Pesticides Residue Testing Market Share, Size, Trends, Industry Analysis Report

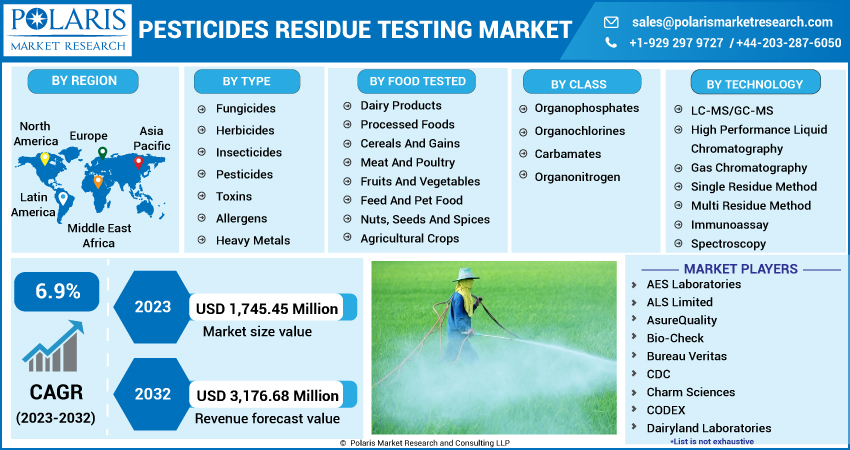

By Type (Fungicides, Herbicides, Insecticides, Pesticides, Toxins, Allergens, Heavy Metals and Others); By Food Tested; By Class; Technology; By Region; Segment Forecast, 2023 - 2032

- Published Date:Jun-2023

- Pages: 115

- Format: PDF

- Report ID: PM3443

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

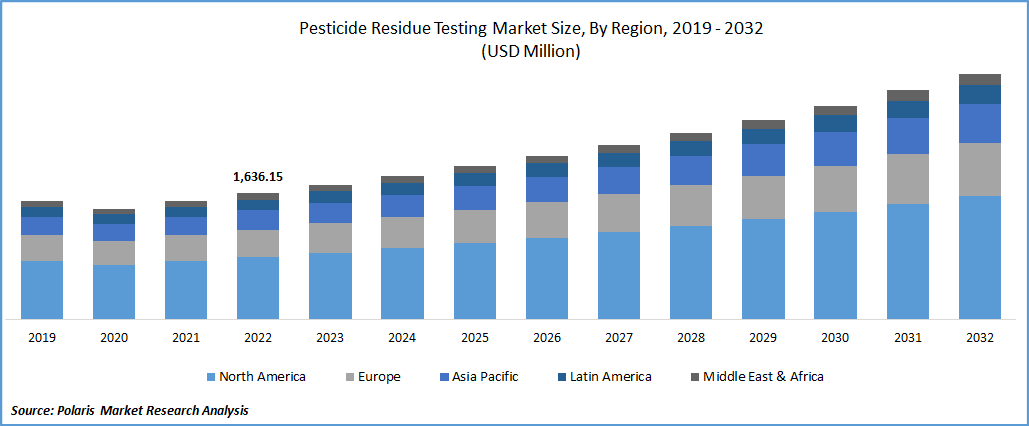

The global pesticides residue testing market was valued at USD 1,636.15 million in 2022 and is expected to grow at a CAGR of 6.9% during the forecast period. The global pesticide residue testing market is projected to grow due to the increasing demand for food safety worldwide. Pesticide residue refers to the pesticides that remain on and in food after being sprayed on crops. Regulatory bodies specify the maximum allowable levels of these residues in nutrition, and consumers are at times exposed to these residues through food consumption or being in close contact with areas treated with pesticides. The bioaccumulation of chemical residues in the body and environment, especially derivatives of chlorinated pesticides, can build up to harmful levels.

To Understand More About this Research: Request a Free Sample Report

Moreover, the increasing population and consumption of fresh produce have led to a greater emphasis on food safety and pesticide residue testing. Persistent chemicals can accumulate throughout the food chain, making it necessary to monitor various products. Governments worldwide have implemented strict regulations on pesticide residue levels to protect consumers. The excessive use of pesticides can result in harmful chemicals entering the food chain, further highlighting the need for testing. The growing demand for food safety and regulatory monitoring drives market growth.

The COVID-19 pandemic has resulted in a significant shift in consumer demand from food away from home to food consumed at home, leading to notable changes in the food supply chains. It has adversely affected the food processing industry due to social distancing rules, labor shortages, and lockdown measures, reducing demand for pesticide residue testing. It has also increased awareness about food safety and hygiene, increasing demand for testing services. Stricter regulations imposed by governments and regulatory bodies to ensure food safety have also boosted the market's growth.

For Specific Research Requirements, Request for a Customized Report

Industry Dynamics

Growth Drivers

Several factors are driving the growth of the pesticides residue testing market. Firstly, there has been an increase in chemical contamination in the food processing sector, which has led to stringent safety requirements. Secondly, rising consumer allergies, increased disposable income, worldwide commerce in food products, and a global organic revolution have contributed to the market’s growth. However, a lack of knowledge of food safety rules, infrastructure, and resources for food control impedes the industry’s expansion. Regulatory bodies such as the European Food Safety Authority (EFSA) are crucial in evaluating consumer safety based on pesticide toxicity.

In addition, expanding food commerce between emerging economies’ borders increases the market’s potential for expansion. The demand for testing services is expected to rise in emerging economies as authorities implement rules to restrict the import and supply of tainted food and enforce food recalls. Advancements in testing technologies and international trade of food materials also contribute to the market’s growth.

