Magnetic Resonance Imaging Market Size, Share, Trends, Industry Analysis Report

: By Architecture (Open Systems, and Closed Systems), Field Strength, Application, End Use, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025-2034

- Published Date:May-2025

- Pages: 129

- Format: PDF

- Report ID: PM5671

- Base Year: 2024

- Historical Data: 2020-2023

Magnetic Resonance Imaging Market Overview

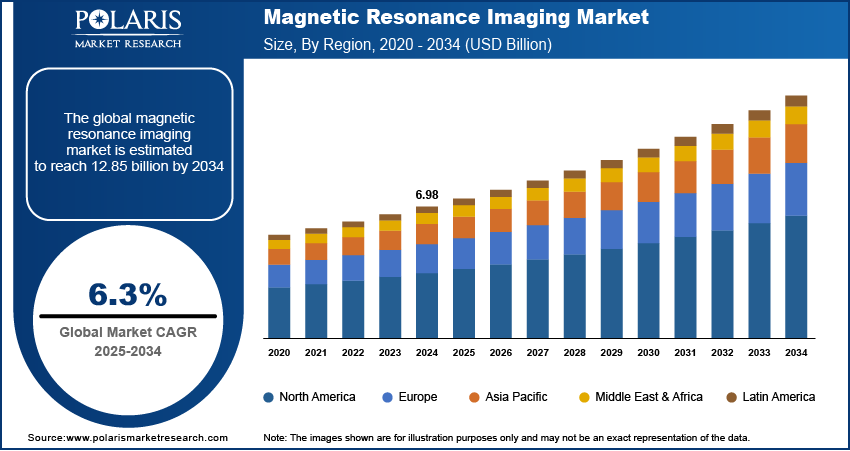

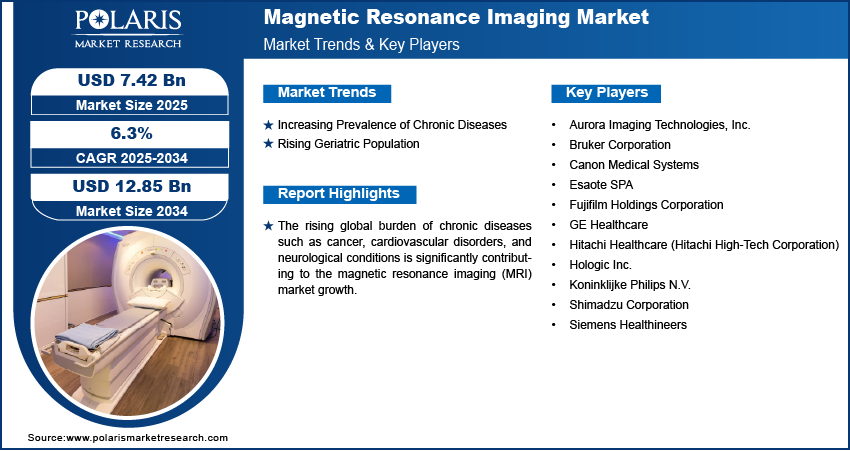

Magnetic resonance imaging market size was valued at USD 6.98 billion in 2024 and is expected to reach USD 7.42 billion by 2025 and USD 12.85 billion by 2034, exhibiting a CAGR of 6.3% during the forecast period (2025-2034).

The magnetic resonance imaging (MRI) market encompasses the global industry involved in the manufacturing, distribution, and advancement of MRI systems non-invasive diagnostic tools that use strong magnetic fields and radio waves to generate detailed images of organs and tissues. These systems are widely used across various medical fields including neurology, orthopedics, cardiology, and oncology. The MRI market also includes associated software, coils, contrast agents, and service components. Continuous innovation, technological integration, and rising healthcare demands are shaping the evolving market dynamics of MRI. Technological innovations including the development of 3T and 7T MRI scanners, diffusion tensor imaging (DTI), and AI in diagnostic tools are enhancing imaging capabilities. These advancements are improving diagnostic precision and workflow efficiency, thereby supporting ongoing magnetic resonance imaging market expansion.

