Construction Fabrics Market Size, Share, Trends, & Industry Analysis Report

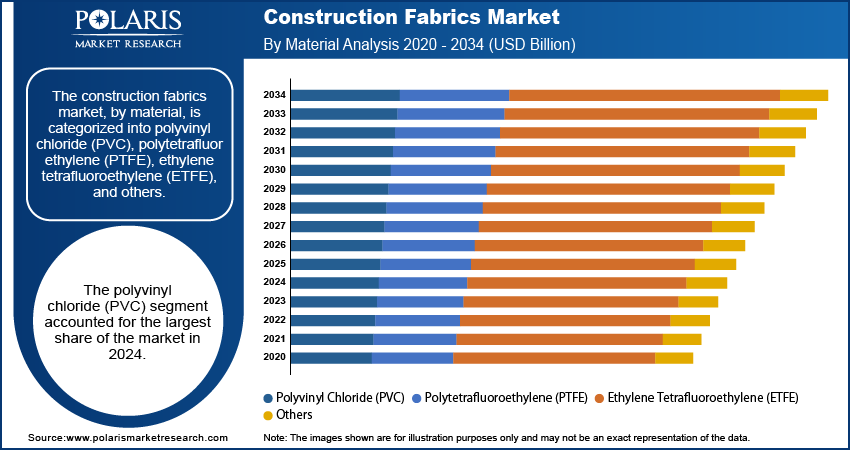

: By Material [Polyvinyl Chloride (PVC), Polytetrafluoroethylene (PTFE), Ethylene Tetrafluoroethylene (ETFE), and Others], End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM5810

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

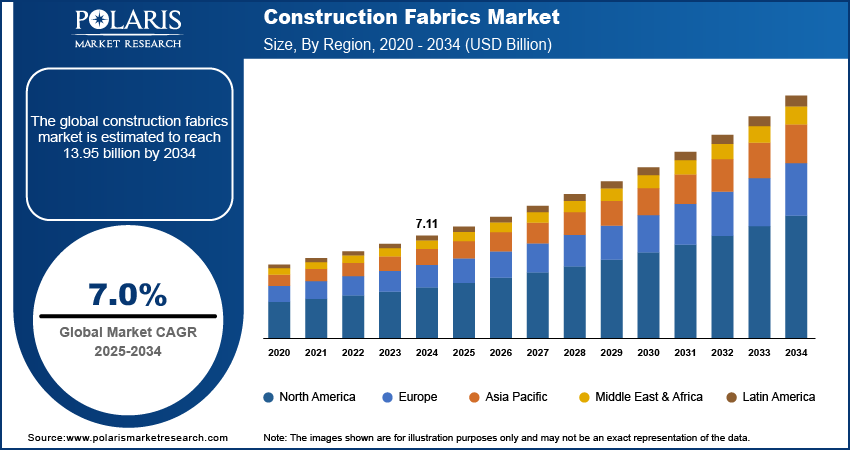

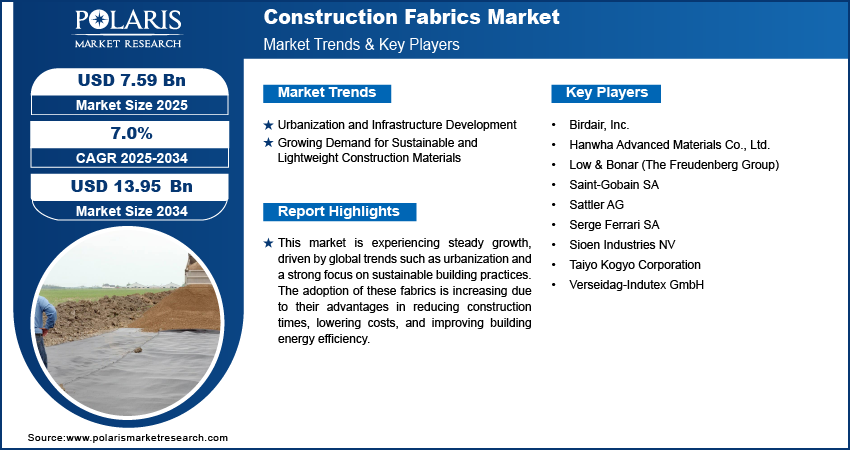

The global construction fabrics market size was valued at USD 7.11 billion in 2024 and is anticipated to register a CAGR of 7.0% from 2025 to 2034. The increasing demand for strong and light materials in building projects and rapid urbanization and infrastructure developments across the world boost the demand for these fabrics.

