Food Coating Ingredients Market Size, Share, Trends, & Industry Analysis Report

By Ingredient Type, By Equipment Type, By Form, Mode of Operation, Application, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6120

- Base Year: 2024

- Historical Data: 2020-2023

Overview

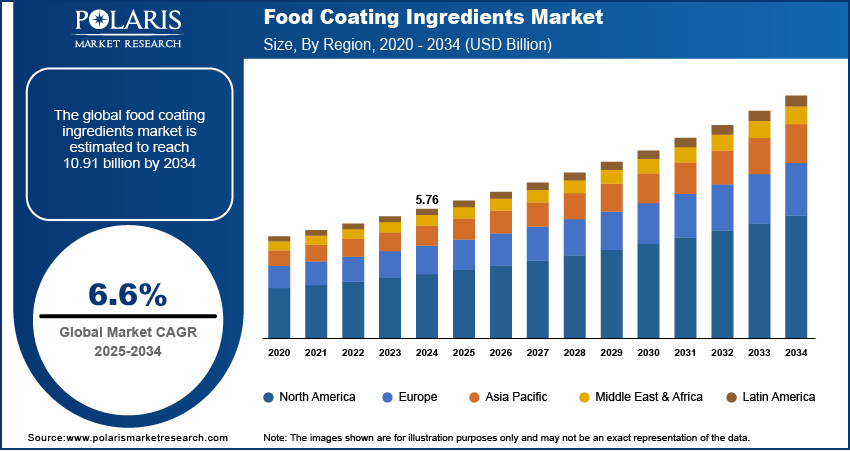

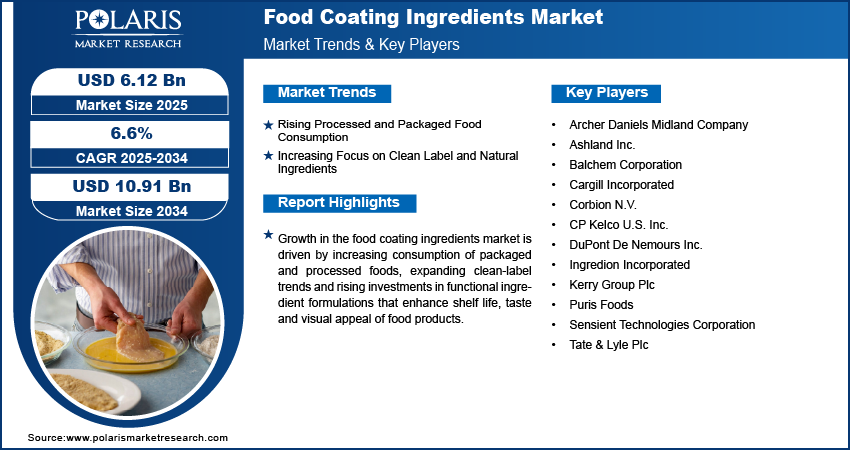

The global food coating ingredients market size was valued at USD 5.76 billion in 2024, growing at a CAGR of 6.6% from 2025–2034. Rising consumption of processed and packaged foods coupled with increasing focus on natural and clean-label ingredients is driving the demand for food coating solutions that enhance product safety, visual appeal and shelf stability while meeting regulatory and consumer expectations for transparency and healthier formulations.

Key Insights

- The dry segment dominated the food coating ingredients market share in 2024.

- The snacks and nutritional bars segment is projected to grow at the fastest CAGR, due to increasing consumer demand for convenient, protein-rich, and functional snack formats.

- The North America food coating ingredients market dominated the global market share in 2024, fueled by growing consumption of packaged foods and the robust presence of leading food manufacturers.

- The US food coating ingredients market held the largest regional share of the North America market in 2024, driven by strong demand for value-added coatings across meat, poultry and bakery applications.

- The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period, driven by rising investment in food processing infrastructure and increasing consumer preference for Western-style packaged foods.

- The China food coating ingredients market is expanding steadily, fueled by urbanization-led dietary shifts, rapid growth in ready-to-eat segments and government incentives promoting food innovation and safety compliance.

Industry Dynamics

- Rising consumption of processed and packaged foods is increasing the demand for coating ingredients that help maintain product stability, improve mouthfeel, and support longer shelf life under varying storage and handling conditions.

- Increasing focus on clean-label and natural ingredients is pushing manufacturers to adopt plant-based, allergen-free, and non-GMO formulations that meet consumer expectations and regional regulatory standards.

