Personal Care Ingredients Market Share, Size, Trends, Industry Analysis Report

By Source (Natural Ingredients, Synthetic Ingredients); By Type; By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 115

- Format: PDF

- Report ID: PM2515

- Base Year: 2024

- Historical Data: 2020-2023

What is the personal care ingredients market size?

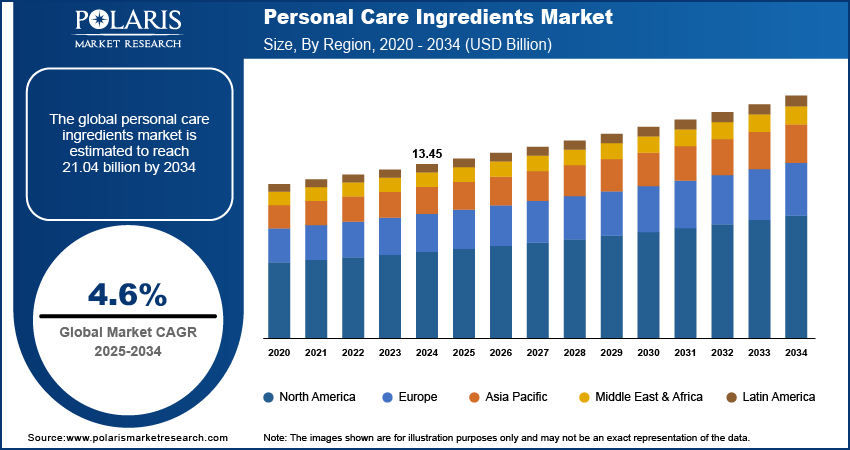

The global personal care ingredients market was valued at USD 13.45 billion in 2024 and is expected to grow at a CAGR of 4.6% during the forecast period. Personal care ingredients, such as emulsifiers, surfactants, emollients, UV absorbers, and antimicrobials, are used to develop beauty products.

Key Insights

- By source, the synthetic ingredients subsegment held the largest share in 2024 due to its cost-effectiveness and high functional efficiency.

- By type, Emollients held the largest share in 2024 driven by their crucial and widespread use in skin care products like moisturizers, creams, and lotions, where they enhance hydration, barrier function, and deliver a smooth, desirable texture.

- By application, the skin care application segment held the largest share in 2024 due to the increasing consumer awareness regarding skin health, protection from sun and pollution.

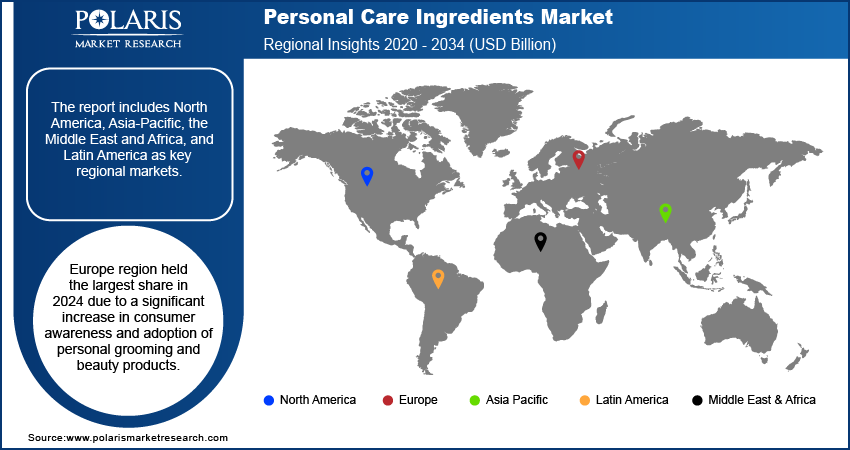

- By region, the Europe region held the largest share in 2024 due to a significant increase in consumer awareness and adoption of personal grooming and beauty products.

Industry Dynamics

- The industry's expansion is fundamentally driven by a significant surge in consumer awareness about personal hygiene and skin health.

- A major trend involves the increasing consumer preference for natural, organic, and plant-derived components over synthetic ones, pushing manufacturers toward clean label formulations.

- The rapid pace of new product development and the adoption of multifunctional ingredients are also key drivers, particularly in emerging economies with rising disposable incomes.

Market Statistics

- 2024 Market Size: USD 13.45 billion

- 2034 Projected Market Size: USD 21.04 billion

- CAGR (2025-2034): 4.6%

- Europe: Largest market in 2024

Impact of AI on Market

- AI tools can analyze large amounts of individual data, such as skin type, concerns, lifestyle, and environmental factors.

- AI is speeding up the process of creating new products. Algorithms can screen billions of potential ingredients and predict their efficacy, stability, and safety much faster than traditional lab methods.

- AI powers several customer-facing tools that improve the shopping experience.