Construction fabrics are specialized textiles and membranes used in various building and infrastructure applications. These materials, often coated with polymers such as PVC, PTFE, or ETFE, are chosen for their durability, lightweight nature, and versatility in modern architectural designs. They are increasingly used in tensile structures, roofs, facades, and awnings, offering functional benefits and aesthetic appeal.

The global push for innovative and lightweight construction solutions drives the construction fabrics market growth. Construction fabrics provide an excellent alternative to traditional heavy materials such as concrete and steel. Their ability to enable unique and expansive designs, often with reduced material usage and faster installation times, contributes to their increased penetration in residential and nonresidential segments. Another significant factor is the rising awareness and adoption of sustainable building practices, with construction fabrics offering energy-efficient properties and a lower environmental impact than conventional options.

Rapid urbanization and extensive infrastructure development worldwide influence the adoption of construction fabrics. As populations migrate to urban centers, there is a substantial need for new housing, commercial spaces, and public facilities. This necessitates the construction of smart cities, transportation networks, and modern architectural structures that can benefit from the unique properties of fabric materials. The demand for resilient and long-lasting materials in these large-scale projects and the need for quick and efficient building solutions continue to propel construction fabrics.

Industry Dynamics

Urbanization and Infrastructure Development

The global trend of rapid urbanization propels the demand for construction fabrics. The United Nations Department of Economic and Social Affairs highlighted in their report that 68% of the world population is projected to live in urban areas by 2050, and 55% of the world's population resides in urban areas. This projected increase of 2.5 billion people in urban areas, with nearly 90% in Asia and Africa, necessitates massive construction and infrastructure overhauls.

As populations increasingly move to cities, there is an urgent need to build new residential, commercial, and public spaces to accommodate this growth. Urbanization fuels extensive infrastructure development, including new transportation networks, public facilities, and urban regeneration projects. These large-scale developments often prioritize speed of construction, durability, and cost-effectiveness, all areas where construction fabrics offer distinct advantages. This intense construction activity, particularly in developing regions, leads to the demand for innovative building techniques and materials. Construction fabrics offer benefits such as design flexibility and lightweight properties, making them suitable for complex architectural projects that characterize modern urban landscapes.

Growing Demand for Sustainable and Lightweight Construction Materials

There is an increasing focus on sustainable building practices and reducing the adverse environmental impact of the construction industry, which is a major driver for construction fabrics. Traditional building materials often have a large carbon footprint due to their production and transportation. In contrast, many construction fabrics offer properties that align with green building standards, such as improved energy efficiency through better insulation, reduced material weight, and sometimes the ability to use recycled content. This shift toward eco-friendly solutions encourages the adoption of these innovative materials.

The preference for lightweight construction materials offers sustainable benefits, structural efficiency, and ease of installation. Lightweight materials can reduce the overall load on a structure, potentially decreasing the amount of foundational support required and speeding up construction timelines. A study titled "A Sustainable Alternative for Green Structural Lightweight Concrete: Performance Evaluation" published on PubMed in 2022 highlighted that structural lightweight concrete reduces the total dead load of structural elements and offers environmental benefits through the use of waste materials. While this study focuses on concrete, it underscores the broader industry trend towards lightweight alternatives and waste utilization, a trend that construction fabrics, often made from advanced polymers and sometimes incorporating recycled content, fit into perfectly.

Segmental Insights

By Material

The polyvinyl chloride (PVC) segment held the largest share in 2024. This dominance is primarily attributed to its excellent balance of cost-effectiveness, durability, and versatility, making it a popular choice for various applications. PVC-coated fabrics are widely used in structures such as awnings, canopies, and temporary tensile structures owing to their strong resistance to weather, water, and UV radiation. They are also relatively easy to fabricate and maintain. Their widespread adoption in various construction projects, from small-scale coverings to larger temporary event structures, ensures their continued leadership in the segment.

