Pharmacogenomics Technologies Market Share, Size, Trends, Industry Analysis Report

By Technology (PCR, In-situ Hybridization, Immunohistochemistry, Sequencing, Others); By Therapeutic Area; By Region; And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 115

- Format: PDF

- Report ID: PM3906

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

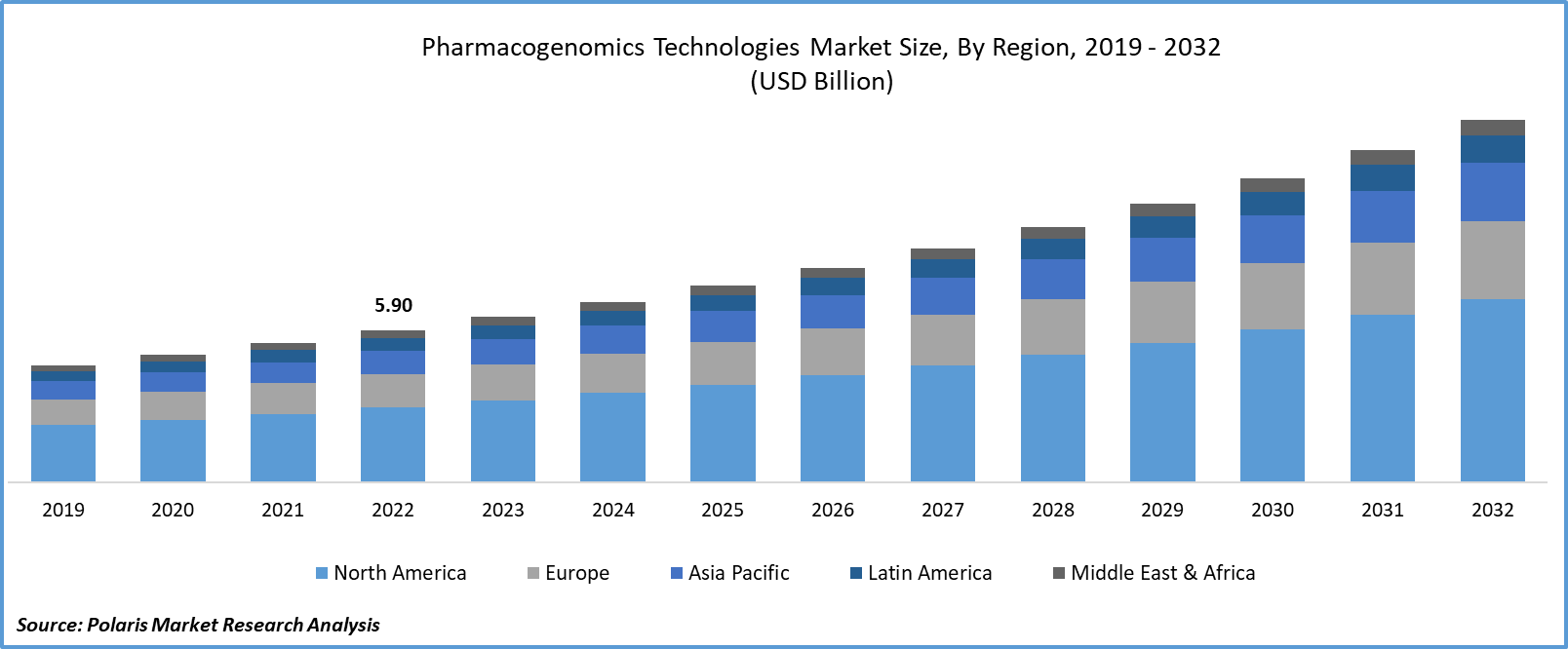

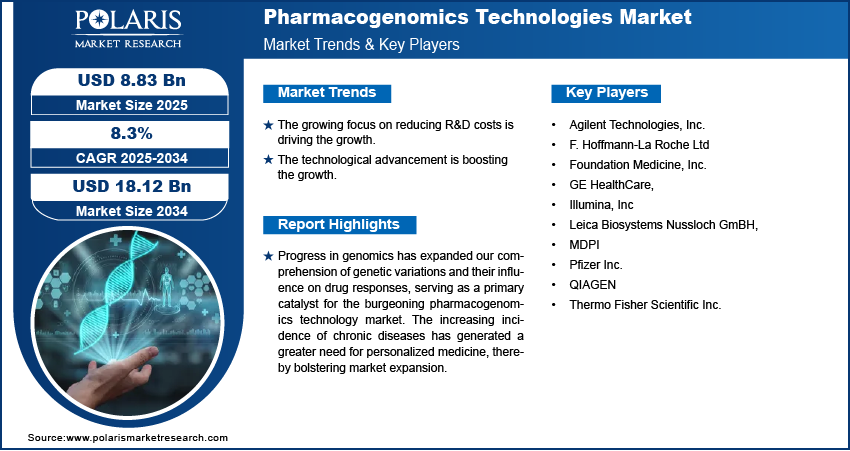

The global pharmacogenomics technologies market size and share was valued at USD 6.43 billion in 2023 and is expected to grow at a CAGR of 9.10% during the forecast period.