To Understand More About this Research:Request a Free Sample Report

Investments in healthcare infrastructure across Asia Pacific, Latin America, and the Middle East are improving access to advanced diagnostic imaging services. The expansion of diagnostic centers and hospitals in these regions is contributing to the market growth. The emphasis on early disease detection and preventive healthcare is heightening the adoption of MRI systems. The modality’s non-ionizing nature and detailed soft tissue imaging capabilities are driving its use across multiple specialties, strengthening market expansion.

Magnetic Resonance Imaging Market Dynamics

Increasing Prevalence of Chronic Diseases

The rising global burden of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions is significantly contributing to the magnetic resonance imaging (MRI) market growth. For instance, in 2023, around 129 million people in the US have at least one major chronic disease such as heart disease, cancer, diabetes, obesity, or hypertension according to the the US Department of Health and Human Services. Notably, five of the top ten causes of death are linked to preventable chronic conditions. These illnesses often require detailed, non-invasive imaging for multi cancer early detection, staging, and treatment planning making MRI an indispensable diagnostic tool. High-resolution imaging capabilities, especially for soft tissues, position MRI as a preferred modality among healthcare providers. In both developed and developing regions, increasing awareness around preventive diagnostics and routine screening is accelerating MRI utilization. This trend is reshaping market dynamics, encouraging investments in advanced MRI technologies, and boosting product innovations aimed at improving speed, image quality, and patient comfort, ultimately supporting global market expansion.

Rising Geriatric Population

The expanding elderly population worldwide is playing a pivotal role in driving the demand for MRI systems. For instance, according to data from the World Health Organization (WHO), the global population of individuals aged 60 and older is anticipated to rise from 1.1 billion in 2023 to approximately 1.4 billion by the year 2030. Aging individuals are more prone to chronic, degenerative, and age-related diseases such as osteoarthritis, Alzheimer’s, and various cardiovascular conditions, necessitating regular and precise imaging diagnostics. This demographic trend is contributing to the market growth by increasing the need for high-quality, non-invasive diagnostic solutions that minimize patient risk and maximize clinical insight. Healthcare systems are responding by investing in upgraded MRI infrastructure capable of handling growing diagnostic volumes. The surge in geriatric care facilities and long-term care centers is further influencing market dynamics and accelerating the adoption of MRI technologies, particularly in regions with advanced healthcare delivery frameworks.

Magnetic Resonance Imaging Market Segment Insights

Magnetic Resonance Imaging Market Assessment by Architecture Outlook

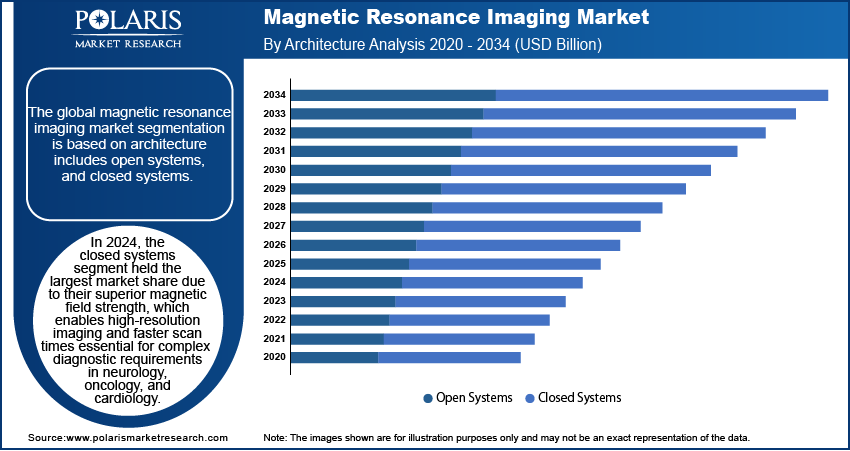

The global magnetic resonance imaging market segmentation is based on architecture includes open systems, and closed systems. In 2024, the closed systems segment held the largest market share due to their superior magnetic field strength, which enables high-resolution imaging and faster scan times essential for complex diagnostic requirements in neurology, oncology, and cardiology. The demand is particularly high in tertiary care and academic hospitals where precision and throughput are critical. Closed systems also support advanced imaging techniques such as functional MRI (fMRI), spectroscopy, and diffusion tensor imaging (DTI), offering comprehensive diagnostic capabilities. Continuous innovations in 3T and 7T MRI units are enhancing image quality and workflow efficiency, further reinforcing their dominance. Strong reimbursement frameworks in developed markets are also contributing to their sustained market leadership.

