Europe Metal Powder Market Size, Share, Trends, & Industry Analysis Report

By Production Method (Chemical, Mechanical, and Physical), By Type, By Application, By End Use, and By Country – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6432

- Base Year: 2024

- Historical Data: 2020-2023

Overview

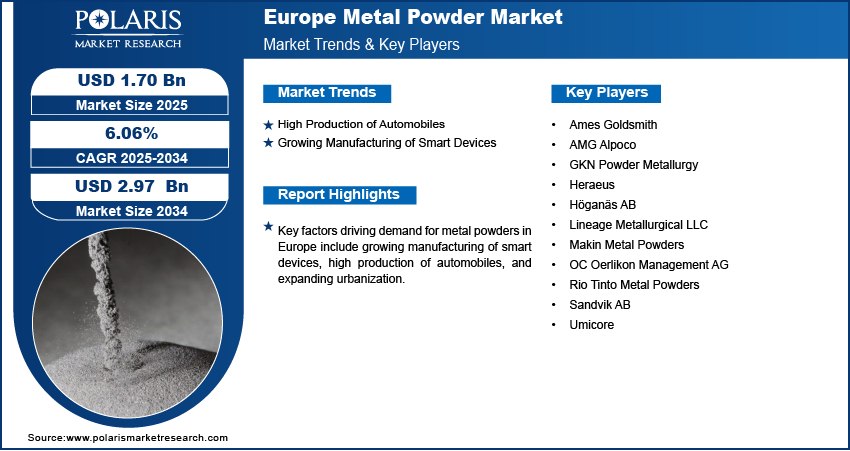

The Europe metal powder market size was valued at USD 1.61 billion in 2024, growing at a CAGR of 6.06% from 2025 to 2034. Key factors driving demand for metal powders in Europe include growing manufacturing of smart devices, high production of automobiles, and expanding urbanization.

Key Insights

- The chemical segment accounted for a major revenue share in 2024 due to the expansion of 3D printing technologies.

- The ferrous segment held the largest revenue share in 2024 due to industries across automotive and construction sectors relied on metal powders for high-strength manufacturing.

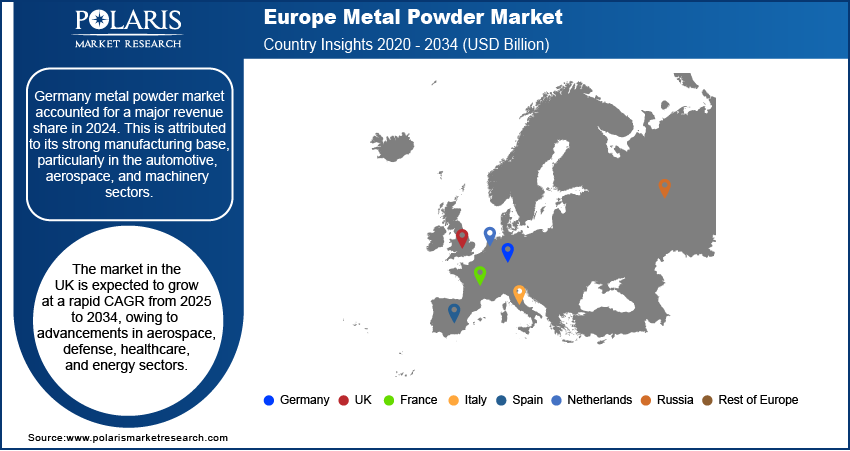

- Germany metal powder market accounted for a major revenue share in 2024, owing to its strong manufacturing base.

- The market in the UK is expected to grow at a rapid CAGR from 2025 to 2034, owing to advancements in the aerospace and defense sectors.

Industry Dynamics

- High production of automobiles is boosting demand for metal powder, as automakers use it to improve fuel efficiency and reduce emissions.

- Growing manufacturing of smart devices is propelling the adoption of metal powders as smartphones, wearables, and IoT gadgets require complex parts such as sensors, connectors, and microelectromechanical systems (MEMS).

- The increasing industrialization in emerging nations such as Germany and France is creating a lucrative market opportunity.

- The high production and handling costs of metal powder may hamper the market growth.

AI Impact on the Europe Metal Powder Market

- AI enhances production efficiency by optimizing metal powder manufacturing processes through predictive maintenance and real-time monitoring.

