SMS Firewall Market Share, Size, Trends, Industry Analysis Report

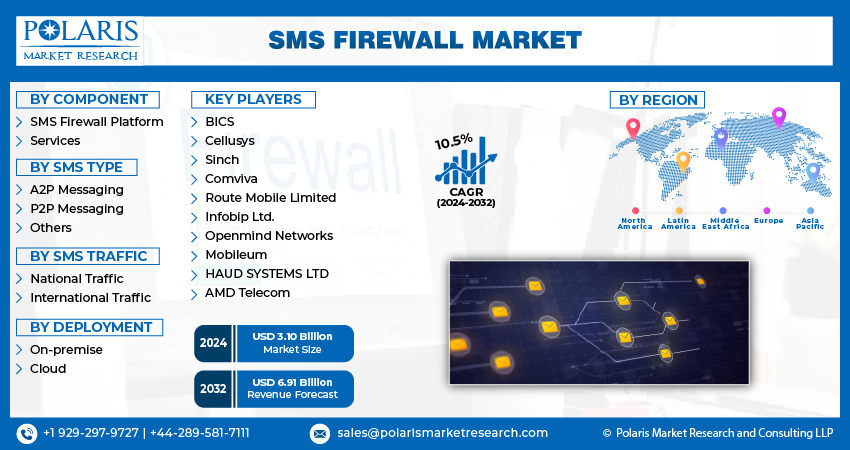

By Component (SMS Firewall Platform, Services), By SMS Type (A2P Messaging, P2P Messaging), By Deployment Mode (On-premise, Cloud), By SMS Traffic, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4160

