Insect Pest Control Market Size, Share, Trends, & Industry Analysis Report

By Insect Type, By Application, By Control Method (Chemical, Physical, Biological, Others), By Form, By Region – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 114

- Format: PDF

- Report ID: PM2192

- Base Year: 2024

- Historical Data: 2020 - 2023

Overview

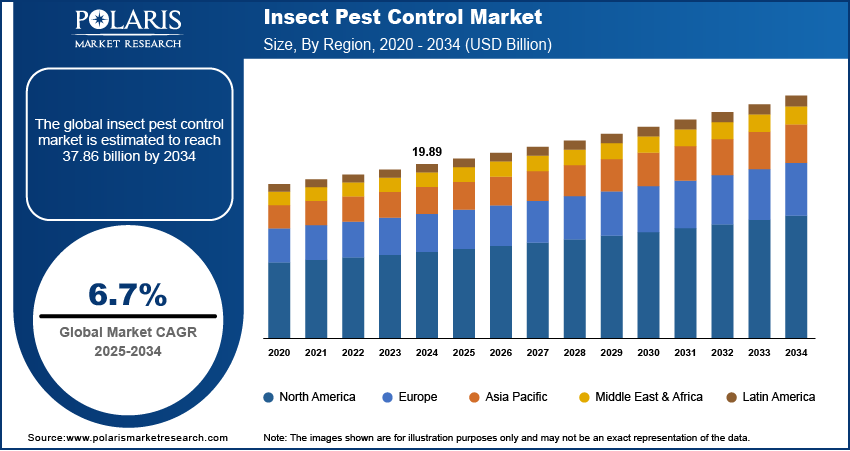

The global insect pest control market was valued at USD 19.89 billion in 2024 and is expected to grow at a CAGR of 6.7% during the forecast period. The prime factors for the industry development are increasing economic activities along with the growing number of residential and commercial spaces.

Key Insights

- The bed bugs insect segment dominated in 2024 driven by the rising number of bed bugs causing allergic problems, blood loss, and infections.

- The Commercial & industrial segment is expected to register significant growth due to government rules and regulations related to sanitization.

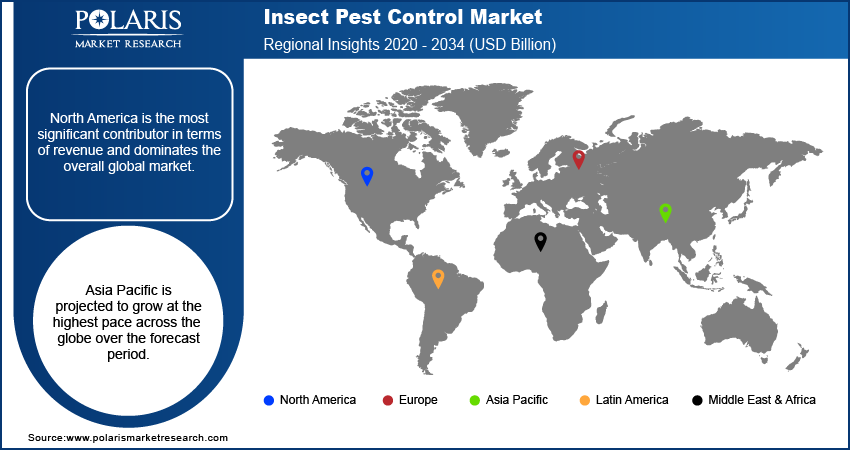

- North America dominates the overall global market due to the increasing number of residential and commercial spaces.

- Asia Pacific is projected to grow at the highest pace across the globe over the forecast period driven by significant threats of mosquitoes and termites.