The open systems segment is expected to witness significant growth over the forecast period, driven by due to rising demand for patient-centric imaging, particularly for claustrophobic, pediatric, and geriatric populations. Technological advancements have improved the imaging quality of open systems, narrowing the performance gap with closed units. Increasing preference among outpatient diagnostic centers and smaller healthcare facilities for open configurations owing to lower cost, ease of installation, and patient compliance is driving adoption. Additionally, rising demand in emerging economies where affordability and accessibility are priorities is supporting market expansion. Open MRI’s versatility in accommodating diverse body types is making it increasingly relevant in personalized and inclusive healthcare delivery.

Magnetic Resonance Imaging Market Evaluation by End Use Outlook

The global magnetic resonance imaging market segmentation is based on end use includes, obstructive sleep apnea, brain & neurological, spine & musculoskeletal, vascular, abdominal, cardiac, breast, and others. The brain & neurological segment accounted for the largest market share in 2024 due to the high diagnostic reliance on MRI for neurodegenerative, demyelinating, and cerebrovascular conditions. MRI’s unmatched ability to visualize soft tissues, white matter abnormalities, and functional brain activity makes it essential in diagnosing disorders such as multiple sclerosis, Alzheimer’s, epilepsy, and stroke. Growing prevalence of these conditions, along with increasing clinical application of functional and structural neuroimaging, is driving utilization. Integration of advanced imaging protocols and AI-based neuroimaging analytics is further enhancing diagnostic confidence, especially in early-stage neurological pathologies. These factors are collectively contributing to the segment’s sustained market dominance.

The breast segment is expected to grow at the fastest CAGR over the forecast period, driven by due to increasing adoption of breast MRI in high-risk screening and pre-surgical planning. Rising breast cancer incidence, coupled with growing awareness of supplemental imaging beyond mammography, is fueling demand. Technological advancements, such as contrast-enhanced MRI and diffusion-weighted imaging, are improving lesion characterization and sensitivity, especially in dense breast tissues. Expanding reimbursement coverage for MRI-based breast screening in several countries and growing preference for non-ionizing diagnostic options are accelerating adoption. The integration of MRI in multimodal diagnostic pathways and personalized oncology is contributing to rapid segment expansion.

