Reciprocating Air Compressor Market Size, Share, Trends, & Industry Analysis Report

By Type (Stationary and Portable), By Technology, By Lubrication, End User, and By Region – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6122

- Base Year: 2024

- Historical Data: 2020-2023

Overview

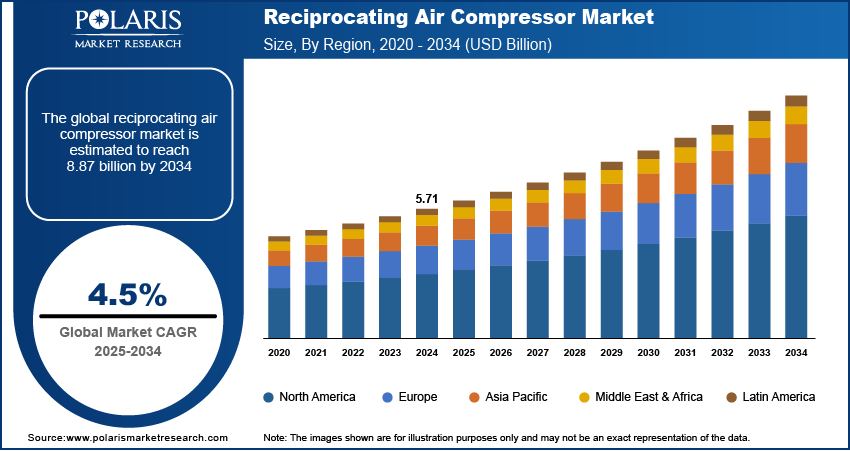

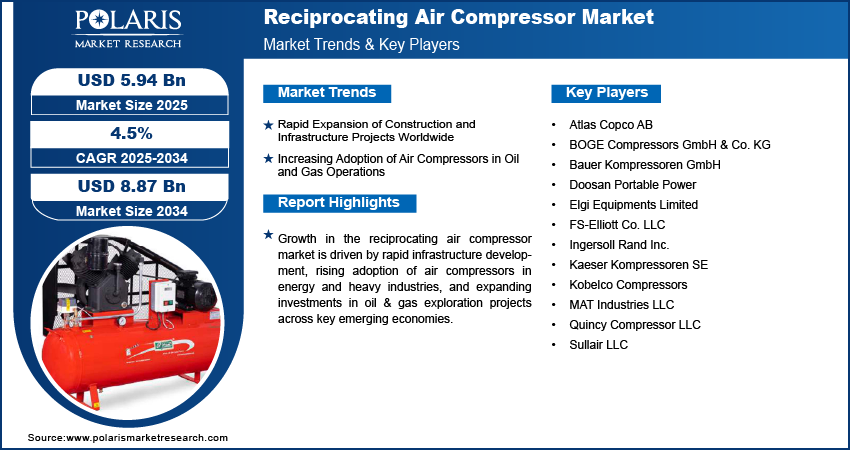

The global reciprocating air compressor market size was valued at USD 5.71 billion in 2024, growing at a CAGR of 4.5% from 2025–2034. Expansion of construction and infrastructure projects along with the rapid adoption of air compressors in oil and gas operations is driving global demand for reciprocating air compressors across high-pressure and mobile applications.

Key Insights

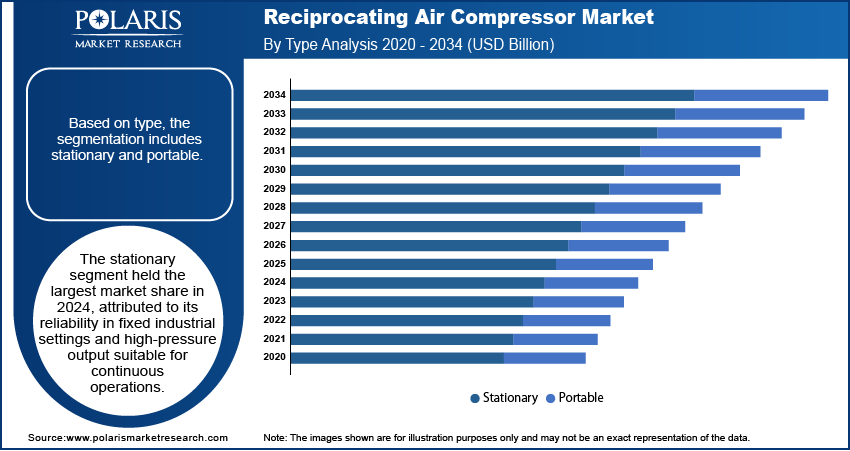

- The stationary segment dominated the reciprocating air compressor market share in 2024.

