Consumer Genomics Market Share, Size, Trends, Industry Analysis Report

By Application (Genetic Relatedness, Ancestry, Diagnostics, Sports Nutrition & Health), By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 118

- Format: PDF

- Report ID: PM4162

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

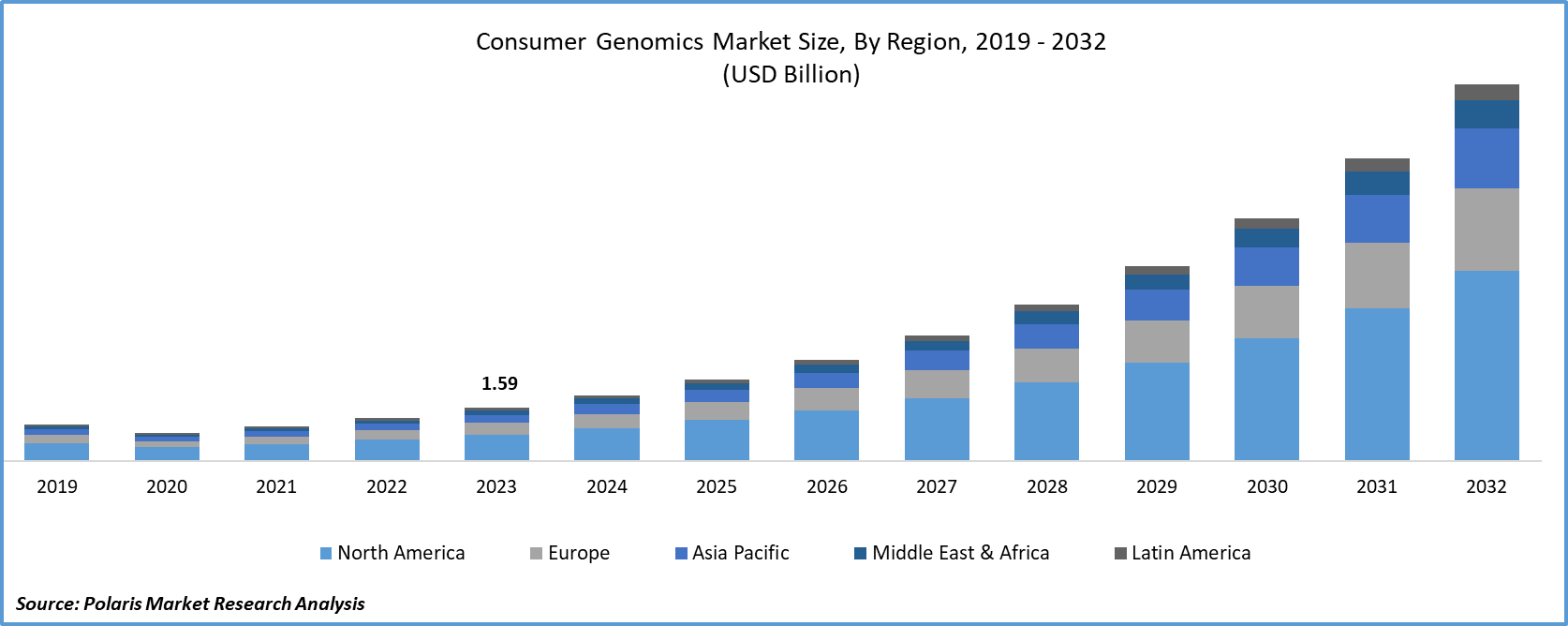

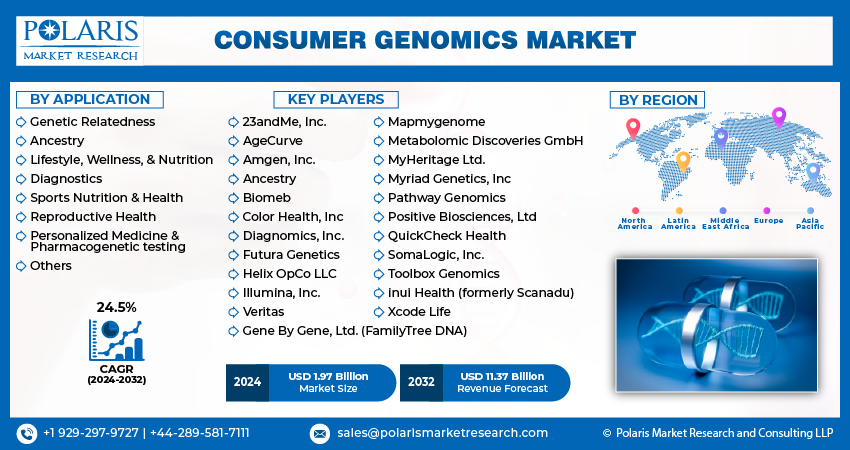

The global consumer genomics market was valued at USD 1.59 billion in 2023 and is expected to grow at a CAGR of 24.5% during the forecast period.

