Coffee Creamer Market Share, Size, Trends & Industry Analysis Report

By Type (Dairy, Non-Dairy); By Form (Liquid, Powder); By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 114

- Format: PDF

- Report ID: PM4180

- Base Year: 2024

- Historical Data: 2020-2023

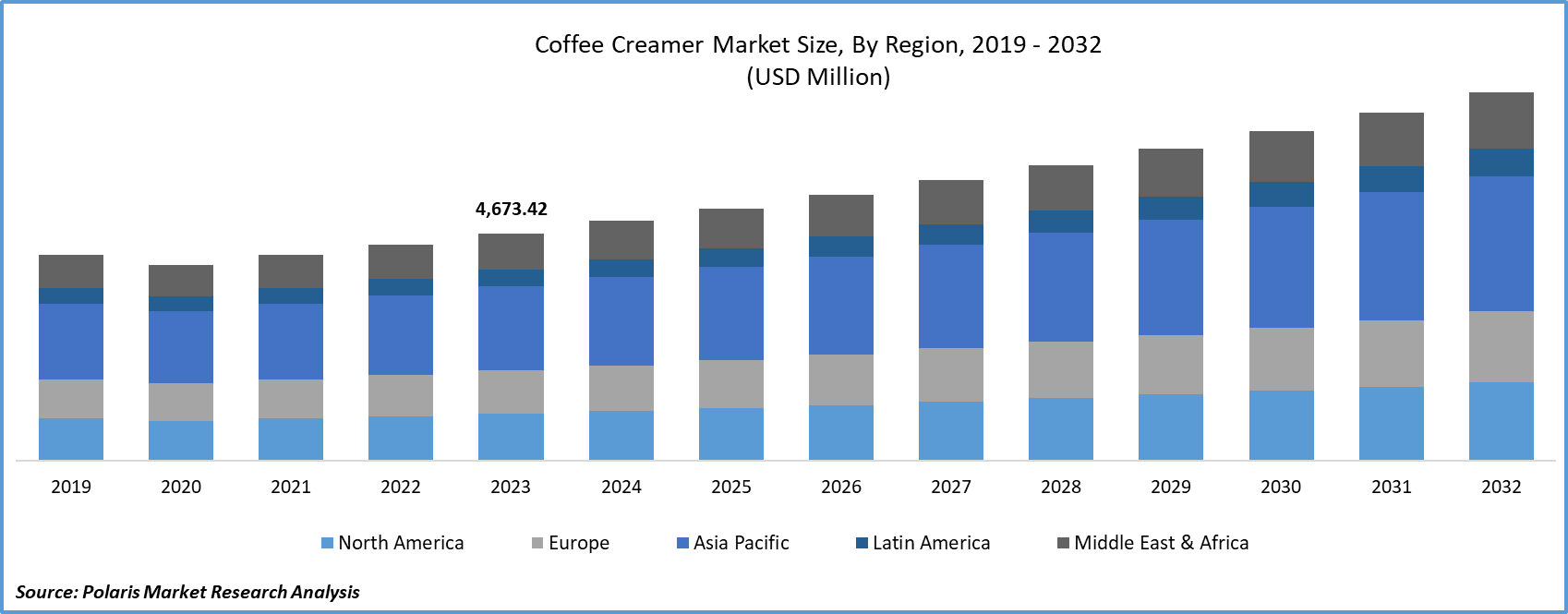

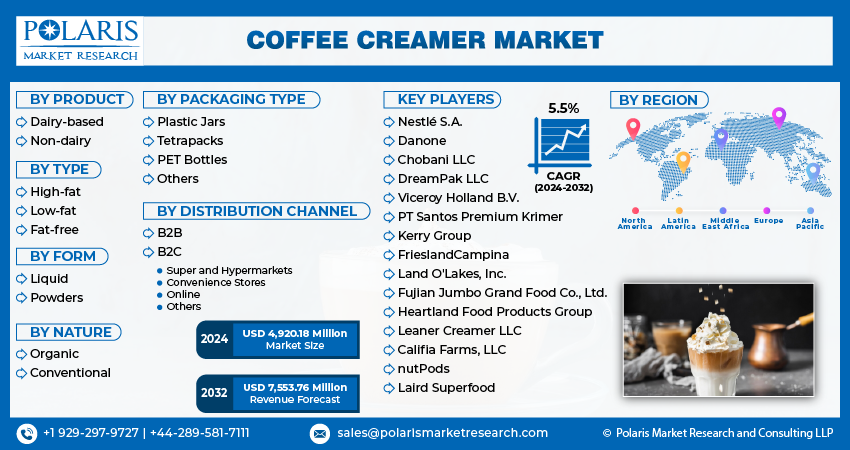

The global Coffee Creamer Market was valued at USD 5.5 billion in 2024 and is expected to grow at a CAGR of 5.00% from 2025 to 2034. Consumer preference for enhanced coffee flavors, convenience, and the availability of plant-based and low-calorie variants are supporting steady market growth.