- Machine learning models improve quality control by detecting defects and ensuring consistent powder characteristics.

- AI-driven demand forecasting helps suppliers align production with market needs, reducing waste and inventory costs.

- Automation powered by AI accelerates R&D in additive manufacturing applications, boosting metal powder adoption.

Market Statistics

- 2024 Market Size: USD 1.61 Billion

- 2034 Projected Market Size: USD 2.97 Billion

- CAGR (2025-2034): 6.06%

Metal powder consists of finely divided particles of metals such as iron, aluminum, copper, nickel, and titanium, produced through methods such as atomization, reduction, or electrolysis. It serves as a crucial raw material in industries due to its versatility and high surface area. Manufacturers use it in additive manufacturing, powder metallurgy, coatings, and welding applications. Its properties make it ideal for producing lightweight, durable, and high-performance components required in automotive, aerospace, electronics, construction, and healthcare sectors.

Europe’s metal powder industry plays a crucial role in driving technological advancements across manufacturing industries. The region benefits from strong demand in the automotive and aerospace sectors, where lightweight and high-strength components are essential. Rising adoption of additive manufacturing, supported by government initiatives promoting sustainable production, further fuels market expansion. Countries such as Germany, France, and the U.K. lead the region with advanced manufacturing capabilities and established automotive bases. Increasing investments in electric vehicles, renewable energy infrastructure, and healthcare technologies also accelerate the need for innovative metal powder.

The Europe metal powder market demand is driven by the growing urbanization. European Commission, in its report, stated that Europe's level of urbanization is expected to increase to approximately 83.7% in 2050. This is pushing governments and developers to build new infrastructure, such as high-rise buildings, bridges, and public transport systems, all of which rely on advanced materials like metal powders for stronger, lighter, and more durable components. Additionally, urbanization is accelerating the adoption of electric vehicles, renewable energy systems, and high-tech gadgets, all requiring specialized metal powders for batteries, motors, and conductive parts. Therefore, the expanding urbanization is fueling the demand for metal powder in Europe.

Drivers & Opportunities/Trends

High Production of Automobiles: The high production of automobiles is boosting demand for metal powder, as automakers use it to improve fuel efficiency and reduce emissions. European Automobile Manufacturers' Association, in its report, stated that 14.8 million vehicles are manufactured in the European Union per year. The rising production of electric vehicles (EVs) is further accelerating the adoption of metal powder, as EV batteries, motors, and power electronics require specialized powders, such as those made from nickel, cobalt, and aluminum, for better performance and energy density. Automakers also rely on metal powders for precision parts like gears, bearings, and injection-molded components, which enhance durability and efficiency. Therefore, as car production grows in the region, the need for cost-effective, high-performance materials drives up the consumption of metal powders.

Growing Manufacturing of Smart Devices: Smartphones, wearables, and IoT gadgets require complex parts such as sensors, connectors, and microelectromechanical systems (MEMs), which often use metal powders for their precision and conductivity. Additive manufacturing and metal injection molding (MIM) processes rely on fine metal powders to produce complex, lightweight, and durable components that traditional methods cannot achieve. The push for faster, more efficient devices is driving manufacturers to use advanced materials, including copper, silver, and tungsten powders, for better thermal management and electrical performance. Hence, as consumers demand thinner, more powerful, and feature rich devices, producers turn to metal powders to meet these specifications and maintain high production volumes.

Segmental Insights

Production Method Analysis

Based on production method, the segmentation includes chemical, mechanical, and physical. The chemical segment accounted for a major revenue share in 2024 due to the expansion of 3D printing technologies in healthcare and prototyping. Manufacturers preferred this method as it enabled precise control over particle size distribution, shape, and chemical composition, which directly improved the performance of powders in applications such as additive manufacturing, automotive components, and aerospace parts. The demand for lightweight and durable materials in Europe’s automotive and aerospace sectors drove the adoption of chemically produced powders, since these industries emphasized high quality and consistency to meet stringent regulatory standards.

