Peptide Synthesis Market Size, Share, Trends, Industry Analysis Report

: By Product, Technology, Application (Therapeutics, Diagnosis, and Research), End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Apr-2025

- Pages: 129

- Format: PDF

- Report ID: PM5527

- Base Year: 2024

- Historical Data: 2020-2023

Peptide Synthesis Market Overview

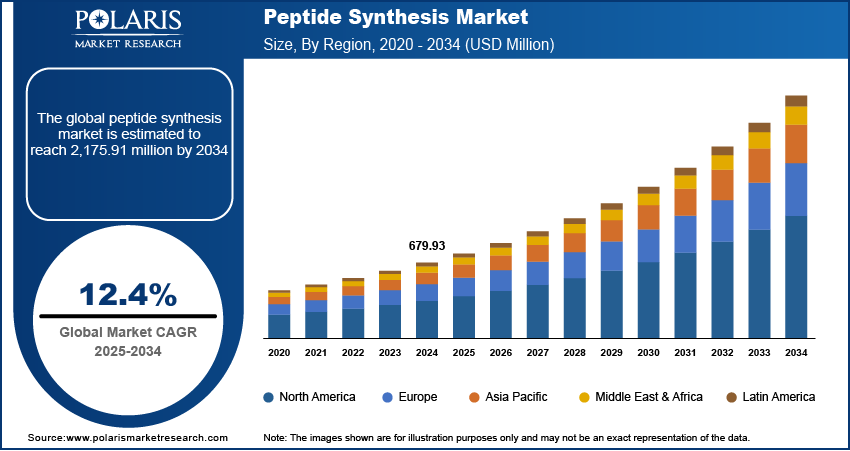

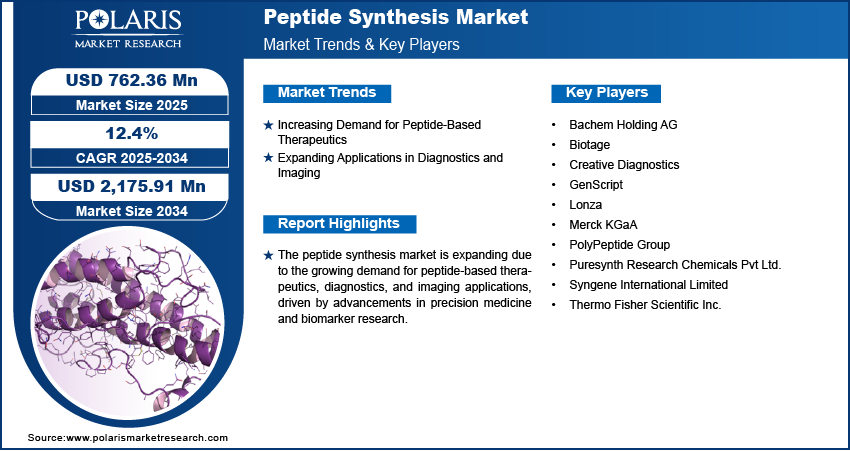

The global peptide synthesis market was valued at USD 679.93 million in 2024. It is expected to grow from USD 762.36 million in 2025 to USD 2,175.91 million by 2034, at a CAGR of 12.4% from 2025 to 2034.

Peptide synthesis refers to the process of creating peptides, which are short chains of amino acids linked by peptide bonds, used in pharmaceuticals, diagnostics, and research applications. The peptide synthesis market is expanding due to advancements in therapeutics for rare diseases, personalized medicine, and precision therapeutics. According to an August 2024 FDA report, one in ten Americans, or 25 to 30 million people, have a rare disease. The growing focus on targeted drug development has fueled synthetic peptides market demand, which plays a crucial role in innovative treatment approaches. The need for highly specific and custom peptides continues to rise due to advanced research in rare diseases and precision medicine, which further boosts market growth. This advancement is particularly noticeable in cell therapy development, where peptide-based solutions are allowing breakthrough treatments. For instance, in August 2024, Precision BioSciences partner TG Therapeutics received FDA IND clearance for Azercabtagene Zapreleucel (azer-cel), an allogeneic CAR T therapy, to begin Phase 1 trials for progressive multiple sclerosis. Additionally, the increasing adoption of personalized medicine has accelerated the demand for peptide-based therapeutics, as these molecules offer precise and tailored treatment options for individual patients.

To Understand More About this Research: Request a Free Sample Report

Rising investments and substantial funding for genomics and proteomics research further drive the peptide synthesis market expansion by improving drug discovery and development processes. For instance, in February 2024, Curve Therapeutics received a 49.2 million USD Series A financing from Pfizer Ventures to advance its Microcycle platform, targeting complex intracellular proteins, and progress its pipeline, such as HIF-1/2 and ATIC inhibitors, toward clinical development. Genomics and proteomics advancements provide crucial insights into disease mechanisms, directing the identification of novel therapeutic targets and the development of peptide-based drugs. Government initiatives, private sector funding, and research collaborations have strengthened the infrastructure for peptide synthesis, securing a continuous pipeline of innovative therapeutics. As a result, the market benefits from expanding research capabilities, technological advancements in peptide synthesis methods, and increased accessibility to high-quality peptides for various biomedical applications.