Progress in genomics has expanded our comprehension of genetic variations and their influence on drug responses, serving as a primary catalyst for the burgeoning pharmacogenomics technology market. The increasing incidence of chronic diseases has generated a greater need for personalized medicine, thereby bolstering market expansion. Additionally, the decreasing costs associated with genomic sequencing and ongoing technological improvements are further propelling market growth.

Pharmacogenomics is the study of how disparities in the human genome command a person’s counter to medications. In a study, an additional 99% of people examined had a genotype linked with an escalated probability to at the minimum one medication. Citations from pharmacogenomics research can cause superlative future results for both persons and healthcare donors through enhanced medication security and efficiency and minimized medical prices.

Capitalizing pharmacogenomics techniques will finally sanction healthcare providers to accelerate the calculated usage of a medication or a cure, lessen untimely drug responses, accelerate of time to obtain therapeutic advantage of a drug, and lessen the opportunity of side effects or reliance. Pharmacogenomics reduces the cost of healthcare disbursements by utilizing genomics to recognize the most suitable and cost-effective drugs initially. The pharmacogenomics technologies market size is expanding as it lessens premature drug responses early in the cure thereby lessening hospital expanse at stays, lessening hospital readmissions, and lessening ER visits.

To Understand More About this Research: Request a Free Sample Report

The adoption of theragnostic by pharmaceutical companies is being driven by its potential to reduce research and development costs while expediting clinical trial timelines. Market prospects are motivating smaller players to concentrate on creating new tests for drugs that are already licensed, which is expected to fuel growth in the future. Collaborations and upcoming product pipelines are significant drivers of the pharmacogenomics technology market. These collaborations aim to identify suitable tumor targets by expanding the knowledge of mutations linked to faulty DNA repair. Companies are actively working on creating comprehensive tests capable of capturing a vast amount of pertinent content.

Advancements in genomics have significantly enhanced our understanding of the impact of genes on health. The development of next-generation sequencing technologies has accelerated the analysis of DNA and RNA sequencing, enabling the examination of vast amounts of genetic data. Genome-wide association studies have played a pivotal role in pinpointing specific gene variations linked to various diseases, offering valuable insights into the genetic underpinnings of illnesses.

The research report provides a comprehensive analysis, both quantitative and qualitative, of the pharmacogenomics technologies market, empowering informed decision-making. It delves into essential trends and identifies growth opportunities expected to significantly influence the market. Additionally, the study includes forecasts for segment and regional revenue, facilitating thorough market evaluation.

- For instance, in June 2021, Qiagen introduced the QIAprep CRISPR Kit in conjunction with CRISPR Q-Primer Solutions. This innovation enables the rapid and efficient analysis of modified genetic material.

Furthermore, the adoption of theragnostic by pharmaceutical companies is driven by its potential to reduce R&D costs and accelerate the pace of clinical trials. It encourages smaller players in the market to concentrate on creating innovative tests for drugs that have already received approval, ultimately fostering growth in the foreseeable future.

Industry Dynamics

Growth Drivers

- Increasing Awareness and Adoption of Personalized Healthcare

The increasing adoption of personalized care has made a substantial contribution to the expansion of the pharmacogenomics technologies market. The emphasis on customizing medical treatments for individual patients has given rise to personalized care, with a growing awareness of the influence of genetic factors on drug responses. These technologies perform a pivotal role in recognizing genetic deviations that impact drug effectiveness and metabolism. In May 2022, Invitae unveiled its comprehensive 38-gene testing panel for pharmacogenomics, known as the Invitae Pharmacogenomics (PGx) Panel, for Mental Health Panel in combination with a clinical decision support tool.

Pharmacogenomics technologies can enhance treatment effectiveness and reduce adverse drug reactions, resulting in improved patient outcomes, which is a significant driver for their adoption. There is an increasing awareness among healthcare professionals and patients about the impact of genetic variations on drug responses, prompting the use of pharmacogenomics to optimize treatments. It plays a crucial role in drug development and clinical trials, helping pharmaceutical companies identify and target specific patient populations for their medications.

Key Report Segmentation

The market is primarily segmented based on technology, therapeutic area, and region.

|

By Technology |

By Therapeutic Area |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Technology Analysis

- PCR segment held the largest market share in 2022

In 2022, the PCR segment held the largest market share due to its pivotal role in genetic analysis and diagnostics. PCR enables the amplification of precise DNA sequences, making it an indispensable tool for genotyping and identifying genetic variations linked to drug response. Its extensive utilization involves the detection of single nucleotide polymorphisms (SNPs) and genetic mutations that influence drug metabolism and effectiveness.