Demand for direct-to-consumer genetic testing has surged in recent years, offering individuals insights into their health risks, genetic traits, and ancestry by analyzing their DNA. The expansion of the consumer genomics field has led to a growing number of companies providing genetic testing directly to consumers. While these services offer valuable information, it is essential to exercise caution and carefully assess the quality and credibility of such offerings.

To Understand More About this Research: Request a Free Sample Report

Unlike other medical tests that require a healthcare professional's involvement, direct-to-consumer genetic testing allows individuals to access genetic information without an intermediary. The lack of regulatory oversight in this industry raises concerns about the accuracy, reliability, and interpretation of the genetic data provided. Different companies may use varied testing methodologies and interpret results differently, leading to potential in-consistencies.

To navigate this landscape responsibly, individuals considering direct-to-consumer genetic testing should thoroughly research the companies offering these services. It is advisable to choose reputable companies with a track record of accurate testing and transparent policies regarding data privacy. Additionally, consulting with a healthcare professional before and after testing can help individuals better understand the implications of their genetic information in the context of their overall health.

The research study provides a comprehensive analysis of the industry, assessing the market on the basis of various segments and sub-segments. It sheds light on the competitive landscape and introduces Consumer Genomics Market key players from the perspective of market share, concentration ratio, etc. The study is a vital resource for understanding the growth drivers, opportunities, and challenges in the industry.

The heightened public concern about health in the wake of the COVID-19 pandemic has led to an increased interest in advanced methodologies such as consumer genomics. This growing awareness of health issues and the significance of genetics has played a pivotal role in sustaining the market's growth. A key driver for this expansion is the increasing emphasis on research and development (R&D) efforts centered around DNA, particularly in the field of bioinformatics. These endeavors aim to create diagnostic tools and effective therapies, with a notable focus on addressing health challenges.

Growth Drivers

Expansion of Direct-To-Consumer Genetic Testing Services

The market is driven by the broadening scope of application areas for direct-to-consumer (DTC) genetic tests. These tests cover a wide range of services, such as identifying ancestry, determining race, and exploring family connections. The versatility of these applications has resulted in an increased adoption not only in clinical practices but also in various domains, including genealogical & forensic uses.

Companies like 23andMe, bio.logis Genetic Information Management, & DNA Testing Centers of Canada offer carrier screening test kits for various genetic conditions in clinical settings. Similarly, Gene Diet, SmartDNA, & Halo Health International provide personalized services customized to an individual's genetic profile. The trend of the DTC personalized genomic testing is gaining momentum, propelled by the affordability of these tests, with prices ranging from as low as USD 100 to over USD 2,000, depending on the complexity and scope of the tests.

Report Segmentation

The market is primarily segmented based on application, and region.

|

By Application |

By Region |

|

|

To Understand the Scope of this Report: Speak to Analyst

By Application Analysis

Genetic Relatedness Segment Held the Largest Share

Genetic relatedness segment held the largest share. This growth is primarily due to increasing adoption of paternal testing. The rise in demand for paternity testing, maternity testing, and prenatal paternity testing contributes significantly to revenue generation in this market segment. While paternity testing kits are readily available for online purchase, it is important to note that not all these tests comply with legal standards. Simultaneously, a considerable number of consumers are turning to DTC genetic testing to uncover information about their hereditary traits and identify unknown relatives, including long-distance cousins.

In a research paper published by the University of Cambridge in November 2021, it was revealed that genome sequencing from a single blood test identifies 31% more instances of uncommon genetic disorders compared to standard testing. Moreover, genetic relatedness has been significantly employed in cancer screening.

