Japan Ophthalmic Spectacle Lenses and Equipment Market Size, Share, Trends, Industry Analysis Report

By Product (Ophthalmic Spectacle Lenses, Ophthalmic Spectacle Equipment), By Lens Type, By Lens Material, By Usage, By Equipment – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM6168

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

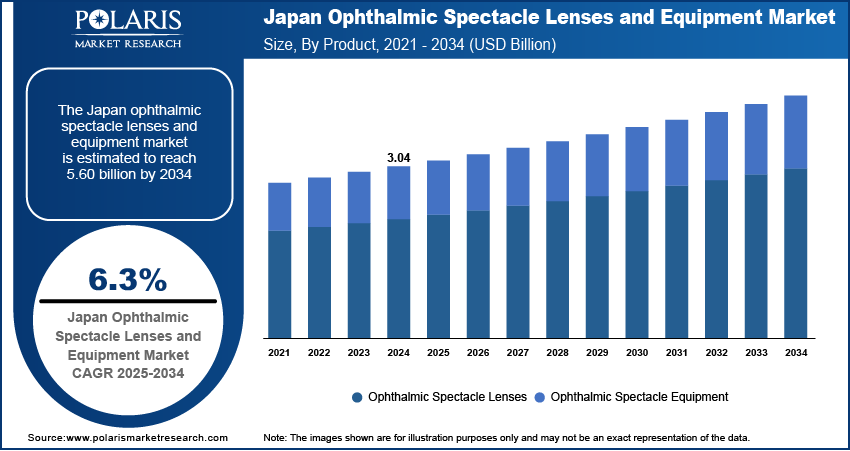

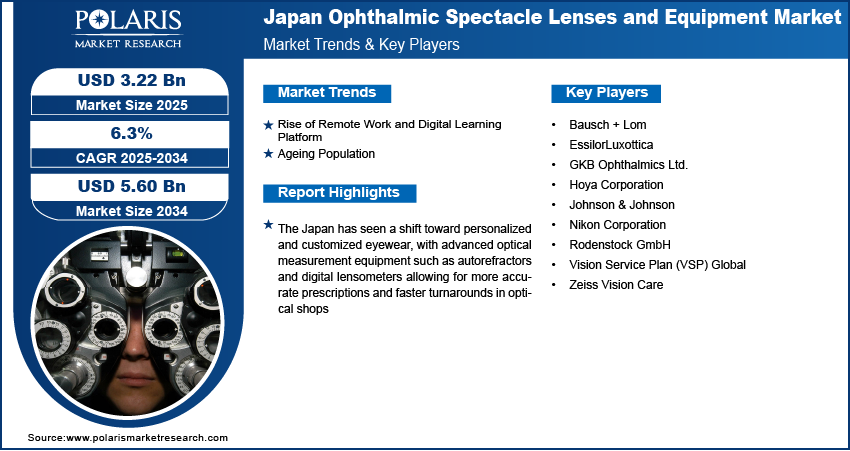

The Japan ophthalmic spectacle lenses and equipment market was valued at USD 3.04 billion in 2024 and is expected to register a CAGR of 6.3% from 2025 to 2034. The market growth is driven by the rising adoption of remote work and digital learning platforms, and ageing population.

Key Insights

- The ophthalmic spectacle lenses segment accounted for 80.55% regional share in 2024 due to high rates of vision issues such as myopia and presbyopia.

