Bio-Based Polymers Market Share, Size, Trends, Industry Analysis Report

By Product (PET, PA, PEF, PE, PUR, PBS, PHA, PTT, Epoxies, Others); By End-Use; By Region; Segment Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 120

- Format: PDF

- Report ID: PM1615

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global bio-based polymers market was valued at USD 16.7 billion in 2024 and is expected to grow at a CAGR of 14.30% from 2025 to 2034. The increasing demand for bio-based polymers, due to increasing environmental consciousness among consumers and businesses, drives the industry expansion. With a surge in public awareness regarding climate change and plastic pollution, there has been a growing preference for sustainable products. Bio-based polymers, being biodegradable and derived from renewable resources, align seamlessly with this eco-conscious requirements. Manufacturers and consumers recognize the importance of reducing carbon footprints and minimizing the accumulation of non-biodegradable waste, driving the adoption of bio-based polymers in various applications.

Key Insights

- The polyamide (PA) segment held the dominant share in 2024. Bio-based polyamides offer a significantly lower carbon footprint than their conventional petroleum-based alternatives. This attribute makes it a dominant segment.

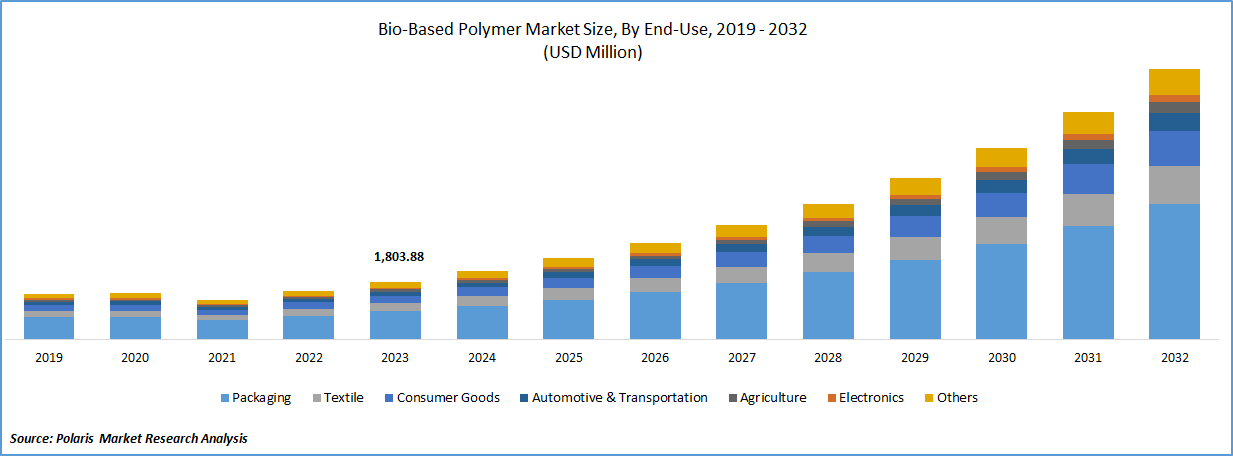

- Based on end-use, the packaging segment is projected to grow at a high CAGR during the projected period. Unlike traditional packaging materials, which are primarily derived from petrochemical sources, bio-based polymers are made from renewable resources such as biomass, agricultural by-products, and side streams. It contributes to the reduction of carbon footprints, which drives the segment expansion.

- Europe dominated the largest market and contributed to more than 38% of the share in 2024. Rising need for bio-based polymers in Europe is attributed to increasing environmental concerns and regulatory pressures.

- The Asia Pacific market is expected to be the fastest-growing CAGR during the forecast period. The regional industry benefits from abundant sources of raw materials for bio-based polymers and rising demand for biodegradable packaging materials.

Industry Dynamics

- Government regulations and policies spur the demand for bio-based polymers.

- The industry is expanding due to the rising investments in research and development of these polymers to address the pressing issue of plastic waste.