The increasing global incidence of cancer is expected to drive the market. For instance, the American Cancer Society forecasted 1,918,030 new cancer cases in the United States, in 2022. According to the International Agency for Research on Cancer (IARC), the number of un-diagnosed cancer cases is expected to reach 30.2 Mn, by 2040. Consequently, genetic testing serves as a valuable tool to offer insights into the risk factors associated with future cancer development and the potential familial predisposition to the disease.

Companies provide a range of paternal and maternal tests that enable individuals to obtain genetic information and ancestry details at an affordable price. DTC tests are viewed as effective tools for identifying the shared inheritance patterns among individuals & tracing relatives. Additionally, some companies offer infidelity testing alongside paternal testing.

Wellness & nutrition segment projected to grow at the fastest rate. Numerous companies provide nutrigenetic testing services encompassing areas such as fitness, diet, wellness, and personalized nutrition plans. Few companies also specialize in delivering tailored services related to diet, meals, & food plans. Genetic tests focused on nutrition & lifestyle are regarded as promising tools and are readily accessible to support individuals in creating personalized diet and lifestyle plans.

Regional Insights

North America Region Held the Largest Share of the Global Market in 2023

The North America region dominated the market. The region's market dominance is attributed to factors such as high patient awareness levels, substantial per capita healthcare spending, and a prevalent occurrence of the target disorders. Chronic diseases represent a significant cause of mortality and disability in the U.S. each year. This increased incidence of chronic diseases in the country supports the growth of consumer genomics.

Canada is poised to bolster its proficiency in Direct-to-Consumer (DTC) genetics through heightened government initiatives aimed at strengthening genomics projects. The Canadian Medical Association (CMA) plays a pivotal role in supporting public knowledge and education, contributing to increased patient awareness regarding the potential advantages and limitations of DTC genetic testing. Additionally, the CMA is actively involved in training healthcare providers, ensuring they stay abreast of the rapid advancements in molecular genetics.

The Asia Pacific region projected to grow at the rapid pace. This growth is attributed to the rising awareness of Direct-to-Consumer (DTC) genetics and the availability of funding for long-term research initiatives in the region. The entry of new market participants further contributes to the robust growth of the consumer genomics market in Asia Pacific. For instance, Prenetics Limited, has expanded its market presence in East & South-east Asian markets.

Key Market Players & Competitive Insights

The consumer genomics market is characterized by intense competition, with numerous manufacturers holding a significant portion of the market share. Key business strategies employed by market participants to sustain and expand their global presence include product launches, approvals, strategic acquisitions, and innovations.

Some of the major players operating in the global market include:

- 23andMe, Inc.

- AgeCurve

- Amgen, Inc.

- Ancestry

- Biomeb

- Color Health, Inc

- Diagnomics, Inc.

- Futura Genetics

- Gene By Gene, Ltd. (FamilyTree DNA)

- Helix OpCo LLC

- Illumina, Inc.

- inui Health (formerly Scanadu)

- Mapmygenome

- Metabolomic Discoveries GmbH

- MyHeritage Ltd.

- Myriad Genetics, Inc

- Pathway Genomics

- Positive Biosciences, Ltd

- QuickCheck Health

- SomaLogic, Inc.

- Toolbox Genomics

- Veritas

- Xcode Life

Recent Developments

- In May 2023, Grifols introduced the AlphaIDAt Home, allowing American consumers to independently screen for genetic chronic obstructive pulmonary disease (COPD).

- In October 2022, GC LabTech, an FDA-registered specialty laboratory specializing in life-saving plasma tests, has chosen 1health.io to provide its innovative new lab tests directly to consumers.

- In May 2022, Genetic Technologies has acquired the direct-to-consumer eCommerce business and distribution rights associated with the AffinityDNA.

Consumer Genomics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 1.97 billion |

|

Revenue forecast in 2032 |

USD 11.37 billion |

|

CAGR |

24.5% from 2024– 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

The Consumer Genomics Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Browse Our Top Selling Reports

Smart Pills Market Size, Share 2024 Research Report

In-Vehicle Payment Services Market Size, Share 2024 Research Report

Audience Analytics Market Size, Share 2024 Research Report

FAQ's

The consumer genomics market report covering key segments are application, and region.

Consumer Genomics Market Size Worth $11.37 Billion By 2032

The global consumer genomics market is expected to grow at a CAGR of 24.5% during the forecast period.

North America is leading the global market

key driving factors in consumer genomics market are Rising Adoption of DTC Genetic Testing