In-Vehicle Payment Services Market Share, Size, Trends & Industry Analysis Report

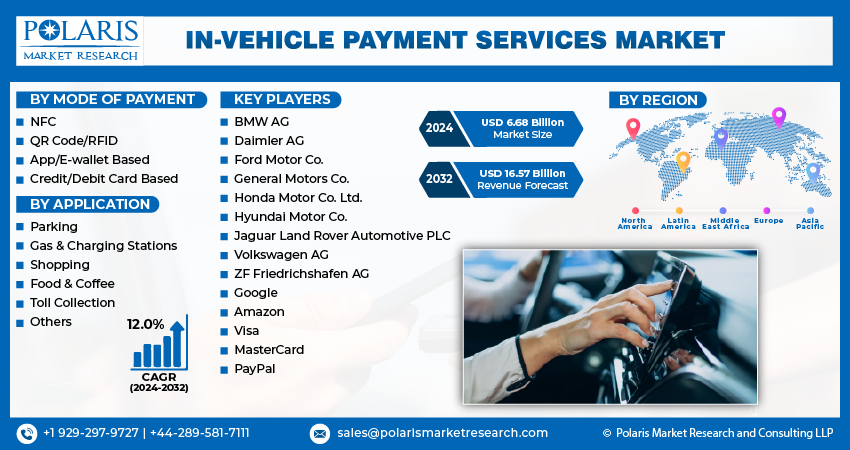

By Mode of Payment (NFC, QR Code/RFID, App/E-wallet, Credit/Debit Card), By Application (Parking, Shopping, Others), By Region, And Segment Forecasts, 2025 - 2034

- Published Date:May-2025

- Pages: 115

- Format: PDF

- Report ID: PM4155

- Base Year: 2024

- Historical Data: 2020-2023

The global in-vehicle payment services market was valued at USD 5.2 billion in 2024 and is projected to grow at a CAGR of 25.60% from 2025 to 2034. Growth is supported by advancements in automotive connectivity and contactless payment technologies.

In-vehicle payments enable drivers to conveniently order & pay for various services such as food, gasoline, parking slots, & tolls without needing to leave their vehicles. The market is poised for growth due to advancements in Internet of Things (IoT) technology and the proactive efforts of automakers to integrate advanced infotainment solutions into their vehicle models. The increasing popularity of contactless payment methods, driven by the COVID-19 pandemic, and ongoing innovations in smart vehicles further contribute to the optimistic outlook for market expansion.

To Understand More About this Research: Request a Free Sample Report

Automobile manufacturers are actively working on developing integrated systems, including voice-based controls, that have the potential to enable drivers to shop while driving without compromising road safety standards. However, the implementation of voice-activated dashboards raises concerns about diverting the driver's attention, emphasizing the need for drivers to prioritize road safety even when attending to shopping needs while driving. As per the study conducted at the University of Utah has highlighted the cognitive disruption caused by the “speech to text” technology, as it requires extra effort to interact with a dashboard compared to conversing with an individual.

In this context, advancements in self-driven and connected car technologies become crucial for the growth of the market over the forecast period. As autonomous and connected car technologies evolve, they can contribute to safer and more efficient in-vehicle experiences, addressing concerns related to driver distraction and enhancing overall road safety. This aligns with the market's growth trajectory, emphasizing the importance of integrating advanced technologies responsibly to ensure a balance between convenience and safety.

The increasing integration of driver support systems is expected to contribute to the expansion of the market throughout the forecast period. Driver support systems offer a range of benefits to drivers, including streamlined parking processes and the ability to make purchases directly from the control panel. This eliminates the need for additional devices or cards, providing a convenient and seamless experience for drivers.

Growth Drivers

- Rise of Mobile Payments

With the widespread adoption of smartphones, there is a growing trend towards mobile payments. In-vehicle payment services leverage this trend, allowing users to make payments using their mobile devices while in the car.

Various payment solution providers, including MasterCard, Visa, & PayPal, are collaborating with automakers globally to develop and incorporate new payment processes and methods into vehicles. Major automobile manufacturers such as Volkswagen AG, Honda Motor & Ford Motor have also introduced in-vehicle payment solutions and platforms. While the COVID-19 pandemic significantly impacted the global economy with disruptions in supply chains and temporary halts in manufacturing activities, the in-vehicle payment services market is anticipated to grow over the forecast period. This growth is attributed to the continued advocacy of social distancing measures by governments and the increasing preference for contactless payments as individuals seek to avoid potential exposure to the coronavirus.

