U.S. Metal Powder Market Size, Share, Trends, & Industry Analysis Report

By Production Method (Chemical, Mechanical, and Physical), By Type, By Application, By End Use– Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 124

- Format: PDF

- Report ID: PM6431

- Base Year: 2024

- Historical Data: 2020-2023

Overview

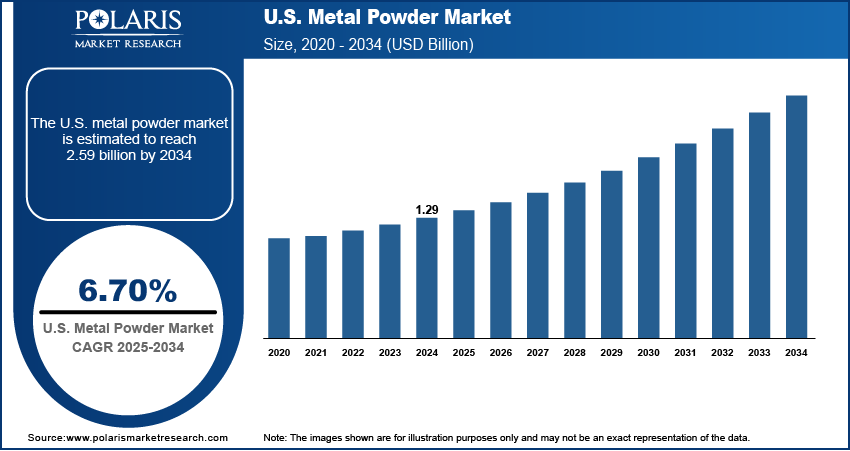

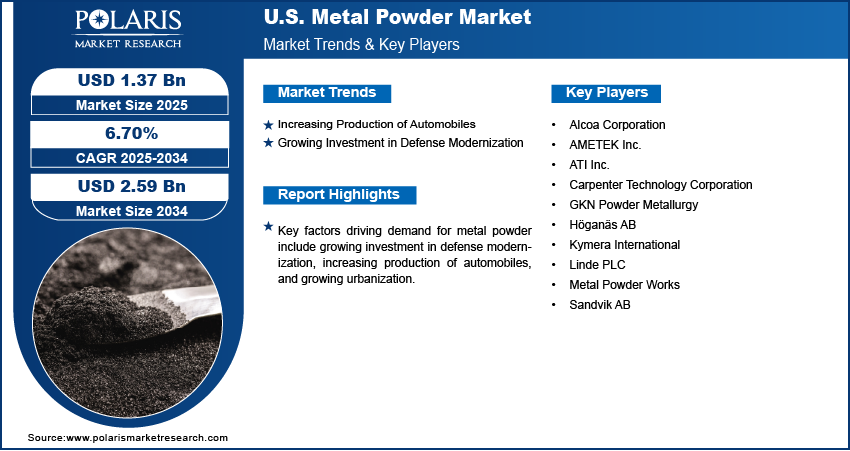

The U.S. metal powder market size was valued at USD 1.29 billion in 2024, growing at a CAGR of 6.70% from 2025 to 2034. Key factors driving demand for metal powder include growing investment in defense modernization, increasing production of automobiles, and growing urbanization.

Key Insights

- The chemical segment accounted for 60.55% of the revenue share in 2024 due to its ability to produce powders with uniform particle size.

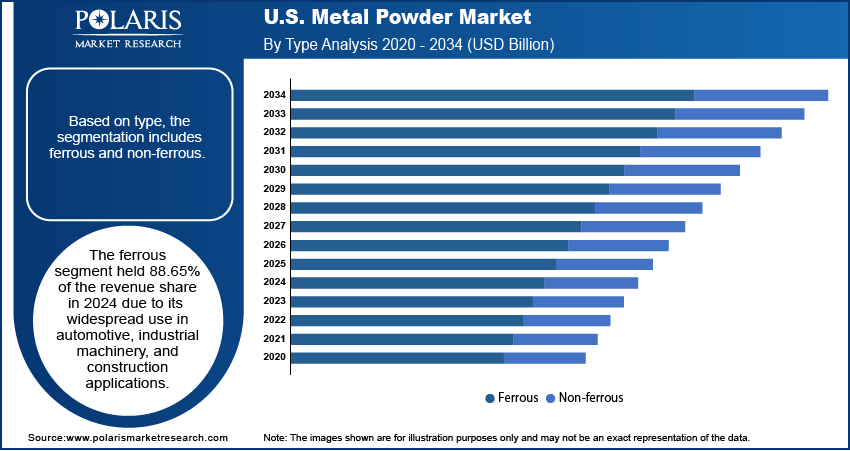

- The ferrous segment held 88.65% of the revenue share in 2024 due to its widespread use in industrial machinery.

- The press & sinter segment accounted for 74.00% from 2025 to 2034, owing to its role in producing high-volume components for the automotive industry.

- The aerospace & defense segment is estimated to grow at a CAGR of 8.95% from 2025 to 2034, owing to the increasing use of additive manufacturing.

