Insecticides Market Size, Share, Trends, Industry Analysis Report

: By Application (Agriculture, Industrial, Household, Commercial, and Others), Product, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:May-2025

- Pages: 118

- Format: PDF

- Report ID: PM3265

- Base Year: 2024

- Historical Data: 2020-2023

Insecticides Market Overview

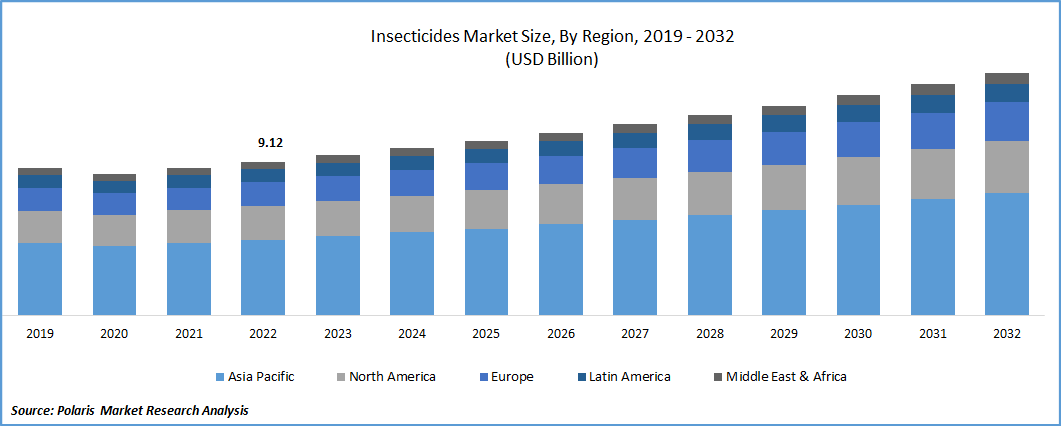

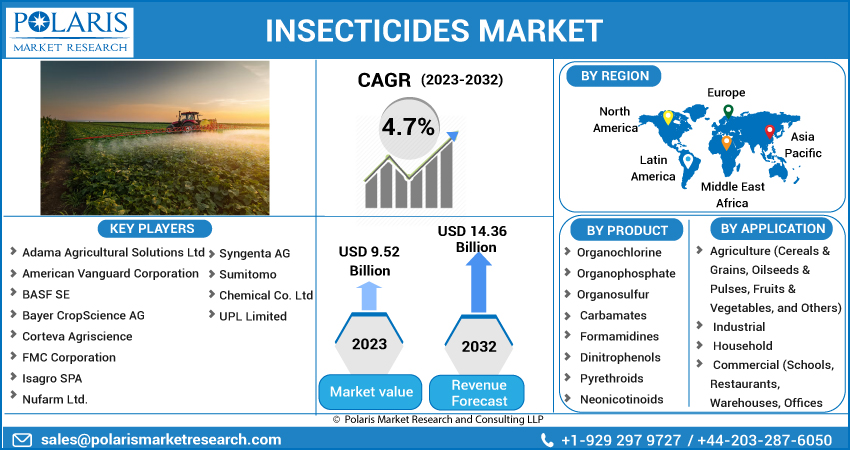

The insecticides market size was valued at USD 9.91 billion in 2024. The market is projected to grow from USD 10.34 billion in 2025 to USD 15.50 billion by 2034, exhibiting a CAGR of 4.6% during 2025–2034.

The insecticides market encompasses the production, distribution, and sale of chemical and biological agents designed to control or eliminate insect pests that negatively impact agricultural yields, public health, and industrial processes. This market is significantly influenced by the imperative to safeguard global food security. Rising populations and the subsequent increase in food demand necessitate effective pest management strategies to reduce crop losses. Furthermore, evolving agricultural practices, including the adoption of intensive farming methods, contribute to the proliferation of insect infestations, thereby amplifying the market demand. The growing awareness of vector-borne diseases, such as malaria and dengue, also fuels the need for insecticides in public health initiatives, impacting the market growth.

To Understand More About this Research: Request a Free Sample Report

The increasing incidence of invasive insect species, driven by climate change and global trade, creates a sustained need for effective pest control solutions. Concurrently, advancements in insecticide formulations, including the development of targeted and environmentally sustainable products, along with pesticides residue testing approaches, are expanding the market potential. Regulatory frameworks concerning pesticide use and safety are also impacting market trends, pushing manufacturers to invest in research and development to comply with evolving standards. The analysis of these elements provides valuable market insights into the current market outlook and future market forecast.