Report Segmentation

The market is primarily segmented based on mode of payment, application, and region.

|

By Mode of Payment |

By Application |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Mode of Payment Analysis

- Credit/Debit Cards segment held the largest share

Credit/Debit cards segment held the largest share. Both debit and credit cards continue to be widely utilized for both contact and contactless payments, reflecting their popularity as payment methods. The increasing inclination towards card-based transactions, including contactless options, and the shift away from cash transactions across diverse age demographics are anticipated to be key drivers of market growth in the forecast period.

App/e-wallet segment projected to grow at the fastest rate. The increasing preference for digital payment methods and the convenience associated with using e-wallets are driving individuals to embrace in-vehicle payment services, contributing significantly to market expansion. Notably, popular apps and e-wallets such as Amazon Pay, Google Pay, AliPay, Apple Pay, Venmo, and Samsung Pay are widely adopted for seamless transactions. Moreover, Amazon and Google have integrated their intelligent virtual assistants with their payment platforms and e-wallets to facilitate interactive shopping and payments for consumers.

By Application Analysis

- Gas & charging stations segment registered the largest market share in 2024

Gas & charging stations segment accounted for the largest share. This can be attributed to the rising acceptance of electric vehicles (EVs), the increasing prevalence of contactless payments, and the growing accessibility of in-vehicle payment technology. Factors such as connected cars, advancements in payment technologies, and heightened competition among payment providers are further propelling the expansion of this market.

Parking segment will grow rapidly. The surge in the population of both passenger & commercial vehicles is anticipated to be a significant contributor to the segment’s growth. According to data from OICA, sales of commercial vehicles in China saw an 18.7% increase in 2020. The rising numbers of both passenger and commercial vehicles create a heightened demand for parking spaces. Integrating in-vehicle payment services in parking areas is seen as a solution to alleviate long queues at these spaces.