To Understand More About this Research: Request a Free Sample Report

These ingredients are used in formulating a wide range of products for skincare, hair care, and cosmetics. These ingredients offer properties such as anti-aging, moisturizing, cleansing, complexion-enhancing, and pollution defense, among others. Natural and organic ingredients are gradually replacing synthetic personal hygiene constituents.

Market players are increasingly developing products with natural constituents to offer benefits such as skin repair, prevention of cell damage, enhanced skin immunity, hydration, and anti-aging effects. Lifestyle changes of consumers, growing awareness regarding skincare, and increasing inclination towards the use of personal hygiene natural constituents support the market growth.

Complex emulsions are used in cosmetics and beauty products for sustained skin moisturization, protection of sensitive biologicals, and prolonged release of aerosol fragrances. Consumers are increasingly turning towards natural products, increasing the demand for green, sustainable, and biodegradable emulsifiers. There has been a decline in the use of ethoxylated/propoxylated emulsifiers, whereas demand for green-based non-ethoxylated emulsifiers such as polyglyceryl esters and alkyl glucosides is increasing.

There has been a steady market demand for personal care constituents during the pandemic for the manufacturing of cleaning products, soaps, sanitizers, detergents, and personal care products on account of greater awareness pertaining to individual hygiene. However, the manufacturing of products has been impacted by several operational challenges, logistics delays, and trade restrictions.

The cosmetics and personal beauty products sectors have been severely affected by the pandemic and have experienced declined market demand, disruption of the supply chain, and workforce impairment. Manufacturing activities saw a sudden decline owing to several restrictions and lockdowns across the sectors.

Industry Dynamics

Which are the major factors driving the personal care ingredient market?

Rising Demand for Natural and Sustainable Ingredients

Consumers are increasingly preferring eco-friendly, plant-based, and clean-label products over synthetic alternatives due to growing awareness about health, safety, and environmental impact. This shift has encouraged manufacturers to innovate with biobased emollients, natural surfactants, and organic preservatives. L’Oréal and Unilever have both invested heavily in developing green chemistry-based formulations that use biodegradable ingredients like sugar-derived surfactants and plant oils. Similarly, BASF’s “Care Creations” line emphasizes sustainability through renewable feedstocks, meeting the demand for ethical and transparent personal care solutions.

Growing Personalization and Functional Innovation in Skincare and Haircare

Consumers now seek personalized solutions tailored to their specific skin or hair concerns, leading to rising demand for active ingredients that offer targeted benefits such as anti-aging, UV protection, hydration, or scalp health. The integration of biotechnology and AI-driven formulation analysis has further fueled ingredient innovation. Companies like DSM-Firmenich and Croda have introduced peptides, ceramides, and microbiome-friendly ingredients that support skin barrier repair and anti-aging effects. Additionally, brands like The Ordinary and Function of Beauty use data-driven customization, boosting the consumption of niche, high-performance ingredients across personal care formulations.

Report Segmentation

The market is primarily segmented based on source, type, application, and region.

|

By Source |

By Type |

By Application |

By Region |

|

|

|

|

Know more about this report: Request for sample pages

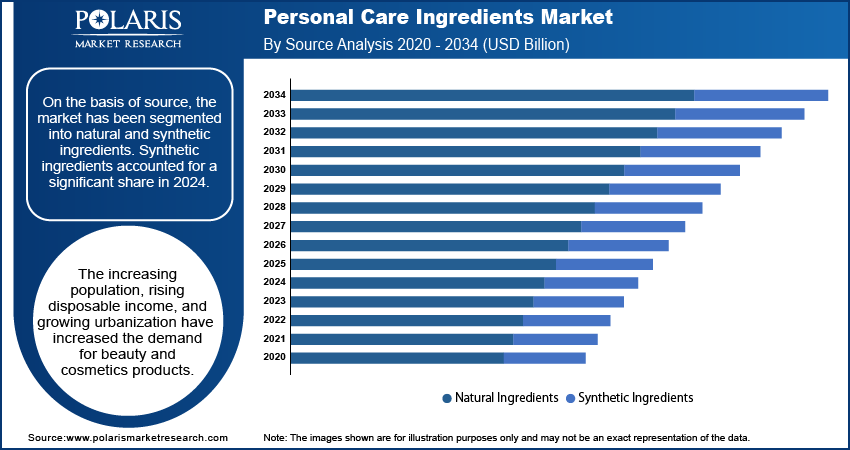

Synthetic ingredients accounted for a major share

On the basis of source, the market has been segmented into natural and synthetic ingredients. Synthetic ingredients accounted for a significant share in 2024. The increasing population, rising disposable income, and growing urbanization have increased the demand for beauty and cosmetics products. The growing use of soaps, cleaning products, and detergents, especially during the pandemic, is also fueling market growth.