- Growing adoption of gluten-free and allergen-free foods is creating opportunities for coating formulations using millet, quinoa, rice flour and legume-based ingredients.

- High input costs associated with natural and specialty coating ingredients are limiting widespread adoption among small and mid-sized food manufacturers operating in cost-sensitive markets.

Market Statistics

- 2024 Market Size: USD 5.76 billion

- 2034 Projected Market Size: USD 10.91 billion

- CAGR (2025-2034): 6.6%

- North America: Largest market in 2024

Food coating ingredients, commonly referred to as edible coatings, are functional materials applied to the surface of food products to enhance texture, taste and appearance. These ingredients form a thin layer that adheres to the food surface during processing, either through spraying, dipping or enrobing techniques. The coatings serve as protective barriers that help retain moisture, prevent oxidation and improve product integrity during storage and transportation. They are widely applied in bakery items, confectioneries, meat products and frozen foods to improve visual appeal, extend shelf life and support flavor retention across various temperature and handling conditions.

The demand for food coating ingredients is growing due to the rising consumption of ready-to-eat meals, frozen foods and snack products that require reliable coating solutions for taste enhancement and product stability. Food manufacturers are focusing on formulations that support moisture retention, flavor encapsulation and heat resistance during processing. The expansion of organized retail, increasing preference for packaged convenience foods and the rising footprint of quick-service restaurant chains are driving the use of specialty coating blends. These include emulsifiers, starches, proteins and hydrocolloids designed to deliver uniform coverage, improved adhesion and resistance to thermal degradation. Additionally, clean-label and plant-based trends producers are incorporating natural and allergen-free ingredients to address shifting dietary preferences and regulatory requirements. In July 2024, the United States Department of Agriculture (USDA) Food Safety and Inspection Service (FSIS) announced a new allergen verification sampling program and the imminent release of detailed import datasets.

Regulatory standards related to food safety, labeling and allergen control are influencing manufacturers to reformulate coating ingredients using approved additives and transparent sourcing practices. Compliance with frameworks such as the Food Safety Modernization Act (FSMA), European Food Safety Authority (EFSA) regulations, and Codex Alimentarius is pushing the use of traceable, non-Genetically Modified Organism (non-GMO) and clean-label ingredients in coating applications. Food producers are investing in advanced formulation technologies and quality assurance systems to ensure consistency, allergen segregation and adherence to global standards. Moreover, growing collaborations between ingredient suppliers and food processors are driving the development of region-specific coating solutions that meet functional performance, sensory expectations and regulatory requirements across export markets.

Drivers & Opportunities

Rising Processed and Packaged Food Consumption: The global increase in processed and packaged food consumption is driving the demand for food coating ingredients that enhance product appearance, extend shelf life and maintain texture during storage and distribution. According to the 2024 UNCTAD report, global food trade increased by 350% between 2000 and 2021, reaching a total value of USD 1.7 trillion. Processed foods accounted for approximately 48% of total food imports in developed economies, compared to about 35% in developing economies. Growing urbanization, changing dietary habits and a rise in dual-income households are contributing to the preference for ready-to-eat meals, frozen snacks and convenience foods. Coating solutions are essential in preserving product quality throughout manufacturing and logistics processes. Manufacturers are increasingly investing in coating technologies that provide consistency, durability and improved barrier properties to meet the growing supply chain demands of mass-produced packaged food products.

Increasing Focus on Clean Label and Natural Ingredients: The growing focus on clean-label and natural ingredients is driving the reformulation of food coating blends using plant-based, allergen-free and non-GMO components to meet rising consumer demand for transparency and healthier food options. For instance, in July 2024, Ingredion launched two clean-label citrus fiber ingredients, FIBERTEX CF 500 and CF 100, in the EMEA region, made from upcycled citrus peels. These fibers enhance texture and stability while enabling the reduction or replacement of ingredients such as eggs, oils, and tomato solids in bakery, plant-based meat, and savory products. Moreover, the regulatory authorities and food industry organizations are guiding manufacturers to follow safer ingredient standards and clearer labeling practices. This is leading food producers to remove synthetic additives and artificial preservatives from coating formulations. This shift is increasing the adoption of natural starches, proteins, and hydrocolloids that fulfill functional performance and compliance requirements. Moreover, the demand for safe and clearly labeled products is pushing the development of coatings that ensure quality without compromising on ingredient integrity.