Peptide Synthesis Market Dynamics

Increasing Demand for Peptide-Based Therapeutics

Peptides high specificity, efficacy, and lower toxicity compared to traditional small molecules make them ideal for treating various diseases, such as cancer, metabolic disorders, and infectious diseases. As a result, peptides have emerged as an essential component in modern drug development. Advances in peptide engineering, formulation technologies, and delivery systems have further improved their therapeutic potential, driving their adoption in clinical applications. For instance, in May 2023, SynCrest Inc., a peptide and nucleotide CRDMO, expanded its services globally, offering continuous flow synthesis with in-line measurement for APIs, intermediates, and raw materials, specializing in peptide-based therapeutics, non-natural amino acids, and amides, leveraging advanced manufacturing technologies. Additionally, the growing interest in biologics and targeted therapies has strengthened the demand for synthetic peptides, necessitating efficient and scalable peptide synthesis techniques. Thus, as pharmaceutical companies and research institutions continue to invest in peptide-based drug development, the need for high-quality synthetic peptides continues to rise, boosting peptide synthesis market growth.

Expanding Applications in Diagnostics and Imaging

The expanding applications of peptide synthesis in diagnostics and imaging contribute to market development by improving disease detection and monitoring. Peptides are widely used in biomarker identification, molecular imaging, and targeted contrast agents due to their high binding affinity and specificity. Their role in diagnostic assays, immunoassays, and radiolabeled peptides for imaging techniques has greatly improved the accuracy and efficiency of disease diagnosis. Additionally, advancements in peptide-based probe development have allowed more precise imaging of tumors, neurological disorders, and infectious diseases. Strategic investments in peptide-based imaging technologies across the pharmaceutical industry further contribute to this shift. For instance, in June 2024, Lantheus acquired global rights to Life Molecular's RM2 technology for USD 35 million, including radiotherapeutic and diagnostic compounds targeting GRPR receptors in cancer cells. The deal covers 177Lu-DOTA-RM2 and 68Ga-DOTA-RM2, with clinical trials planned for 2025. Therefore, as the demand for early disease detection and personalized diagnostics increases, the utilization of synthetic peptides in these applications is expected to grow, driving the peptide synthesis market expansion.

Peptide Synthesis Market Segment Insights

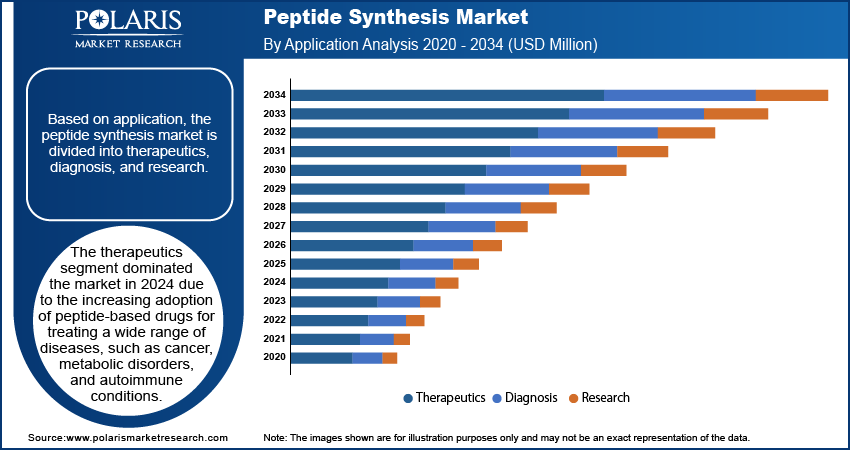

Peptide Synthesis Market Assessment by Application Outlook

The global peptide synthesis market assessment, based on application, includes therapeutics, diagnosis, and research. The therapeutics segment dominated the peptide synthesis market in 2024 due to the increasing adoption of peptide-based drugs for treating a wide range of diseases, such as cancer, metabolic disorders, and autoimmune conditions. Peptides have gained attention in modern drug development due to their high specificity, efficacy, and minimal side effects compared to conventional small molecules. Advancements in peptide drug formulation and delivery technologies have further improved their stability and bioavailability, supporting their broader clinical applications. Additionally, the rising focus on precision medicine and biologics has strengthened the demand for synthetic peptides in targeted therapies, contributing to the segment’s dominance within the market.

