Ready Meals Market Share, Size, Trends, Industry Analysis Report

By Product (Chilled, Frozen, Shelf-stable, Canned); By Meal Type (Vegan, Vegetarian, Non-vegetarian); By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 115

- Format: PDF

- Report ID: PM2464

- Base Year: 2024

- Historical Data: 2020-2023

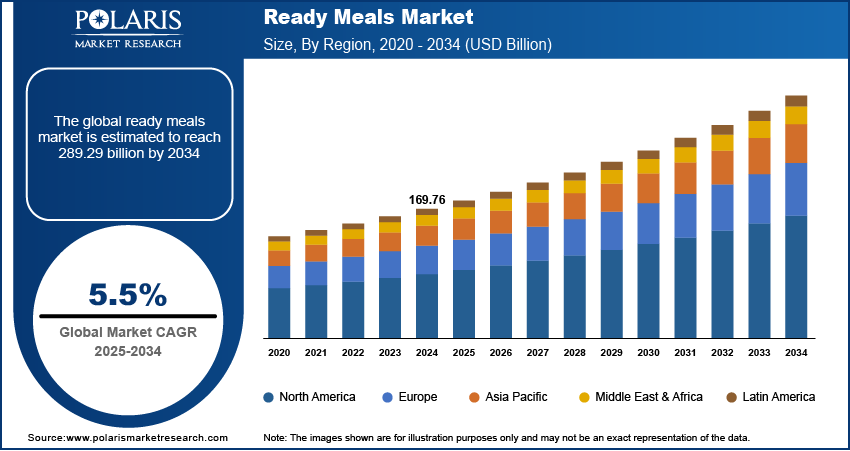

The global ready meals market was valued at USD 169.76 billion in 2024 and is expected to grow at a CAGR of 5.5% during the forecast period. Change in lifestyle among individuals due to rapid urbanization coupled with the introduction of healthy and convenient ready foods is expected to increase the market throughout the forecast period.

Key Insights

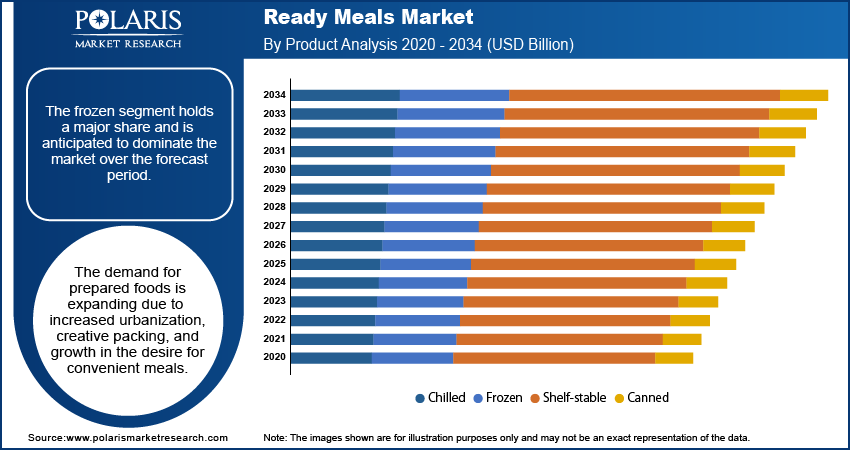

- By product, the frozen subsegment held the largest share in 2024. This is primarily due to the ready-prepared nature of frozen foods along with their ease of preparation, storage, and long shelf life.

- By meal type, the non-vegetarian held the largest share in 2024. This is because of the growing consumption and demand of proteinaceous food products like chicken nuggets, sausages, and other meat derivatives, favored by meat-lovers.

- By distribution channel, Supermarket & hypermarkets held the largest share in 2024. This is due to the vast array of ready-to-eat meals and the ready availability of these outlets to the large population.