Segmental Insights

Ingredient Type Analysis

Based on ingredient type, the segmentation includes sugars and syrups, cocoa and chocolates, fats and oils, spices and seasonings, flours, batter and crumbs, and other ingredient types. The batter and crumbs segment dominated the market in 2024, driven by rising demand across fried and baked products in the bakery and meat processing industries. These coatings provide texture, moisture retention, and flavor enhancement, which support product consistency during high-volume production. Their widespread use in quick-service restaurants and frozen food manufacturing contributes to higher consumption. Moreover, growing demand for crispy coatings in convenience meals is further accelerating segment dominance.

The spices and seasonings segment is projected to grow at the fastest CAGR during the forecast period, due to rising consumer demand for region-specific flavors and taste innovation in coated foods. Manufacturers are integrating spice blends into coating systems to create differentiated product offerings across snacks, ready meals, and processed meat. Additionally, the growing demand for clean-label and natural seasoning extracts is driving their use in value-added coating applications.

Equipment Type Analysis

By equipment type, the segment includes coaters & applicators and enrobers. The coaters & applicators segment dominated the market in 2024, fueled by their broad use in high-speed production lines for uniform application of dry and liquid coatings. These machines are widely deployed in the bakery, snack, and meat processing industries where consistent coating distribution is critical. Additionally, technological advancements in precision coating systems are enhancing operational efficiency and reducing material waste.

The enrobers segment is projected to grow at the fastest CAGR during the forecast period, due to increasing demand for confectionery and chocolate-coated products across emerging markets. Enrobing equipment is growing in popularity in premium bakery and snack applications that require full or partial coating. Moreover, demand for aesthetically appealing and innovative coated products is contributing to greater adoption across small and mid-scale food processing units.

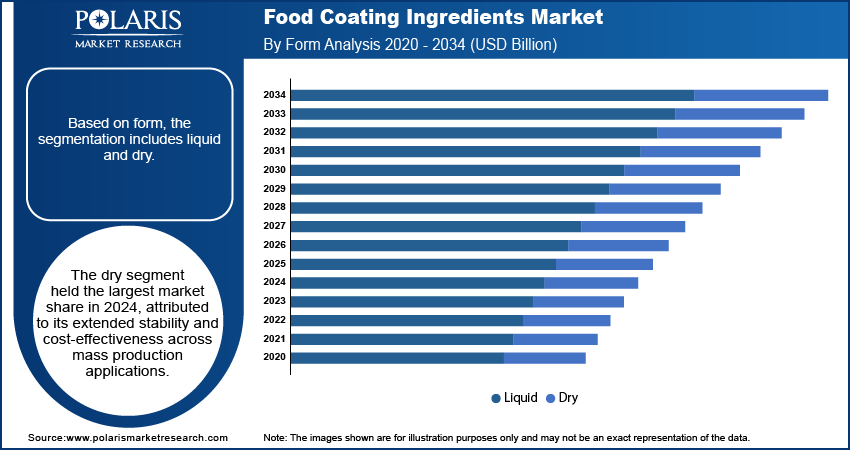

Form Analysis

Based on form, the segmentation includes liquid and dry. The dry segment dominated the market in 2024, due to its widespread use in snack products, meat processing, and bakery applications where dry coatings help retain texture and extend shelf life. Ingredients such as flours, spices, and breadcrumbs are used in various forms of dry coating systems. Moreover, the longer storage stability and lower handling costs of dry coatings contribute to their higher consumption.

The liquid segment is projected to grow at the fastest CAGR during the forecast period, driven by growing use in confectionery, dairy, and fruit coating applications. Liquid coatings offer better adhesion for inclusions and flavors and are preferred for glossy finishes and moisture barriers. Additionally, rising demand for functional coatings with vitamins, flavorings, and natural extracts is driving their application in liquid format.

Mode of Operation Analysis

By mode of operation, this segment includes automatic and semi-automatic. The automatic segment dominated the market in 2024, due to increasing adoption across large-scale food manufacturing facilities that require high-speed production, minimal labor intervention, and consistent output. Automatic systems support continuous processing and help ensure product uniformity while optimizing operational cost. Moreover, automation reduces human error and improves safety in high-capacity production lines.

The semi-automatic segment is projected to grow at the fastest CAGR during the forecast period, this is rising due to the adoption among small and medium food processors seeking cost-effective equipment with flexible operations. These systems are preferred in emerging markets where capital investment capacity is limited. Additionally, the growing availability of compact and easy-to-integrate models is fueling adoption across startups and specialty food production units.