Peptide Synthesis Market Evaluation by Technology Outlook

The global peptide synthesis market evaluation, based on technology, includes solid phase peptide synthesis (SPPS), liquid phase peptide synthesis (LPPS), and hybrid technology. The hybrid technology segment is expected to witness the fastest growth during the forecast period, as it combines the advantages of both SPPS and LPPS. This approach allows higher efficiency, improved yield, and cost-effectiveness in large-scale peptide production, making it highly suitable for pharmaceutical and biotechnological applications. Hybrid technology improves the synthesis of complex and long-chain peptides, which are increasingly used in therapeutics and research. Additionally, continuous advancements in automation and process optimization have improved the scalability and reproducibility of peptide synthesis, making hybrid technology a preferred choice for manufacturers seeking high-purity peptides for commercial and research purposes.

Peptide Synthesis Market Regional Analysis

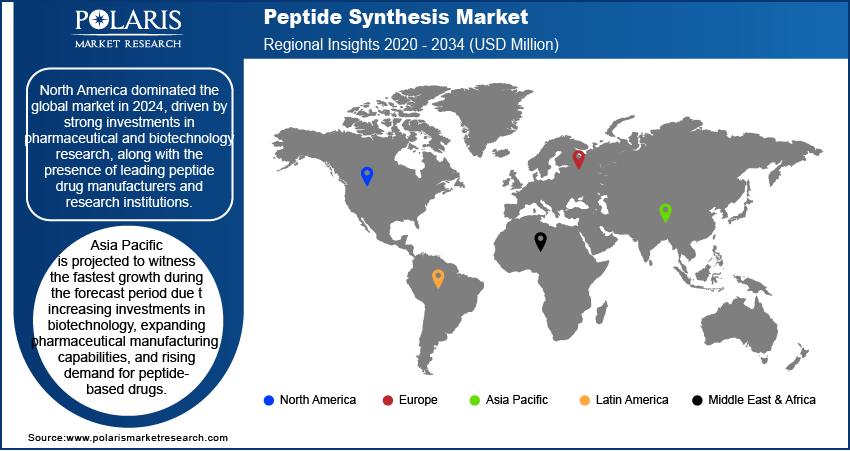

By region, the report provides the peptide synthesis market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America dominated the peptide synthesis market in 2024, driven by strong investments in pharmaceutical and biotechnology research, along with the presence of leading peptide drug manufacturers and research institutions. The region benefits from a well-established healthcare infrastructure, a robust regulatory framework, and substantial funding for drug discovery and development. Additionally, the FDA reported in November 2024 that over 30 million Americans suffer from over 7,000 rare diseases. This increased demand for peptide-based treatments due to the rising prevalence of chronic and rare diseases, further fueling peptide synthesis market expansion. The growing adoption of advanced peptide synthesis technologies and the presence of key industry players in the region have contributed to North America's leadership in the global market. For instance, in September 2024, Cambrex launched a novel liquid-phase peptide synthesis (LPPS) technology developed by Snapdragon Chemistry using batch reactors and continuous flow. This method reduces solvent use and reagent waste compared to traditional solid-phase synthesis, improving efficiency in peptide production. These technological advancements and continued investment in research infrastructure position North America to maintain its market leadership in peptide synthesis technologies.

The Asia Pacific peptide synthesis market is projected to witness the fastest growth during the forecast period due to increasing investments in biotechnology, expanding pharmaceutical manufacturing capabilities, and rising demand for peptide-based drugs. For instance, in June 2024, Alembic Pharmaceuticals received USFDA final approval for Icatibant Injection, 30 mg/3 mL, a peptide product for treating hereditary angioedema in adults. The region’s rapidly growing healthcare sector, coupled with a strong focus on research and development, is driving the adoption of peptide synthesis technologies. Additionally, supportive government initiatives and increasing collaborations between academic institutions and biopharmaceutical companies are fostering innovation in peptide drug development. As a result, Asia Pacific is emerging as a key hub for peptide synthesis, with considerable growth potential in therapeutics, diagnostics, and research applications.

Peptide Synthesis Market – Key Players and Competitive Insights

The competitive landscape features global leaders and regional players competing for peptide synthesis market share through innovation, strategic partnerships, and geographic expansion. Global companies such as Thermo Fisher Scientific, Merck KGaA, Bachem Holding AG, and others leverage strong R&D capabilities and extensive distribution networks to offer advanced peptide synthesis technologies, such as solid-phase and liquid-phase synthesis, as well as automated platforms. Peptide synthesis market trends highlight increasing demand for synthetic peptides in therapeutics, diagnostics, and research, driven by advancements in personalized medicine and targeted therapies. According to peptide synthesis market statistics, the market is projected to grow, fueled by rising applications in oncology, metabolic disorders, and infectious diseases.

