Remote Monitoring and Control Market Size, Share, Trends, Industry Analysis Report

: By Component (Solution and Field Instruments), Industry, and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 155

- Format: PDF

- Report ID: PM4029

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

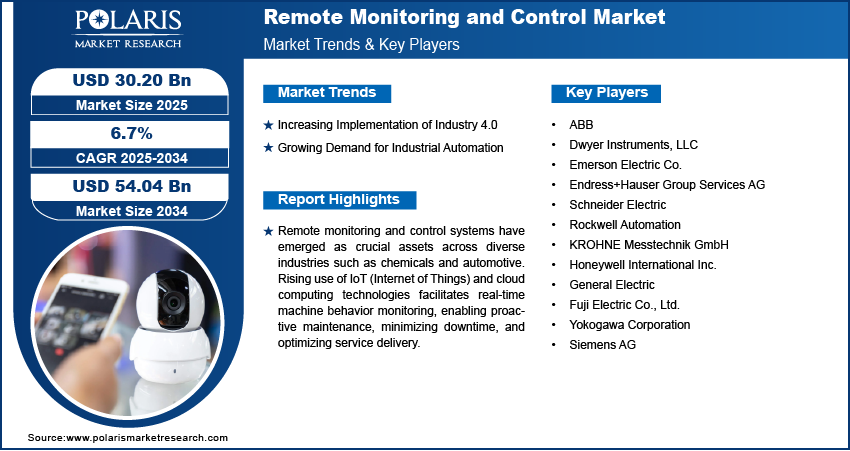

The global remote monitoring and control market size was valued at USD 28.60 billion in 2024, growing at a CAGR of 6.7% during 2025–2034. The growing adoption of advanced technologies such as IoT and machine learning and the rising need for instant data analysis are a few of the key factors fueling market growth.

Key Insights

- The solution segment led the market in 2024, owing to rapid advancements in solutions that make remote access more efficient and versatile.

- The water and wastewater treatment segment is witnessing growth due to the growing prevalence of waterborne diseases and the introduction of stringent government regulations.

- North America dominated the market in 2024. The regional market dominance is primarily attributed to the increased adoption of IoT devices in major economies like the US.

- Asia Pacific is registering rapid growth. The rising demand for automation and efficiency across various sectors fuels market growth in the region.

Industry Dynamics

- The shift towards Industry 4.0, which has led to increased integration of big data, AI, and IoT, is fueling the demand for remote monitoring and control solutions.

- The rising adoption of automation by businesses globally to improve efficiency and streamline operations is fueling market growth.

- The growing focus on innovation and improving product offerings is expected to create several market opportunities.

- The high cost of installing the SCADA system may present market challenges.

Market Statistics

2024 Market Size: USD 28.60 billion

2034 Projected Market Size: USD 54.04 billion

CAGR (2025-2034): 6.7%

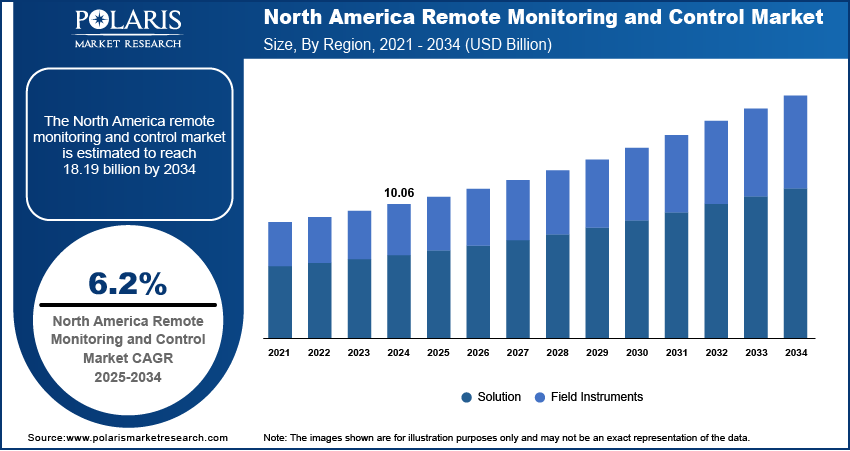

North America: Largest Market in 2024

AI Impact on Remote Monitoring and Control Market

- AI processes sensor data in real time, enabling faster detection of system anomalies and performance deviations.