Industry Dynamics

- Increasing production of automobiles is propelling the demand for metal powder, as automakers are using these powders extensively to create complex, lightweight, and high-strength components.

- Growing investment in defense modernization is fueling the demand for metal powder as modern defense equipment requires high-performance materials that offer superior strength, durability, and lightweight properties.

- The increasing industrialization is creating a lucrative market opportunity.

- The high production and handling costs of metal powder may hamper the market growth.

Market Statistics

- 2024 Market Size: USD 1.29 Billion

- 2034 Projected Market Size: USD 2.59 Billion

- CAGR (2025-2034): 6.70%

AI Impact on U.S. Metal Powder Market

- AI enhances production efficiency by optimizing metal powder manufacturing processes.

- Predictive maintenance reduces downtime in powder production facilities.

- AI accelerates R&D, enabling faster development of advanced alloy powders in the U.S. market

Metal powder refers to finely divided particles of metals such as aluminum, copper, iron, nickel, and titanium that are produced through processes like atomization, reduction, or electrolysis. These powders serve as essential raw materials in powder metallurgy, additive manufacturing, and thermal spraying. They enable the production of lightweight, durable, and complex components with high precision. Industries such as automotive, aerospace, electronics, and construction rely on these powders to create parts with improved strength, wear resistance, and performance.

The U.S. metal powder market continues to expand due to the nation’s strong industrial base, advanced manufacturing capabilities, and rising adoption of additive manufacturing technologies. Growing demand for lightweight materials in the automotive and aerospace sectors is driving the consumption of powders such as aluminum and titanium. The country’s focus on electric vehicle production, defense innovation, and sustainable manufacturing further supports market growth. Additionally, the presence of major powder producers, technological advancements, and government investments in research and development strengthen the U.S. position as a global metal powder industry.

The demand for metal powders in the U.S. is driven by the growing urbanization. According to the World Bank Group, the urban population in the U.S. reached 84% in 2024 from 83% in 2022. This increased the construction of high-rise buildings, bridges, and infrastructure projects that required advanced materials, and metal powders played a crucial role in producing high-strength, lightweight materials through processes like additive manufacturing (3D printing) and powder metallurgy. Urbanization in the country is also increasing the development of consumer electronics, medical devices, and industrial machinery, all of which rely on metal powder components. Additionally, the push for sustainable and energy-efficient solutions in urban areas is boosting the adoption of metal powders in renewable energy technologies, such as wind turbines and solar panels. Therefore, the growing urbanization in the U.S. is fueling the demand for metal powders.

Drivers & Opportunities/Trends

Increasing Production of Automobiles: Automakers are using metal powders extensively in powder metallurgy and additive manufacturing (3D printing) to create complex, lightweight, and high-strength components such as gears, engine parts, and structural elements. Therefore, the growing production of automobiles is driving the demand for metal powder. United States Motor Vehicle Production was reported at 10,611,555.000 units in Dec 2023. This records an increase from the previous number of 10,052,958.000 units for Dec 2022. The rise of electric vehicles (EVs) is further accelerating the demand for metal powder, since EVs require specialized parts such as battery components, electric motor cores, and heat exchangers that rely on metal powders for precision and performance. Mass production of cars is also driving the need for cost-effective, scalable manufacturing processes, and metal powders enable efficient, high-volume production with minimal material waste. Additionally, the push for fuel efficiency and reduced emissions in vehicles is compelling manufacturers to adopt lighter materials, and metal powders help achieve these goals by allowing the creation of intricate, optimized designs that traditional methods cannot match.

Growing Investment in Defense Modernization: Modern defense equipment, such as advanced aircraft, armored vehicles, missiles, and drones, requires high-performance materials that offer superior strength, durability, and lightweight properties, all of which metal powders provide through processes like additive manufacturing and powder metallurgy. The production of complex, precision-engineered components for stealth technology, ballistic protection, and high-temperature applications relies heavily on metal powders, which enable the creation of parts with complex geometries and enhanced mechanical properties. Additionally, the push for rapid prototyping and on-demand production in defense industries favors metal powder-based technologies, allowing for faster development and customization of critical components. Therefore, as the country allocates more resources to defense innovation and self-reliance, the need for advanced materials such as metal powders continues to surge.

Segmental Insights

Production Method Analysis

Based on production method, the segmentation includes chemical, mechanical, and physical. The chemical segment accounted for 60.55% of the revenue share in 2024 due to its ability to produce powders with high purity, uniform particle size distribution, and superior quality, which industries such as automotive, aerospace, and healthcare highly demand. Manufacturers favored this method as it ensured consistent performance in applications like additive manufacturing, powder metallurgy, and specialized coatings. The growing adoption of advanced manufacturing technologies, particularly in defense and biomedical applications, also supported the expansion of this method, as it enables the creation of powders with precise compositions and enhanced functionality.