- The oil & gas segment is projected to grow at the fastest CAGR, due to expanding exploration activities and increasing deployment of compressed air systems in offshore and onshore operations.

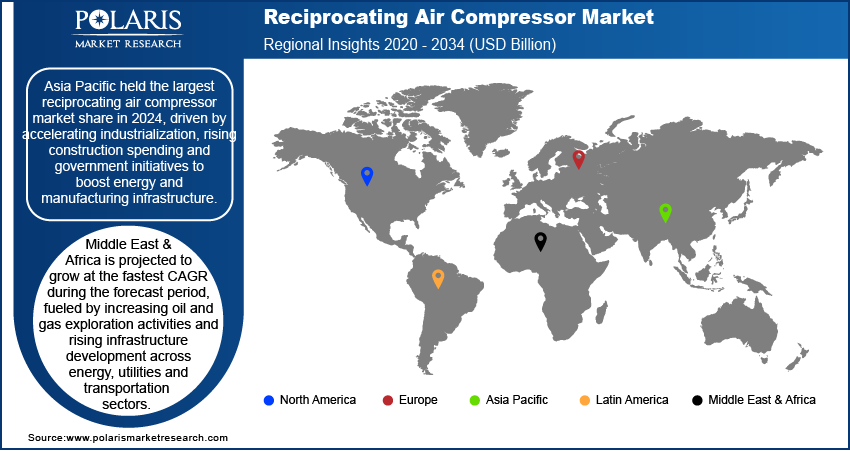

- The Asia Pacific reciprocating air compressor market dominated the global market share in 2024.

- The China reciprocating air compressor market held the largest regional share of the Asia Pacific market in 2024, driven by strong demand from manufacturing and construction sectors alongside government-based industrial expansion.

- The market in Middle East & Africa is projected to grow at the fastest CAGR during the forecast period, driven by rising investments in oil & gas, mining and power generation industries.

- The Saudi Arabia market is expanding steadily, driven by large-scale infrastructure development under Vision 2030, increasing energy sector investments and a growing focus on industrial modernization.

Industry Dynamics

- Expansion of construction and infrastructure projects is driving the demand for reciprocating air compressors across residential, commercial and industrial applications, where these systems are used to power tools and equipment.

- Rapid adoption of air compressors in oil and gas operations is contributing to market growth, as these systems are used for gas compression, vapor recovery and wellhead applications in upstream and midstream activities.

- The integration of IoT sensors and remote monitoring and control systems is creating opportunities for compressor manufacturers to offer smart solutions that support predictive maintenance, reduce downtime and improve overall equipment efficiency.

- High energy consumption and noise levels associated with reciprocating compressors are limiting their adoption in noise-sensitive and energy-regulated environments in sectors with strict operational standards.

Market Statistics

- 2024 Market Size: USD 5.71 billion

- 2034 Projected Market Size: USD 8.87 billion

- CAGR (2025-2034): 4.5%

- Asia Pacific: Largest market in 2024

Reciprocating air compressors, also known as piston compressors, are positive displacement machines that compress air using a piston driven by a crankshaft. These compressors draw atmospheric air into a cylinder, compress it through a reciprocating motion and discharge it into a storage tank for industrial or commercial use. They are available in single-stage or multi-stage variants that help achieve desired pressure levels, depending on the configuration. Key applications span across automotive, manufacturing, construction, oil and gas and food processing industries. This technology is valued for its high-pressure output, cost efficiency, compact design and suitability for intermittent-duty operations where air demand is variable.

The market for reciprocating air compressors is growing due to rising demand from automotive, construction, oil and gas and general manufacturing sectors. As per the OICA, Global vehicle production rose from 79.9 million units in 2021 to 84.8 million in 2022, before climbing further to 93.4 million in 2023, reflecting an 11% increase in 2022 and a 10% rise in 2023. These compressors are commonly used for operating pneumatic tools, spray systems, material handling units and packaging equipment in workshop and assembly environments. Their usage in construction includes powering drills, hammers and compactors, while in the oil and gas sector, they support applications such as gas compression and vapor recovery. The growing industrial activity across developing countries such as China, India, Brazil, and Thailand coupled with rising demand for reliable and energy-efficient compressed air systems are accelerating the expansion of this market.

The integration of digital control panels and sensor-based systems in reciprocating air compressors is driving operational visibility and allowing real-time monitoring of pressure, temperature and performance metrics. The adoption of predictive maintenance tools is reducing unexpected breakdowns by enabling early fault detection and timely service scheduling. Moreover, the growing use of cloud-based monitoring platforms is improving compressor management across multiple locations by enhancing remote diagnostics and usage tracking. In addition, the increasing demand for automated control features is helping industries optimize compressor output based on changing load requirements, which supports energy savings and consistent system performance in dynamic operating environments.