Magnetic Resonance Imaging Market Share by Regional Analysis

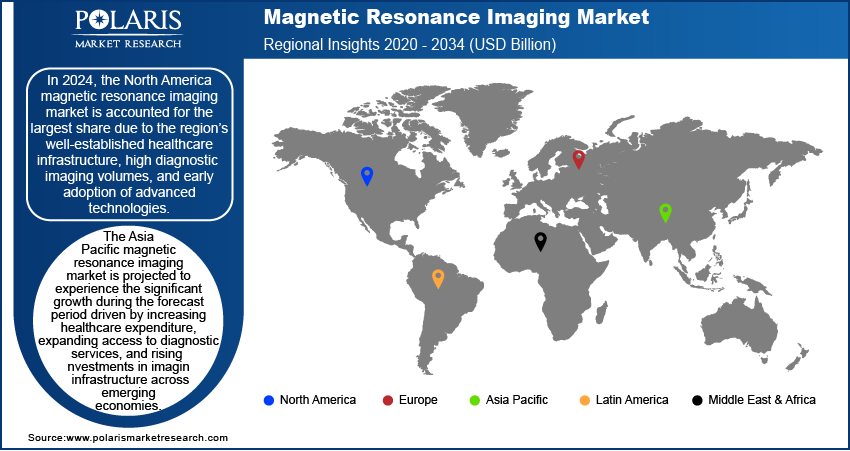

By region, the study provides market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North America is accounted for the largest share due to the region’s well-established healthcare infrastructure, high diagnostic imaging volumes, and early adoption of advanced technologies. Strong reimbursement frameworks, particularly in the US, support the widespread use of high-end MRI systems across hospitals, outpatient centers, and specialty clinics. Continuous innovation by leading manufacturers, coupled with increased integration of AI and cloud-based imaging platforms, is enhancing clinical workflow and diagnostic accuracy. Additionally, the region’s high prevalence of chronic conditions such as neurological disorders, cancer, and cardiovascular diseases is driving sustained demand for precise, non-invasive imaging, contributing to overall market expansion. For instance, in 2022, there were 702,880 fatalities attributed to cardiovascular disease, representing approximately 20% of total mortality rates.

The Asia Pacific is projected to experience the significant growth during the forecast period driven by increasing healthcare expenditure, expanding access to diagnostic services, and rising investments in imaging infrastructure across emerging economies. Countries such as China, India, and Indonesia are witnessing rapid urbanization and a growing middle-class population, leading to increased demand for quality healthcare. Government-led initiatives aimed at improving rural diagnostic capabilities and boosting indigenous manufacturing of imaging systems are further contributing to market dynamics. Rising awareness of early disease detection and growing burden of lifestyle-related and age-associated disorders are accelerating MRI adoption, positioning the region as a key driver of global market expansion.

Magnetic Resonance Imaging Key Market Players & Competitive Analysis Report

The competitive landscape of the magnetic resonance imaging (MRI) market is shaped by intense industry analysis, ongoing technology advancements, and aggressive market expansion strategies. Key players are focused on differentiating their offerings through innovations such as AI-integrated imaging platforms, 3T and 7T MRI systems, and hybrid modalities that combine functional and anatomical imaging. Strategic alliances and joint ventures between diagnostic imaging firms and research institutions are fostering the development of next-generation MRI technologies tailored for neurology, cardiology, and oncology applications. Mergers and acquisitions remain pivotal, enabling companies to consolidate regional presence, expand product portfolios, and improve access to emerging markets. Post-merger integration efforts are increasingly oriented toward harmonizing digital platforms and enhancing R&D capabilities.

Launches of portable and open MRI systems targeting outpatient and ambulatory care segments are addressing the growing demand for patient-centric imaging solutions. Additionally, investments in cloud-based imaging, workflow optimization tools, and precision diagnostics are redefining operational efficiency. The shift toward value-based healthcare, coupled with rising imaging volumes and demand for early diagnosis, is accelerating innovation. As reimbursement landscapes evolve and clinical imaging needs diversify, competitive dynamics will continue to be influenced by technological differentiation, regulatory agility, and strategic collaborations across global healthcare ecosystems.

Koninklijke Philips N.V., commonly known as Philips, is a company that operates in various industries, including healthcare technology, consumer electronics, and lighting. Philips provides medical equipment, software, and services in healthcare, including imaging systems, patient monitoring systems, and clinical informatics solutions. Philips produces various products in consumer electronics, including televisions, audio equipment, and personal care products. The company also offers in the lighting industry, providing energy-efficient lighting solutions for homes, businesses, and public spaces. Philips home appliances cover various categories, including kitchen appliances, personal care devices, and household equipment. Philips offers air fryers, blenders, food processors, coffee makers, juicers, toasters, and electric kettles in the kitchen appliances segment. These appliances are designed to provide convenience, efficiency, and ease of use in the kitchen, catering to diverse cooking and beverage preparation needs. Philips is engaged in magnetic resonance imaging (MRI), offering a wide range of advanced MRI systems, including high-field and ultra-high-field scanners, and collaborating with research institutions for ongoing innovation. Their MRI technology is widely used in clinical and research settings, supporting applications from neuroimaging to cardiac and breast imaging.

