Mobile Phone Insurance Market Share, Size, Trends & Industry Analysis Report

By Phone Type (Budget Phones, Premium Smartphones); By Coverage; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 145

- Format: PDF

- Report ID: PM4728

- Base Year: 2024

- Historical Data: 2020-2023

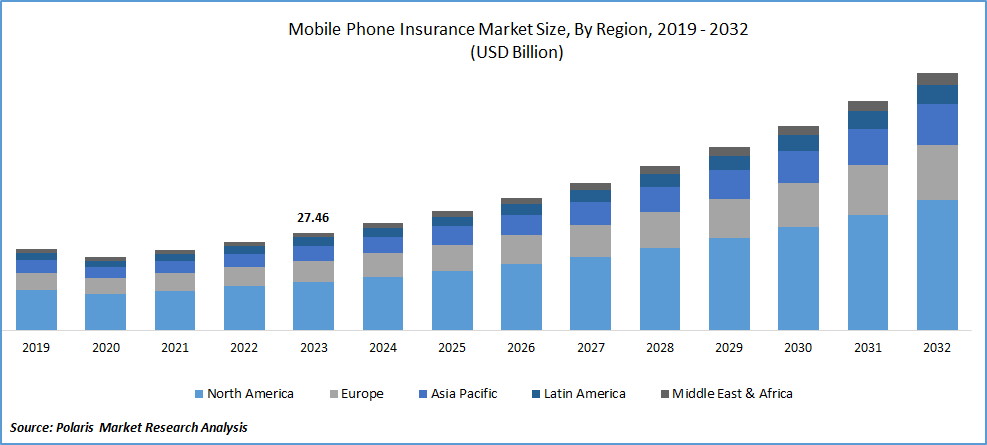

The global Mobile Phone Insurance Market was valued at USD 35.4 billion in 2024 and is expected to grow at a CAGR of 10.10% from 2025 to 2034. Increasing smartphone ownership and accidental damage risks are key growth drivers.

The rising occurrences of accidental damage, thefts, virus infections, and device malfunctions are anticipated to propel market growth in the forecast period. These incidents have prompted consumers to seek ways to protect their mobile phones, leading to the adoption of mobile phone insurance policies. Mobile phone insurance provides a safety net for consumers, mitigating the financial impact of high replacement costs in the event of loss or device breakdown. Typically, such insurance policies cover physical damage, internal failure, theft and loss protection, as well as virus and data protection.

Mobile phones play a dual role as platforms for both entertainment and education, as well as efficient tools for digital transactions. The growing reliance on smart phones for storing the personal information & digital transactions has heightened the importance of securing these devices. As per the report by GSMA, it is projected that by 2025, around 75 percent of internet users will use smartphones to access internet. Service providers offering mobile phone insurance are partnering with smartphone producers to assess the effectiveness of insurance schemes or policies bundled with mobile phone purchases.

To Understand More About this Research:Request a Free Sample Report

The market is expected to experience growth due to the rising adoption of Business Intelligence (BI) tools among market players. These tools play a crucial role in helping businesses identify negative trends in product costs and performance. Business Intelligence is applied in both strategic and tactical ways. Strategically, it is utilized to monitor KPIs related to policy growth, claims ratio, claim settlement, & other metrics.

Mobile phones commonly come with a warranty that covers the expenses of repairing mechanical breakdowns, internal disk crashes, or damages caused by touch sensors, among other issues. Manufacturers or retailers typically provide a one-year limited warranty, which can be extended for an additional fee. However, due to the stringent and limited terms and conditions associated with the warranty coverage, customers often find themselves responsible for covering the cost of replacing damaged parts.

The market faces challenges due to the complexities associated with the terms & conditions, making it challenging for consumers to have appropriate claims. Some market players offer coverage plans with fixed premiums and coverage amounts, leading to customer reluctance. These policies may require users to pay high premiums for damage repair, regardless of the nature of the damages covered. However, providers have recognized these issues & introduced policies with the monthly premiums & coverage tailored to customer requirements. Simplifying terms and conditions and claim procedures is expected to boost the adoption of mobile insurance plans globally.

Growth Drivers

- The rising cost of smartphones compelling consumers to seek coverage policies

Mobile phones are prone to physical and technical damages, such as casing issues and exposure to excessive dust and dirt, which can harm the Printed Circuit Board (PCB) and other components. These damages pose significant risks for users, leading to an increased demand for mobile phone insurance in the forecast period. The rising costs of smartphones are a driving factor compelling consumers to seek coverage policies. Additionally, the growing partnerships between mobile phone manufacturers and insurance providers are expected to contribute to market growth. The emergence of the direct-to-consumer insurance assistance model presents substantial growth opportunities, offering an enhanced customer experience compared to traditional distribution channels for insurance sales.

