Virtual Sports Market Share, Size, Trends & Industry Analysis Report

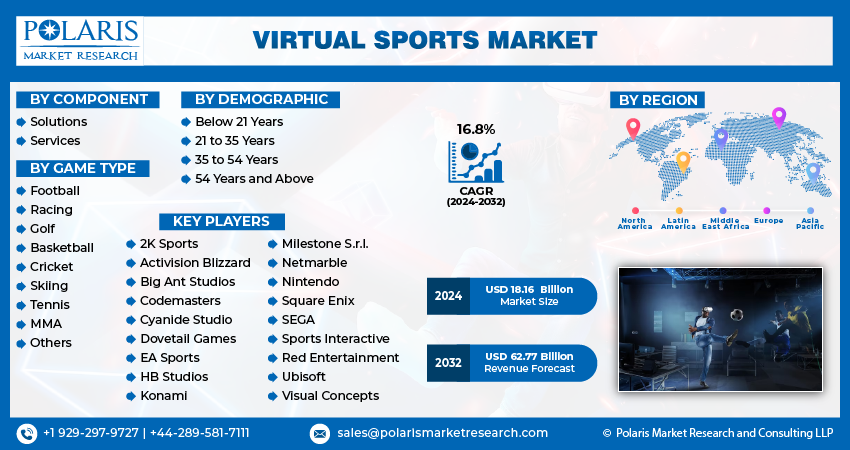

By Component (Solutions, Services); By Game; By Demographic (Below 21 Years, 21 To 35 Years, 35 To 54 Years, 54 Years and Above); By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 130

- Format: PDF

- Report ID: PM4161

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global Virtual Sports Market was valued at USD 5.4 billion in 2024 and is expected to grow at a CAGR of 12.70% from 2025 to 2034. Gaming industry expansion and interactive entertainment preferences are driving market growth.

Key Insights

- The solution segment dominated the market due to increasing demand for immersive virtual sports experiences fueled by AI and virtual reality.

- The football category took the biggest chunk, with the popularity of e-sports prompting more people to experiment with virtual sports as a novel method of competing in their favorite games.

- The 21-35 age group captured the highest proportion, largely due to the increasing possibilities in competitive gaming and e-sports, which serve as a platform for players to showcase their capabilities and compete worldwide.