- Machine learning models predict equipment failures, supporting proactive maintenance and reducing unplanned downtime.

- AI-powered platforms optimize energy usage, production efficiency, and resource allocation across remote facilities.

- Intelligent analytics improve decision-making by delivering actionable insights, enhancing the safety, reliability, and cost-effectiveness of remote operations.

To Understand More About this Research: Request a Free Sample Report

Remote monitoring and control systems have emerged as crucial assets across diverse industries, including chemicals and automotive. Factors such as the rising dominance of IoT (Internet of Things) and cloud computing technologies facilitate real-time machine behavior monitoring, enabling proactive maintenance, minimizing downtime, and optimizing service delivery. Moreover, businesses are increasingly prioritizing data-driven decision-making, which is influencing the adoption of remote monitoring and control solutions globally. Therefore, the growing use of IoT, cloud computing, AI (Artificial Intelligence), and related technology advancements are driving the demand for remote monitoring and control solutions.

Technologies such as IoT, machine learning, and others enable seamless connectivity, real-time data collection, and analysis, thereby helping organizations to optimize operations and make informed decisions. As more devices become connected and data volumes increase, the need for effective remote monitoring and control systems is becoming more critical. Additionally, the rise in automation and the need for instant data analysis are fuelling this demand. Automation helps businesses improve efficiency and reduce costs by streamlining processes and reducing manual intervention. Also, real-time data analysis allows organizations to quickly identify and resolve issues, reducing downtime and enhancing overall performance, which is ultimately propelling the remote monitoring and control market demand.

Leading companies in the remote monitoring and control market are expanding their products and services to meet the increasing demand for complete solutions. In October 2022, GE Healthcare partnered with AMC Health to offer remote patient monitoring, connecting hospital care with home care for patients after discharge. These efforts focus on integrating advanced technology and creating easy-to-use systems to improve accessibility and efficiency. By innovating and growing their offerings, industry leaders are expected to witness lucrative growth opportunities during the forecast period.

Market Dynamics

Increasing Implementation of Industry 4.0

Companies integrate advanced technologies such as IoT, AI, big data, and automation into their operations to embrace Industry 4.0. This shift allows businesses to manage assets, processes, and systems remotely with greater efficiency and precision. As a result, the demand for reliable remote monitoring and control solutions that work seamlessly with these technologies is increasing.

Industry 4.0 drives higher demand for remote monitoring systems by enabling smarter operations. IoT sensors and AI-powered tools support predictive maintenance, helping businesses fix potential problems before they escalate. This reduces downtime, improves productivity, and lowers operational costs. Additionally, the ability of remote monitoring and control systems to function remotely reduces the need for on-site personnel, leading to cost savings and better safety practices.

As global competition intensifies, businesses are turning to digital transformation to stay competitive. This shift fuels the need for interconnected systems that streamline processes and improve productivity. The adoption of Industry 4.0 principles is reshaping traditional monitoring and control methods, creating a significant growth opportunity for the remote monitoring and control market.

Growing Demand for Industrial Automation

Businesses across the world aim to improve efficiency, reduce manual work, and streamline operations by adopting automation technologies such as robotics, sensors, and control systems. These solutions increase productivity, precision, and operational reliability. With the growing adoption of automation across the industries, the demand for advanced remote monitoring and control systems rises. These systems allow businesses to monitor automated processes in real time, detect issues, and take quick action to ensure smooth operations. By integrating remote monitoring with automation, companies can optimize performance, use resources effectively, and minimize downtime. This combination enhances the value of automation efforts. Businesses can remotely track and adjust systems, identify problems early, and maintain continuous improvement. The synergy between automation and remote monitoring enhances efficiency and output as well as strengthens overall business performance.

The push for automation creates a competitive market dynamic where efficiency and agility are crucial. Companies invest in sophisticated remote monitoring solutions to stay ahead, benefiting from real-time insights, predictive analytics, and remote-control capabilities. This trend fuels innovation and growth in monitoring technologies, meeting the demands of increasingly automated industries. Therefore, the growing need for industrial automation is expected to drive the remote monitoring and control market development during the forecast period.