Insecticides Market Dynamics

Increasing Global Food Demand and Agricultural Intensification

The burgeoning global population necessitates a substantial increase in agricultural output, driving the demand for effective insect pest control solutions. Intensive farming practices, characterized by monoculture and high-density planting, create favorable conditions for pest proliferation, necessitating the use of insecticides to protect yields. The Food and Agriculture Organization of the United Nations (FAO) emphasizes the critical role of pest management in securing food supplies. The global population is projected to reach nearly 10 billion by 2050, requiring an estimated 70% increase in food production to meet the growing demand.

A 2022 report from the FAO indicates the ongoing fight against desert locusts in East Africa, highlighting the necessity of insecticide interventions to prevent widespread crop devastation. Furthermore, a 2023 study published in the National Library of Medicine (NCBI) discussed how the increasing use of pesticides directly correlates with the demand to increase crop yield to sustain the growing population. These instances clearly indicate that the drive to meet escalating food demands and the prevalence of intensified agricultural practices are significant factors propelling the insecticides market growth.

Rise in Vector-Borne Diseases and Public Health Concerns

The escalating prevalence of vector-borne diseases, such as malaria, dengue fever, and Zika virus, has amplified the need for effective vector control measures, primarily through the use of insecticides. Government health agencies and research institutions are actively involved in developing and implementing insecticide-based strategies to mitigate the spread of these diseases. As per WHO, Vector-borne diseases (VBDs), transmitted by insects such as mosquitoes, ticks, and flies, account for over 17% of all infectious diseases globally, causing more than 700,000 deaths annually.

The World Health Organization (WHO) has released multiple updates regarding the use of insecticides in vector control. A 2021 report from the WHO highlighted the use of insecticide-treated nets (ITNs) in malaria prevention programs, showcasing the continued reliance on insecticides for public health interventions. Also, a research article from the National Institute of Health (NIH) published in 2022 discusses the significance of insecticides in curbing the spread of the West Nile Virus, a vector-borne disease that has seen increased prevalence. Consequently, the growing concern for public health and the imperative to control vector-borne diseases are significant drivers of the insecticides market expansion.

Climate Change and Invasive Pest Species Proliferation

Climate change is altering ecosystems, creating favorable conditions for the spread of invasive pest species and the emergence of new pest threats. Warmer temperatures and altered rainfall patterns can expand the geographical range of pests and increase their reproductive rates, thereby escalating the demand for insecticides. Scientific studies and government reports document the increasing impact of climate change on pest dynamics. A 2023 research article published in the journal "Environmental Health Perspectives" from the National Institute of Environmental Health Sciences (NIEHS) discussed the impact of climate change on the spread of invasive insect species, highlighting the increased need for pest control measures. Also, a 2021 report from the United States Environmental Protection Agency (EPA) detailed the increased need for pesticides due to changing weather patterns and the increasing invasive species. Therefore, the escalating influence of climate change on pest proliferation is a significant driver of the insecticides market expansion.

Insecticides Market Segment Insights

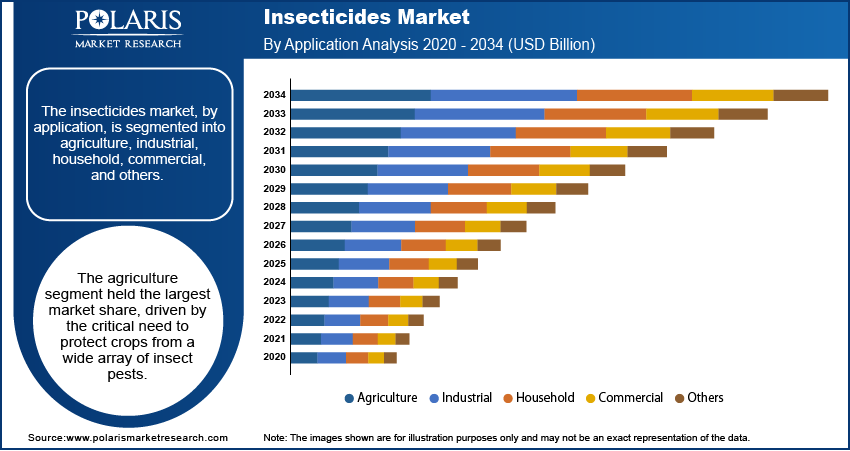

Market Assessment – By Application

The market, based on application, is segmented into agriculture, industrial, household, commercial, and others. The agriculture segment demonstrates the largest insecticides market share, driven by the critical need to protect crops from a wide array of insect pests. This sector's dominance is underpinned by the essential role of insecticides in ensuring food security and maximizing agricultural yields. The widespread adoption of intensive farming practices and the continuous pressure to meet increasing global food demands contribute significantly to this segment's substantial market footprint.

The household segment exhibits the highest growth rate, reflecting the rising awareness of urban pest infestations and the increasing demand for effective home pest control solutions. This growth is propelled by factors such as urbanization, changing lifestyles, and the growing concern for hygiene and health within residential environments. The accessibility of consumer-friendly insecticide products and the expansion of retail channels further contribute to the rapid market expansion for this segment.