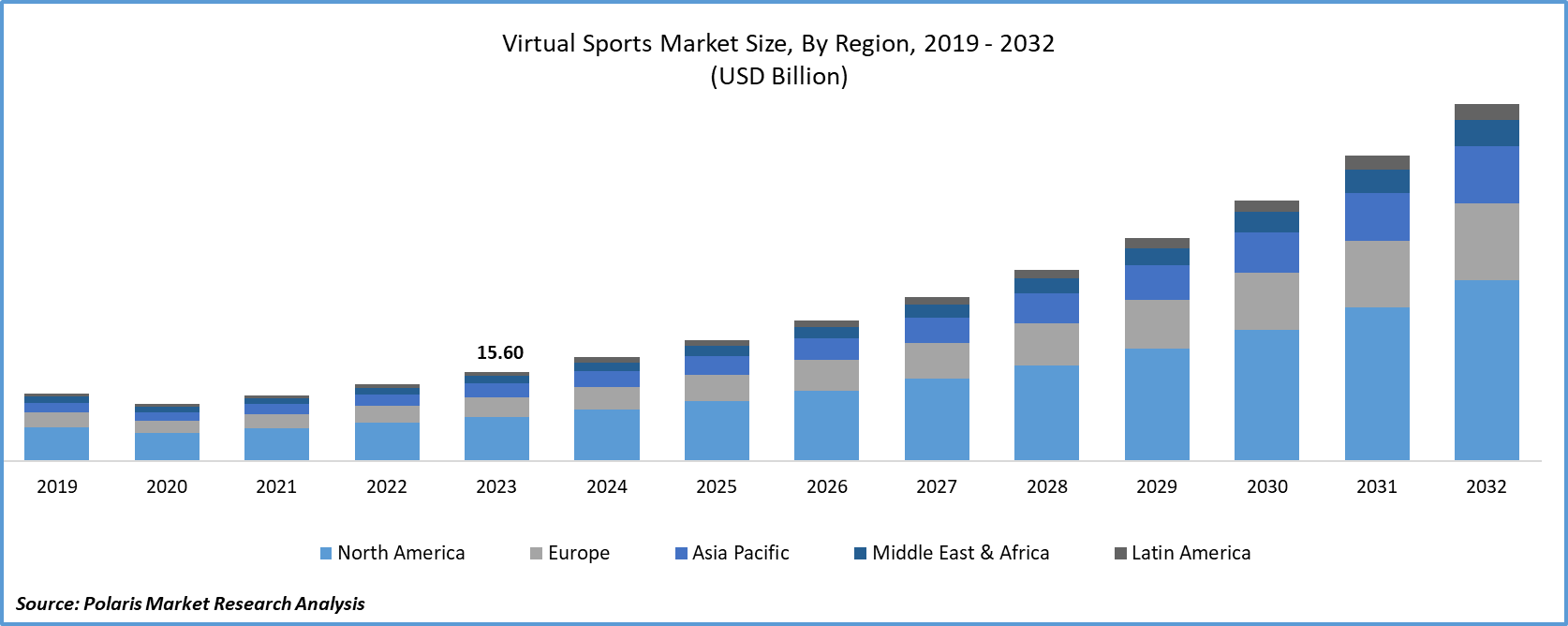

- North America dominated the market due to the quick development of gaming technology.

- Asia Pacific is expected to expand rapidly due to the region's rapid adoption of new technologies.

Industry Dynamis

- Improvements in graphics, AI, and virtual reality technologies have rendered virtual sports experiences increasingly realistic, driving market expansion.

- NFTs and blockchain ensure traceability and authenticity, thereby protecting ownership of virtual assets and minimizing the risk of fraud.

- Emerging monetization strategies, including in-app purchases, subscriptions, and sponsorships, provide new sources of revenue for creators and developers.

- The high costs of development for next-generation graphics and VR technology can limit access, especially among smaller developers new to the industry.

- Gameplay realism problems, including substandard physics and graphics rendering, can reduce immersion and compromise player interaction.

Market Statistics

2024 Market Size: USD 5.4 billion

2034 Projected Market Size: USD 17.9 billion

CAGR (2025-2034): 12.70%

North America: Largest Market Share

AI Impact on Virtual Sports Market

- Machine learning technologies support adaptive difficulty levels, dynamically changing games based on an individual's competence and preferences, thus providing a better user experience.

- Artificial intelligence-based analytics enhance game development by analyzing player data, enabling developers to design more enhanced and customized virtual sporting experiences.

- AI technology enables the creation of realistic virtual worlds and character animation, delivering high-quality graphics and physics simulations that make the experience feel truly immersive.

- AI content generation enables the faster development of virtual sports worlds and scenarios, saving developers time and money.

To Understand More About this Research: Request a Free Sample Report

The swift advancement of technology, coupled with progress in graphics, Artificial Intelligence (AI), & Virtual Reality (VR), has empowered developers to craft exceptionally realistic and immersive experiences for the market. This has elevated the quality of gameplay and broadened the spectrum of sports that can be authentically simulated.

Blockchain and Non-Fungible Tokens (NFTs) have emerged as transformative innovations in the virtual sports market, reshaping the creation, ownership, and trading of virtual assets. The incorporation of blockchain and NFTs has effectively addressed persistent challenges related to authenticity and provenance in the market. With each transaction recorded on the blockchain, the complete ownership history of an NFT becomes easily traceable. This feature allows players and collectors to authenticate the legitimacy of their virtual assets, reducing the risks associated with fraud or counterfeit items.

A critical breakthrough in virtual sports technology revolves around the enhancement of graphics and rendering capabilities. The integration of high-definition graphics & rendering techniques empowers developers to craft virtual environments and characters that closely replicate their real-world counterparts. This heightened level of visual fidelity is paramount for delivering a realistic and immersive experience to players. Additionally, advancements in computer graphics have facilitated the incorporation of progressive physics behavior for objects. For instance, in virtual soccer games, the trajectory and collision dynamics of the ball are computationally based on real-world physics principles, contributing an authentic layer to the gameplay.

Growth Drivers

- Monetization Opportunities

Monetization models have undergone significant evolution, leading to the emergence of different revenue streams. In-app purchases, subscription services, & sponsorship deals serve as primary avenues for developers and content creators to generate income. Moreover, the popularity of customizable virtual goods & skins, enhancing the appearance or capabilities of in-game characters or equipment, has fostered a dynamic marketplace for virtual items.

The intersection of virtual and traditional sports has opened new opportunities for fan engagement. Recognizing the potential of virtual sports to connect with younger audiences and broaden their global fan base, many professional sports teams and leagues have established virtual sports divisions, enabling fans to interact with their favorite teams and players in virtual environments.

Report Segmentation

The market is primarily segmented based on component, game type, demographic, and region.

|

By Component |

By Game Type |

By Demographic |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

- Solution segment held the largest share

Solution segment held the largest share. With the increasing prevalence of advanced technologies such as AI and VR, there is a growing consumer demand for more immersive and captivating virtual sports experiences. In response to this demand, companies in the market are actively developing innovative solutions that incorporate a diverse range of features and functionalities. One significant area of growth within solution components is player customization. Virtual sports games now provide players with various options to personalize their avatars, allowing them to alter their appearance and choose different abilities and skills.