The ethylene tetrafluoroethylene (ETFE) segment is anticipated to register the highest growth rate during the forecast period. This segment’s rapid growth is driven by its exceptional properties that cater to modern architectural trends focusing on aesthetics, transparency, and environmental performance. ETFE is notably lightweight, highly transparent (often seen as an alternative to glass), and durable. It also comprises self-cleaning properties and superior resistance to harsh weather and UV light. Its application in iconic, large-scale projects such as stadium roofs, transparent facades, and complex architectural envelopes highlights its increasing acceptance as an advanced building material.

By End Use

The nonresidential segment held the largest market share in 2024, driven by the extensive use of these materials in large-scale commercial, public, and industrial projects. Construction fabrics are ideal for creating expansive, column-free spaces and unique architectural designs often seen in stadiums, airports, exhibition centers, and shopping malls. Their ability to provide lightweight, durable, and aesthetically appealing solutions for roofing, facades, and tensile structures makes them a preferred choice for such ambitious undertakings, where visual impact and functional efficiency are paramount.

The residential segment is anticipated to register the highest growth rate during the forecast period. An increasing awareness of the benefits of construction fabrics in home improvement, modern housing designs, and modular construction fuels its demand. Homeowners and developers increasingly incorporate these materials for applications such as awnings, canopies, carports, sunshades, and even decorative elements for outdoor living spaces. The demand is also spurred by the growing trend of creating flexible and energy-efficient residential structures, where these fabrics contribute to insulation, natural lighting, and weather protection. As consumers seek more innovative and aesthetically pleasing home solutions, the residential end-use of construction fabrics is expected to rise in the coming years.

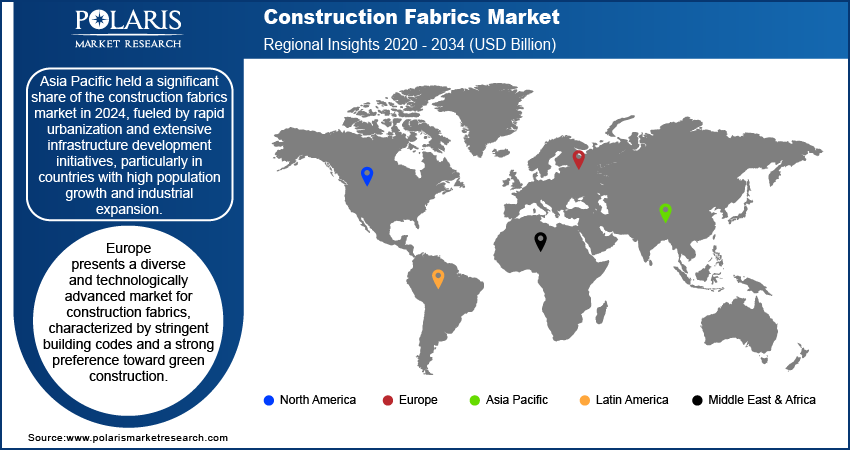

Regional Analysis

The Asia Pacific construction fabrics market held the largest share in 2024, primarily fueled by unprecedented urbanization and massive infrastructure development projects. Countries across the region are undergoing significant transformations, with extensive investments in new cities, transportation networks, and large-scale public and commercial buildings. This growth creates a vast need for efficient, durable, and cost-effective building materials, making construction fabrics an increasingly popular choice.

China Construction Fabrics Market

In the Asia Pacific region, China holds the largest market share in the construction fabrics market due to a combination of factors that position it as a regional leader. The country’s rapid urbanization, continuous infrastructure development, and extensive government investment in large-scale construction projects have significantly driven the demand for advanced building materials, including construction fabrics. China’s ambitious Belt and Road Initiative and ongoing smart city developments further contribute to the growing use of these fabrics in temporary structures, roofing systems, facades, and tensile architecture.

Additionally, China benefits from a well-established textile and manufacturing base, which ensures a steady supply of construction fabrics at competitive costs. The strong presence of local manufacturers and fabricators allows for quicker innovation, customization, and scalability, supporting both domestic demand and exports. Governmental emphasis on sustainable and energy-efficient building solutions also encourages the use of construction fabrics, known for their lightweight, durable, and environmentally friendly properties. Collectively, these factors reinforce China’s leading position in the Asia Pacific construction fabrics market.