The demand for natural ingredients is expected to increase during the forecast period. Increasing health consciousness among users and shifting trends toward sustainable and bio-based constituents boost the growth of this segment. The introduction of regulations associated with the use of chemicals in cosmetic products and the increase in demand for organic, sustainable, and luxurious personal hygiene products accelerates the demand for natural personal care ingredients.

Emollients accounted for a major share of the global personal care ingredients market

Emollients are widely used across products, and other cosmetics to soften skin and seal in moisture by forming a barrier on the surface. Some commonly used emollients include shea butter, cocoa butter, mineral oil, lanolin, petrolatum, and paraffin, among others. Emollients are lubricating and thickening agents used in personal hygiene products to prevent water loss and impart softening and soothing properties to the skin. Emollients also offer glossiness and softness to hair conditioning formulations.

Skin care segment is expected to hold a significant revenue share

The skin care segment accounted for a significant share in 2024. Greater demand for skin care products such as moisturizers, anti-aging creams, and sunscreen products drive the growth of this segment. Personal hygiene ingredients are used in sun protection products to offer enhanced water resistance, a greater duration of UV protection, and superior film formation.

Growing demand in the beauty and color cosmetics sector from the developing economies is expected to fuel the growth of this segment. The increasing adoption of western trends, growing awareness regarding skincare, and promotional strategies employed by industry players have increased the demand for cosmetics and beauty products.

Europe is expected to account for a significant share during the forecast period

The demand for personal hygiene ingredients is high in Europe owing to the growing population, high disposable income, and increasing urbanization. Rising demand for soap and detergents, fragrances, and beauty products has augmented the market growth in Europe. Increasing awareness regarding hygiene, growing trends regarding beauty and wellness, and greater demand for luxury products support market growth.

Change in consumer preference and shift toward the use of organic and natural products, growing research and development activities, the presence of international players in this region, and technological advancements are some factors expected to offer growth opportunities.

Competitive Insight

Who are the major players in personal care ingredients market?

The leading players in the personal care ingredients market include ADEKA Corporation, Ashland, BASF SE, Clariant, Croda International Plc., Dow, Evonik Industries AG, Henan Qingshuiyuan Technology CO., Ltd., Kemira, Lonza, Maxwell Additives Pvt. Ltd, Nouryon, Nippon Shokubai Co Ltd, Solvay, and the Lubrizol Corporation.

Recent Developments

In October 2024: BASF SE introduced Emulgade Verde, a new range of natural-based emulsifiers for personal care applications.

In October 2023: Clariant AG acquired Lucas Meyer Cosmetics for USD 810 million as part of its purpose-driven growth strategy. This acquisition strengthens Clariant’s foothold in the high-value cosmetic ingredients market, particularly in North America.

In July 2022, BASF introduced Verdessence RiceTouch, a plant-based sensory powder biopolymer used in personal hygiene products for light and smooth skin. The ingredient is manufactured using non-GMO rice and offers shine control, a mattifying effect, and excellent oil absorbency. The biopolymer is derived from renewable feedstocks, is readily biodegradable, and free from any preservatives. It also exhibits a low microbial count while decreasing stickiness and improving spreading properties.

In June 2022, Clariant introduced Plantasens OP 95, a fully microplastic-free opacifier. The product is designed to reduce the impact of rinse-off products on marine and river life. The ingredient is naturally derived and readily biodegradable. The ingredient provides high opacifying performance even at low concentrations and imparts a creamy white appearance to the products.

In June 2022, Solvay introduced a new line of biosurfactants called Microsoft. The new range of products is aimed at carbon-neutral and circular beauty products. The biosurfactants are biobased and biodegradable, with a wide range of applications in hair and skin care. The ingredients are derived from rapeseed oil and sugar through a cost-efficient fermentation process, offering a reduced carbon footprint.

Personal Care Ingredients Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 13.45 billion |

| Market size value in 2025 | USD 14.04 billion |

|

Revenue forecast in 2034 |

USD 21.04 billion |

|

CAGR |

4.6% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Source, By Type, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

ADEKA Corporation, Ashland, BASF SE, Clariant, Croda International Plc., Dow, Evonik Industries AG, Henan Qingshuiyuan Technology CO., Ltd., Kemira, Lonza, Maxwell Additives Pvt. Ltd, Nouryon, Nippon Shokubai Co Ltd, Solvay, the Lubrizol Corporation |

FAQ's

? The global market size was valued at USD 13.45 billion in 2024 and is projected to grow to USD 21.04 billion by 2034.

? The global market is projected to register a CAGR of 4.6% during the forecast period.

? Europe dominated the market share in 2024.

? The synthetic ingredients segment accounted for the largest share of the market in 2024.