By Game Type Analysis

- Football segment registered the largest market share in 2024

Football segment accounted for the largest share. The surge in e-sports has prompted an increasing number of individuals to explore virtual sports as a novel and thrilling means of engaging with their preferred sports. Football games stand out in this trend, offering virtual renditions of well-known football leagues and teams for players to participate in. This trend is anticipated to persist in the foreseeable future as more individuals discover the thrill and accessibility of virtual sports.

It provides a unique avenue for people to connect with their favorite sports in an innovative and entertaining manner. The ability to compete in virtual versions of popular football leagues and teams contributes to the widespread appeal, making virtual football games a compelling choice for both football enthusiasts and those seeking an enjoyable and immersive way to experience the sport.

Basket Ball segment will grow rapidly. The rising popularity of virtual basketball games is fostering increased global interest in the sport. Given basketball's widespread appeal in numerous countries, virtual basketball games provide fans with a means to interact with the sport, especially in regions where access to live games may be limited. Moreover, these virtual games present players with a distinctive opportunity to compete and establish connections with others on a global scale.

By Demographic Analysis

- 21-35 years segment held the significant market revenue share in 2024

21-35 years segment held the largest share. The market's landscape has introduced fresh avenues for competitive gaming and esports, offering players a platform to demonstrate their abilities and engage in global competition. Furthermore, virtual sports have played a pivotal role in establishing online communities, providing individuals with the opportunity to connect with like-minded enthusiasts who share a common passion for gaming and sports.

Below 21 years will grow at the substantial pace. The advent of technology and the internet has enabled younger generations to actively engage in virtual sports, particularly through online gaming, offering a more immersive and captivating experience. Industry players have introduced novel opportunities for education and career advancement among the younger demographic. Accessible online courses and certifications in areas such as game design, programming, and esports management have become prevalent, paving the way for potential success in the industry.

Regional Insights

- North America region held the largest share of the global market in 2024

The North America region dominated the market. This dominance is primarily due to swift advancement of gaming technology. The emergence of robust graphics engines, advanced physics simulation, and virtual reality technologies has transformed sports experiences, enhanced game-play quality and broadening the appeal to both casual gamers and dedicated enthusiasts. The market's expansion has been significantly influenced by the widespread adoption of online streaming platforms. Platforms such as Twitch, YouTube Gaming, & Facebook Gaming have emerged as central hubs for content creators and viewers, providing gamers with a global stage to showcase their skills and personalities.

Asia Pacific is projected to grow at the rapid pace. The region's enthusiastic embrace of cutting-edge technologies is a key driver of this rapid growth. The emergence of the robust gaming consoles, and adoption of the VR & AR devices have laid a sole foundation for the development and widespread acceptance of virtual sports.

Key Market Players & Competitive Insights

Major players in the industry concentrate on crafting captivating games and offering exclusive deals to gain a competitive advantage. Companies are dedicated to integrating technology, creating more interactive gaming experiences. Additionally, market participants are collaborating to enhance their products and explore new avenues for generating revenue.

Some of the major players operating in the global market include:

- 2K Sports

- Activision Blizzard

- Big Ant Studios

- Codemasters

- Cyanide Studio

- Dovetail Games

- EA Sports

- HB Studios

- Konami

- Milestone S.r.l.

- Netmarble

- Nintendo

- Square Enix

- SEGA

- Sports Interactive

- Red Entertainment

- Ubisoft

- Visual Concepts

Recent Developments

- In May 2024, Inspired Entertainment launched "NBA Re-Play" in Greece with OPAP, using archived NBA footage for virtual sports betting. The exclusive game offers realistic wagers, enhancing fan engagement and retail gaming innovation.

- In June 2023, Big Ant Studios & NACON have revealed the release date for Cricket 24 on PS5, PS4, Xbox Series X|S, & Xbox One. It features teams and nations from across the world, aiming to deliver the most comprehensive video game simulation of the cricket.

- In September 2023, 2K has introduced NBA 24, the latest installment in the NBA video game series. NBA 2K24 Seasons introduces the new Season Pass choices & the Seasonal progression track, seamlessly integrating MyCAREER & MyTEAM into a unified rewards system.

- In April 2023, SEGA Corporation has successfully acquired Rovio Entertainment, with the goal of expediting growth in the global gaming market and enhancing corporate value through synergies between SEGA's current operations and the strengths of Rovio.

Virtual Sports Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 6.1 billion |

|

Revenue forecast in 2034 |

USD 17.9 billion |

|

CAGR |

12.70% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Game Type, By Demographic, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The global virtual sports market size is expected to reach USD 17.9 billion by 2034

Key players in the market are 2K Sports, Big Ant Studios, Cyanide Studio, Dovetail Games

North America contribute notably towards the global virtual sports market

The global virtual sports market is expected to grow at a CAGR of 12.70% during the forecast period.

The virtual sports market report covering key segments are component, game type, demographic, and region.