Growth is attributed to the diverse range of flavored options available, including those with seasonal variations. Coffee creamers provide a convenient way to enhance the flavor and richness of coffee without the need for additional ingredients or complex preparation, contributing to the market's expansion. The trend towards healthier and natural alternatives compared to the traditional creamers, with non-dairy options such as almond, soy, or coconut milk gaining popularity. The availability of a broad spectrum of flavored creamers, including seasonal varieties, further fuels the growth of the market.

To Understand More About this Research: Request a Free Sample Report

PET bottles provide a lightweight and shatterproof alternative, offering consumers a convenient and safer option for handling and transporting creamer. Their attributes, such as better protection against oxygen and light, contribute to preserving the freshness and flavor of the creamer over extended periods. Moreover, the recyclability of PET bottles aligns with the increasing consumer demand for eco-friendly products, making them a sustainable packaging choice. The market trend towards PET bottles is expected to persist as manufacturers invest in product innovation and packaging design to meet evolving consumer preferences.

In Germany, consumers are showing a heightened interest in natural and organic coffee creamers that are devoid of additives and preservatives. The market is witnessing an increasing demand for plant-based and vegan creamers, aligning with the preferences of health-conscious consumers. German manufacturers are actively engaged in product innovation, introducing new flavors and exploring diverse packaging options to stay abreast of evolving consumer tastes. Meanwhile, in France, consumers emphasize the importance of the taste and aroma of their coffee. To meet these expectations, manufacturers are introducing novel and distinctive flavor profiles, contributing to the growth of the coffee creamer market.

We strive to offer our clients the finest in market research with the most reliable and accurate research findings. We use industry-standard methodologies to offer a comprehensive and authentic analysis of the Coffee Creamer Market. Besides, we have stringent data-quality checks in place to enable data-driven decision-making for you.

In the UK, consumers are displaying a rising preference for easily accessible creamers that offer a diverse range of flavors and varieties. The market is witnessing a notable shift towards healthier and more natural creamers, with a particular demand for low-fat and dairy-free alternatives. Sustainability holds a significant focus in the UK market, with consumers actively seeking environmentally friendly packaging choices and ingredients sourced sustainably.

Industry Dynamics

Growth Drivers

- Rising extensive range options of coffee creamers drive the market

The appeal of diverse flavors adds novelty and excitement to consumers' coffee experiences, with an extensive range of options available for them to choose from. The expansion of e-commerce and online grocery shopping has facilitated easy access to and the purchase of various coffee creamer products for consumers. As global coffee consumption continues to rise, the demand for coffee creamers is expected to follow suit. According to the National Coffee Association of the U.S.A., as of January 2021, approximately 66% of Americans consume coffee daily, representing a nearly 14% increase. The growing expenditure on coffee globally is a significant contributing factor driving the growth of the market.

Report Segmentation

The market is primarily segmented based on product, type, form, nature, packaging type, distribution channel, and region.

|

By Product |

By Type |

By Form |

By Nature |

By Packaging Type |

By Distribution Channel |

By Region |

|

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

- Non-dairy creamers segment accounted for the largest market share in 2024

Non-dairy creamers segment accounted for the largest share in 2024. This trend is attributed to the escalating demand for plant-based products, the expanding vegan population, and a rise in lactose intolerance. The increasing awareness of health and environmental considerations is driving a growing preference for plant-based alternatives among consumers. Plant-based ingredients like soy, almonds, and coconut form the foundation of non-dairy creamers, making them a favored choice among consumers who opt for plant-based alternatives.

By Type Analysis

- Fat free creamers segment will grow at substantial pace during forecast period

The fat free segment held a significant market share. These creamers, characterized by low or no-fat content, are particularly popular among health-conscious consumers aiming to minimize their calorie and fat intake. Despite this, there remains a substantial demand for coffee creamers with a moderate fat content, appealing to consumers who prioritize the taste and creaminess of their coffee over strict calorie concerns.

The market for high-fat coffee creamers has experienced a decline in recent years, reflecting a shift in consumer preferences towards healthier alternatives. The rise of health-conscious consumers has propelled the prominence of coffee creamers with low or moderate fat content in the market.

By Form Analysis

- Liquid form segment will grow at substantial pace over anticipated period

The liquid form segment held a significant market share. This dominance is anticipated to persist throughout the forecast period, driven by the growing preference for convenient products among consumers, particularly millennials and Gen Z. Liquid coffee creamer, providing a swift and trouble-free method of imparting flavor and creaminess to coffee, is favored over traditional milk or cream.

Moreover, the increasing prevalence of at-home coffee consumption has heightened the demand for liquid coffee creamer products. Concurrently, the market is experiencing a surge in new product introductions featuring innovative flavors and health benefits, drawing in more consumers and propelling market growth.