Market Segment Insights

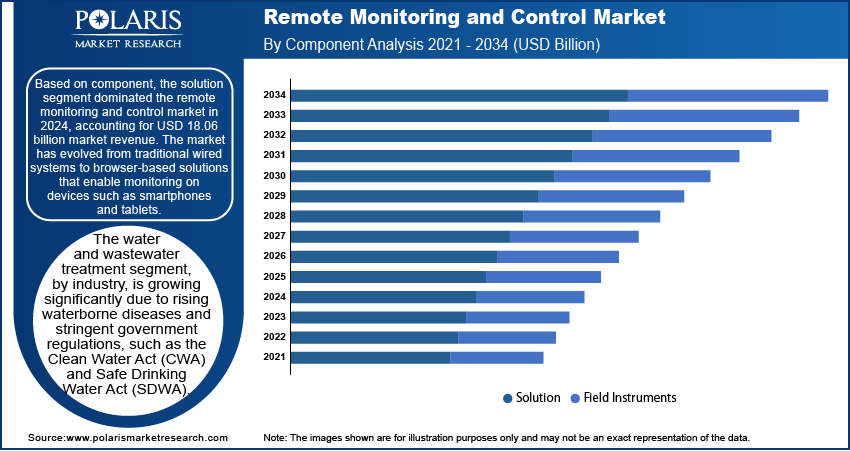

Outlook, by Component Insights

The remote monitoring and control market, based on component, is bifurcated into solution and field instruments. In 2024, the solution segment dominated the market segmentation, accounting for USD 18.06 billion market revenue share. The market has evolved from traditional wired systems to browser-based solutions that enable monitoring on devices such as smartphones and tablets. These advancements are supported by high-speed internet connectivity, making remote access more versatile and efficient.

The remote monitoring and control market provides solutions to a range of industries, including oil & gas, food & beverage, pharmaceuticals, automotive, and power. By leveraging technologies such as Industry 4.0, IoT, and AI, remote monitoring systems enhance operational efficiency and productivity. Its key benefits include real-time data collection, predictive maintenance, and automation, allowing businesses to optimize operations remotely.

Despite significant growth potential, the remote monitoring and control market faces challenges such as the high costs of installation and maintenance, particularly with systems such as Supervisory Control and Data Acquisition (SCADA). To overcome these barriers, companies are introducing innovative solutions. For instance, human-centered remote monitoring systems for industrial robots provide advanced features such as low-latency video and data access, secure remote configurations, error recovery, and safe robot control from any location via secure browser connections. These solutions aim to improve connectivity and functionality, ensuring businesses can monitor and control operations efficiently while addressing cost and complexity challenges. The market demand trends are focusing on creating systems that are accessible, secure, and user-friendly.

Assessment, by Industry Insights

The remote monitoring and control market segmentation, based on industry, includes food and beverages, oil and gas, water and wastewater treatment, metals and mining, chemical, automotive, power, semiconductor and electronics, pharmaceutical, and others. The water and wastewater treatment segment is growing due to rising waterborne diseases and stricter government regulations, such as the Clean Water Act (CWA) and Safe Drinking Water Act (SDWA). These laws aim to protect water sources from contamination. The water & wastewater industry increasingly uses process control solutions, such as SCADA systems, which provide operators with real-time data to improve safety, efficiency, and operational uptime.

Key players such as ABB Ltd. and Endress+Hauser, offer tailored solutions for various water processes such as desalination, pumping, industrial treatment, and coastal protection. Rapid urbanization and population growth are pushing governments to upgrade water infrastructure and invest in new projects, driving demand for RMC systems. Additionally, rising consumer expectations for water quality, energy efficiency, and resource management are putting pressure on stakeholders to innovate.

ABB’s technologies ensure secure operations, remote maintenance, and easy system upgrades. In 2022, Endress+Hauser introduced Netilion Water Networks Insights (NWNI), software that enables comprehensive monitoring of water networks. It helps service providers manage data efficiently through a unified platform. In addition, government funding, such as the investment of USD 307 billion by the United States Department of Agriculture in rural water infrastructure, will boost the market expansion strategies by enhancing utilities' ability to monitor and manage water systems.

