Powder Metallurgy Market Size, Share, & Industry Analysis Report

By Material (Titanium, Nickel, Steel, Aluminum, Cobalt), By Application, By Process, By End Use, and By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 125

- Format: PDF

- Report ID: PM6364

- Base Year: 2024

- Historical Data: 2020-2023

Overview

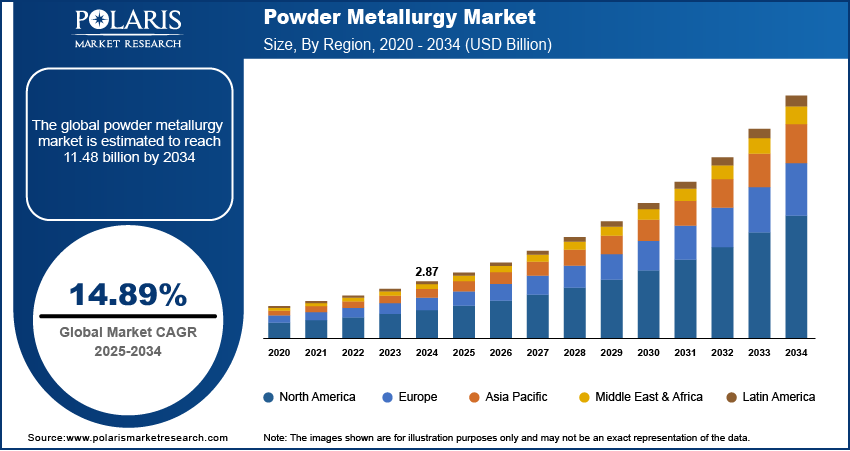

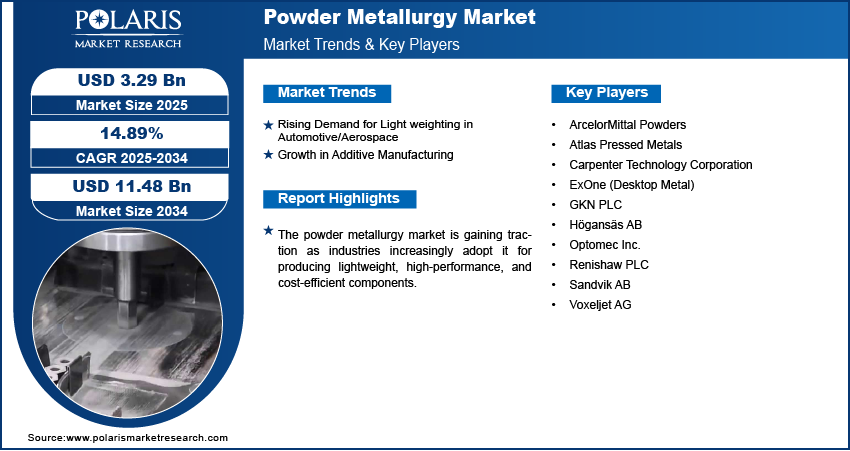

The global powder metallurgy market size was valued at USD 2.87 billion in 2024, growing at a CAGR of 14.89% from 2025–2034. Key factors driving demand include superior material properties, medical implant demand, rising demand for light weighting in automotive and aerospace, and growth in additive manufacturing.

Key Insights

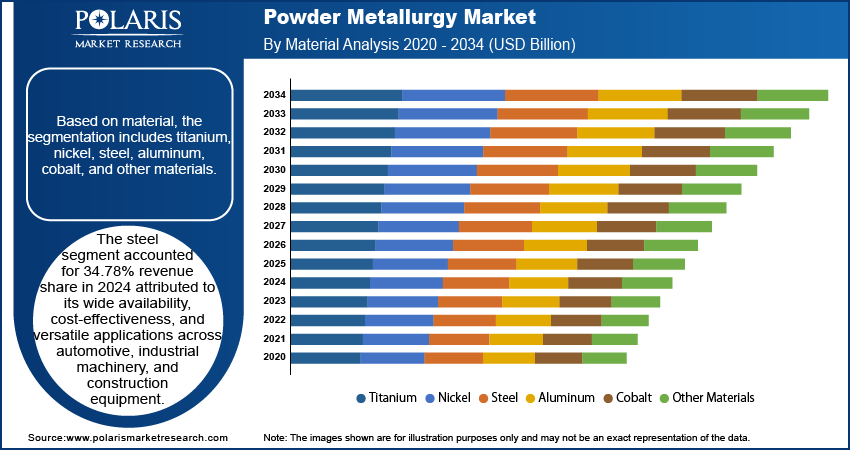

- The steel segment held a 34.78% revenue share in 2024, owing to its wide availability, cost-effectiveness, and versatile use in automotive and industrial applications.