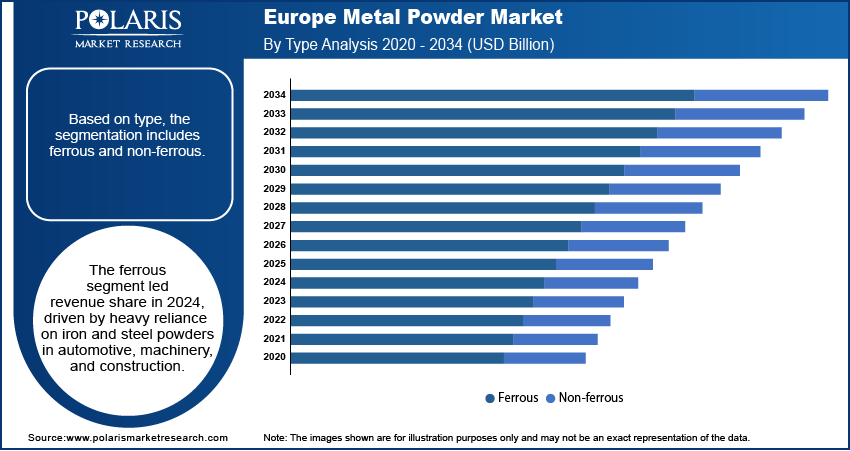

Type Analysis

Based on type, the segmentation includes ferrous and non-ferrous. The ferrous segment held the largest revenue share in 2024 due to industries across automotive, industrial machinery, and construction sectors relied heavily on iron and steel powders for high-strength and cost-efficient manufacturing. Automakers increased their use of ferrous powders to produce lightweight engine components, gears, and structural parts with excellent durability, while manufacturers of heavy machinery adopted them for tools and wear-resistant applications. The strong presence of advanced manufacturing hubs in Germany, Italy, and France also supported demand, as companies utilized ferrous powders in powder metallurgy and additive manufacturing to improve production efficiency and reduce material wastage.

Application Analysis

In terms of application, the segmentation includes additive manufacturing, press & sinter, metal injection molding, and others. The press & sinter segment dominated the revenue share in 2024 due to its cost-effectiveness for producing high volumes of components. Companies preferred press and sinter technology as it enabled them to achieve precise dimensional control and consistent mechanical strength while minimizing material waste. The automotive industry in particular drove demand by using this process to manufacture gears, bearings, and structural parts at scale, while industrial players adopted it for producing durable machine components. The availability of advanced sintering technologies and well-established powder metallurgy infrastructure in countries such as Germany, Italy, and the United Kingdom further contributed to the dominance of the segment.

End Use Analysis

In terms of end use, the segmentation includes automotive, industrial, aerospace & defense, construction, healthcare, and others. The aerospace & defense segment is expected to grow at a robust pace in the coming years, owing to the rising use of additive manufacturing for high-performance and complex components. Aircraft manufacturers increasingly depend on titanium and nickel-based powders to produce lightweight structures that enhance fuel efficiency and reduce operating costs. Defense contractors also leverage these materials to create durable parts for military vehicles, weapons systems, and maintenance applications. Growing investments in 3D printing hubs across the region are supporting this expansion, as the technology enables faster prototyping and precision production of mission-critical components. Strong government backing for aerospace innovation and the rising need for sustainable aviation is further driving the preference for metal powders in the segment.