- An increase in the shift in consumer preference toward bio-based plastics is expected to offer lucrative opportunities during the forecast period.

- High cost of production hinders the market expansion.

Market Statistics

2024 Market Size: USD 16.7 billion

2034 Projected Market Size: USD 63.7 billion

CAGR (2025–2034): 14.30%

Europe: Largest market in 2024

AI Impact on Bio-Based Polymers Market

- Artificial intelligence (AI) systems are accelerating advancements and sustainability in the bio-based polymers market by transforming the design, testing, and optimization of the materials.

- systems analyze vast datasets of monomers, processing parameters, and additives to identify optimal polymer blends. It minimizes trial-and-error in laboratories and facilitates the rapid development of biodegradable polymers.

- AI tools help predict how polymers break down in environments, including soil, compost, marine, and others. This enables the customization of materials for applications with a minimal ecological impact.

To Understand More About this Research:Request a Free Sample Report

Industry Trend

One of the primary driving factors behind the escalating demand for bio-based polymers is the increasing environmental consciousness among consumers and businesses alike. With a surge in public awareness regarding climate change and plastic pollution, there has been a growing preference for sustainable products. Bio-based polymers, being biodegradable and derived from renewable resources, align seamlessly with this eco-conscious mindset. Manufacturers and consumers are recognizing the importance of reducing carbon footprints and minimizing the accumulation of non-biodegradable waste, driving the adoption of bio-based polymers in various applications.

Additionally, stringent regulations and policies implemented by governments across the globe are propelling the bio-based polymer market forward. Environmental regulations aimed at curbing plastic waste and promoting sustainable practices have created a favorable environment for the development and commercialization of bio-based polymers. These regulations encourage industries to invest in research and development, leading to the creation of innovative and eco-friendly polymer solutions. Government incentives and initiatives further bolster the market, offering financial support to companies engaged in the production of bio-based polymers, thus accelerating their adoption across diverse sectors.

Furthermore, advancements in technology and research have played a pivotal role in the expansion of the bio-based polymer market. Ongoing research efforts have led to the development of bio-based polymers with enhanced properties, making them suitable for a broader range of applications. These innovations have paved the way for bio-based polymers to be used in industries beyond packaging, including automotive, textiles, agriculture, and healthcare. The versatility and adaptability of bio-based polymers have opened new avenues for their utilization, driving market growth and encouraging further investment in research and development.

What are the market drivers driving the demand for the bio-based polymer market?

Government regulations and policies have been projected to spur product demand.

Government regulations and policies play a pivotal role in shaping the bio-based polymer market, driving its growth and ensuring environmental sustainability. Across the globe, governments are increasingly recognizing the importance of transitioning from traditional fossil fuel-based products to sustainable alternatives, including bio-based polymers. These initiatives are grounded in environmental concerns, aiming to mitigate the adverse effects of plastic pollution and reduce greenhouse gas emissions. Regulatory bodies are implementing stringent standards and certifications to encourage the development and adoption of bio-based polymers, fostering innovation within the industry.

In Europe, the European Union's Circular Economy Action Plan outlines ambitious targets for recycling and reducing single-use plastics. Regulations like the EU Plastic Waste Directive mandate the use of bio-based materials in certain applications, creating a significant market for bio-based polymers. Similarly, in the United States, the BioPreferred Program, administered by the USDA, encourages federal agencies to purchase bio-based products, providing incentives for manufacturers and stimulating market demand. Additionally, numerous states have enacted legislation to ban single-use plastics, further propelling the market for bio-based alternatives.

In Asia, governments are investing heavily in research and development of bio-based polymers to address the pressing issue of plastic waste. Countries like Japan and South Korea have stringent waste management regulations, driving the adoption of bio-based alternatives. China, a major consumer of plastics, has also introduced policies to promote the production and use of bio-based polymers, aligning with its commitment to environmental sustainability.