Regional players focus on cost-effective solutions and localized services, particularly in emerging markets. Peptide synthesis competitive strategies include mergers and acquisitions, collaborations with biopharmaceutical companies, and the development of novel synthesis methods to improve efficiency and scalability. These trends highlight the importance of technological innovation, market adaptability, and strategic investments in driving the peptide synthesis market expansion. A few key major players are Bachem Holding AG; Biotage; Creative Diagnostics; GenScript; Lonza; Merck KGaA; PolyPeptide Group; Puresynth Research Chemicals Pvt Ltd.; Syngene International Limited; and Thermo Fisher Scientific Inc.

Thermo Fisher Scientific Inc. is a supplier of analytical instruments, life sciences solutions, specialty diagnostics, laboratory products, and pharmaceutical and biotechnology services. Founded through the merger of Thermo Electron and Fisher Scientific in 2006, the company is headquartered in Waltham, Massachusetts. Thermo Fisher's product portfolio includes laboratory supplies, equipment, and instruments, as well as clinical and diagnostics tools, which serve various sectors such as biotechnology, pharmaceuticals, and healthcare. In the context of peptide synthesis, Thermo Fisher Scientific offers a range of products and services that support research and development in this field. The company provides advanced instruments and reagents necessary for peptide synthesis, such as chromatography and mass spectrometry devices, which are crucial for analyzing and purifying peptides. Additionally, Thermo Fisher's brands, such as Invitrogen and Applied Biosystems, offer molecular biology tools that can be used in peptide synthesis processes, facilitating the discovery and development of new drugs and therapies. Through its comprehensive solutions, Thermo Fisher supports scientists in conducting biological and biomedical research, which includes peptide synthesis, thereby contributing to advancements in life sciences and pharmaceutical development.

Merck KGaA, headquartered in Darmstadt, Germany, is a science and technology company founded in 1668. It operates across three main sectors: Healthcare, Life Science, and Electronics. The company focuses on research and development in areas such as oncology, neurology, and immunology, producing a range of prescription drugs and innovative solutions for various industries. Merck KGaA is particularly recognized for its advancements in peptide synthesis, which plays a critical role in drug development and biopharmaceutical manufacturing. The Life Science division offers comprehensive solutions for protein research, cell culture, and biopharmaceutical production, leveraging cutting-edge technologies to improve efficiency and effectiveness in peptide synthesis processes. Merck KGaA continues to invest heavily in R&D, ensuring its position at the forefront of scientific innovation and contributing to advancements in healthcare and life sciences globally.

List of Key Companies in Peptide Synthesis Market

- Bachem Holding AG

- Biotage

- Creative Diagnostics

- GenScript

- Lonza

- Merck KGaA

- PolyPeptide Group

- Puresynth Research Chemicals Pvt Ltd.

- Syngene International Limited

- Thermo Fisher Scientific Inc.

Peptide Synthesis Industry Developments

January 2025: BioDuro opened a fully automated solid-phase peptide synthesis lab in Shanghai, improving its peptide manufacturing capabilities. The facility supports scale-up to 800 mmol, producing linear, cyclic peptides, and peptide drug conjugates for global partners.

June 2024: Vapourtec launched the Peptide-ExplorerLT, a compact, cost-effective system for linear peptide synthesis. It delivers high-quality peptides such as its predecessor, and the Peptide-Explorer, which is designed for chemists exploring and optimizing peptide synthesis processes.

Peptide Synthesis Market Segmentation

By Product Outlook (Revenue, USD Million, 2020–2034)

- Equipment

- Reagents & Consumable

- Services

By Technology Outlook (Revenue, USD Million, 2020–2034)

- Solid Phase Peptide Synthesis (SPPS)

- Liquid Phase Peptide Synthesis (LPPS)

- Hybrid Technology

By Application Outlook (Revenue, USD Million, 2020–2034)

- Therapeutics

- Diagnosis

- Research

By End Use Outlook (Revenue, USD Million, 2020–2034)

- Pharmaceutical & Biotechnology Companies

- Contract Development & Manufacturing Organization/Contract Research Organization

- Academic & Research Institutes

By Regional Outlook (Revenue, USD Million, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Peptide Synthesis Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 679.93 million |

|

Market Size Value in 2025 |

USD 762.36 million |

|

Revenue Forecast by 2034 |

USD 2,175.91 million |

|

CAGR |

12.4% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global peptide synthesis market size was valued at USD 679.93 million in 2024 and is projected to grow to USD 2,175.91 million by 2034.

The global market is projected to grow at a CAGR of 12.4% during the forecast period.

North America dominated the market in 2024.

Some of the key players in the market are Bachem Holding AG; Biotage; Creative Diagnostics; GenScript; Lonza; Merck KGaA; PolyPeptide Group; Puresynth Research Chemicals Pvt Ltd.; Syngene International Limited; and Thermo Fisher Scientific Inc.

The therapeutics segment dominated the market in 2024.