Industry Dynamics

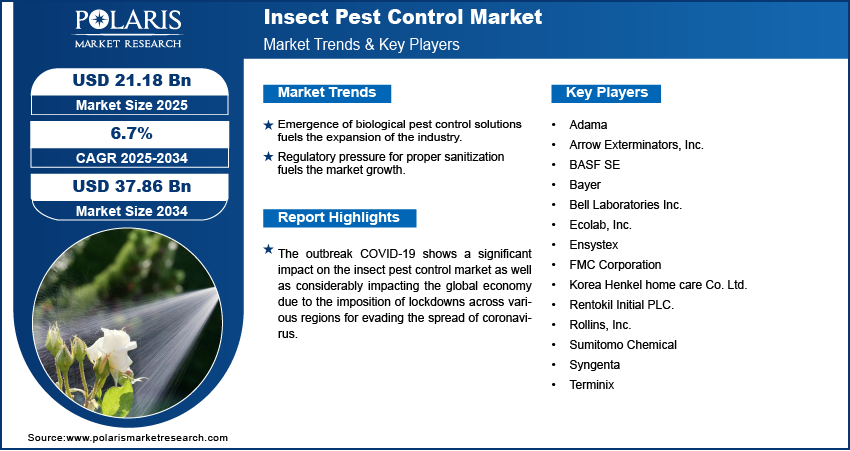

- Emergence of biological pest control solutions fuels the expansion of the industry.

- Regulatory pressure for proper sanitization fuels the market growth.

- The continuous advancements in both ingredient and product levels create various opportunities for insect pest control market growth.

- Stringent environmental regulations and growing concerns over pesticide resistance are limiting the growth.

Market Statistics

- 2024 Market Size: USD 19.89 Billion

- 2034 Projected Market Size: USD 37.86 Billion

- CAGR (2025-2034): 6.7%

- Largest Market: North America

To Understand More About this Research: Request a Free Sample Report

Additionally, frequent climate changes globally support the demand for pest regulator services. As per the World Health Organization (WHO), the recent warmer temperature can raise the fly insect’s populations by 244% by 2080, which may cause the concomitant increases in fly-borne diseases over the forecast period.

The outbreak COVID-19 shows a significant impact on the insect pest control market as well as considerably impacting the global economy due to the imposition of lockdowns across various regions for evading the spread of coronavirus. However, the government offers several subsidies to critical industry players, which supports the industry growth.

Moreover, companies that offer regulator services like purification and disinfection exhibit a rise in the business because of the growing inclination to disinfect houses. Also, there is a rise in dengue fever in South East Asia, along with the outbreak of the COVID-19 pandemic, which has increased people's awareness and is likely to increase the pest regulator services to control the mosquito's growth which in turn is boosting the insect pest control market demand.

Know more about this report: request for sample pages

Industry Dynamics

Growth Drivers

The emergence of biological control solutions is propelling the industry demand. The continuous advancements in both ingredient and product levels create various opportunities for insect pest control market growth. For instance, the adoption of biological insecticides shows no or minor side effects on human health is, which is gaining huge traction among the population. In addition, it is projected that the utilization of chemicals for insect regulators will considerably decline by the consumers in the impending period as it is hazardous for both human health and the environment.

In addition, regulatory restructuring guidelines and resistance improvement among pest organisms are also boosting the industry demand. The forbid usage of neonicotinoid pesticides across Europe is the major example of biological regulator methods being highly adopted compared to chemicals pesticides.

Furthermore, the growing proliferation of machine learning-based technologies in pest regulators is also attributed to industry development. This will boost the effectiveness and competence of control by incorporating a wide range of tools like biological agents (microbial and predators), chemical pesticides, synthetic pheromones, and light traps.

The penetration of diverse, innovative technologies, like AI, has increased because of the low service cost, and it can easily be accessible in remote areas. Therefore, the rising inclination towards biological control solutions and technological advancements in control methods catalyzes global insect pest control industry development in the forecast period.

Which Trends are Expected to Boost the Insect Pest Control Market During the Forecast Period?