These regulations not only promote the use of bio-based polymers but also drive research and development efforts, leading to technological advancements and innovations within the industry. Manufacturers are incentivized to invest in eco-friendly production processes and develop bio-based polymers with enhanced properties, further expanding their applications across various sectors. Moreover, government support encourages collaboration between researchers, industry stakeholders, and policymakers, fostering a conducive environment for the growth of the bio-based polymer market.

In conclusion, government regulations and policies are instrumental in steering the bio-based polymer market toward a sustainable future. By creating a supportive regulatory framework, governments worldwide are not only reducing the environmental impact of plastic waste but also promoting innovation and driving economic growth within the bio-based polymer industry. These initiatives underline the importance of collaborative efforts between governments, industries, and consumers in creating a more sustainable and eco-friendly global economy.

Which factor is restraining the demand for bio-based polymer?

Cost of production are expected to hinder the growth of the market.

The bio-based polymer market, while experiencing substantial growth, is not without its challenges. Several restraining factors influence the industry's progress. One significant challenge is the cost of production. While the demand for eco-friendly alternatives is increasing, the production processes for bio-based polymers can be more expensive compared to traditional fossil fuel-based counterparts. Factors such as raw material acquisition, processing technologies, and economies of scale significantly impact the overall production costs. As a result, manufacturers face the dilemma of balancing environmental sustainability with economic feasibility, often making it difficult for bio-based polymers to compete on price alone with their conventional counterparts.

Additionally, market volatility and fluctuations in raw material prices pose another challenge. The availability and affordability of biomass sources like corn, sugarcane, and soybeans are influenced by various factors, including weather conditions, agricultural practices, and global market demands. Any disruption in the supply chain can lead to price instability, affecting the cost-effectiveness of bio-based polymer production. Furthermore, technological constraints and the need for continuous research and development efforts to improve the efficiency of bio-based polymer manufacturing processes also contribute to the cost challenges faced by the industry.

Despite these restraining factors, the bio-based polymer market continues to thrive due to growing environmental consciousness and supportive government policies promoting sustainable practices. As consumers become more eco-conscious, there is an increasing demand for products with reduced environmental impact. Manufacturers, in response, are investing in research and innovation to develop cost-effective production methods, explore new biomass sources, and optimize existing technologies. Collaborative efforts between research institutions, government bodies, and private enterprises play a crucial role in overcoming these challenges.

In conclusion, the bio-based polymer market is on a trajectory of growth driven by environmental awareness and changing consumer preferences. While cost-related challenges persist, industry stakeholders are actively addressing these issues through technological advancements and strategic collaborations. As the market continues to evolve, finding innovative and sustainable solutions to reduce production costs and enhance the competitiveness of bio-based polymers will be pivotal. Overcoming these challenges will not only drive the adoption of bio-based polymers in various applications but also contribute significantly to creating a more sustainable and eco-friendly future.

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

To Understand the Scope of this Report:Speak to Analyst

Category Wise Insights

By Product Insights

Based on product analysis, the market is segmented on the PET, PA, PEF, PE, PUR, PBS, PHA, PTT, epoxies, others. PA segment held the largest market share in 2024. PA, or Polyamide, is a type of polymer known for its versatility and range of applications in various industries. It is growing in demand within the bio based polymer market due to several factors. Bio-based polyamides offer a significantly lower carbon footprint in comparison to their conventional petroleum-based alternatives. This attribute makes them a worthwhile option for individuals and industries striving to reduce their environmental impact. They are especially preferred for use in automotive interiors and engine compartments, aligning with the automotive industry's growing emphasis on fuel efficiency and sustainability.

Companies are collaborating and introducing bio-based PA materials to meet the growing demand for sustainable and environmentally friendly products. For instance, in March 2022, Avient introduced Nymax BIO Formulations, a series of bio-based polyamide materials that help clients achieve their sustainability goals. These materials address the issue of water absorption, a long-standing challenge in existing bio-derived polyamides.

These innovations not only reduce the carbon footprint of products but also contribute to the efficient use of natural resources. Favorable government regulations and the easy availability of raw materials for bio-polyamide synthesis, particularly in the U.S., are projected to fuel the growth of the bio-based polymer market.