Market Evaluation – By Product

The market, by product, is segmented into organochlorine, organophosphate, organosulfur, carbamates, formamidines, dinitrophenols, pyrethroids, neonicotinoids, and others. The pyrethroids segment holds the largest market share, owing to their broad-spectrum activity and relatively low mammalian toxicity. Their efficacy against a wide range of agricultural and household pests, coupled with their versatility in various formulations, has solidified their position as a dominant product type within the market. This segment's established presence is further supported by continuous advancements in pyrethroid technology.

The neonicotinoids product segment is experiencing the fastest growth rate, driven by their effectiveness against sap-feeding insects and their systemic action within plants. The increasing adoption of precision agriculture and the demand for targeted pest control solutions contribute significantly to the rapid expansion of neonicotinoids. The segment's growth is also influenced by ongoing research and development efforts aimed at enhancing their application and mitigating potential environmental impacts, addressing the growing concerns around sustainability.

Insecticides Market – Regional Analysis

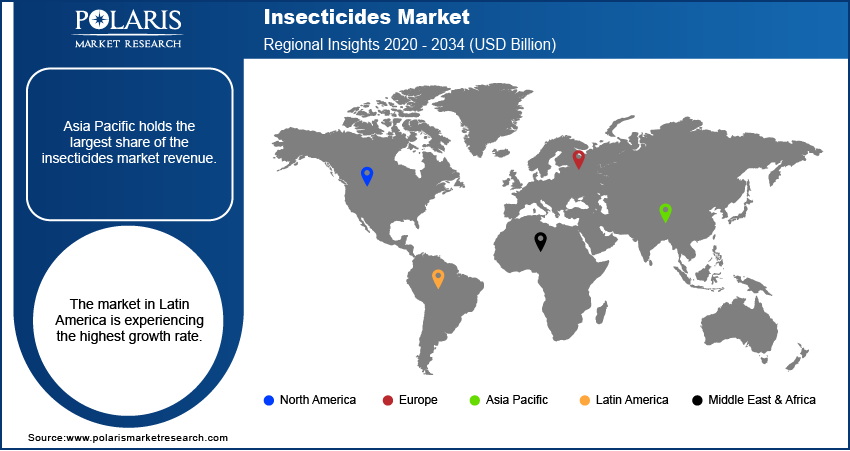

The insecticides market exhibits diverse regional dynamics, influenced by varying agricultural practices, regulatory landscapes, and economic development. North America and Europe demonstrate mature markets, characterized by stringent regulations and a focus on advanced, sustainable insecticide solutions. Meanwhile, Asia Pacific, driven by its vast agricultural sector and rapidly expanding economies, represents a significant growth hub. Latin America and the Middle East & Africa are witnessing increasing insecticide demand, propelled by expanding agricultural activities and growing public health concerns. The regional disparities highlight the need for tailored market strategies to address specific local requirements and challenges.

Asia Pacific holds the largest share of the global insecticides market revenue. This dominance is primarily attributed to the region's extensive agricultural sector and Asia Pacific crop protection chemicals demands, which play a crucial role in global food production. The high demand for insecticides in countries such as China and India, driven by their large populations and intensive farming practices, significantly contributes to the region's market leadership. Furthermore, the increasing adoption of modern agricultural techniques and the rising awareness of crop protection among farmers are further propelling the market in this region. The sheer scale of agricultural activity, coupled with a growing emphasis on maximizing crop yields, solidifies Asia Pacific's position as the leading market.

The market in Latin America is experiencing the highest growth rate. This rapid expansion is primarily driven by the region's burgeoning agricultural industry, which is characterized by the cultivation of high-value crops and the increasing adoption of advanced farming technologies. The favorable climatic conditions for agriculture and the rising demand for export-oriented crops are further fueling the demand for effective pest control solutions. The expansion of agricultural land and the increasing investments in modern farming practices are creating significant opportunities for insecticide manufacturers in this region. This confluence of factors is positioning Latin America as a key growth market within the global insecticide landscape.

Insecticides Market – Key Players and Competitive Insights

The insecticides market is populated by a diverse array of companies, including Bayer AG; Syngenta (ChemChina); BASF SE; FMC Corporation; Sumitomo Chemical Co., Ltd.; Corteva Agriscience; Nufarm Limited; ADAMA Ltd. (ChemChina); United Phosphorus Limited (UPL); Valent BioSciences LLC (Sumitomo Chemical); and Nippon Soda Co., Ltd. These entities are actively involved in the development, manufacturing, and distribution of a wide range of insecticide products, catering to various applications across agriculture, household, and industrial sectors.