Report Segmentation

The market is primarily segmented based on phone type, coverage, and region.

|

By Phone Type |

By Coverage |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Phone Type Analysis

- Premium phones segment held the largest share in 2024

Premium phones segment held the largest share. Premium smartphones often experience technical malfunctions, and users face potential losses due to issues such as theft and hardware damage. Repairing such damages and maintaining these high-end phones can result in significant expenses for users. These factors are anticipated to drive the adoption of mobile phone insurance among premium smartphone users.

Mid & high demand phones segment projected to grow at the fastest rate. The growth of the light sensor mobile phone insurance market is fueled by the increasing prevalence of mid-end smartphones worldwide. Advances in technology and the decreasing costs of mid-end smartphones are influencing users to choose these devices over premium ones. As a result, mobile phone insurance companies are strategically focusing on developing insurance plans tailored for mid and high-end smartphones, contributing to the growth of this segment over the forecast period.

By Coverage Analysis

- Physical damage segment registered the largest market share in 2024

The physical damage segment holds the largest share in the market. This is primarily due to the widespread adoption of physical damage protection plans, which are favored by many users. Given the susceptibility of mobile phones to physical damages such as circuit board cracks and screen damage, insurance companies often include coverage for such issues within their physical damage plans. This approach helps users avoid significant expenses for repairs and maintenance.

According to the International Telecommunication Union (ITU), Argentina and Peru experience a daily theft count ranging from 4,700 to 6,000 smartphones. Additionally, around 70 million cases of smartphone theft are reported on an annual basis.

The internal coverage segment is anticipated to grow rapidly. Electronic damages resulting from overcharging, voltage fluctuations, and other factors are driving demand for plans within this segment. These plans also offer protection against the gradual deterioration of electronic components, parts, and accessories. Increasing awareness of potential cyberattack threats, such as trojans and botnets, is prompting users to prioritize device security, leading to substantial growth in the virus and protection segment.

Regional Insights

- North America region held the largest share of the global market in 2022

The North America region emerged as the dominant player in the market. This growth can be primarily attributed to the abundance of mobile phone insurance providers and the rising occurrences of crimes involving smartphones in Canada and the U.S. According to the Bureau of Justice Assistance, the U.S. witnesses an average annual theft of over one million smartphones. Furthermore, the availability of insurance plans offering additional protection for software malfunctions and replacement of stolen devices is expected to propel the regional market's growth in the forecast period.

The Asia Pacific region projected to grow at the rapid pace. Collaboration between e-commerce platforms like Flipkart and insurance service providers including Bajaj Allianz to provide mobile phone insurance is expected to be a significant driver of growth. Additionally, countries are anticipated to experience substantial market growth, fueled by a significant rise in disposable income.

In China, the increasing trend among consumers to ensure their mobile phones is driven by the affordability and quality of the glass used for phone screens. For example, the iPhone X series incorporated a glass back for aesthetic purposes, but it lacked durability. In response to this, in China companies like Sinosafe introduced specialized insurance for iPhone screen.

Key Market Players & Competitive Insights

To enhance their market share, industry participants are employing inorganic growth strategies, including collaborations, acquisitions, and mergers. For instance, in January 2023, collaboration between Cox Mobile, & Asurion. This partnership aims to offer device protection and trade-in services to wireless customers of Cox Mobile.

Some of the major players operating in the global market include:

- Apple Inc.

- American International Group, Inc.

- Assurant, Inc

- Asurion

- AT&T Intellectual Property.

- AmTrust Financial

- Brightstar Corp.

- GoCare Warranty Group

- SquareTrade, Inc.

- Taurus Insurance Services Limited

Recent Developments

- In May 2024, Epic launched device insurance for smartphones and tablets in Malta, offering affordable protection against accidental damage, with easy enrollment, up to two annual claims, and coverage through authorized repair shops.

- In July 2023, Apple introduced AppleCare+, an extended warranty plan offering accidental damage coverage and round-the-clock technical support. This service can be acquired within 60 days of iPhone purchase in most countries and regions.

Mobile Phone Insurance Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 39 billion |

|

Revenue forecast in 2034 |

USD 84.7 billion |

|

CAGR |

10.10% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Power Source, By Product, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The key companies in Mobile Phone Insurance Market Apple, Assurant, Asurion, AT&T Intellectual, AmTrust Financial, Brightstar Corp

The global mobile phone insurance market is expected to grow at a CAGR of 10.10% during the forecast period.

Mobile Phone Insurance Market report covering key segments are phone type, coverage, and region

The key driving factors in Mobile Phone Insurance Market are The rising cost of smartphones compelling consumers to seek coverage policies

Mobile Phone Insurance Market Size Worth $84.7 Billion By 2034.