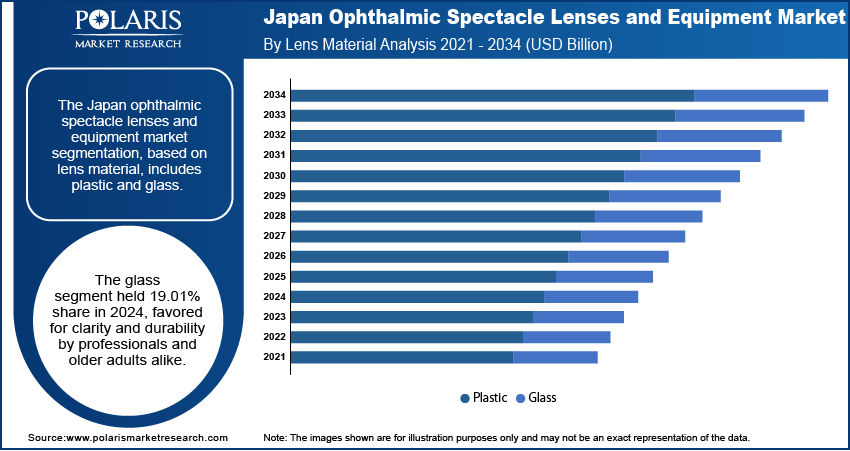

- The glass segment accounted for 19.01% market share in 2024, as they are preferred by individuals who prioritize optical clarity and scratch resistance, such as professionals with demanding visual needs or older adults used to traditional materials

Industry Dynamics

- Rising adoption of remote work and digital learning platforms fuels the industry growth.

- Increasing ageing population in Japan is fueling its adoption.

- Rising shift toward personalized and customized eyewear is boosting the growth.

- The high costs of advanced lenses and equipment, limited insurance coverage, and intense market competition limit the growth.

Market Statistics

- 2024 Market Size: USD 3.04 billion

- 2034 Projected Market Size: USD 5.60 billion

- CAGR (2025–2034): 6.3%

To Understand More About this Research: Request a Free Sample Report

Ophthalmic spectacle lenses are vision-correcting lenses prescribed to address refractive errors such as myopia (nearsightedness), hyperopia (farsightedness), astigmatism, and presbyopia (age-related difficulty in focusing on close objects). These lenses are fitted into eyeglass frames and are available with advanced features, including anti-reflective optical coatings, photochromic tinting, and blue light filtering.

Ophthalmic equipment refers to the tools and devices used by eye care professionals for eye examinations, lens manufacturing, and fitting. This includes refractors, lens edgers, and diagnostic imaging systems.

Growing consumer awareness of preventive eye care solutions drives the Japan ophthalmic spectacle lenses and equipment market into a new era of technological advancement. Integration with digital platforms, such as smartphone applications for vision monitoring and virtual try-on tools, enhances consumer experience and accelerates market adoption. For instance, in December 2021, the Government of Japan reported the launch of the Smart Eye Camera by OUI Inc. The device attaches to smartphones and utilizes advanced imaging technology for noninvasive ocular disease diagnosis. Smart Eye Camera aims to improve patient outcomes and increase accessibility to ophthalmic care throughout Japan by enhancing diagnostic accuracy.

The market shows growth potential through the expansion of specialized eye care services for children, driven by the increasing prevalence of early-onset myopia. A report published by NIH in June 2022 highlighted that the majority of myopia and high myopia were 2.9 and 0.2%, respectively, among Japanese preschool children in 2021, further driving the need for ophthalmic spectacle lenses and equipment.

Drivers & Opportunities

Rising Adoption of Remote Work and Digital Learning Platforms: The rise of remote work and e-learning platforms creates new opportunities for spectacle lens manufacturers to develop products specifically designed to address digital eye strain and maintain optimal visual comfort during extended screen time. In April 2024, TOKAI OPTICAL CO., LTD. introduced an innovative blue light-filtering coating designed to minimize blue light exposure while maintaining optimal visual sense. This advanced coating improves user comfort during extended screen time and ensures that wearers appear natural to others, effectively balancing visual performance with aesthetic considerations.

Ageing Population: Japan has one of the most rapidly aging populations in the world. Vision issues such as presbyopia, cataracts, and age-related macular degeneration become more common as people grow older. This increases demand for high-quality ophthalmic lenses and diagnostic equipment. Older adults typically require multifocal or progressive lenses, regular eye exams, and advanced diagnostic tools. The aging population is driving the Japan eye care market with a strong cultural focus on healthcare and quality of life in old age, fueling steady demand for both lenses and sophisticated equipment tailored to the needs of elderly patients, thereby driving the growth

Segmental Insights

Product Analysis

The ophthalmic spectacle lenses segment accounted for 80.55% regional share in 2024 due to high rates of vision issues such as myopia and presbyopia. Consumers often seek advanced lens options such as progressive, photochromic, and blue light filtering lenses. Frequent eye exams and early vision correction contribute to strong demand. Japanese consumers further prefer well-fitted, lightweight lenses supported by professional service from opticians. Local brands and global players compete by offering innovative solutions tailored to digital lifestyles and aging eyes, thereby driving the segment growth.

