and healthcare organizations are taking action to improve the accessibility and quality of medical gas services, which further drives market growth. Additionally, the aging population is associated with an increased prevalence of age-related health conditions, necessitating a greater focus on healthcare services. This, combined with the growing preference for home healthcare solutions and point-of-care products, contributes significantly to the expanding scope of the market.

To Understand More About this Research: Request a Free Sample Report

Every year, over 2 million individuals receive medical oxygen. As per the National Health Service (NHS), around 17.5% of patients in the UK are receiving medical oxygen at any given time, totaling approximately 18,000 patients daily. Furthermore, a research article published in MDPI (2018) calculated the annual consumption for every hospital bed, with figures of 350 m3 for oxygen, 325 m3 for medicinal air, 9 m3 for nitrogen protoxide, and 3 m3 for CO2.

The demand for medical gases is increasing, fueled by the growing prevalence of Chronic Respiratory Diseases (CRDs) such as Asthma, chronic obstructive pulmonary disease, occupational lung diseases, and pulmonary hypertension. Chronic Obstructive Pulmonary Disease (COPD) alone accounted for around 3.23 million global deaths in 2019, according to the World Health Organization (WHO). Additionally, Asthma affected nearly 262 million individuals in 2019, leading to 455,000 deaths. Medical gases, including oxygen, lung gas mixtures, and heliox, play a crucial role in the treatment and diagnosis of these respiratory disorders.

The medical gas market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

In 2020, the global population of individuals aged 60 and above surpassed the number of children under five, according to the World Health Organization (WHO). Furthermore, by 2050, it is projected that the global population of adults aged 60 and above will nearly double to 2.1 billion, with the number of individuals aged 80 or older reaching 426 million. This significant rise in the geriatric population has led to an increased prevalence of respiratory conditions. For instance, approximately 15.0% of older adults are affected by Asthma, chronic obstructive pulmonary disease (COPD), or other respiratory disorders, according to data from the Princeton Health Care Center. These trends indicate a growing demand for oxygen supply.

Industry Dynamics

Growth Drivers

Increasing Prevalence of Respiratory Diseases

Oxygen plays a crucial role in preventing pulmonary artery hypertension, and its prolonged use may alleviate strain on the heart. As a result of the increasing prevalence of respiratory diseases, the medical gas market is experiencing growth. However, the market faced significant challenges during the COVID-19 pandemic. The surge in demand for medical oxygen during the pandemic caused shortages and disruptions in the supply chain. For instance, in India, the demand for liquid medical oxygen (LMO) increased from 700 tons per day (TPD) before the pandemic to 2,800 TPD during the first wave of COVID-19. In the second wave, the demand surged to more than seven times the pre-COVID-19 levels, reaching 5,000 TPD.

Report Segmentation

The market is primarily segmented based on product, application, end use, and region.

|

By Product |

By Application |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

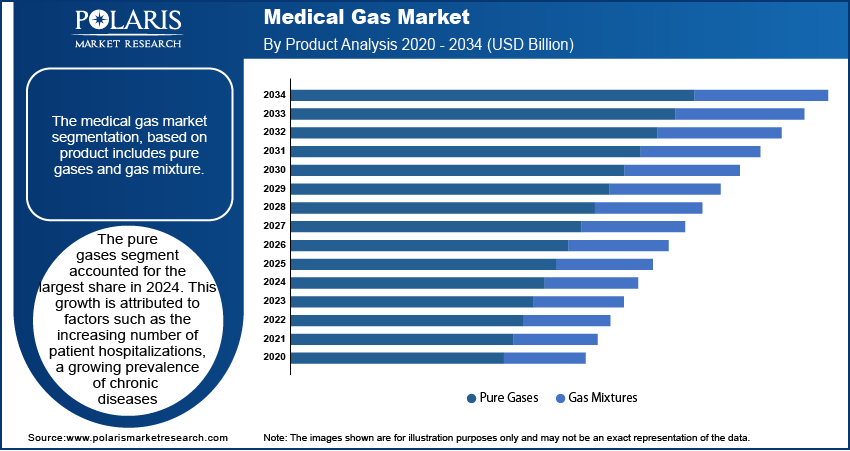

By Product Analysis

Pure Gases Segment Accounted for the Largest Market share in 2024

The pure gases segment accounted for the largest share in 2024. This growth is attributed to factors such as the increasing number of patient hospitalizations, a growing prevalence of chronic diseases, and the occurrence of road accidents worldwide. According to the United Nations 2021 statistics, road accidents contribute to 1.3 million annual deaths, with the World Health Organization (WHO) reporting that between 20 to 50 million people are injured each year, many of whom experience permanent disabilities because of these accidents. This surge in road accidents is contributing to a substantial increase in the demand for oxygen therapy across various life care settings.