The global insect pest control industry is undergoing a transformation driven by technological innovation and regulatory changes. There is a rising shift from traditional chemical-based pest control methods toward sustainable, efficient, and data-driven solutions. Rising demand for eco-friendly and residue-free products and the integration of smart monitoring and predictive technologies are boosting industry growth. Regulatory pressure to manage resistance and the growing focus on sustainability and ESG compliance also drive the industry. The following table presents information on future trends expected to fuel the insect pest control market during the forecast period.

|

Trend |

Description/Emerging Focus |

Drivers |

Business Implications |

|

Adoption of Biopesticides & Biological Controls |

Rising shift toward eco-friendly, microbial, and plant-based biocontrol agents from synthetic chemicals. |

Increasing focus on regulatory compliance, growing adoption of organic farming, and consumer preference for residue-free food |

Surging investments in R&D, emphasis on partnerships with biocontrol startups, and new product registration strategies. |

|

Integration of AI, IoT, and Smart Monitoring Systems |

The use of AI-based traps, drones, and sensors for real-time pest detection and predictive analytics. |

Smart farming, automation, and labor efficiency. |

Enables subscription-based monitoring and data-driven pest management services. |

|

Integrated Pest Management (IPM) Expansion |

Combines biological, cultural, and chemical methods for sustainable pest control. |

Farm audits, sustainability mandates, and government IPM incentives. |

Pest control firms are required to offer IPM consulting, proof-of-efficacy documentation, and training. |

|

Sustainability & ESG Integration |

Inclusion of pest control KPIs in ESG and sustainability reporting. |

Corporate ESG goals, requirement for green certification systems. |

Companies are required to measure pesticide reduction, brand themselves as sustainable, and report eco-impacts. |

|

Subscription-Based Service Models |

Rising shift from one-time treatments to continuous monitoring and predictive services. |

Rising adoption of IoT adoption, digital platforms, and customer retention strategies. |

Creates recurring revenue streams and higher customer lifetime value. |

|

Industry Consolidation and Tech Partnerships and Collaborations |

Increasing mergers and acquisitions (M&A) between chemical, agtech, and biotech players. |

High R&D costs and tech-driven disruption. |

Larger enterprises acquire startups; small operators specialize or form partnerships and collaborations. |

|

Climate Change and Pest Range Expansion |

Warmer climates expand pest habitats and extend infestation seasons. |

Global warming and changing crop zones. |

Increases market demand in temperate regions; rising requirement for adaptive pest management planning. |

|

Regulatory Realignment for Green Chemistries |

Rapid approvals for low-risk biopesticides; stricter bans on hazardous chemicals. |

Global trade standards and health & safety legislation. |

Encourages rapid adoption of green products and regional portfolio optimization. |

Report Segmentation

The market is primarily segmented on the basis of insect type, application, control method, form, and region.

|

By Insect Type |

By Application |

By Control Method |

By Form |

By Region |

|

|

|

|

|

Know more about this report: request for sample pages

Insight by Type

The bed bugs insect segment is the leading segment in terms of revenue generation in 2024 and is projected to dominate the market over the forecast period. The rising number of bed bugs is causing some allergic problems, blood loss, or some infections among the population that may require some medical treatment which in turn is boosting the market demand. As per the research done by the National Pest Management Association (NPMA), across the U.S., 97% of the professionals have treated bed bugs, 84% of them noted being contacted to treat different types of problems only to discover bed bugs present instead. Also, 69% of professionals stated that the whole bed bug service was helpful, and 66% said that the demand for these services is rising.

Besides, 89% of professionals encounter bed bugs in apartments/condominiums, 45% in college dorms, 46% in office buildings, 68% in hotels/motels, 36% in hospitals, and 59% in nursing homes. Thus, these factors may lead the segment dominance globally, which stimulates the market demand. The termite segment is estimated to show the highest growth rate in the forecasting years. The termites can eat wood or wooden furniture and can agitate mold and mildew, which can cause spores to be released into the air.