By End-Use Insights

Based on end-use analysis, the market has been segmented on the basis of packaging, textile, consumer goods, automotive & transportation, agriculture, electronics, others. The packaging segment expected to be the fastest growing CAGR during the forecast period. Bio-based polymers are increasingly influencing the packaging industry as a response to growing consumer demand for sustainable and eco-friendly alternatives. Unlike traditional packaging materials, which are primarily derived from petrochemical sources, bio-based polymers are made from renewable resources such as biomass, agricultural by-products, and side streams, contributing to reduced carbon footprints.

In terms of performance and durability, bio-based polymers, including polyhydroxyalkanoates, polyethylene furoate, and polylactic acid (PLA), are being explored for various packaging applications. While PLA has significant heat resistance and mechanical strength, its slow biodegradation requires industrial composting conditions.

Consumer perception of products packaged with bio-based polymers is generally positive, as these materials align with the growing trend toward environmentally conscious consumerism. However, challenges exist, such as limited sorting or recyclability of bio-based materials and the need for increased awareness and education among consumers. Regulatory frameworks play a crucial role in shaping the use of bio-based polymers in packaging. Standards for food contact, biodegradability, and recyclability are essential considerations, and ongoing efforts are being made to establish guidelines that promote the sustainable and circular use of bio-based packaging materials.

Regional Insights

Europe

Europe region accounted to be the largest market share in 2024. The European automotive industry is experiencing growth driven by the increasing demand for electric vehicles (EVs) and sustainability initiatives. This growth is intertwined with a rising need for bio-based polymers in Europe due to environmental concerns and regulatory pressures. As automakers adapt to these changes, they are collaborating with bio-based polymer manufacturers to address their material needs, thereby fostering the expansion of the bio-based polymer market.

The European automotive industry's growth is closely linked to the shift towards electric vehicles. With stricter emissions regulations and consumer preferences for cleaner transportation, automakers are investing in EV production. This transformation in the automotive sector has a direct impact on the demand for bio-based polymers. As automakers seek to reduce their carbon footprint, they are increasingly incorporating bio-based polymers into vehicle components, such as interior trims, upholstery, and even structural parts, to enhance sustainability. Manufacturers of automotive components and bio-based polymers are recognizing the synergy in their goals. For instance, in November 2022, DSM Engineering Materials partnered with Renault to develop lighter fuel tanks for hybrid vehicles using Akulon Fuel Lock, a high-performance, low-carbon footprint PA6 material. This innovation aligns with sustainability goals and complements DSM's bio-based Fuel Lock polymers. These partnerships leverage the expertise of both industries to develop innovative solutions that meet the stringent requirements of the automotive market while adhering to eco-friendly standards. Bio-based polymer manufacturers are tailoring their materials to meet automotive specifications, ensuring durability, safety, and performance. The collaborative efforts between automotive manufacturers and bio-based polymer producers are instrumental in driving the growth of the bio-based polymer market in Europe. As automakers adopt more sustainable materials for their vehicles, it not only reduces their environmental impact but also stimulates the bio-based polymer industry. This collaborative approach fosters research and development, resulting in the introduction of novel bio-based polymer products specifically tailored for automotive applications. It benefits both sectors by creating a more sustainable, environmentally responsible supply chain.

Asia Pacific

Asia Pacific is expected for the growth of fastest CAGR during the forecast period. The Asia-Pacific region has been actively involved in the production and utilization of bio-based polymers as part of its efforts to promote sustainability and reduce the environmental impact of traditional petroleum-based plastics. Bio-based polymers in the Asia-Pacific region are used in various applications, and several countries in the region have shown significant interest and investment in this field. The Asia-Pacific region benefits from abundant sources of raw materials for bio-based polymers. Biomass feedstocks, such as sugarcane, corn, cassava, and oilseeds, are readily available. These materials are used to produce bio-based polymers like polylactic acid (PLA), polyhydroxyalkanoates (PHA), and bio-based polyethylene. The Asia-Pacific region has witnessed significant adoption of bio-based polymers in the packaging industry. Bio-based plastics are used to create biodegradable packaging materials, reducing plastic waste and environmental impact. Several governments in the Asia-Pacific region have introduced policies and incentives to promote the use of bio-based materials, including bio-based polymers, to reduce plastic waste and environmental pollution.