Within pure gases, the oxygen sub-segment is expected to grow at the fastest pace. As reported by Pharma Review, the usage of oxygen varies in medical treatments, with 20-40% oxygen commonly employed for COPD treatment, 40-60% for bronchial asthma, and 100% for severe hypoxia and noxious gas poisoning. This diverse application in medical conditions contributes to the growth of this segment. Moreover, patients admitted to intensive care units (ICUs) and those undergoing various surgeries in ambulatory care often require oxygen gas for life support.

The gas mixtures segment will grow rapidly. These mixtures play a crucial role in calibrating analytical instruments that detect the quantity of carbon monoxide in the lungs and are utilized in pulmonary function testing. Such diagnostic tests find applications in various medical fields, including intensive care, neonatal care, rehabilitation, disability assessments, and the diagnosis of respiratory, gastrointestinal, and cardiovascular system diseases.

By Application Analysis

Therapeutic Segment held the Significant Market share in 2024

The therapeutic segment of the healthcare industry holds a significant market share due to the widespread use of medical gases in treating and managing various diseases. These gases are categorized as medicines and are required to meet rigorous purity and quality standards. Key therapeutic gases include oxygen, medical air, carbon dioxide, nitric oxide, and mixtures of helium and oxygen. Medical oxygen is commonly used in various healthcare settings, ranging from anesthesia to inhalation therapy.

On the other hand, the diagnostic segment is expected to experience substantial growth due to the increasing utilization of medical gases in medical imaging and laboratory applications. Laboratories require controlled anaerobic incubator environments for purposes such as biological cell culture or tissue growth. Oxygen-rich mixtures are used to create controlled aerobic conditions, while hydrogen or CO2 rich mixtures are employed for establishing anaerobic conditions.

Regional Insights

North America Region Dominated the Global Market in 2024

North America dominated the global market. This consistent growth is linked to the increased utilization of medical gases in treating respiratory diseases such as COPD and asthma. The elevated prevalence of conditions like COPD and asthma, as well as other medical issues, including cardiovascular and lifestyle-related diseases, is anticipated to boost the demand for medical gases. Additionally, the presence of advanced healthcare facilities, especially in intensive care units, a well-established market, and a growing geriatric population have collectively positioned the U.S. as the major contributor to the market share.

The Asia Pacific will grow at a substantial pace during the forecast period. This accelerated growth is attributed to the presence of densely populated emerging economies, which are anticipated to be significant contributors to the market expansion in the region. Furthermore, there is a noticeable increase in investments within the region. For instance, in May 2023, INOX Air announced an investment of approximately USD 364 million by 2025 in response to the escalating demand in the market.

Key Market Players & Competitive Insights

The market exhibits a moderate level of consolidation, primarily due to the presence of a limited number of key players. Moreover, prominent industry participants are actively engaged in activities such as collaborations, product launches, mergers, and acquisitions as strategic initiatives to enhance and fortify their product portfolios.

Some of the major players operating in the global market include:

- Linde plc.

- Air Liquide

- Atlas Copco

- Messer

- Air Products and Chemicals Inc.

- TAIYO NIPPON SANSO CORPORATION

- Matheson Tri-Gas Inc.

- INOX-Air Products Inc.

Recent Developments

- In January 2025, Air Liquide signed with 20 hospitals across Europe and Brazil in 2024 to supply certified low-carbon medical gases, helping healthcare facilities reduce their carbon footprint by over 70% on average.

- In March 2023, Atlas Copco has acquired the operating assets of FS Medical, encompassing medical and laboratory gas equipment and systems. This strategic acquisition is anticipated to enhance the support and service capabilities of the company.

- In January 2022, NOVAIR has confirmed the acquisition of Oxygen Generating Systems Intl., a move expected to enhance the company's manufacturing capacity and expand its global footprint.

Medical Gas Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 15.83 billion |

|

Revenue forecast in 2034 |

USD 29.04 billion |

|

CAGR |

7.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Services, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

Explore the market dynamics of the 2024 medical gas market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Research Industry Reports.

FAQ's

The medical gas market report covering key segments are product, application, end use, and region.

The global medical gas market size is expected to reach USD 28.34 billion by 2034

The global medical gas market is expected to grow at a CAGR of 7.0% during the forecast period.

North America is leading the global market

key driving factors in medical gas market are increasing prevalence of respiratory diseases