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

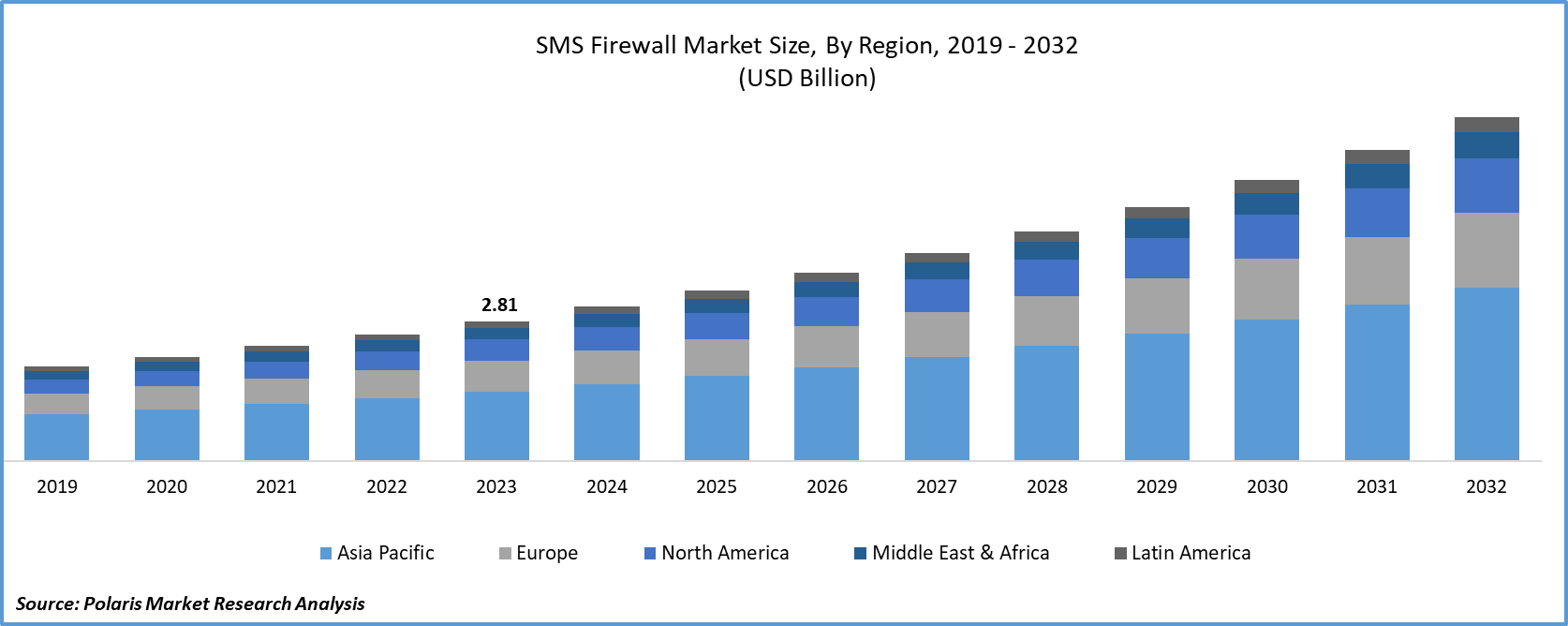

The global SMS firewall market was valued at USD 2.81 billion in 2023 and is expected to grow at a CAGR of 10.5% during the forecast period.

Factors responsible for the market growth include, escalating threats to mobile messaging services, the rise in grey route SMS traffic, and the increasing count of mobile subscribers. Additionally, the market demand is being propelled by the advantages offered by SMS firewalls, including revenue monetization and fraud prevention. The global market also witnessed a positive impact from the COVID-19 pandemic. The restrictions imposed during the pandemic led to a notable surge in internet activity, with individuals dedicating more time to interact with social media platforms and other online services.

To Understand More About this Research: Request a Free Sample Report

As a direct result of this shift in behavior, a significant increase in the total volumes of SMS Type-to-Person (A2P) messaging was noted. Throughout the pandemic, SMS emerged as a crucial communication channel for both government and private entities, experiencing a substantial rise in usage for disseminating essential information. According to Anam Technologies Ltd, there was a notable surge in international A2P SMS during the pandemic, with recorded growth of approximately 30% across multiple markets.

The abrupt alteration in people's daily routines amid the pandemic, coupled with the emergence of new lifestyle patterns, has led to significant changes in the types of message traffic. This shift coincided with the rise of new brands catering to the evolving needs of individuals adjusting to their modified lifestyles. Notably, brands associated with online education and fitness class apps gained prominence and increased visibility. Furthermore, there was a substantial increase in the frequency of notifications and transactional messages as businesses implemented update and notification programs to keep their customers informed about relevant changes given the new circumstances.

For More Details, Request for Report Discount

Growth Drivers

The increasing number of SMS-based threats, such as spam, phishing, and fraud, is a significant driver for the SMS Firewall market.

The increasing number of SMS-based threats, such as spam, phishing, and fraud, is a significant driver for the SMS Firewall market. As cyber threats evolve, the need for robust security solutions to protect mobile networks and users from malicious SMS activities becomes crucial.

Numerous mobile network operators (MNOs) are grappling with significant financial losses attributed to the prevalence of grey routes and fraudulent messaging schemes. Despite an overall decline in grey-route traffic, it continues to represent a noteworthy portion of A2P messaging traffic. A2P and Machine-to-Machine (M2M) messaging serve as lucrative revenue streams for mobile operators, but their susceptibility to fraudulent activities allows fraudsters to inundate networks with unsolicited text messages, leading to missed termination fees for operators.

To counter the increasing sophistication of messaging security attacks, MNOs must adopt innovative solutions like SMS firewalls incorporating machine learning and advanced analytics. These technologies can effectively detect and prevent security attacks while safeguarding the interests of enterprise customers and end subscribers.

Report Segmentation

The market is primarily segmented based on component, SMS type, SMS traffic, deployment mode, and region.

|

By Component |

By SMS Type |

By SMS Traffic |

By Deployment |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

- SMS firewall platforms segment held the largest share

SMS firewalls segment held the largest share. SMS firewall platforms offer several advantages, including proactive fraud prevention, SMS revenue monetization, and detection and prevention of grey route SMS. As mobile network operators and businesses recognize the critical need to secure messaging services and capitalize on SMS revenue streams, the deployment of SMS firewall platforms becomes instrumental in safeguarding against fraudulent activities, optimizing revenue generation, and ensuring the integrity of SMS traffic.

Services segment projected to grow at the fastest rate. Opting for a managed service rather than self-hosting is a preferred strategy for enhancing network protection, especially in identifying grey traffic infiltrating the network. This preference is rooted in the managed service's capability to consistently maintain and update essential filtering rules. By leveraging a managed service, networks are poised to experience enhanced protection, ensuring that the firewall remains current and effectively detects any attempts of grey traffic to breach the network.