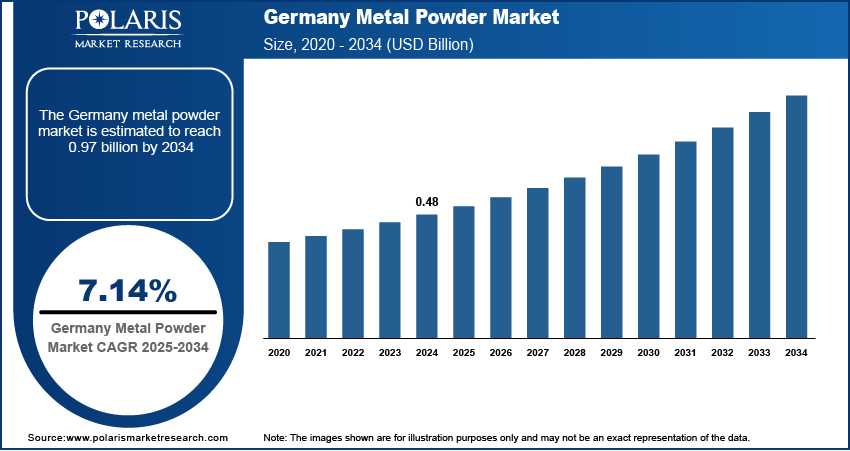

Country Analysis

Germany metal powder market accounted for a major revenue share in 2024. This is attributed to its strong manufacturing base, particularly in the automotive, aerospace, and machinery sectors. Germany has heavily invested in advanced manufacturing technologies, including additive manufacturing (3D printing), which relies on high-quality metal powders such as titanium, aluminum, and nickel-based superalloys. The automotive industry in the country used metal powders in powder metallurgy for producing precision components such as gears, sprockets, and connecting rods. Additionally, Germany’s focus on innovation and R&D in clean energy and lightweight engineering, especially for electric vehicles and fuel-efficient aircraft, further boosted demand. Major industrial companies and research institutions across Germany actively developed new applications for metal powders.

The market in the UK is expected to grow at a rapid CAGR from 2025 to 2034, owing to advancements in aerospace, defense, healthcare, and energy sectors. The aerospace industry in the country is a major consumer of high-performance metal powders, particularly nickel and titanium alloys for manufacturing turbine blades and other critical engine components using additive manufacturing. The UK government’s commitment to innovation through funding programs such as the Industrial Strategy Challenge Fund has accelerated the adoption of 3D printing in both public and private sectors. Furthermore, the push toward net-zero emissions is increasing interest in hydrogen and nuclear energy technologies, where metal powders are used in specialized components and coatings.

Key Players & Competitive Analysis Report

The European metal powder market is highly competitive, driven by key players such as Höganäs AB, GKN Powder Metallurgy, Sandvik AB, Umicore, and Rio Tinto Metal Powders. These companies dominate in production capacity, innovation, and geographic reach, leveraging advanced technologies in additive manufacturing, automotive, and aerospace applications. Höganäs leads in iron and metal powder production, while GKN excels in powder metallurgy solutions for automotive components. Umicore focuses on sustainable and specialty materials, aligning with Europe’s green transition. The region benefits from strong R&D infrastructure and supportive regulations promoting industrial innovation. Competition is intensifying with emerging firms and growing demand for lightweight, high-performance materials.

Major companies operating in the Europe metal powder industry include Ames Goldsmith, AMG Alpoco, GKN Powder Metallurgy, Heraeus, Höganäs AB, Lineage Metallurgical LLC, Makin Metal Powders, OC Oerlikon Management AG, Rio Tinto Metal Powders, Sandvik AB, and Umicore.

Key Players

- Ames Goldsmith

- AMG Alpoco

- AMETEK

- GKN Powder Metallurgy

- Heraeus

- Höganäs AB

- Lineage Metallurgical LLC

- Makin Metal Powders

- OC Oerlikon Management AG

- Rio Tinto Metal Powders

- Sandvik AB

- Umicore

Industry Developments

August 2025, Sandvik introduced Osprey MAR 55, a highly versatile tool steel powder that bridges the gap between maraging steels and tool steels.

June 2024, AMETEK announced the launch of its new high green strength stainless steel powders, ideal for use in powder metallurgy for a wide range of automotive pressed and sintered parts.

Europe Metal Powder Market Segmentation

By Production Method Outlook (Revenue, USD Billion, 2020–2034)

- Chemical

- Mechanical

- Physical

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Ferrous

- Non-ferrous

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Additive Manufacturing

- Press & Sinter

- Metal Injection Molding

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Industrial

- Aerospace & Defense

- Construction

- Healthcare

- Others

By Country Outlook (Revenue, USD Billion, 2020–2034)

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

Europe Metal Powder Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.61 Billion |

|

Market Size in 2025 |

USD 1.70 Billion |

|

Revenue Forecast by 2034 |

USD 2.97 Billion |

|

CAGR |

6.06% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Country Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.61 billion in 2024 and is projected to grow to USD 2.97 billion by 2034.

The market is projected to register a CAGR of 6.06% during the forecast period.

Germany dominated the market in 2024

A few of the key players in the market are Ames Goldsmith, AMG Alpoco, GKN Powder Metallurgy, Heraeus, Höganäs AB, Lineage Metallurgical LLC, Makin Metal Powders, OC Oerlikon Management AG, Rio Tinto Metal Powders, Sandvik AB, and Umicore.

The chemical segment dominated the market revenue share in 2024.

The aerospace & defense segment is projected to witness the fastest growth during the forecast period.