- The automotive segment is projected to grow at the fastest rate of 7.0% CAGR, driven by the industry's push for light weighting and improved fuel efficiency.

- The metal injection molding segment captured a dominant 49.74% share in 2024, due to its precision in manufacturing small, complex parts with superior properties.

- The AM operators segment is forecast to grow at a 6.5% CAGR, supported by the rising integration of additive manufacturing technologies.

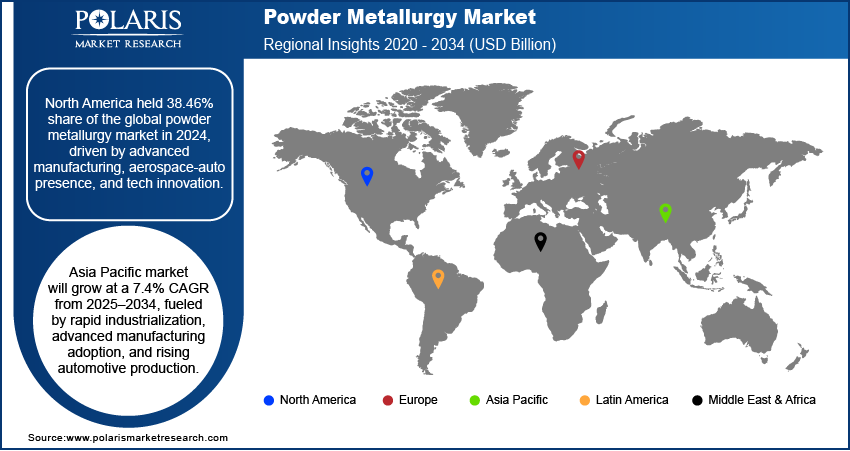

- North America held a leading 38.46% global market share in 2024, attributed to its advanced manufacturing base and strong aerospace and automotive sectors.

- The U.S. accounted for 95.91% of the North American market in 2024, fueled by its robust manufacturing infrastructure and technological advancements.

- The Asia Pacific market is expected to grow at a 7.4% CAGR from 2025 to 2034, driven by rapid industrialization and expanding automotive production.

- China's market is projected to expand at a 7.7% CAGR, driven by its massive industrial base and focus on automotive and electronics manufacturing.

Industry Dynamics

- Rising demand for lightweight automotive and aerospace components drives market growth, as manufacturers aim for fuel-efficient, high-performance parts without sacrificing strength or durability.

- Growth in additive manufacturing expands powder metallurgy, as it relies on metal powders to produce complex, customized parts efficiently and with minimal material waste.

- High initial capital investment for specialized equipment and tooling creates substantial entry barriers, especially for small and medium-sized manufacturers.

- Growing demand for lightweight, complex components in electric vehicles and aerospace offers major expansion potential for high-performance powder metallurgy solutions.

Market Statistics

- 2024 Market Size: USD 2.87 billion

- 2034 Projected Market Size: USD 11.48 billion

- CAGR (2025-2034): 14.89%

- North America: Largest market in 2024

AI Impact on Powder Metallurgy Market

- AI enhances production efficiency by optimizing sintering parameters and predicting equipment failures, reducing downtime and ensuring consistent part quality.

- AI algorithms analyze vast datasets to rapidly design and test new metal powder compositions, speeding innovation for high-performance applications.

Powder metallurgy is a manufacturing process where metal powders are compacted and sintered to form high-performance components. It is gaining importance due to its ability to deliver superior material properties. This process allows for more precise control over microstructure, density, and composition, resulting in components with improved wear resistance, mechanical strength, and thermal stability. For instance, in May 2025, AM 4 AM collaborated with Gränges Powder Metallurgy to utilize their advanced material characterization equipment. This collaboration aims to enhance metal powder performance for additive manufacturing through comprehensive analysis and testing. Such advantages make powder metallurgy highly suitable for industries such as automotive, aerospace, and electronics, where durability and lightweight designs are critical. Furthermore, the technique reduces material waste and supports cost-effective production of complex geometries, reinforcing its role as a sustainable and efficient manufacturing method.