Application Analysis

By application, this segment includes bakery, confectionery, breakfast cereals, snacks and nutritional bars, dairy products, meat and poultry products, fruits and vegetables, and other applications. The bakery segment dominated the market in 2024, driven by high consumption of coated bread, cakes, and pastries in retail and foodservice channels. In February 2025, Dawn Foods expanded its portfolio of bakery coatings by introducing new dipping and enrobing options designed to enhance texture, appearance, and flavor. The extended line aims to meet growing demand for versatile, high-performance coatings across a wide range of bakery applications. Coating ingredients such as sugars, oils, flours, and batters are used to enhance the appearance, texture, and shelf life of bakery products. Moreover, growing demand for frozen and pre-baked items is driving consistent use of coating systems in the bakery segment.

The snacks and nutritional bars segment is projected to grow at the fastest CAGR during the forecast period, due to increasing consumer demand for flavored, coated, and fortified snack options. Coating ingredients are used to improve taste, texture, and shelf life while also serving as carriers for functional additives. Additionally, rising demand for on-the-go nutrition and protein-based snack bars is driving segment growth across developed and developing regions.

Regional Analysis

North America food coating ingredients market dominated the global market in 2024. This is driven by strong demand for coated snack foods and bakery products across the US and Canada. The presence of large-scale food processing facilities and continuous innovation in ready-to-eat meals is boosting the use of functional coating blends. Moreover, growing focus by food manufacturers towards clean-label and organic ingredient formulations to meet evolving consumer preferences for transparency and wellness is fueling market growth. In addition, rising regulatory frameworks implemented by the US Food and Drug Administration (FDA) are driving the use of approved and traceable coating ingredients across commercial food manufacturing operations.

The US Food Coating Ingredients Market Insight

The US held a largest market share in the North America food coating ingredients landscape in 2024, fueled by the high consumption of coated bakery items, frozen meals and snack products across large-scale retail and foodservice sectors. According to the American Frozen Food Institute, unit sales of various frozen meats in the first half of 2023 saw notable increases, with processed chicken up by 9.6%, breakfast sausage by 7.4%, and beef by 3.1%. Frozen meal solutions also recorded growth, including pizza (up 1.3%), side dishes (up 3.2%), and potato-based products such as fries (up 0.6%) and tater tots (up 8.2%). Moreover, the presence of well-established food manufacturing companies that are adopting automated coating systems to meet growing demand for consistency, flavor enhancement, and extended shelf life is boosting the food coatings market. In addition, the rising consumer interest in clean-label and plant-based food items is pushing manufacturers to develop coating blends with natural ingredients, free from synthetic additives or preservatives. Which in turn drives the demand for the food coatings market in this region.

Asia Pacific Food Coating Ingredients Market

The market in Asia Pacific is projected to grow at the fastest CAGR during the forecast period. This growth is witnessed due to the rapid consumption of packaged, frozen and ready-to-cook food is rising across China, India, and Japan, which is increasing the need for efficient and functional food coating systems. Moreover, growing focus by regional food manufacturers towards localized coating blends to match traditional flavor profiles and consumer taste preferences in snack and meat applications. This is driving the demand for the adoption of food coatings ingredients in this region. In addition, the rising income levels and urbanization are accelerating to the expansion of organized retail and quick-service restaurant formats across key Asia Pacific economies.

China Food Coating Ingredients Market Overview

The market in China is expanding driven by rising demand for convenience foods and rapid expansion of modern retail chains. According to the China Chain Store & Franchise Association (CCFA), China's prepared food market grew by 24.1% in 2021 to reach USD 43.19 billion, and is projected to grow over 20% annually, reaching USD 115.63 billion by the end of 2025. The consumer segment is expected to triple its share from 10% in 2021 to 30% in 2025, representing a market value of around USD 34.83 billion. Moreover, there is a rapidly growing focus on localized coating technologies by domestic food processors to improve the texture, flavor and appearance of frozen and packaged products across urban markets. Which in turn thrives the demand for the food coatings ingredients market in the country. In addition, the growing government focus on food safety compliance is fueling manufacturers to use certified, traceable and allergen-free ingredients in coating formulations for mass-market distribution.