In September 2021, Thermo Fisher Scientific Inc. introduced the QuantStudio Absolute Q Digital PCR System, a comprehensive digital PCR (dPCR) technology designed to provide highly precise results rapidly. This innovative system does not rely on complex, multi-instrument workflows. Instead, it integrates microfluidic array technology with simplified processes, enhancing data consistency and accuracy.

The IHC segment will grow rapidly, primarily due to its significant impact on drug development & personalized medicine. It plays a crucial role in the examination of protein expression patterns & biomarkers, facilitating the identification & localization of the specific proteins within concerned tissues. For instance, in April 2023, Leica received clearance for the BOND MMR Antibody Panel to assist customers by providing the IHC Mismatch Repair (MMR) option for screening patients who have colorectal cancer or who might have Lynch syndrome.

By Therapeutic Area Analysis

- The oncology segment is expected to witness the fastest growth during the forecast period.

The oncology segment is expected to witness the fastest growth during the forecast period. It is linked to the expanding range of therapies developed using molecular diagnostics principles for cancer treatment. The key to implementing companion diagnostics in cancer lies in the careful selection of predictive biomarkers. These biomarkers are specific genetic or molecular characteristics that can be identified through diagnostic tests. They play a crucial role in identifying which patients are likely to benefit from a particular treatment. In other words, companion diagnostics help determine whether a specific drug or therapy is suitable and effective for a particular individual's cancer.

Oncology has increasingly turned to a deeper understanding of the genetic makeup of both tumors and individual patients to revolutionize the selection of effective therapies. This shift towards precision medicine in oncology is made possible through the utilization of pharmacogenomics technologies, which empower oncologists to identify crucial genetic variations present within tumors. These genetic variations serve as valuable targets for specific drugs, thereby opening the door to more precise and effective treatment options for cancer patients. By pinpointing these genetic variations, oncologists can tailor treatment plans to the individual characteristics of each patient's cancer. This personalized approach often leads to more effective therapies with fewer side effects. It also helps identify which drugs are likely to work best for a particular patient, enhancing the chances of successful treatment outcomes.

Regional Insights

- North America region held the largest market in 2022

In 2022, North America held the largest market due to the presence of well-established industry key players operating within the region. These key players have been actively pursuing collaborations to secure their foothold in the pharmacogenomics companion diagnostics market.

The United States has seen a significant surge in integrated medicine research and development. It has been facilitated by the active involvement of regulatory bodies and government initiatives aimed at promoting this field. The FDA (Food and Drug Administration) has played a pivotal role by issuing guidance documents that facilitate milestone review coordination across various agencies, establish performance requirements, clarify regulatory strategies, and define timelines.

APAC region held the fastest market share. The region's rapid growth in the pharmacogenomics technology market can be attributed to its diverse population, the increasing prevalence of chronic diseases, a focus on precision medicine, and significant investments in research and infrastructure. These factors collectively drive the demand for pharmacogenomics solutions and contribute to the region's expanding pharmacogenomics technologies market.

It boasts a diverse population, making it a fertile ground for genetic research. This diversity allows for a broader range of genetic variations to be studied, which can lead to more comprehensive insights into the genetic underpinnings of diseases and drug responses. Moreover, the growing health burden has amplified the demand for personalized medicine and targeted therapies. Pharmacogenomics technologies are instrumental in tailoring treatments to individual patients, which is particularly crucial in managing chronic diseases effectively.

Key Market Players & Competitive Insights

The market exhibits intense competition, with companies employing strategies like introducing new products, securing approvals, engaging in strategic acquisitions, and fostering innovations to expand their global presence.

Some of the key players operating in the global market are:

- Agilent Technologies, Inc.

- F. Hoffmann-La Roche Ltd

- Foundation Medicine, Inc.

- GE HealthCare,

- Illumina, Inc

- Leica Biosystems Nussloch GmBH,

- MDPI

- Pfizer Inc.

- QIAGEN

- Thermo Fisher Scientific Inc.

Recent Developments

- In January 2023, QIAGEN unveiled a strategic collaboration with Helix, a company specializing in population genomics. This partnership aims to facilitate the development of companion diagnostics for genetic diseases.

Pharmacogenomics Technologies Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 7.01 billion |

|

Revenue forecast in 2032 |

USD 14.10 billion |

|

CAGR |

9.10% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Type, By Application, By Distribution Channel, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Delve into the intricacies of pharmacogenomics technologies in 2024 through the meticulously compiled market share, size, and revenue growth rate statistics by Polaris Market Research Industry Reports. Uncover a comprehensive analysis that not only projects market trends up to 2032 but also provides valuable insights into the historical landscape. Immerse yourself in the depth of this industry analysis by acquiring a complimentary PDF download of the sample report.