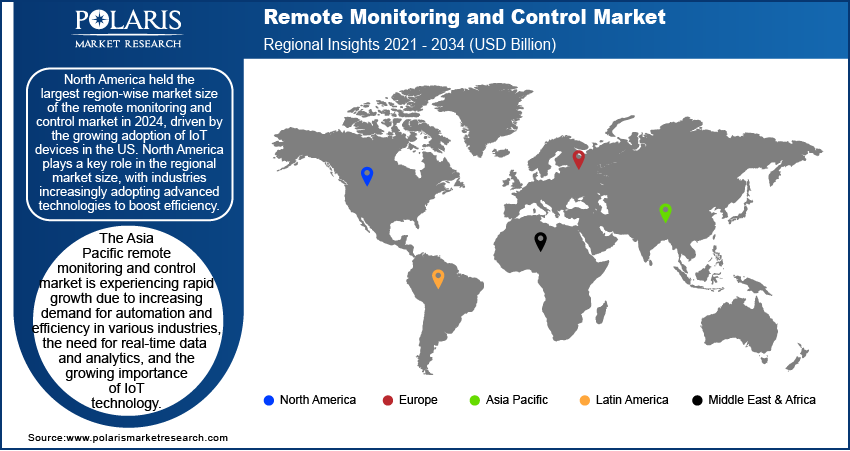

Regional Insights

By region, the study provides remote monitoring and control market insights into North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. North America held the largest market share in 2024, driven by the growing adoption of IoT devices in the US. North America plays a key role in the global remote monitoring and control market, with industries in the region increasingly adopting advanced technologies to boost efficiency.

The US is the dominant player, with leading companies such as General Electric and Honeywell International Inc. investing in research and development to offer unique solutions for sectors such as manufacturing, oil and gas, transportation, and healthcare. For instance, in June 2022, GE Healthcare introduced Portrait Mobile, a remote patient monitoring technology that uses wearable sensors to track vital signs and detect early signs of patient deterioration. This allows healthcare professionals to intervene quickly. The growing adoption of IoT devices in the US has further driven demand for remote monitoring solutions.

Canada plays an important role in the region's remote monitoring and control market, with a strong industrial base in natural resources, energy, and manufacturing. Government support for innovation has helped boost the growth of startups, leading to new opportunities and partnerships. A notable example is FluidAI Medical, an AI startup, which partnered with Medtronic Canada in September 2023. Together, they are working on the CCPC (Continuous Connected Patient Care) project under Canada's DIGITAL initiative. This project uses FluidAI's Stream Platform to offer advanced post-surgical monitoring, allowing healthcare professionals to remotely track patients' vital signs and detect potential complications in real time. Overall, North America continues to drive innovation in remote monitoring, with the US and Canada playing significant roles in advancing technological advancement in various industries.

In the remote monitoring and control market, Europe accounts for the second-largest market regional market size due to the increasing demand for efficiency and productivity by various sectors such as food and beverages and automotive. Companies in the region are focused on optimizing their operations to improve profitability. A key factor driving market adoption is the need for predictive maintenance. This approach uses data and analytics to predict when equipment might fail, allowing businesses to schedule maintenance ahead of time and minimize disruptions. Remote monitoring systems collect real-time data to help companies make accurate maintenance forecasts.

During Offshore Europe 2023, TWMA launched the RotoMill 2.0, a sustainable solution designed to optimize energy efficiency and reduce environmental impact. The system includes XLink remote monitoring software, which offers real-time operational insights and automates well-site processes. Its predictive maintenance features help avoid unexpected downtimes and reduce maintenance costs.

Europe's diverse economies, including established ones such as Germany, France, the UK, and Italy, as well as emerging markets such as Poland, Spain, and Sweden, contribute to the demand for remote monitoring technologies. The industrial sectors in these countries, particularly automotive, machinery, and electronics, have embraced these solutions. Governments in the region are also promoting the use of artificial intelligence (AI) in remote monitoring to accelerate adoption. A notable example is the EU-funded eCAN Joint Action project, launched in November 2023. The project focuses on improving cancer care through teleconsultation and remote monitoring, demonstrating the growing Industry of these technologies in healthcare as well. These initiatives are significantly driving the remote monitoring and control market expansion in Europe, with a strong push from industry and government efforts to integrate AI and improve operational efficiency.

The Asia Pacific remote monitoring and control market revenue share by region is experiencing rapid growth due to increasing demand for automation and efficiency in various industries, the need for real-time data and analytics, and the growing importance of IoT technology. The regional remote monitoring and control market is experiencing strong growth owing to the rising importance of IoT technology. IoT enables devices to communicate, collect, and analyze data from multiple sources. For instance, in March 2024, Kallipr, an Australian IoT provider, launched the Captis S2 Pulse, a new IoT solution aimed at improving remote asset management in harsh environments. This technology helps businesses optimize operations, reduce downtime, and increase profitability. Overall, remote monitoring solutions use IoT to collect data from sensors and devices, offering businesses valuable insights for better decision-making and enhanced performance.