Drivers & Opportunities

Rapid Expansion of Construction and Infrastructure Projects Worldwide: The global rise in construction and infrastructure development is driving the demand for reciprocating air compressors across various project sites. According to Oxford Economics, the global construction market is projected to expand from USD 9.7 trillion in 2022 to USD 13.9 trillion by 2037. This growth will be primarily led by China, the US, and India, fueled by ongoing urbanization and rising investments in sustainable infrastructure. These compressors are widely used to operate pneumatic tools such as drills, compactors and hammers in residential, commercial and industrial construction. The growing focus by governments and private firms to invest in urban development, transport infrastructure and smart city projects is fueling the market growth. This is due to its reliability and portability offered by these air compressors. Moreover, the increasing popularity of reciprocating compressors in infrastructure projects is due to their ability to deliver high-pressure output, ease of mobility and suitability for intermittent-duty operations in diverse working conditions.

Increasing Adoption of Air Compressors in Oil and Gas Operations: The oil and gas sector is witnessing increased adoption of reciprocating air compressors due to their efficiency in supporting key processes such as gas compression, vapor recovery and pressure control. These compressors are commonly deployed in upstream and midstream operations where durable and high-pressure systems are required for continuous and remote field operations. In addition, the demand for air compressors is rising due to exploration and production activities across onshore and offshore locations, as it offers operational flexibility and are suitable for handling variable loads that make it suitable for oilfield environments.

Segmental Insights

Type Analysis

Based on type, the segmentation includes stationary and portable. The stationary segment dominated the market in 2024, driven by its widespread deployment in industrial settings where continuous and stable air supply is required. These compressors are installed in factories, production plants and processing units to operate heavy-duty pneumatic machinery. Their robust design, higher output capacity and ability to handle extended operational hours make them suitable for large-scale applications. Stationary systems are growing popular in sectors such as manufacturing, oil and gas and automotive, where fixed installations support centralized air distribution. Long service life and ease of integration into existing systems further support segment dominance.

The portable segment is projected to grow at the fastest CAGR during the forecast period, due to rising demand across construction sites, remote operations and field service applications. For instance, in February 2024, ELGi launched an upgraded range of portable screw air compressors designed for improved efficiency, durability, and fuel economy across demanding applications. These enhancements are expected to strengthen the company’s position in infrastructure, mining and construction sectors. These compressors are compact, mobile and easy to transport, making them suitable for tasks requiring frequent relocation. Increasing infrastructure activities in developing economies are creating strong demand for portable units to power tools at temporary or hard-to-reach locations. Their flexibility and low setup requirements also make them attractive for small workshops and service stations, contributing to rising adoption across non-industrial and semi-industrial use cases.

Technology Analysis

Based on technology, the segmentation includes single-acting and double-acting. The single-acting segment dominated the market in 2024, fueled by its wide usage in low to medium-pressure applications across small and medium enterprises. These compressors use a single side of the piston to compress air, resulting in lower mechanical complexity and reduced maintenance. Their cost-effectiveness and simple operation make them suitable for industries such as automotive repair, food packaging and small-scale manufacturing. The demand for entry-level and user-friendly systems with reliable performance in intermittent operations further driving the dominance of this segment in developed and emerging markets.

The double-acting segment is expected to grow at the fastest CAGR during the forecast period, driven by the rising demand for high-pressure and continuous-duty systems in heavy industrial applications. These compressors use both sides of the piston for compression, increasing efficiency and output. Industries such as oil and gas, energy and aerospace require compressors that offer stable performance under demanding conditions, making double-acting systems more favorable. The increasing shift toward centralized air supply systems in large manufacturing units is contributing to the growth of this segment.

Lubrication Analysis

By lubrication, the segment includes oil free and oil filled. The oil filled segment dominated the market in 2024, due to its higher durability, better heat dissipation and suitability for demanding industrial operations. These compressors are used in applications that require continuous and high-volume compressed air, such as heavy machinery, automotive assembly lines and metal fabrication. The presence of lubrication reduces wear and allows for longer operational cycles. Industrial users prefer oil-lubricated systems for their ability to deliver stable performance in harsh environments, which accelerates the segment's leading position across manufacturing-intensive economies.