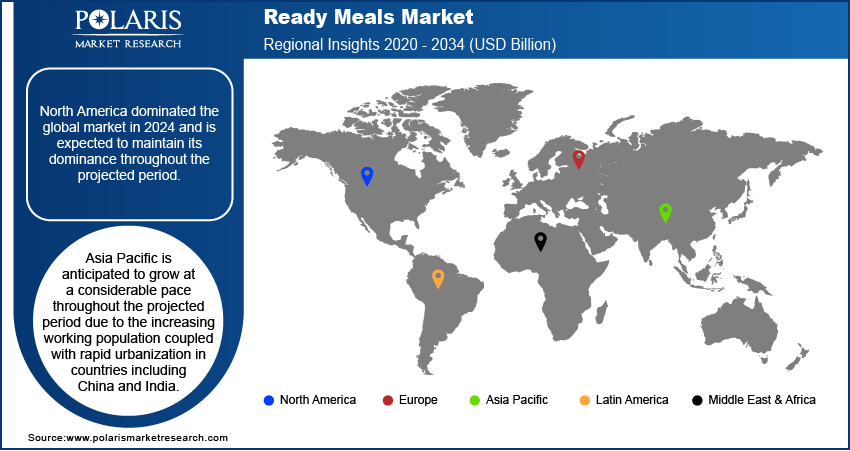

- By region, North America held the largest share in 2024. This is due to factors such as busy lifestyles of the population, the growing number of single and dual-income families, and the increasing demand for time-efficient meals.

Industry Dynamics

- An increasing number of individuals migrating to live in urban areas and adopting busy lifestyles means people have limited time to spend on meal preparation. Thus, growing the demand of ready meals.

- Increasing prioritization of convenience above the time spent on meal preparation has led to the increasing popularity of ready-to-eat meals.

- Technology and innovation in the food industry have improved quality, nutrition, and the convenience of preparing meals and have also prolonged the shelf life of ready-to-eat meals.

Market Statistics

- 2024 Market Size: USD 169.76 billion

- 2034 Projected Market Size: USD 289.29 billion

- CAGR (2025-2034): 5.5%

- North America: Largest market in 2024

AI Impact on the Market

- AI is gaining a foothold in manufacturing to improve processes and enhance the productivity of encompassing resources at a given stage.

- AI allows businesses to forecast demand more precisely and manage their inventories accordingly. This prevents shortages and overstocking.

To Understand More About this Research: Request a Free Sample Report

The outbreak of the Covid-19 has had a significant influence on the worldwide ready meals sector. Because of its longer shelf lifetime and ease of preparation, customers started purchasing and storing packaged foods, which in turn has increased knowledge regarding convenience food, contributing to industry development.

On the other hand, convenience meals are frequently connected with less healthful eating habits, which can lead to overweight and severe illnesses, including diabetes, heart illness, and cancer. This, in turn, is expected to hinder the growth of the industry throughout the forecast period.

Industry Dynamics

Growth Drivers

Ready-to-eat meals are food products that have been pre-cooked so that they may be enjoyed without further preparation. Consumers are getting more mindful of dietary products' quality and purity. As novel processed foods are offered to the marketplace, such as organic, ready-to-eat, and frozen with sophisticated technology, the demand for the industry is also likely to increase.

Ready-to-eat meals come in various tastes and appearances, appealing to a large client base. These foods are emerging as an increasingly important aspect of human existence across the world. The adoption of organic prepared foods, the entrance of new types of ready foods, technical improvements, and the construction of a powerful worldwide distribution infrastructure are all critical aspects anticipated to propel ready meals market growth over the forecast period.

Report Segmentation

The market is primarily segmented based on product, meal type, distribution channel, and region.

|

By Product |

By Meal Type |

By Distribution Channel |

By Region |

|

|

|

|

Insight by Product

The frozen segment holds a major share and is anticipated to dominate the market over the forecast period. The demand for prepared foods is expanding due to increased urbanization, creative packing, and growth in the desire for convenient meals. Further, the segment benefits from customers' growing need for convenience and comfort as a result of their hectic schedules.

The shelf-stable segment is expected to hold a considerable share throughout the forecast period as these meals do not require freezing or refrigeration, making them easier to store. Further, shelf-stable food meals are more affordable than other alternatives, contributing to the increasing demand.