Key Players and Competitive Insights

Key market players are investing significantly in research and development to broaden their product offerings, which will drive the remote monitoring and control market growth during the forecast period. Companies are focusing on strategies such as new product launches, forming partnerships, mergers and acquisitions, and increasing investments to expand their global reach. To stay competitive and thrive in the growing international business, companies in this sector must focus on competition strategy.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global remote monitoring and control market to benefit clients. A few major players in the international competition are ABB; Dwyer Instruments, LLC; Emerson Electric Co.; Endress+Hauser Group Services AG; Schneider Electric; Rockwell Automation; KROHNE Messtechnik GmbH; Honeywell International Inc.; General Electric; Fuji Electric Co., Ltd.; Yokogawa Corporation; and Siemens AG.

ABB Ltd. is a global manufacturer and seller of electrification, automation, robotics, and motion products. The company operates in various segments to serve a diverse range of industries. Its process automation segment develops and sells control technologies, manufacturing execution systems, advanced process control software, marine propulsion systems, instrumentation, and turbochargers. It provides services such as preventive maintenance, remote monitoring, emission monitoring, asset performance management, cybersecurity, and others. ABB serves a broad range of industries globally, including aluminum, chemical, automotive, data centers, mining, oil and gas, power generation, railway, food and beverage, water, and wind power.

Dwyer Instruments, LLC, is an automation machinery manufacturing company that specializes in valves, pressure instrumentation, air quality instrumentation, test equipment, level instrumentation, temperature instrumentation, flow instrumentation, humidity instrumentation, and air velocity instrumentation.

List of Key Companies

- ABB

- Dwyer Instruments, LLC

- Emerson Electric Co.

- Endress+Hauser Group Services AG

- Schneider Electric

- Rockwell Automation

- KROHNE Messtechnik GmbH

- Honeywell International Inc.

- General Electric

- Fuji Electric Co., Ltd.

- Yokogawa Corporation

- Siemens AG

Remote Monitoring and Control Industry Developments

August 2023: ABB unveiled its latest Remote Input/Output Controllers, expanding the company's XIO series. These controllers offer real-time monitoring and control, improved data accessibility, and heightened data integrity.

November 2023: Emerson announced the release of the new Fisher FIELDVUE DPC2K Digital Process Controller.

April 2022: Dwyer Instruments, LLC introduced the Series RSME, a room status monitor designed for low differential pressure industries that require rigorous pressure monitoring and alarming.

Remote Monitoring and Control Market Segmentation

By Component Outlook

- Solution

- Vibration Monitoring

- SCADA (Supervisory Control and Data Acquisition)

- Field Instruments

- Temperature

- Transmitters

- Humidity

- Transmitters

- Pressure

- Transmitters

- Level

- Transmitters

- Intelligent

- Flow Meters

- Others

By Industry Outlook

- Food and Beverages

- Oil and Gas

- Water and Wastewater Treatment

- Metals and Mining

- Chemical

- Automotive

- Power

- Semiconductor and Electronics

- Pharmaceutical

- Others

By Regional Outlook

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Remote Monitoring and Control Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 28.60 billion |

|

Market Size Value in 2025 |

USD 30.20 billion |

|

Revenue Forecast by 2034 |

USD 54.04 billion |

|

CAGR |

6.7% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2024 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global remote monitoring and control market size was valued at USD 28.60 billion in 2024 and is projected to grow to USD 54.04 billion by 2034.

The global market is expected to register a CAGR of 6.7% during 2025–2034.

North America accounted for the largest share of the market in 2024, owing to the increasing demand for managing complex energy systems, ensuring grid stability, and integrating renewable energy sources across the power sector.

ABB; Dwyer Instruments, LLC; Emerson Electric Co.; Endress+Hauser Group Services AG; Schneider Electric; Rockwell Automation; KROHNE Messtechnik GmbH; Honeywell International Inc.; General Electric; Fuji Electric Co., Ltd.; Yokogawa Corporation; and Siemens AG are a few major market players.

The solution segment dominated the market in 2024 due to the adoption of Industry 4.0, IoT, and AI in various sectors such as oil & gas, food & beverage, pharmaceuticals, automotive, and power.

The water and wastewater treatment segment held the largest market share in 2024.