Packaged Food Market Size, Share, Trends, Industry Analysis Report

By Product Type (Bakery Products, Diary Products, Breakfast Products, Meals, Beverages, and Others), By Distribution Channel, By Packaging Type, and By Region -Market Forecast, 2025-2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM2861

- Base Year: 2024

- Historical Data: 2020-2023

Overview

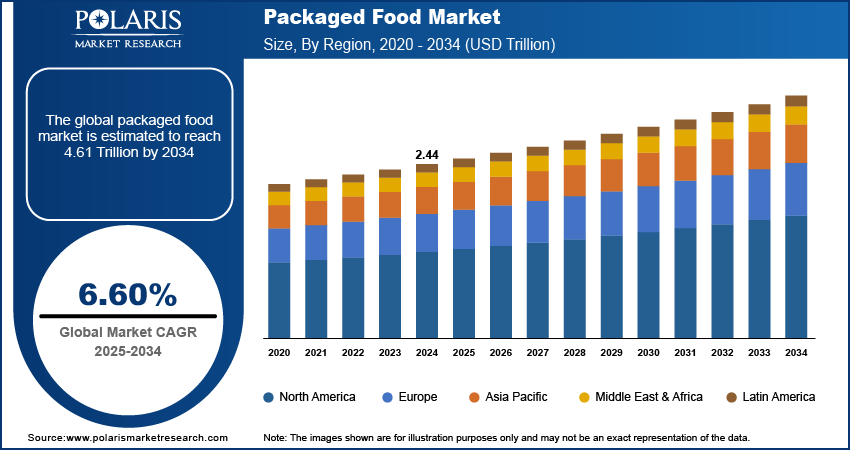

The global packaged food market size was valued at USD 2.44 trillion in 2024. The market is projected to grow at a CAGR of 6.60% during 2025 to 2034. Key factors driving demand for packaged foods include urbanization, improvements in food packaging technology, and the growth of e-commerce.

Key Insights

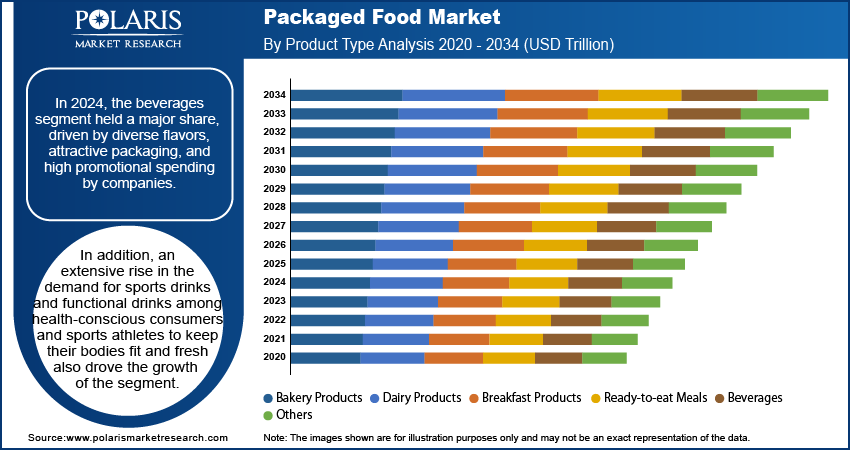

- The beverages segment accounted for the largest revenue share in 2024. This growth is attributed to the wide range of flavors, attractive packaging, and high expenditure on promotion.

- The online distribution channel segment is projected to register the fastest growth at a significant CAGR due to the rising penetration of the internet and rapid growth in the number of mobile phone users across the globe.

- North America dominated the packaged food market in 2024. This growth is attributed to the rising penetration of hectic lifestyles and high consumer spending power.

- The market in the Asia Pacific is projected to grow at a rapid pace in the coming years, owing to easy access to packaged food products and evolving consumer lifestyles.