GE HealthCare, based in Chicago, Illinois, is a global medical technology company. It became an independent publicly traded company in January 2023 after separating from General Electric. The company serves more than one billion patients annually and operates in over 160 countries. The company employs around 51,000 people and has research and development centers in 18 countries, along with manufacturing facilities in 20 countries. The company’s operations are divided into four main segments. The Imaging segment includes medical imaging equipment such as computed tomography (CT), magnetic resonance imaging (MRI), molecular imaging, X-ray, and mammography. The Ultrasound segment offers ultrasound devices used in women’s health, cardiovascular care, general radiology, primary care, and point-of-care settings, including handheld and wireless models. The patient care solutions segment provides equipment for patient monitoring, anesthesia delivery, respiratory care, maternal and infant care, and diagnostic cardiology. The pharmaceutical diagnostics segment produces imaging agents and radiopharmaceuticals used in neurology, cardiology, and oncology diagnostics.

Key Companies in the Magnetic Resonance Imaging Market

- Aurora Imaging Technologies, Inc.

- Bruker Corporation

- Canon Medical Systems

- Esaote SPA

- Fujifilm Holdings Corporation

- GE Healthcare

- Hitachi Healthcare (Hitachi High-Tech Corporation)

- Hologic Inc.

- Koninklijke Philips N.V.

- Shimadzu Corporation

- Siemens Healthineers

Magnetic Resonance Imaging Market Developments

In March 2025, Polarean Imaging plc expanded its Xenon MRI imaging platform to support pharmaceutical research, partnering with VIDA Diagnostics to introduce a new service model for advanced applications.

In October 2023, Siemens Healthineers and Cardiff University strengthened their long-standing collaboration, focusing on imaging research and precision diagnostics, with CUBRIC leading innovations in MR technology and brain mapping.

In April 2024, Siemens Healthineers expanded its manufacturing in India, opening an MRI production facility in Bengaluru under the government’s PLI scheme and adding a new MRI machine production line.

Magnetic Resonance Imaging Market Segmentation

By Architecture Outlook (Revenue USD Billion 2020 - 2034)

- Open Systems

- Closed Systems

By Field Strength Outlook (Revenue USD Billion 2020 - 2034)

- Low

- Mid

- High

By Application Outlook (Revenue USD Billion 2020 - 2034)

- Obstructive Sleep Apnea

- Brain & Neurological

- Spine & Musculoskeletal

- Vascular

- Abdominal

- Cardiac

- Breast

- Others

By End Use Outlook (Revenue USD Billion 2020 - 2034)

- Hospitals

- Imaging Centers

- Ambulatory Surgical Centers

- Others

By Regional Outlook (Revenue USD Billion 2020 - 2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia-Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia-Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Magnetic Resonance Imaging Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 6.98 billion |

|

Market Size Value in 2025 |

USD 7.42 billion |

|

Revenue Forecast in 2034 |

USD 12.85 billion |

|

CAGR |

6.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020– 2023 |

|

Forecast Period |

2025 – 2034 |

|

Quantitative Units |

Revenue, USD Billion; and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global magnetic resonance imaging market size was valued at USD 6.98 billion in 2024 and is projected to grow to USD 12.85 billion by 2034.

The global market is projected to grow at a CAGR of 6.3% during the forecast period.

In 2024, the North America magnetic resonance imaging market is accounted for the largest share due to the region’s well-established healthcare infrastructure, high diagnostic imaging volumes, and early adoption of advanced technologies.

Some of the key players in the market are Aurora Imaging Technologies, Inc.; Bruker Corporation; Canon Medical Systems; Esaote SPA; Fujifilm Holdings Corporation; GE Healthcare; Hitachi Healthcare (Hitachi High-Tech Corporation); Hologic Inc.; Koninklijke Philips N.V.; Shimadzu Corporation; Siemens Healthineers.

In 2024, the closed systems segment held the largest market share due to their superior magnetic field strength, which enables high-resolution imaging and faster scan times essential for complex diagnostic requirements in neurology, oncology, and cardiology.

The brain & neurological segment accounted for the largest market share in 2024 due to the high diagnostic reliance on MRI for neurodegenerative, demyelinating, and cerebrovascular conditions.