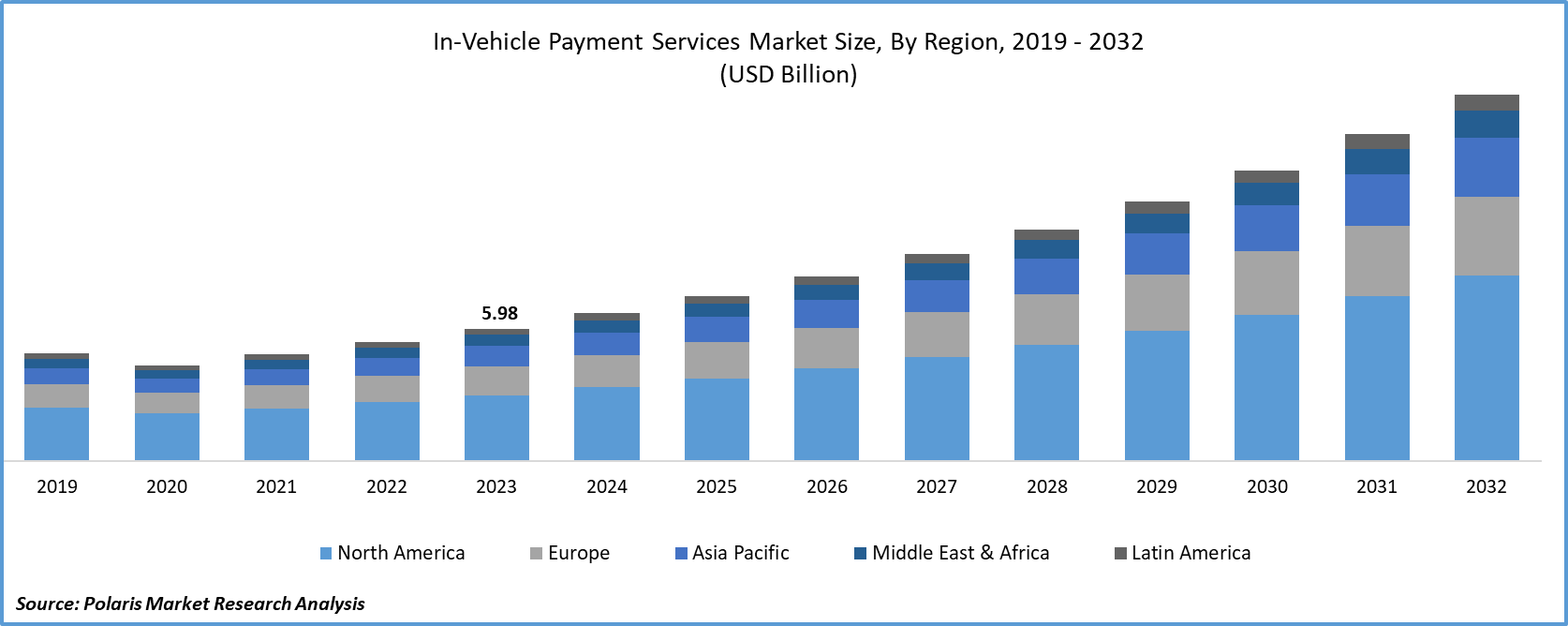

Regional Insights

- North America region held the largest share of the global market in 2024

The North America region dominated the market. Region boasts the highest penetration of connected cars, indicating a widespread adoption of advanced automotive technologies. Connected cars are vehicles equipped with internet connectivity and integrated technologies that enhance safety, entertainment, & overall driving experience.

Furthermore, region is home to prominent technology companies, notably Apple & Google Inc. These companies have leveraged their technological prowess and entered the automotive market. Their foray into the automotive industry signifies a convergence of the technology and automotive sectors. By integrating their innovative capabilities, these tech giants are able to compete with traditional automotive companies, contributing to the overall dynamism and innovation in the market.

The Asia Pacific region projected to grow at the rapid pace. The increasing number of consumers, coupled with rising levels of disposable income, creates a conducive environment for the adoption of in-vehicle payment services. As more individuals in the region gain access to vehicles and advanced automotive technologies, the demand for convenient and innovative payment solutions within vehicles is likely to surge.

Moreover, the region is known for its proactive adoption of the latest and advanced technologies. The continuous innovation in the field of payments, including the integration of digital and contactless methods, aligns with the tech-savvy nature of consumers in this region. As the automotive industry embraces these technological advancements, in-vehicle payment services are expected to become an integral part of the driving experience.

Key Market Players & Competitive Insights

Major players in the market are implementing various strategies, including the development of new products, engaging in mergers and acquisitions, forming strategic partnerships, and expanding their business footprint, to reinforce their dominance in the market.

Some of the major players operating in the global market include:

- BMW AG

- Daimler AG

- Ford Motor Co.

- General Motors Co.

- Honda Motor Co. Ltd.

- Hyundai Motor Co.

- Jaguar Land Rover Automotive PLC

- Volkswagen AG

- ZF Friedrichshafen AG

- Amazon

- Visa

- MasterCard

- PayPal

Recent Developments

- In September 2023, Hyundai Motor America launched Hyundai Pay, enabling drivers to locate and pay for parking via their vehicle’s touchscreen. The service debuted with the 2024 Hyundai Kona and integrated Parkopedia’s parking payment platform.

- In July 2023, Car IQ, has partnered with Visa to launch a vehicle wallet. This innovative solution enables drivers to make direct payments at Visa network shops and banks. The Car IQ pay vehicle wallet facilitates transactions for various services, including fuel, tolls, parking, insurance, and vehicle maintenance.

- In June 2023, Mercedes has introduced Mercedes Pay, a new service enabling customers in the U.S. to utilize their vehicles for booking & paying for off-street parking. Integrated with the Mercedes User Experience (MBUX) infotainment system, Mercedes Pay allows drivers to reserve parking spaces, with the automatic payment processing upon arrival.

In-Vehicle Payment Services Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 6.53 billion |

|

Revenue forecast in 2034 |

USD 50.4 billion |

|

CAGR |

25.60% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Payment Mode, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in in-vehicle payment services market are BMW, Daimler, Ford Motor, General Motors, Honda Motor

The global in-vehicle payment services market is expected to grow at a CAGR of 25.60% during the forecast period.

The in-vehicle payment services market report covering key segments are mode of payment, application, and region.

key driving factors in in-vehicle payment services market are Rise of Mobile Payments

The global in-vehicle payment services market size is expected to reach USD 50.4 billion by 2034