The rising demand for medical implants, which especially benefits from the versatility of this technology, further drives the growth opportunities. The process enables the production of biocompatible implants with controlled porosity, allowing better bone integration and improved patient outcomes. Materials such as titanium and its alloys, widely used in orthopedic and dental applications, are efficiently processed using powder metallurgy to achieve high precision and customized designs. For instance, in May 2025, Oerlikon Metco launched MetcoMed Ti64 G23-C, a biocompatible titanium alloy for medical 3D printing. It offers 1000+ MPa tensile strength, 10% extension, and is optimized for dental/orthopedic implants via laser powder bed fusion. Additionally, advancements in additive manufacturing, integrated with powder metallurgy, further help with the development of tailored medical devices, aligning with the growing need for patient-specific solutions in modern healthcare.

Drivers & Opportunities

Rising Demand for Light weighting in Automotive/Aerospace: The rising demand for light weighting in automotive and aerospace is driving the market expansion, as the industry increasingly prioritizes fuel efficiency, performance, and emission reduction. According to a report by the Alliance for Automotive Innovation, the manufacturing of automobiles contributed USD 360 billion to the U.S. economy in 2024, highlighting the growing opportunities for powder metallurgy. It enables the production of strong yet lightweight components with precise geometries, helping manufacturers replace heavier materials without compromising mechanical strength or durability. In aerospace, where weight reduction directly impacts fuel consumption and payload capacity, powder metallurgy provides advanced alloys and composites that meet strict safety and performance standards. Similarly, in the automotive sector, the technology supports the production of lightweight engine parts, gears, and structural components that enhance efficiency while following environmental regulations.

Growth in Additive Manufacturing: Growth in additive manufacturing is another factor fueling the expansion of powder metallurgy, given its dependence on metal powders as feedstock. The convergence of these technologies allows for the fabrication of complex, customized components with minimal waste and shorter lead times, aligning with the growing demand for flexible and cost-effective production methods. Powder metallurgy ensures consistent powder quality and performance, which is critical for achieving the required mechanical properties in 3D-printed parts. This is particularly valuable in sectors such as medical, aerospace, and industrial tooling, where design freedom and precision are paramount. For instance, in August 2025, America Makes launched a USD 1.7 million project to train and qualify non-traditional additive manufacturing suppliers for defense production, focusing on compliance with required process control documents (PCDs) to scale industrial base capabilities. Moreover, the integration with powder metallurgy is expected to accelerate the adoption of advanced metal powders across diverse applications as additive manufacturing continues to evolve.

Segmental Insights

Material Analysis

Based on material, the segmentation includes titanium, nickel, steel, aluminum, cobalt, and other materials. The steel segment accounted for 34.78% revenue share in 2024 attributed to its wide availability, cost-effectiveness, and versatile applications across automotive, industrial machinery, and construction equipment. Powder metallurgy enables the production of steel components with high wear resistance, dimensional precision, and durability, making it suitable for gears, bearings, and structural parts. The established supply chain for steel powders further strengthens its market presence, ensuring consistent demand across multiple end-use industries.

The nickel segment is expected to witness rapid growth at a CAGR of 6.9% during the forecast period driven by its superior mechanical strength and corrosion resistance under high-temperature conditions. Nickel-based super alloys produced through powder metallurgy are extensively used in aerospace and energy industries, particularly in turbine engines and power generation systems. These alloys offer exceptional performance where conventional materials fall short, especially in extreme operating environments. Additionally, the rising need for high-performance materials in critical applications is fueling the increased adoption of nickel powders, positioning this segment as a growing contributor.

Application Analysis

In terms of application, the segmentation includes aerospace & defense, automotive, medical & dental, oil & gas, industrial. The aerospace & defense dominated the market with a 50.66% share in 2024 due to the sector’s reliance on lightweight, high-strength materials to improve fuel efficiency, payload capacity, and overall performance. Powder metallurgy enables the production of complex and customized aerospace components such as turbine blades, engine parts, and structural assemblies with precision and reliability. Furthermore, the ability to produce advanced alloys tailored for demanding conditions strengthens its relevance in aerospace and defense applications.