The oil free segment is projected to grow at the fastest CAGR during the forecast period, due to growing demand from industries that require clean and contaminant-free air. The rising demand from sectors such as pharmaceuticals, food and beverage, and healthcare are rapildy adopting oil-free systems to maintain air purity standards. These compressors reduce the risk of product contamination and lower maintenance associated with oil separation and filtration. The growing focus on stringent regulatory guidelines related to air quality in production processes are further boosting the adoption of oil-free systems in critical environments.

End User Analysis

By end user, this segment includes automotive, oil & gas, manufacturing, food & beverage, pharmaceuticals, healthcare & medical, construction, energy & power, aerospace & defense, and mining. The manufacturing segment dominated the market in 2024, driven by its widespread use of reciprocating air compressors in powering assembly tools, controlling actuators and supporting automation systems. These compressors provide the necessary air pressure to maintain operational efficiency in tasks such as cutting, welding, shaping and packaging. The growth in industrial output and investment in factory modernization across Asia Pacific, Europe and North America is further driving compressor usage in this sector. The requirement for continuous compressed air supply across varied manufacturing processes supports the segment's leading share.

The oil & gas segment is expected to grow at the fastest CAGR during the forecast period, fueled by increasing exploration, drilling and transportation activities across upstream and midstream operations. Reciprocating compressors are used for gas compression, injection, and recovery processes that require reliable high-pressure systems. Their robust performance in remote and challenging field conditions makes them suitable for oilfield applications. Moreover, the expanding investments in refining capacity and pipeline infrastructure in the Middle East, the US, and Asia are contributing to the segment’s accelerated growth.

Regional Analysis

Asia Pacific reciprocating air compressor market dominated the global market in 2024. This is driven by strong growth in industrial output and increasing investment in infrastructure and urban development across countries such as China, India, and Indonesia. Rapid expansion of manufacturing clusters and special economic zones is increasing the demand for industrial-grade compressors across assembly, processing, and fabrication operations. Moreover, the presence of local compressor manufacturers offering affordable and serviceable systems is improving accessibility for small and medium-sized enterprises across emerging economies. In addition, the rise in government-based infrastructure development programs is contributing to the demand for portable air compressors in construction and mining activities.

China Reciprocating Air Compressor Market Insight

The China held largest market share in Asia Pacific reciprocating air compressor landscape in 2024, fueled by the rapid expansion of manufacturing sectors such as electronics, automotive and metal processing, which require reliable compressed air systems for high-volume operations. According to the China Association of Automobile Manufacturers (CAAM), China produced 31.28 million and sold 31.44 million vehicles in 2024, marking year-on-year growth of 3.7% and 4.5%, respectively. This reflects continued strength in production and sales, with totals exceeding 30 million units for the second consecutive year. The ongoing development of industrial parks and infrastructure projects under national plans such as “Made in China 2025” is boosting the demand for heavy-duty compressors across factories and construction sites. Moreover, the rising government support for energy-efficient and locally manufactured equipment is improving adoption among small and mid-sized industries. In addition, the presence of numerous domestic compressor producers is accelerating the supply ecosystem and reducing overall equipment procurement costs.

Middle East & Africa Reciprocating Air Compressor Market

The market in Middle East & Africa is projected to grow at the fastest CAGR during the forecast period. This is driven by rising oil and gas exploration activities and increasing investment in pipeline and offshore infrastructure. These air compressors are used in drilling rigs, gas recovery and refinery operations, making them essential for upstream and midstream projects in countries such as Saudi Arabia, UAE, and Nigeria. Moreover, the expansion of non-oil sectors such as construction and mining in line with economic diversification plans is boosting demand for mobile compressors across infrastructure projects. In addition, growing regional investments in energy and utilities are pushing industrial compressor deployment in this region.

Saudi Arabia Reciprocating Air Compressor Market Overview

The market in Saudi Arabia is expanding due to the large-scale upstream and midstream oil and gas projects under the Vision 2030 initiative. In February 2025, as per the Saudi Arabia’s Minister of Economy and Planning, the country’s non-oil sector is expected to see strong growth by 2026 due to the expansion of key industries. Infrastructure investments are projected to reach nearly USD 1 trillion by 2030 fueled by clear economic targets and private-sector strategies. These air compressors are widely used in gas compression, wellhead operations and drilling activities in onshore and offshore installations. Moreover, the diversification of the industrial base beyond oil is promoting compressor demand in sectors such as construction, utilities and manufacturing. In addition, the public and private sector investments in megaprojects such as NEOM and The Red Sea Project are creating steady demand for mobile and high-pressure compressor systems.