By Distribution Channel Analysis

- B2B segment held the significant market share in 2024

The B2B segment held a significant market share. This dominance is credited to widespread product utilization in restaurants and cafes, with product sales on the rise globally, fueled by the increasing number of cafes and coffee outlets. Additionally, various businesses in the hospitality industry, such as hotels and restaurants, prominently serve roasted coffee, contributing to the anticipated growth in the industry.

The B2C segment will propel at a rapid pace. The proliferation of the e-commerce sector has facilitated businesses in reaching a broader customer base, encompassing even remote areas, thereby expanding the overall market. The appeal of online ordering and home delivery has increased, making it more convenient for consumers to purchase coffee creamers in larger quantities, contributing to heightened sales volumes. Online platforms offer a diverse array of flavors and types of coffee creamers, enabling consumers to easily explore and experiment with new products, thereby further propelling the growth of this distribution channel.

Regional Insights

- Europe region dominated the global market in 2024

Europe region dominated the global market. This dominance is projected to persist throughout the forecast period, driven by the escalating trend of coffee consumption fueled by the increasing popularity of cafes and coffee shops. The continued growth of this trend is anticipated to result in an upsurge in the demand for coffee creamers.

Furthermore, the increasing preference for healthier and natural coffee creamers, characterized by low fat, sugar, and calorie content, is poised to contribute significantly to market growth in the region. The heightened health consciousness among European consumers has spurred the development of an extensive range of low-fat and dairy-free creamers to meet these evolving preferences.

Europe region dominated the global market. This dominance is projected to persist throughout the forecast period, driven by the escalating trend of coffee consumption fueled by the increasing popularity of cafes and coffee shops. The continued growth of this trend is anticipated to result in an upsurge in the demand for coffee creamers.

Furthermore, the increasing preference for healthier and natural coffee creamers, characterized by low fat, sugar, and calorie content, is poised to contribute significantly to market growth in the region. The heightened health consciousness among European consumers has spurred the development of an extensive range of low-fat and dairy-free creamers to meet these evolving preferences..

Key Market Players & Competitive Insights

Some of the major players operating in the global market include:

- Nestlé S.A.

- Danone

- Chobani LLC

- DreamPak LLC

- Viceroy Holland B.V.

- PT Santos Premium Krimer

- Kerry Group

- FrieslandCampina

- Land O'Lakes, Inc.

- Fujian Jumbo Grand Food Co., Ltd.

- Heartland Food Products Group

- Leaner Creamer LLC

- Califia Farms, LLC

- nutPods

- Laird Superfood

Recent Developments

-

In August 2023, Danone introduced almond and coconut-based plant-based coffee creamers under their Silk and So Delicious brands.

-

In January 2023, Danone introduced a new line of plant-based coffee creamers made from almond and coconut under its popular brands Silk and So Delicious, giving consumers more dairy-free options to enjoy with their coffee

-

In August 2022, Dunkin' released its Pumpkin Munchkin coffee creamer, capturing the cozy flavors of fall. With a rich pumpkin taste, sweet donut glaze, and a hint of warm spices, the creamer was launched in 32oz bottles and hit shelves at supermarkets and convenience stores across the U.S.

-

In March 2022, Coffee Mate rolled out a fun twist on creamer with its Drumstick Ice Cream flavor. Inspired by the classic frozen treat, the creamer blends notes of milk chocolate, peanuts, and waffle cone for a nostalgic and indulgent coffee experience.

-

In January 2022, Chobani introduced a range of new plant-based coffee creamers, featuring flavors such as caramel macchiato, chocolate hazelnut, sweet & creamy, & French vanilla.

Coffee Creamer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 5.8 billion |

|

Revenue forecast in 2034 |

USD 8.5 billion |

|

CAGR |

5.00% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, Type, By Form, By Nature, By Packaging Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

Explore the market dynamics of the 2024 Coffee Creamer Market share, size, and revenue growth rate, meticulously examined in the insightful reports crafted by Polaris Market Rersearch Industry Reports.

Browse Our Top Selling Reports

Medical Gas Market Size, Share 2024 Research Report

Coffee Creamer Market Size, Share 2024 Research Report

Veterinary Scales Market Size, Share 2024 Research Report

FAQ's

key companies in coffee creamer market are Nestle, Danone, Chobani, DreamPak, Viceroy Holland, Kerry Group, Land O'Lakes

The global coffee creamer market is expected to grow at a CAGR of 5.00% during the forecast period.

The coffee creamer market report covering key segments are product, type, form, nature, packaging type, distribution channel, and region.

key driving factors in coffee creamer market rising extensive range options of coffee creamers drive the market

The global coffee creamer market size is expected to reach USD 8.5 billion by 2034