Type Analysis

Based on type, the segmentation includes ferrous and non-ferrous. The ferrous segment held 88.65% of the revenue share in 2024 due to its widespread use in automotive, industrial machinery, and construction applications. Manufacturers preferred these powders as they offer excellent strength, durability, and cost-effectiveness, making them suitable for producing gears, bearings, and structural components through powder metallurgy. The strong demand for stainless steel and iron powders in heavy-duty applications further strengthened the segment’s position. Expanding infrastructure projects and the continued need for robust machinery parts also created consistent growth opportunities for ferrous-based material.

The non-ferrous segment is expected to grow at a CAGR of 7.62% from 2025 to 2034, owing to the rising adoption of lightweight and high-performance materials in aerospace, defense, and electric vehicle production. Industries favor non-ferrous powders such as aluminum, titanium, and copper as they combine strength with reduced weight, which supports fuel efficiency and energy savings. Growing investment in 3D printing and additive manufacturing is projected to further accelerate demand, since non-ferrous alloys allow the precise fabrication of complex parts with superior corrosion resistance.

Application Analysis

In terms of application, the segmentation includes additive manufacturing, press & sinter, metal injection molding, and others. The press & sinter segment accounted for 74.00% from 2025 to 2034, owing to its role in producing high-volume components for automotive, industrial, and consumer goods. Manufacturers relied on this method as it delivers cost efficiency, design flexibility, and strong mechanical properties, which are essential for parts such as gears, bearings, and bushings. The continued demand for reliable and durable metal components in heavy-duty applications further contributed to the dominance of the segment.

End Use Analysis

In terms of end use, the segmentation includes automotive, industrial, aerospace & defense, construction, healthcare, and others. The aerospace & defense segment is estimated to grow at a CAGR of 8.95% from 2025 to 2034, owing to the increasing use of additive manufacturing to produce lightweight, high-strength components with precise geometries. Aircraft and defense system manufacturers prefer powders such as titanium, aluminum, and nickel alloys as they offer superior strength-to-weight ratios and resistance to extreme operating conditions. The rising demand for fuel-efficient aircraft, combined with stringent regulatory requirements for safety and performance, is projected to accelerate the adoption of advanced powder-based production. Expanding investments in defense modernization programs and next-generation aircraft platforms are further strengthening the segment’s dominance.

Key Players & Competitive Analysis Report

The U.S. metal powder market features a competitive landscape shaped by established players and specialized producers serving aerospace, automotive, industrial, and additive manufacturing sectors. Key companies such as Carpenter Technology Corporation, ATI Inc., and GKN Powder Metallurgy dominate through advanced material innovation and vertical integration. Global firms like Höganäs AB and Sandvik AB maintain strong U.S. operations, leveraging technical expertise in iron, steel, and specialty alloy powders. Industrial gas and material suppliers like Linde PLC contribute through powder production and recycling technologies. Alcoa Corporation and AMETEK Inc. focus on high-performance aluminum and specialty metal powders, respectively. Emerging demand from additive manufacturing is driving consolidation and R&D investments. Competition is focused on purity, consistency, customization, and cost-efficiency, with companies expanding capabilities to meet stringent industry standards and evolving customer requirements across defense, energy, and medical applications.

Major companies operating in the U.S. metal powder industry include Alcoa Corporation, AMETEK Inc., ATI Inc., Carpenter Technology Corporation, GKN Powder Metallurgy, Höganäs AB, Kymera International, Linde PLC, Metal Powder Works, and Sandvik AB.

Key Companies

- Alcoa Corporation

- AMETEK Inc.

- ATI Inc.

- Carpenter Technology Corporation

- GKN Powder Metallurgy

- Höganäs AB

- Kymera International

- Linde PLC

- Metal Powder Works

- Sandvik AB

Industry Developments

August 2025, Sandvik introduced Osprey MAR 55, a highly versatile tool steel powder that bridges the gap between maraging steels and tool steels.

June 2024, AMETEK announced the launch of its new high green strength stainless steel powders, ideal for use in powder metallurgy for a wide range of automotive pressed and sintered parts.

U.S. Metal Powder Market Segmentation

By Production Method Outlook (Revenue, USD Billion, 2020–2034)

- Chemical

- Mechanical

- Physical

By Type Outlook (Revenue, USD Billion, 2020–2034)

- Ferrous

- Non-ferrous

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Additive Manufacturing

- Press & Sinter

- Metal Injection Molding

- Others

By End Use Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Industrial

- Aerospace & Defense

- Construction

- Healthcare

- Others

U.S. Metal Powder Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.29 Billion |

|

Market Size in 2025 |

USD 1.37 Billion |

|

Revenue Forecast by 2034 |

USD 2.59 Billion |

|

CAGR |

6.70% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market size was valued at USD 1.29 billion in 2024 and is projected to grow to USD 2.59 billion by 2034.

The market is projected to register a CAGR of 6.70% during the forecast period.

A few of the key players in the market are Alcoa Corporation, AMETEK Inc., ATI Inc., Carpenter Technology Corporation, GKN Powder Metallurgy, Höganäs AB, Kymera International, Linde PLC, Metal Powder Works, and Sandvik AB.

The chemical segment dominated the market revenue share in 2024.

The aerospace & defense segment is projected to witness the fastest growth during the forecast period.