Report Segmentation

The market is primarily segmented based on type, food tested, class, technology and region.

|

By Type |

By Food Tested |

By Class |

By Technology |

By Region |

|

|

|

|

|

For Specific Research Requirements: Request for Customized Report

Herbicides segment accounted for the largest market share in 2022

The herbicides segment accounted for the largest market share in 2022. The market's growth can be mainly attributed to the rising demand for the increased use of herbicides in agriculture and concerns about pesticide residue contamination in food products. The development of advanced testing technologies and methods, strict food safety regulations, and the growing adoption of herbicides in agriculture are also contributing to the growth of the global market.

Furthermore, the insecticides segment is expected to witness the fastest growth during the anticipated period due to the rising need for food safety and quality control. Consequently, regulatory authorities have established strict limits on insecticide residues, increasing demand for pesticide residue testing services. Furthermore, consumers’ growing awareness of the potential health risks associated with consuming foods containing pesticide residues has also increased the demand for residue testing services. Therefore, testing companies are expected to invest in developing more effective and precise testing methods for insecticide residues to meet the escalating demand.

Fruits & vegetables segment held the largest market share in 2022

The fruits & vegetables segment held a significant market share due to their direct contact with soil, water, and air. They are highly susceptible to pesticide contamination, leading to severe health risks such as cancer, reproductive and developmental problems, and neurological effects. Farmers and food manufacturers are increasingly adopting organic farming practices, seeking certification for their products, and conducting regular pesticide residue testing to meet the rising demand for safe and organic fruits and vegetables. Thus, the fruits and vegetables sub-segment will likely witness significant future growth.

The growing awareness of the potential health risks associated with pesticide residue consumption and the increasing regulatory requirements by bodies such as the US FDA, EU, and WHO, which have set maximum residue limits (MRLs) for pesticides in fruits and vegetables, are also expected to drive the demand for pesticide residue testing in this segment.

Moreover, the cereal and grains segment is projected to register the highest growth during the forecast period due to the increasing demand for cereals and grains as a staple food among the growing population and the need to ensure the safety of these commodities from pesticide residues. Additionally, implementing stringent regulations and guidelines by various regulatory bodies is expected to further the demand for pesticide residue testing in the cereal and grains sub-segment.

Organochlorine segment dominated the global market in 2022

The organochlorine segment dominated the global market in 2022 due to the ban on organochlorine pesticides in many countries because of their persistent environmental effects and harmful impacts on human health and wildlife. As the market evolves, new technologies and methods will continue to be developed to enhance the precision and efficiency of pesticide residue testing across different classes of pesticides, including organochlorines, organophosphates, carbamates, and pyrethroids, each with unique properties and features suitable for specific applications.

The carbamates segment is anticipated to witness the fastest growth as they are a commonly used pesticide in agriculture for controlling pests. These pesticides function by inhibiting an enzyme necessary for pests’ nervous system function, leading to paralysis and eventual death. Carbamates were widely used due to their effectiveness and low toxicity compared to other pesticides. However, concerns about potential health and environmental effects have resulted in regulations being implemented to limit their use in many countries. Due to increased consumer awareness of the risks associated with exposure to pesticide residues in food, demand for testing for these residues in food products may increase, leading to growth in the carbamates sub-segment of the global market.

North America dominated the market in 2022

The North American region dominated the global market in 2022, accounting for a significant market share. The region's dominance mainly attributed to the high demand for food safety testing, strict regulations on pesticide residues in food, and the presence of major players in the market. Additionally, the increasing awareness among consumers about the harmful effects of pesticide residues on human health and the environment has led to a surge in demand for pesticide residue testing services in the region.

Furthermore, Asia Pacific is expected to grow fastest at a significant CAGR throughout the forecast period. The high volume of pesticides used in the region compared to other countries are the key factor driving the market's growth. This has raised concerns about the exposure of people who apply pesticides and the general population to the harmful effects of these chemicals. As a result, there is an increasing demand for pesticide residue testing services in this region, which is expected to drive market growth in the long term.

Competitive Insight

Some of the major players operating in the global market include AES Laboratories, ALS Limited, AsureQuality, Bio-Check, Bureau Veritas, Dairyland Laboratories, EMSL Analytical, Envirologix, EUROLAB, Eurofins, IEH Laboratories, Krishgen Biosystems, Mérieux NutriSciences, Microbac Laboratories, SCS Global Services, SGS, Silliker, Symbio Laboratories

Recent Developments

- In October 2022, Thermo Fisher introduced LC-MS/MS system for analyzing pesticide residues in food and environmental samples. The system offers improved sensitivity and selectivity for detecting trace levels of pesticides.

Pesticides Residue Testing Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1,745.45 million |

|

Revenue forecast in 2032 |

USD 3,176.68 million |

|

CAGR |

6.9% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2023 to 2032 |

|

Segments covered |

By Type, By Food Tested, By Class, By Technology, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AES Laboratories, ALS Limited, AsureQuality, Bio-Check, Bureau Veritas, CDC, Charm Sciences, CODEX, Dairyland Laboratories, EMSL Analytical, Inc., Envirologix Inc., EUROLAB, Eurofins, FAO, Intertek, IEH Laboratories and Consulting Group, Krishgen Biosystems, Mérieux NutriSciences, Microbac Laboratories, Neogen, Premier Analytical Services, SCS Global Services, SGS, Silliker, Symbio Laboratories |

FAQ's

The pesticides residue testing market report covering key segments are type, food tested, class, technology and region.

Pesticides Residue Testing Market Size Worth $3,176.68 Million By 2032.

The global pesticides residue testing market is expected to grow at a CAGR of 6.9% during the forecast period.

North America is leading the global market.

key driving factors in pesticides residue testing market are Rising risk of pesticide residue contamination.