The Asia-Pacific packaging industry is a dynamic and rapidly growing sector that plays a crucial role in various industries, including food and beverages, pharmaceuticals, cosmetics, consumer goods, and more. This region is home to some of the world's largest and fastest-growing economies, making it a hub for packaging manufacturing and innovation. Bio-based polymers, such as polylactic acid (PLA), polyhydroxyalkanoates (PHA), and starch-based plastics, are used to create biodegradable packaging materials. These materials are designed to break down naturally, reducing plastic waste in landfills and oceans. For example, Consumers in the region are increasingly looking for eco-friendly and sustainable packaging options. This demand has led to a surge in the use of biodegradable packaging across various industries, including food and beverages, cosmetics, and pharmaceuticals.

Competitive Landscape

The competitive landscape of bio-based polymers is evolving rapidly as sustainability becomes a priority in various industries. Companies are increasingly investing in research and development to create innovative bio-based polymer solutions, aiming to replace traditional petroleum-based plastics. Key players in this landscape include major chemical companies, startups specializing in biotechnology, and academic institutions driving advancements in bioengineering. As consumer demand for eco-friendly alternatives grows, the market for bio-based polymers is expected to expand further, fostering competition and driving technological advancements in sustainable materials.

Some of the major players operating in the global market include:

- BASF SE

- Braskem

- Natureworks LLC

- Novamont S.p.A.

- Biome Bioplastics

- TotalEnergies Corbion

- Maip Group

- Mitsubishi Chemical Corporation

- Plantic

- Toray Industries, Inc.

Recent Developments

- In February 2025, researchers at the Green Chemistry Centre of Excellence partnered with Synthomer to develop bio-based monomers for sustainable polymer production. The collaboration aims to reduce the chemical industry's carbon footprint in coatings, adhesives, and construction materials.

· In October 2023, NatureWorks is constructing a new fully integrated PLA biopolymer facility in Thailand, set to start production in 2025, emphasizing sustainability and expanding biobased biomaterials.

· In September 2023, BASF launched industry-first biomass balance plastic additives, reducing fossil feedstock demand, cutting carbon footprint by up to 60%, supporting sustainability goals

· In August 2023, Toray Industries invests ¥1.2 million in Cellulosic Biomass Technology, expanding its stake to 84.4%, to produce key bio-based polymer materials from inedible biomass, promoting circular economy goals.

- In July 2023, Braskem invests $87 million to expand bio-based ethylene plant in Brazil by 30%, meeting global demand for sustainable products.

· In May 2023, Mitsubishi Chemical introduces DURABI D93 Series, a high-content plant-based bioengineering plastic with 74% biobased synthetic polymer, enhanced heat resistance, and versatile applications.

· In March 2023, OrthoLite partners with Novamont to create OrthoLite Cirql, the first circular foam material for footwear, reducing environmental impact and promoting sustainability.

Report Coverage

The bio-based polymer report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, product, end-use, and their futuristic growth opportunities.

Bio-Based Polymer Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 19.09 billion |

|

Revenue forecast in 2034 |

USD 63.7 billion |

|

CAGR |

14.30% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020– 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By End-Use And By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

Bio-Based Polymers Market report covering key segments are product, end-use, and region.

Bio-Based Polymers Market Size Worth $63.7 billion by 2034

The bio-based polymer market exhibiting a CAGR of 14.30% during the forecast period

Europe is leading the global market

The key driving factors in Bio-Based Polymers Market are Government regulations and policies have been projected to spur product demand.