By SMS Type Analysis

- A2P messaging segment registered the largest market share in 2023

A2P messaging segment accounted for the largest share. Segment is undergoing substantial growth and evolution, representing a comprehensive concept that encompasses various communication channels for delivering marketing and transactional information or content. Businesses, whether small-scale or large-scale, rely significantly on this unidirectional messaging method to concurrently enhance customer engagement and optimize the overall customer experience. As per the Telecom Regulatory Authority of India, A2P traffic accounts for around 40% of the total SMS traffic in India.

For instance, Infobip offers A2P SMS services, providing functionalities such as authentication SMS, notification updates, passcode reset links, OTPs, and more. Their aim is to deliver more reliable messaging solutions to customers.

P2P segment will grow rapidly. The broad adoption of mobile devices and the increased availability of affordable smartphones have expanded the user base for P2P messaging. With a growing number of individuals gaining access to mobile devices, the demand for P2P messaging services is on the rise. P2P messaging is favored for its cost-effective communication, cross-platform compatibility, and support for multimedia messaging.

By Deployment Analysis

- Cloud segment held the significant market revenue share in 2023

Cloud segment held the largest share. Cloud-based firewalls are characterized by their software-defined nature, facilitating swift deployment, and considerably reducing the time required compared to traditional firewalls. This efficient deployment process minimizes disruptions to business operations. Furthermore, cloud-based firewalls are more straightforward to maintain and upgrade, demanding fewer manual interventions. A notable advantage of these firewalls is their scalability; as bandwidth needs increase, the cloud-based SMS firewall seamlessly adjusts and scales to accommodate the augmented traffic volume.

For instance, SAP SMS Firewall 365 establishes a firewall for your SMS services, effectively preventing fraud, spam, messaging abuse, spoofing attacks, & other potential threats. This cloud-based firewall solution also enhances the monetization of the messaging services.

On premise segment will grow at the substantial pace. On-premise SMS firewalls provide organizations with full control over their messaging infrastructure and security measures. Organizations can customize and tailor the firewall configuration to align with their specific requirements, ensuring compliance with internal policies and regulatory standards. This heightened level of control enables organizations to gain a thorough understanding and oversight of their SMS traffic.

Regional Insights

- APAC held the largest share of the global market in 2023

APAC region dominated the market. Region’s growth is primarily due to rise in number of mobile subscribers across the globe. According to the GSM Association, region boasted 1.6 Bn unique mobile subscribers with a penetration rate of around 58%. In 2020, the region recorded 2.7 Bn SIM connections. Region’s growth is also supported by a substantial base of mobile users, widespread business message penetration, and a rising number of SMS subscribers.

North America is projected to grow at the fastest rate. The adoption of Application-to-Person (A2P) messaging is increasing in the region, with businesses leveraging it for transactional alerts, appointment reminders, marketing campaigns, and customer engagement. A2P messaging provides an efficient and direct communication channel for businesses to connect with their customers.

Key Market Players & Competitive Insights

The SMS firewall industry exhibits a fragmented competitive landscape, featuring numerous global and local SMS firewall platforms and service providers. Key participants in the market are implementing strategic initiatives, including collaborations, partnerships, expansions, and product launches.

Some of the major players operating in the global market include:

- BICS

- Cellusys

- Sinch

- Comviva

- Route Mobile Limited

- Infobip Ltd.

- Openmind Networks

- Mobileum

- HAUD SYSTEMS LTD

- AMD Telecom

Recent Developments

- In December 2021, HORISEN collaborated with the Cellusys to provide a comprehensive SMS firewall solution. This partnership aimed to boost security and enhance active monitoring capabilities by integrating Cellusys' signaling control technology with HORISEN's testing environment.

- In October 2022, Uganda Telecommunications has chosen 365squared, as its partner for A2P SMS monetization solutions & SMS Firewall services.

SMS Firewall Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.10 billion |

|

Revenue forecast in 2032 |

USD 6.91 billion |

|

CAGR |

10.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Material, Product Type, By Straw Length, Diameter, Sales Channel, End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The SMS firewall market report covering key segments are component, SMS type, SMS traffic, deployment mode, and region.

SMS Firewall Market Size Worth $6.91 Billion By 2032

The global SMS firewall market is expected to grow at a CAGR of 10.5% during the forecast period.

Asia Pacific is leading the global market

key driving factors in SMS firewall market are Growing Mobile Subscriber Base