Europe Food Coating Ingredients Market

The food coating ingredients landscape in Europe is projected to hold a substantial share in 2034. This is owing to the high consumption of processed bakery, confectionery and meat products. According to the Agricultural Market Information Company (AMI), average per capita meat consumption in the EU increased to 66 kg in 2024, marking a 2 kg rise from 2023. The highest consumption levels were observed in Cyprus (88 kg), Ireland (87 kg), Portugal (85 kg), and Spain (85 kg). In contrast, Germany reported significantly lower consumption at 53 kg per person, remaining well below the EU average. Moreover, rapid integration of natural, allergen-free and sustainable coating components by food producers to comply with EFSA guidelines and to meet consumer demand for clean-label products is driving the adoption of specialized coating ingredients across Germany, France and the UK. In addition, growing demand for plant-based alternatives is driving manufacturers to use starches, proteins and hydrocolloids derived from non-animal sources across various coating applications. Thus, this is driving the adoption of the food coating ingredients across the region.

Key Players & Competitive Analysis Report

The food coating ingredients market is moderately competitive, with key players focusing on developing functional, clean-label and application-specific coating solutions. Key companies are expanding their product portfolios through the use of natural, allergen-free and plant-based ingredients to meet evolving regulatory and consumer requirements. In addition, rising collaborations between ingredient suppliers and food processors are accelerating innovation in texture, flavor and shelf-life enhancement, while enabling region-specific product customization and long-term competitiveness in the global food processing industry.

Major companies operating in the food coating ingredients industry include Cargill Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group Plc, Tate & Lyle Plc, Sensient Technologies Corporation, DuPont De Nemours Inc., Ashland Inc., Balchem Corporation, Puris Foods, CP Kelco U.S. Inc., and Corbion N.V.

Key Players

- Archer Daniels Midland Company

- Ashland Inc.

- Balchem Corporation

- Cargill Incorporated

- Corbion N.V.

- CP Kelco U.S. Inc.

- DuPont De Nemours Inc.

- Ingredion Incorporated

- Kerry Group Plc

- Puris Foods

- Sensient Technologies Corporation

- Tate & Lyle Plc

Industry Developments

- February 2025: BioBond introduced a new range of bio-based protective coatings designed specifically for the food industry. These coatings aim to replace synthetic materials with sustainable alternatives that maintain product quality and extend shelf life.

- February 2024: Ingredion launched its first functional native clean-label starch, designed to deliver superior texture and stability without chemical modification. This innovation meets the growing demand for clean-label ingredients while maintaining performance in processed and shelf-stable food applications.

Food Coating Ingredients Market Segmentation

By Ingredient Type Outlook (Revenue, USD Billion, 2020–2034)

- Sugars and Syrups

- Cocoa and Chocolates

- Fats and Oils

- Spices and Seasonings

- Flours

- Batter and Crumbs

- Other Ingredient Types

By Equipment Type Outlook (Revenue, USD Billion, 2020–2034)

- Coaters & Applicators

- Enrobers

By Form Outlook (Revenue, USD Billion, 2020–2034)

- Liquid

- Dry

By Mode of Operation Outlook (Revenue, USD Billion, 2020–2034)

- Automatic

- Semi-automatic

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Bakery

- Confectionery

- Breakfast Cereals

- Snacks and Nutritional Bars

- Dairy Products

- Meat and Poultry Products

- Fruits and Vegetables

- Other Applications

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Food Coating Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.76 Billion |

|

Market Size in 2025 |

USD 6.12 Billion |

|

Revenue Forecast by 2034 |

USD 10.91 Billion |

|

CAGR |

6.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.76 billion in 2024 and is projected to grow to USD 10.91 billion by 2034

The global market is projected to register a CAGR of 6.6% during the forecast period.

North America dominated the market in 2024, driven by the large-scale production of processed foods and strong demand for functional coatings across snacks, meat and bakery categories.

A few of the key players in the market are Cargill Incorporated, Archer Daniels Midland Company, Ingredion Incorporated, Kerry Group Plc, Tate & Lyle Plc, Sensient Technologies Corporation, DuPont De Nemours Inc., Ashland Inc., Balchem Corporation, Puris Foods, CP Kelco U.S. Inc., and Corbion N.V.

The dry segment dominated the market in 2024, driven by its extended shelf life, ease of storage and suitability for high-volume production environments.

The snacks and nutritional bars segment is projected to grow at the fastest CAGR, due to increasing consumer preference for convenient, high-protein, and health-oriented snacking options