Industry Dynamics

- The global packaged food market is fueled by a rapid rise in the number of vegans and vegetarians across the globe

- The growth in e-commerce across countries such as China, Japan, and India is also anticipated to increase demand for Packaged Food.

- Growing disposable income, especially in emerging countries such as India, is creating a lucrative market opportunity.

- Stringent government regulation may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 2.44 Trillion

- 2034 Projected Market Size: USD 4.61 Trillion

- CAGR (2025-2034): 6.60%

- North America: Largest Market Share

The hectic work and busy lifestyles of consumers worldwide, rising preferences for convenience products, and rapid expansion of various e-commerce platforms such as Amazon, Flipkart, and eBay across the globe are major factors projected to boost the growth of the global market during the forecast period.

To Understand More About this Research: Request a Free Sample Report

Growing innovations in food packaging, healthy ingredients, bold flavors, and plant-based products by several large market companies have contributed significantly to the growth of the market. For instance, in November 2022, Fresh Cravings announced the expansion of its dips collection at Publix stores. The company has introduced Jalapeno Popper and French Onion Plant-Based Dips into its existing dips collection. The new product comes with gluten and preservative-free products, which join the cravings family of hummus, refrigerated salsas, and Queso Plant-Based Dip.

Industry Dynamics

Growth Drivers

Extensive growth in the demand for plant-based food products owing to a rapid rise in the number of vegans and vegetarians across the globe is a major factor expected to drive the growth and adoption of packaged food over the projected period. For instance, according to a done by Vegetarian Times, nearly 9.7 million Americans are vegetarians or follow a vegetarian diet, and about 1 million of those are vegan. Moreover, sales of plant-based food grew by 27% with a market value of USD 7 billion.

The increasing efforts by key market players such as Nestle, The Coca-Cola Company, and Tyson Foods on the improvement of quality, better packaging, and lowering costs coupled with the availability of high technological advancements, especially in developed countries like US, Canada, France, and Germany are further likely to fuel the growth of the global market in the coming years.

Report Segmentation

The market is primarily segmented based on product type, distribution channel, packaging type, and region.

|

By Product Type |

By Distribution Channel |

By Packaging Type |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

Beverages Segment Accounted for the Largest Market Share in 2024

The beverages segment accounted for a major market share in 2024. This is attributed to the the availability of a wide range of flavors, attractive packaging, and high expenditure on the promotion of these products to gain consumer traction through various companies. In addition, an extensive rise in the demand for sports drinks and functional drinks among health-conscious consumers and sports athletes to keep their bodies fit and fresh also drove the growth of the segment.

The ready-to-eat meals segment is expected to grow at the fastest CAGR over the study period. Consumers from various developed and even developing nations are extremely shifting towards ready meals owing to their busy life schedules and adopting them as a convenient alternative for dual-earning households. The growing employment rate, especially in emerging countries such as India and Vietnam is leading the segment growth. Moreover, the increasing development of supermarkets in these emerging countries are also driving the segment growth.

Online Segment is Expected to Witness the Fastest Growth

The supermarket/hypermarket segment dominated the market in 2024 and is projected to maintain its dominance throughout the forecast period. A large number of global consumers prefer to buy groceries from supermarkets. This is due to the shopping experience offered by these stores and the option for verifying a product physically along with expert assistance.

The online distribution channel segment is projected to register the fastest growth at a significant CAGR in the coming years. This is attributed due to the rising penetration of the internet and rapid growth in the number of mobile phone users across the globe. In addition, the emergence of various online shopping platforms and the benefits they are offering to their consumers such as a wide range of products in one place, don’t need to bargain, the availability of almost every brand, and free home delivery services attracted consumers to buy their products through these online channels. This contributed to the dominance of the segment.