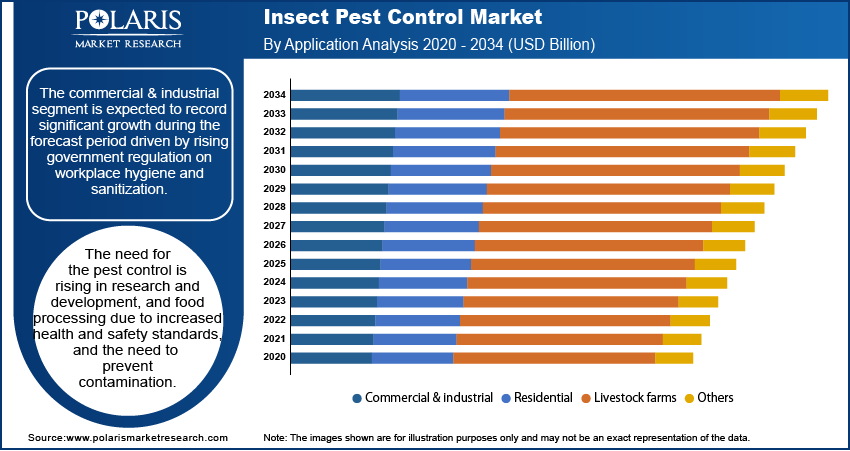

Insight by Application

The commercial & industrial segment is expected to record significant growth during the forecast period driven by rising government regulation on workplace hygiene and sanitization. The need for the pest control is rising in research and development, and food processing due to increased health and safety standards, and the need to prevent contamination. Moreover, companies are investing in pest control solutions to avoid product contamination, brand damage, and operational disruption. The rising number of industries and economic zones worldwide is further driving the demand for the pest control in commercial and industrial sector, thereby fueling the segment growth.

Geographic Overview

Geographically, North America is the most significant contributor in terms of revenue and dominates the overall global market. The increasing number of residential and commercial spaces, as well as gradual economic development, have led to market demand. The number of the residential projects is rising in the region, this is due to rising urbanization and rising disposable income. This has fuel the demand for the the pest control solutions. Moreover, growing number of food processing and pharmaceutical industries in the region is further fueling the demand for these solutions in the industrial sector, thereby boosting the growth in the region.

Asia Pacific is projected to grow at the highest pace across the globe over the forecast period. The significant threats across the region are mosquitoes and termites; moreover, other pests such as flying insects, cockroaches, ants, and rodents are majorly present across the region. Furthermore, the presence of a large food-associated market across the region contributes to market growth as several stringent regulatory policies are the frame for consumer health safety. Furthermore, several factors growing, such as emerging economies, increasing disposable income, and increasing responsiveness of pest regulator services, are fueling the market growth across the region.

Competitive Insight

Some of the major players operating in the global market include Adama, Arrow Exterminators, Inc., BASF SE, Bayer, Bell Laboratories Inc., Ecolab, Inc., Ensystex, FMC Corporation, Korea Henkel home care Co. Ltd., Rentokil Initial PLC., Rollins, Inc., Sumitomo Chemical, Syngenta, and Terminix.

Insect Pest Control Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 19.89 billion |

| Market size value in 2025 | USD 21.18 billion |

|

Revenue forecast in 2034 |

USD 37.86 billion |

|

CAGR |

6.7% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Insect Type, By Application, By Control Method, By Form, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key Companies |

Adama, Arrow Exterminators, Inc., BASF SE, Bayer, Bell Laboratories Inc., Ecolab, Inc., Ensystex, FMC Corporation, Korea Henkel home care Co. Ltd., Rentokil Initial PLC., Rollins, Inc., Sumitomo Chemical, Syngenta, and Terminix. |

FAQ's

• The market size was valued at USD 19.89 billion in 2024 and is projected to grow to USD 37.86 billion by 2034.

• The market is projected to register a CAGR of 6.7% during the forecast period.

• A few of the key players in the market are Adama, Arrow Exterminators, Inc., BASF SE, Bayer, Bell Laboratories Inc., Ecolab, Inc., Ensystex, FMC Corporation, Korea Henkel home care Co. Ltd., Rentokil Initial PLC., Rollins, Inc., Sumitomo Chemical, Syngenta, and Terminix.

• The bedbugs segment dominated the market revenue share in 2024.

• The commercia and industrial segment is projected to witness the fastest growth during the forecast period.