North America Construction Fabrics Market

North America exhibits a mature yet evolving landscape for construction fabrics, driven by the ongoing infrastructure modernization and a strong emphasis on innovative building designs. Adopting advanced fabric solutions is prevalent in sports facilities, entertainment venues, and commercial complexes, where the demand for lightweight and aesthetically versatile materials is high. There's also a growing focus on energy-efficient building envelopes, which further encourages using specialized membranes.

US Construction Fabrics Market Insight

The construction fabrics market in the US contributes a major share in North America. The country's robust construction sector, investments in public infrastructure, and a preference for sustainable building practices fuel the demand. Architectural creativity often pushes the boundaries of traditional construction, leading to increased adoption of fabric solutions for unique roof structures, facades, and protective covers in both new builds and renovation projects.

Europe Construction Fabrics Market

Europe presents a diverse and technologically advanced market for construction fabrics, characterized by stringent building codes and a strong preference toward green construction. The region sees considerable adoption in new constructions and retrofitting projects, particularly in public spaces, transportation hubs, and iconic architectural structures. Innovation in material science, focusing on enhanced durability, fire resistance, and environmental performance, is a key trend across European countries. The Germany construction fabrics market plays a pivotal role in Europe. Its well-established construction industry, a leading position in engineering, and a strong commitment to energy efficiency and sustainable building drive significant demand. German architects and engineers frequently integrate high-performance fabric solutions into complex designs for sports arenas, convention centers, and commercial buildings, pushing the boundaries of architectural possibilities with these versatile materials.

Key Players and Competitive Insights

The construction fabrics market features a dynamic competitive landscape where innovation, product performance, and global reach are key differentiating factors. Companies often compete based on material science advancements, offering enhanced durability, sustainability, and aesthetic versatility in their product lines.

A few prominent companies in the industry include Serge Ferrari SA; Sioen Industries NV; Mehler Texnologies GmbH (Freudenberg Performance Materials); Verseidag-Indutex GmbH; Saint-Gobain SA; Taiyo Kogyo Corporation; Low & Bonar (The Freudenberg Group); Hanwha Advanced Materials Co. Ltd. (Hanwha Corporation); Sattler AG; and Birdair, Inc.

Key Players

- Birdair, Inc.

- Hanwha Advanced Materials Co., Ltd. (Hanwha Corporation)

- Low & Bonar (The Freudenberg Group)

- Saint-Gobain SA

- Sattler AG

- Serge Ferrari SA

- Sioen Industries NV

- Taiyo Kogyo Corporation

- Verseidag-Indutex GmbH

Industry Development

November 2020: Ferguson PLC announced it acquired two companies: Old Dominion Supply Inc., which distributes HVAC parts in Maryland and northern Virginia, and Atlantic Construction Fabrics Inc. (ACF), a geotextile company operating along the East Coast.

Construction Fabrics Market Segmentation

By Material Outlook (Revenue – USD Billion, 2020–2034)

- Polyvinyl Chloride (PVC)

- Polytetrafluoroethylene (PTFE)

- Ethylene Tetrafluoroethylene (ETFE)

- Others

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Residential

- Nonresidential

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Construction Fabrics Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 7.11 billion |

|

Market Size in 2025 |

USD 7.59 billion |

|

Revenue Forecast by 2034 |

USD 13.95 billion |

|

CAGR |

7.0% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Customize your report according to your countries, regions, and segmentation requirements. |

FAQ's

The global market size was valued at USD 7.11 billion in 2024 and is projected to grow to USD 13.95 billion by 2034.

The global market is projected to register a CAGR of 7.0% during the forecast period

Asia Pacific dominated the market share in 2024.

A few key players in the market are Serge Ferrari SA; Sioen Industries NV; Mehler Texnologies GmbH (Freudenberg Performance Materials); Verseidag-Indutex GmbH; Saint-Gobain SA; Taiyo Kogyo Corporation; Low & Bonar (The Freudenberg Group); Hanwha Advanced Materials Co., Ltd. (Hanwha Corporation); Sattler AG; and Birdair, Inc

The polyvinyl chloride (PVC) segment accounted for the largest share of the market in 2024.

The ethylene tetrafluoroethylene (ETFE) segment is expected to grow fastest during the forecast period.