North America Reciprocating Air Compressor Market

The reciprocating air compressor landscape in North America is projected to hold a substantial share in 2034. This is owing to the well-established industrial base and widespread adoption of automated production systems in sectors such as automotive, aerospace and food processing. As these air compressors are used to power robotic tools, manage process pressure and support cleanroom applications across regulated industries. Moreover, the oil and gas sector in the US is increasing compressor demand for gas lifting, compression and vapor recovery operations. According to the US Energy Information Administration (EIA), the US oil production, including crude oil and lease condensate, averaged 12.2 million barrels per day in 2022 and reached 13.4 million barrels per day in 2025. This reflects a 9.8% increase over a three-year period, indicating steady growth in domestic output. In addition, the growing focus on energy-efficient systems and predictive maintenance tools is driving industries to upgrade their legacy equipment with advanced monitoring-enabled compressor units.

Key Players & Competitive Analysis Report

The reciprocating air compressor market is moderately competitive, with key players focusing on expanding their offerings through advanced control systems, durable components and application-specific configurations. Prominent companies are investing in product innovation, after-sales services and energy-efficient models to strengthen their position across industrial and commercial sectors. Moreover, rising partnerships with distributors and end users are helping manufacturers improve regional reach and customer engagement. In addition, growing demand from construction, oil and gas and manufacturing industries is pushing collaboration across OEMs and service providers, contributing to long-term growth and stable competition in the global reciprocating air compressor market.

Major companies operating in the reciprocating air compressor industry include Atlas Copco AB, Ingersoll Rand Inc., Elgi Equipments Limited, Kaeser Kompressoren SE, Sullair LLC, Doosan Portable Power, Bauer Kompressoren GmbH, FS-Elliott Co. LLC, Kobelco Compressors, MAT Industries LLC, BOGE Compressors GmbH & Co. KG, and Quincy Compressor LLC.

Key Players

- Atlas Copco AB

- BOGE Compressors GmbH & Co. KG

- Bauer Kompressoren GmbH

- Doosan Portable Power

- Elgi Equipments Limited

- FS-Elliott Co. LLC

- Ingersoll Rand Inc.

- Kaeser Kompressoren SE

- Kobelco Compressors

- MAT Industries LLC

- Quincy Compressor LLC

- Sullair LLC

Industry Developments

- March 2025: ELGi launched the Stabilisor series, a new line of reciprocating air compressors engineered to provide consistent pressure output and superior air quality across diverse industrial applications. These compressors address power fluctuation challenges, ensuring improved reliability, energy efficiency, and reduced maintenance in demanding operating environments.

- July 2024: Danfoss introduced a new range of semi-hermetic reciprocating compressors optimized for industrial and commercial heat pumps, enabling higher energy efficiency and operation with low-GWP refrigerants. This development is expected to accelerate the adoption of reciprocating air compressors in heat pump systems by enhancing performance, regulatory compliance and long-term system sustainability.

Reciprocating Air Compressor Market Segmentation

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Stationary

- Portable

By Technology Outlook (Revenue, USD Billion, 2020–2034)

- Single-acting

- Double-acting

By Lubrication Outlook (Revenue, USD Billion, 2020–2034)

- Oil Free

- Oil Filled

By End User Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Oil & Gas

- Manufacturing

- Food & Beverage

- Pharmaceuticals

- Healthcare & Medical

- Construction

- Energy & Power

- Aerospace & Defense

- Mining

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Reciprocating Air Compressor Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 5.71 Billion |

|

Market Size in 2025 |

USD 5.94 Billion |

|

Revenue Forecast by 2034 |

USD 8.87 Billion |

|

CAGR |

4.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Typeat |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 5.71 billion in 2024 and is projected to grow to USD 8.87 billion by 2034.

The global market is projected to register a CAGR of 4.5% during the forecast period.

Asia Pacific dominated the market in 2024, driven by the rapid expansion of manufacturing facilities and large-scale construction and infrastructure projects.

A few of the key players in the market are Atlas Copco AB, Ingersoll Rand Inc., Elgi Equipments Limited, Kaeser Kompressoren SE, Sullair LLC, Doosan Portable Power, Bauer Kompressoren GmbH, FS-Elliott Co. LLC, Kobelco Compressors (Kobe Steel Ltd.), MAT Industries LLC, BOGE Compressors GmbH & Co. KG, and Quincy Compressor LLC.

The stationary segment dominated the market in 2024, driven by its widespread use in industrial plants due to high efficiency, consistent pressure output and lower maintenance requirements

The oil & gas segment is projected to grow at the fastest CAGR during the forecast period, due to rising energy demand, growing offshore drilling activities, and increasing adoption of compressed air systems for critical operations.