Competitive analysis of the insecticides market reveals a landscape characterized by both established multinational corporations and specialized regional players. The market is driven by continuous innovation, with companies investing heavily in research and development to introduce new and more effective insecticide formulations. Key competitive factors include product efficacy, regulatory compliance, distribution networks, and customer relationships. The market sees a mix of product differentiation and price competition, with companies striving to offer tailored solutions for specific pest challenges and regional requirements. Market penetration and expansion strategies often involve strategic partnerships, acquisitions, and the development of sustainable product lines.

Bayer AG, headquartered in Leverkusen, Germany, offers a broad portfolio of crop protection chemicals and products, including a variety of insecticides designed for use in agriculture and public health. Their offerings encompass agrochemical and biological solutions, addressing a wide range of pest infestations. Bayer's commitment to research and development has resulted in the introduction of innovative insecticide formulations, contributing to its significant presence in the global market.

Corteva Agriscience, based in Indianapolis, Indiana, US, provides a comprehensive range of agricultural solutions, including insecticides, seeds, and crop protection technologies. Their insecticide product line caters to diverse agricultural needs, offering solutions for various crops and pest types. Corteva's focus on sustainable agriculture and integrated pest management strategies has positioned it as a significant player in the insecticides market.

List of Key Companies in Insecticides Market

- ADAMA Ltd. (ChemChina)

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nippon Soda Co., Ltd.

- Nufarm Limited

- Sumitomo Chemical Co., Ltd.

- Syngenta (ChemChina)

- United Phosphorus Limited (UPL)

- Valent BioSciences LLC (Sumitomo Chemical)

Insecticides Industry Developments

- November 2024: The Board of insecticides India approved an investment in Kaeros Research by acquiring 100% of its issued and paid-up equity share capital from existing shareholders.

- September 2024: Solasta Bio, an agri-biotech firm specializing in eco-friendly insecticides, secured $14 million in a Series A funding round to advance the development of its groundbreaking peptide-based, nature-inspired bioinsecticides—the first of their kind globally.

Insecticides Market Segmentation

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Agriculture

- Industrial

- Household

- Commercial

- Others

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Organochlorine

- Organophosphate

- Organosulfur

- Carbamates

- Formamidines

- Dinitrophenols

- Pyrethroids

- Neonicotinoids

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- Suth Korea

- Indnesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- Suth Africa

- Rest of Middle East & Africa

- Latin America

- Mexic

- Brazil

- Argentina

- Rest of Latin America

Insecticides Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.91 billion |

|

Market Size Value in 2025 |

USD 10.34 billion |

|

Revenue Forecast by 2034 |

USD 15.50 billion |

|

CAGR |

4.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The insecticides market has been broadly segmented on the basis of application and product. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

The insecticides market growth and marketing strategies are increasingly focused on sustainable solutions and integrated pest management (IPM). Companies are investing in research and development to create products with a lower environmental impact and higher efficacy. Digital marketing and precision agriculture tools are being used to reach farmers with tailored solutions. Strategic partnerships and collaborations are expanding distribution networks and enhancing market penetration. Public awareness campaigns addressing vector-borne diseases are also driving demand in the household and public health sectors. Overall, a balance of innovation, sustainability, and targeted marketing is key to market expansion.

FAQ's

The market size was valued at USD 9.91 billion in 2024 and is projected to grow to USD 15.50 billion by 2034.

The market is projected to register a CAGR of 4.6% during the forecast period.

Asia Pacific had the largest share of the market in 2024.

A few key players in the market include Bayer AG; Syngenta (ChemChina); BASF SE; FMC Corporation; Sumitomo Chemical Co., Ltd.; Corteva Agriscience; Nufarm Limited; ADAMA Ltd. (ChemChina); United Phosphorus Limited (UPL); Valent BioSciences LLC (Sumitomo Chemical); and Nippon Soda Co., Ltd.

The agriculture segment accounted for the largest share of the market in 2024.

Following are a few of the market trends: ? Increased Focus on Biopesticides: Growing environmental concerns and regulatory pressures are driving the adoption of biological insecticides as alternatives to synthetic chemicals. ? Precision Agriculture Integration: The use of data-driven technologies for targeted insecticide application is gaining traction, optimizing resource use and minimizing environmental impact. ? Development of Sustainable Formulations: Manufacturers are investing in developing eco-friendly formulations with reduced toxicity and enhanced biodegradability.

Insecticides are substances designed to destroy or prevent the growth of insects. These chemical or biological agents are crucial in various sectors, including agriculture, public health, and household pest control. They work through diverse mechanisms, targeting an insect's nervous system, growth, or other vital functions. While essential for protecting crops and controlling disease-carrying insects, the use of insecticides is also subject to increasing scrutiny due to potential environmental and health impacts.