Plastic Packaging Segment Held the Largest Market Revenue Share in 2024

The dominance of the segment is majorly driven by several benefits offered to distributors, retailers, and consumers such as lightweight, easy availability, and lower emissions with cost-effectiveness. Moreover, plastic packaging can easily withstand harsh conditions and does not disintegrate rapidly and quickly in both cold and cold climates, and retain the freshness of beverages and food products inside. This has resulted in higher adoption of these packaging materials at a high rate in recent years worldwide. For instance, in May 2022, Amcor PLC announced the development of its latest technology, PowerPostTM, which is projected to deliver a bottle up to 30% lighter and made from 100% recyclable material. This is mainly developed for hot-fill beverages and to avoid spills from overflow.

The Demand in Asia Pacific is Expected to Witness Significant Growth

North America dominated the packaged food market in 2024 and is likely to maintain its dominance throughout the projected period. The growth of the regional market can be attributed to the rising penetration of hectic lifestyles, high consumer spending power, and the introduction of various new and attractive food products by key market companies, especially in countries such as the United States and Canada. In addition, packaged foods provide lots of choices for consumers to choose from, which eliminated the risk of food tampering, reduced spoilages of foods, and provided many other advantages that paved the way for higher adoption of these products in the region.

The market in Asia Pacific is projected to grow at a robust pace in the coming years due to easy access to packaged food products, evolving consumer lifestyles, and increasing disposable income of people. Moreover, an extensive rise in the urban population and the rising prevalence of various online shopping platforms in countries like India, China, and Indonesia are further expected to fuel the growth and demand for packaged food over the coming years. For instance, in 2021, India’s urban population was 493,169,259 with a significant increase of 2.32% from 2020. By 2030, the total Indian population living in urban areas is likely to reach over 600 million nearly 40% of the country’s population.

Competitive Insight

Key players in the market include Nestle, Kraft Foods, General Mills, ConAgra Foods, Hormel Foods, Andros Foods, Histon Sweets, Gehl Foods, B & G Foods, Smithfield Foods, PepsiCo, Coca-Cola Company, and Mondelez.

Recent Developments

In November 2021, The Coca-Cola Company announced that the company has acquired complete ownership of BODYARMOR, a sports performance, and hydrational beverages line. With this acquisition, the company will expand its beverage portfolio and is expected to have long-term growth.

In July 2022, Tyson Foods, a U.S.-based leading food company announced its new strategic partnership with Tanmiah, a provider of fresh and value-added poultry and meat products. With this agreement, Tyson Foods Inc. will acquire 15% of the Tanmaih subsidiary and a 60% stake in Supreme Foods Processing Company.

Packaged Food Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 2.44 trillion |

| Market size value in 2025 | USD 2.59 trillion |

|

Revenue forecast in 2034 |

USD 4.61 trillion |

|

CAGR |

6.60% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025– 2034 |

|

Quantitative units |

Revenue in USD trillion and CAGR from 2025 to 2034 |

|

Segments covered |

|

|

Regional scope |

|

|

Key companies |

Nestle S.A., Kraft Foods Group Inc., General Mills, Tyson Foods, ConAgra Foods Inc., Hormel Foods Corporation, Andros Foods, Histon Sweets Spreads Ltd., Gehl Foods LLC., B, and G Foods Inc., Maple Leaf Foods Inc., Smithfield Foods Inc., JBS S.A., PepsiCo Inc., The Coca-Cola Company, and Mondelez Global LLC. |

FAQ's

• The global market size was valued at USD 2.44 trillion in 2024 and is projected to grow to USD 4.61 trillion by 2034.

• The global market is projected to register a CAGR of 6.60% during the forecast period.

• North America dominated the market in 2024.

• A few of the key players in the market include Nestle S.A., Kraft Foods Group Inc., General Mills, Tyson Foods, ConAgra Foods Inc., Hormel Foods Corporation, Andros Foods, Histon Sweets Spreads Ltd., Gehl Foods LLC., B, and G Foods Inc., Maple Leaf Foods Inc., Smithfield Foods Inc., JBS S.A., PepsiCo Inc., The Coca-Cola Company, and Mondelez Global LLC.

• The beverages segment dominated the market revenue share in 2024.