By Lens Material Analysis

The glass segment accounted for 19.01% regional market share in 2024 as they are preferred by individuals who prioritize optical clarity and scratch resistance, such as professionals with demanding visual needs or older adults used to traditional materials. Japanese consumers appreciate the durability and sharpness of glass, despite its heavier weight. Some further choose glass lenses for reading or office use where impact resistance is less of a concern. While not mainstream, this segment continues to appeal to niche users who value visual performance and long-lasting quality, thereby fueling the segment growth.

Key Players & Competitive Analysis

The Japan ophthalmic spectacle lenses and equipment market is highly competitive, shaped by a mix of domestic excellence and global innovation. Local players such as Hoya Corporation, Nikon Corporation, and TOKAI Optical Co., Ltd. lead with strong R&D, precision optics, and deep market understanding. They are well-trusted for their quality and innovation in progressive and digital lenses. International companies such as EssilorLuxottica, Zeiss Vision Care, and Johnson & Johnson offer advanced lens technologies, contact lenses, and diagnostic solutions, intensifying market competition. Rodenstock and GKB Ophthalmics add further depth with specialized lens offerings. Bausch + Lomb and Vision Service Plan (VSP) Global enhance competition through vision care services and global networks. Japanese consumers’ high standards for product performance and quality push all competitors to focus on innovation, customization, and customer service. The market is further driven by tech integration, brand loyalty, and evolving vision needs across all age groups.

Key Players

- Bausch + Lom

- EssilorLuxottica

- GKB Ophthalmics Ltd.

- Hoya Corporation

- Johnson & Johnson

- Nikon Corporation

- Rodenstock GmbH

- TOKAI OPTICAL Co., Ltd.

- Vision Service Plan (VSP) Global

- Zeiss Vision Care

Japan Ophthalmic Spectacle Lenses and Equipment Industry Developments

January 2024: ZEISS launched the Light 2 lenses as part of its SmartLife portfolio, offering progressive and digital lenses with fast adaptation and enhanced comfort. The new design targeted first-time wearers and supported eye care professionals with effective upselling strategies.

Japan Ophthalmic Spectacle Lenses and Equipment Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- Ophthalmic Spectacle Lenses

- Ophthalmic Spectacle Equipment

By Lens Type Outlook (Revenue, USD Billion, 2020–2034)

- Single-Vision Lens

- Multifocal Lenses

- Progressive Lenses

- Bifocal Lenses

- Trifocal Lenses

- Others

By Lens Material Outlook (Revenue, USD Billion, 2020–2034)

- Plastic

- Polycarbonate

- CR-39 Plastic

- Others

- Glass

By Usage Outlook (Revenue, USD Billion, 2020–2034)

- Prescription Spectacle Lenses

- Non-prescription Spectacle Lenses

By Equipment Outlook (Revenue, USD Billion, 2020–2034)

- Lens Fabrication Equipment

- Lens Generators

- Edging Machines

- Others

- Lens Coating Equipment

- Anti-Reflective Coating Machines

- Hard Coating Equipment

- UV Coating Equipment

- Others

- Optical Measurement Equipment

- Refractors & Autorefractors

- Lensometer

- Others

- Others

Japan Ophthalmic Spectacle Lenses and Equipment Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 3.04 Billion |

|

Market Size in 2025 |

USD 3.22 Billion |

|

Revenue Forecast by 2034 |

USD 5.60 Billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2021–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 3.04 billion in 2024 and is projected to grow to USD 5.60 billion by 2034.

The market is projected to register a CAGR of 6.3% during the forecast period.

A few of the key players in the market are Bausch + Lomb; EssilorLuxottica; GKB Ophthalmics Ltd.; Hoya Corporation; Johnson & Johnson; Nikon Corporation; Rodenstock GmbH; Vision Service Plan (VSP) Global; and Zeiss Vision Care.

The ophthalmic spectacles segment dominated the market share in 2024.

The glass segment is expected to witness the fastest growth during the forecast period.