The automotive segment is expected to witness fastest growth at a 7.0% CAGR during the forecast period fueled by the industry’s focus on light weighting, fuel efficiency, and emission reduction. Powder metallurgy supports the cost-effective production of gears, bearings, and engine parts with excellent durability and wear resistance. The technology also enables complex component designs, making it ideal for next-generation automotive solutions, including electric vehicles. The automotive sector is expanding its adoption of powder metallurgy solutions with increasing focus on sustainability and performance optimization.

Process Analysis

The segmentation based on process includes additive manufacturing, metal injection molding, powder metal hot isostatic pressing (PM HIP). The metal injection molding segment captured 49.74% share in 2024 driven by its ability to produce small, intricate components with high precision and excellent mechanical properties. MIM combines the design flexibility of plastic injection molding with the strength of metallurgy, making it suitable for industries requiring mass production of complex shapes, such as electronics, medical devices, and automotive. Its efficiency in producing near-net-shape parts reduces machining requirements and material waste, boosting its adoption across multiple sectors.

The powder metal hot isostatic pressing (PM HIP) segment is expected to witness rapid growth at a CAGR of 3.5% during the forecast period as it enables the production of defect-free, fully dense parts with superior mechanical performance. This process is especially beneficial in aerospace, oil and gas, and medical applications, where reliability and consistency are critical. PM HIP authorizes consolidation of metal powders into large, high-integrity components, often replacing forged or cast parts. Its ability to enhance material properties such as toughness and fatigue resistance highlights its growing importance in advanced engineering applications.

End Use Analysis

Based on end use, the segmentation includes, OEM, AM operators. The OEM segment held 71.95% share in 2024 attributed to OEMs’ direct involvement in large-scale production and their integration of powder metallurgy solutions into automotive, aerospace, and industrial manufacturing. OEMs benefit from powder metallurgy’s efficiency in producing cost-effective, high-quality components that meet stringent design and performance requirements. Their control over production processes and partnerships with suppliers also support consistent adoption of powder-based solutions.

The AM operators segment is expected to grow with a 6.5% CAGR during the forecast period supported by the increasing adoption of additive manufacturing technologies. These operators leverage metal powders as feedstock to produce customized and complex components across industries such as medical, aerospace, and industrial tooling. The flexibility, reduced lead times, and minimal material waste offered by additive manufacturing make it highly attractive. Therefore, as operators expand their capabilities in producing high-performance parts, the demand for powder metallurgy solutions in this segment is expected to rise.

Regional Analysis

North America powder metallurgy market accounted for 38.46% of global market share in 2024. This dominance is owing to its advanced manufacturing ecosystem, strong presence of aerospace and automotive industries, and substantial investments in technology innovation. The region benefits from a well-established supply chain for metal powders and a high adoption rate of additive manufacturing. These factors collectively support its leadership in driving demand for powder metallurgy solutions.

U.S. Powder Metallurgy Market Insight

U.S. held 95.91% market share in North America powder metallurgy landscape in 2024 driven by its strong manufacturing base and advanced technological capabilities. The presence of leading aerospace, automotive, and medical device industries fuels consistent demand for high-performance metal powders and precision components. Additionally, the country’s focus on innovation, with research and development activities, has boosted its position in adopting powder metallurgy for both traditional and additive manufacturing applications.

Asia Pacific Powder Metallurgy Market

The market in Asia Pacific is projected to grow at a CAGR of 7.4% from 2025-2034, driven by rapid industrialization, increasing adoption of advanced manufacturing technologies, and expanding automotive production. The Japan Automobile Manufacturers Association report stated that in 2023, Japan produced 8.99 million motor vehicles, reflecting a 14.8% increase from the previous year. The region’s focus on cost-effective and efficient manufacturing aligns with the benefits of powder metallurgy, making it a preferred choice for mass production. Additionally, growing investments in aerospace, healthcare, and energy sectors are further boosting demand for high-performance metal components in Asia Pacific.

China Powder Metallurgy Market Overview

The market in China is expanding due with a CAGR of 7.7% during the forecast period due to its large-scale industrialization and strong focus on automotive and electronics manufacturing. The country benefits from cost-effective production capabilities, high-volume output, and growing investment in advanced manufacturing technologies. Additionally, increasing demand for lightweight components and the integration of powder metallurgy in automotive and aerospace sectors are further accelerating its adoption. The government’s support for innovation and infrastructure development also drives China’s strong position in this market.