Insight by Distribution Channel

The supermarkets & hypermarkets segment holds a significant share and is expected to dominate over the projected period due to the easy availability and accessibility of ready-to-eat meals. Furthermore, the increasing variety of product offerings by these channels is expected to propel segment growth. For instance, in January 2021, Jempson's, an independent grocer, launched a new line of ready meals using personnel from its defunct cafes and restaurants.

The online segment is expected to grow at the fastest pace throughout the forecast period owing to the rapid adoption of smartphones across multiple economies coupled with increasing discounts and variety offered by online merchants.

Geographic Overview

North America dominated the global market in 2024 and is expected to maintain its dominance throughout the projected period. Increasing trends of gluten-free products due to portability and convenience are expected to propel the demand in the region. Another element boosting the industry is changing food intake habits as a result of increased urbanization.

Furthermore, the presence of a fast-paced culture, particularly in metropolitan regions, contributes to a growth in consumer desire for prepacked dishes to save time. Additionally, In 2020, approximately 36% of individuals in the U.S. reported eating ready-to-eat meals, as per a study released in BioMed Central Ltd. Thus, increasing trends for pere packed food items are expected to propel the ready meals market growth during the forecast period.

Asia Pacific is anticipated to grow at a considerable pace throughout the projected period due to the increasing working population coupled with rapid urbanization in countries including China and India. Furthermore, rising disposable income and improving the standard of living are expected to create lucrative opportunities for industry growth in the region.

Competitive Insight

Industry players operating in the global ready meals market include Associated British Foods Plc, Chao Xiang Yuan Food Co. Ltd., Conagra Foods Inc., Dr. Oetker, Pepsico., General Mills, Graham Packaging Company, Green Mill Food, Greencore Group Plc, Grupo Bimbo, Kerry Group, Kraft Heinz Company, Kellogg Company, Maple Leaf Foods, McCain Foods Limited, Nestle, Premier Foods Plc, Tetra Pak International S.A., Tyson Foods, Inc, Unilever, and WestRock Company.

The industry is highly fragmented due to the presence of prominent players operating regionally and globally. These players are focusing on promotional strategies such as new product launches, product upgradation, partnerships & acquisitions & mergers & expansion in order to expand their global footprint.

For instance, in February 2021, TheVeganKind, the U.K.'s biggest vegan online store, recently teamed up with plant-based meat innovators THIS to introduce Love Plants, their first 100 % plant-based ready-to-eat meal range.

Industry Dynamics

March 2025: YO! broadened its product lineup by launching a frozen meal range in Tesco, featuring items such as the Chicken Katsu Bao Bun Kit, Chicken Teriyaki, Korean-Style BBQ Beef, and Chicken Katsu.

February 2025: Bonduelle rolled out its ready-to-eat Lunch Bowls, made with plant-based ingredients, each offering more than 10 grams of protein and free from artificial preservatives.

Ready Meals Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 169.76 Billion |

| Market size value in 2025 | USD 178.67 Billion |

|

Revenue forecast in 2034 |

USD 289.29 Billion |

|

CAGR |

5.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Meal Type, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key Companies |

Associated British Foods Plc, Chao Xiang Yuan Food Co. Ltd., Conagra Foods Inc., Dr. Oetker, Pepsico., General Mills, Graham Packaging Company, Green Mill Food, Greencore Group Plc, Grupo Bimbo, Kerry Group, Kraft Heinz Company, Kellogg Company, Maple Leaf Foods, McCain Foods Limited, Nestle, Premier Foods Plc, Tetra Pak International S.A., Tyson Foods, Inc, Unilever, and WestRock Company. |

FAQ's

? The global market size was valued at USD 169.76 million in 2024 and is projected to grow to USD 289.29 million by 2034.

? The global market is projected to register a CAGR of 5.5% during the forecast period.

? North America dominated the market share in 2024.

? The frozen segment accounted for the largest share of the market in 2024.