Europe Powder Metallurgy Market

The powder metallurgy landscape in Europe captured 27.92% share in 2024 supported by its strong industrial base and focus on sustainable, high-precision manufacturing. The region has a well-established aerospace and automotive sector that consistently demands lightweight, efficient, and reliable components. Additionally, Europe’s focus on research and development, with strict quality standards, supports the adoption of powder metallurgy across diverse industries. This combination of technological advancement and regulatory support positions Europe as a major player in the market landscape.

UK Powder Metallurgy Market

The UK market is expected to witness robust growth at a CAGR of 6.5% during the forecast period supported by its well-established aerospace and automotive industries. The country’s focus on sustainable manufacturing practices and the development of lightweight, high-performance materials has created favorable conditions for powder metallurgy adoption. Furthermore, investments in research and innovation, particularly in additive manufacturing and medical applications, are driving new opportunities for the industry. Thus, the UK’s strong engineering expertise and focus on advanced technologies continue to enhance its market potential.

Key Players & Competitive Analysis Report

The powder metallurgy sector is highly competitive, dominated by global players such as GKN, Höganäs, and Sandvik, who leverage technological advancement in additive manufacturing and material science to secure revenue growth. Competitive intelligence and strategy focus on developing sustainable value chains and lightweight, high-performance components for the automotive and aerospace sectors, addressing latent demand and opportunities. Industry trends highlight a shift towards custom alloy powders and eco-friendly production processes, driven by economic and geopolitical shifts in material sourcing. Expert's insight stated that future development strategies must prioritize R&D in niche applications such as medical implants and soft magnetic composites to maintain an edge. However, the industry faces pressure from supply chain disruptions affecting metal powder availability and pricing.

Furthermore, strategic investments in atomization technologies and partnerships with OEMs are critical for expansion, particularly in emerging markets where industrial growth fuels demand. Success relies on optimizing production costs while innovating to meet complex client specifications in high-growth sectors.

Major companies operating in the powder metallurgy industry include ArcelorMittal Powders, Carpenter Technology Corporation, ExOne (Desktop Metal), GKN PLC, Atlas Pressed Metals, Högansäs AB, Optomec Inc., Renishaw PLC, Sandvik AB, and Voxeljet AG.

Key Players

- ArcelorMittal Powders

- Carpenter Technology Corporation

- ExOne (Desktop Metal)

- GKN PLC

- Atlas Pressed Metals

- Högansäs AB

- Optomec Inc.

- Renishaw PLC

- Sandvik AB

- Voxeljet AG

Industry Developments

- June 2025, GKN Powder Metallurgy launched new metallic membrane cartridge filters. Designed for fine filtration demands in chemical, pharmaceutical, and food industries, they offer enhanced performance, efficiency, and sustainability.

- June 2024: AMETEK SMP launched high green strength stainless steel powders for powder metallurgy. They offer a 50%+ green strength improvement for automotive and industrial parts, with minimal impact on sintered properties.

Powder Metallurgy Market Segmentation

By Material Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Titanium

- Nickel

- Steel

- Aluminum

- Cobalt

- Other Materials

By Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Aerospace & Defense

- Automotive

- Medical & Dental

- Oil & Gas

- Industrial

By Process Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Additive Manufacturing

- Metal Injection Molding

- Powder Metal Hot Isostatic Pressing (PM HIP)

By End Use Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- OEM

- AM Operators

By Regional Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Powder Metallurgy Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 2.87 Billion |

|

Market Size in 2025 |

USD 3.29 Billion |

|

Revenue Forecast by 2034 |

USD 11.48 Billion |

|

CAGR |

14.89% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 2.87 billion in 2024 and is projected to grow to USD 11.48 billion by 2034.

The global market is projected to register a CAGR of 14.89% during the forecast period.

North America powder metallurgy market accounted for 38.46% of global market share in 2024.

A few of the key players in the market are ArcelorMittal Powders, Carpenter Technology Corporation, ExOne (Desktop Metal), GKN PLC, Atlas Pressed Metals, Högansäs AB, Optomec Inc., Renishaw PLC, Sandvik AB, and Voxeljet AG.

The steel segment accounted for 34.78% revenue share in 2024.

The automotive segment is expected to witness fastest growth at a 7.0% CAGR during the forecast period.