Oncology Companion Diagnostic Market Share, Size, Trends, Industry Analysis Report

By Offering (Product, Services); By Technology; By Disease Type; By End User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 114

- Format: PDF

- Report ID: PM4133

- Base Year: 2023

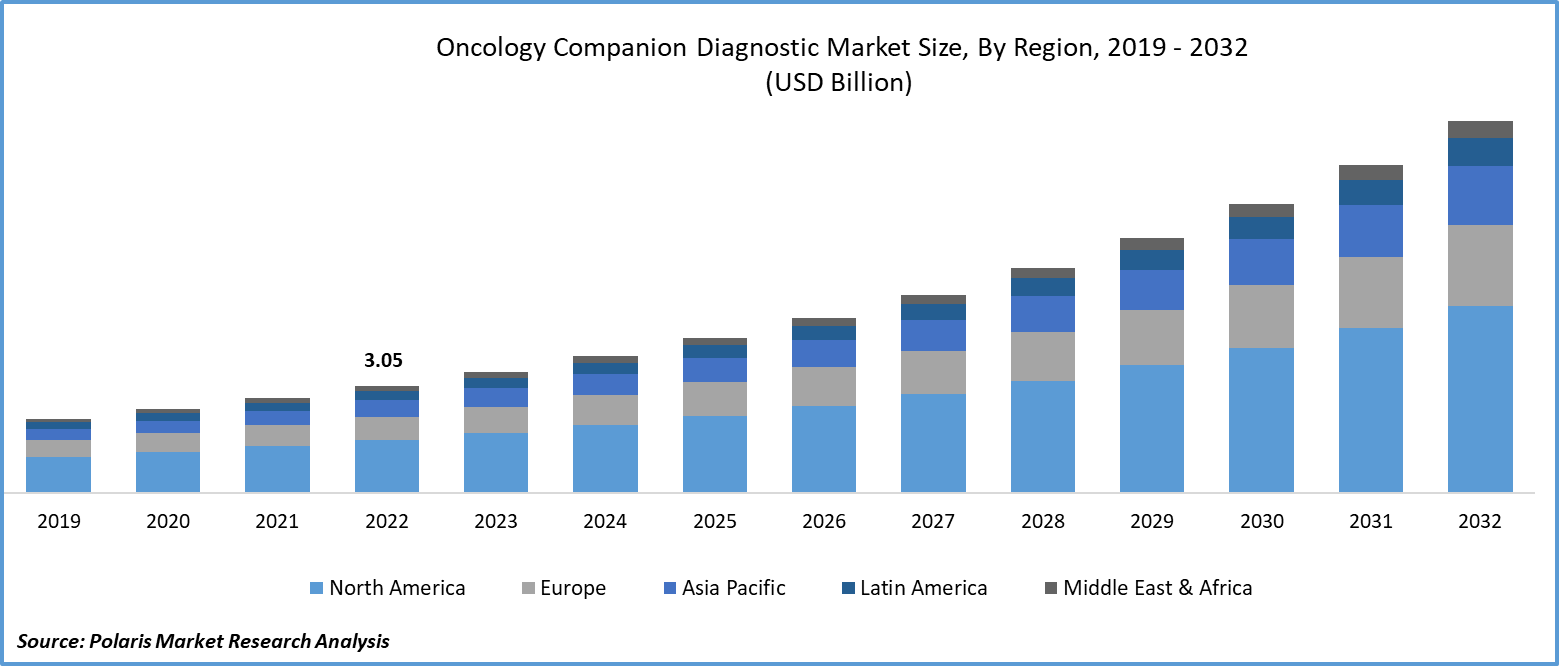

- Historical Data: 2019-2022

Report Outlook

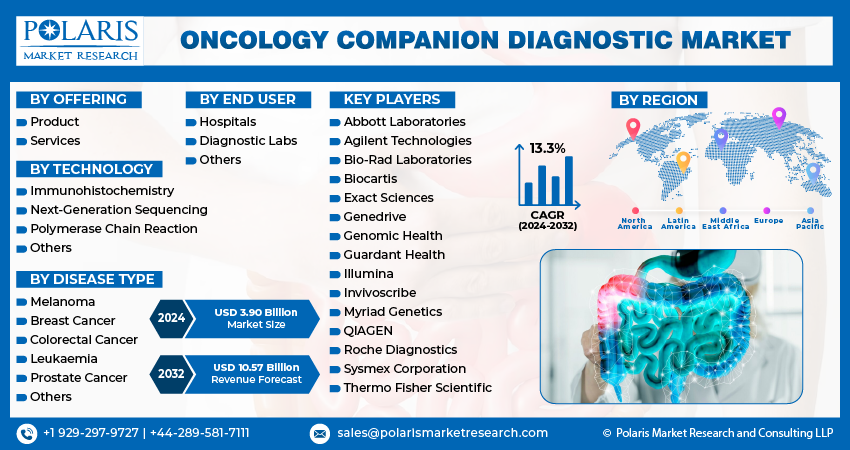

The global oncology companion diagnostic market was valued at USD 3.45 billion in 2023 and is expected to grow at a CAGR of 13.3% during the forecast period.

The capability of companion diagnostics to support early cancer detection and screening initiatives is a compelling market driver. Early diagnosis is pivotal for improving cancer survival rates, making these diagnostics essential in the fight against the disease. The expansion of clinical trials for novel cancer treatments is instrumental in propelling the market. These trials increasingly require precise patient stratification to identify the most suitable participants, leading to an elevated demand for companion diagnostics.

To Understand More About this Research: Request a Free Sample Report

In addition, companies operating in the oncology companion diagnostic market are collaborating to introduce new products with enhanced capabilities to cater to the growing consumer demand.

For instance, in April 2021, Illumina, Inc. and Kartos Therapeutics, Inc. collaborated to create a TP53 companion diagnostic (CDx) derived from the comprehensive genomic profiling assay TruSight Oncology 500 (TSO 500) by Illumina. This companion diagnostic, tailored for various hematologic indications, utilizes TSO 500 with peripheral whole blood as the diagnostic sample type.

Regulatory agencies, such as the U.S. Food and Drug Administration (FDA), play a pivotal role in driving the companion diagnostic market. Their active support and regulation ensure the safety and effectiveness of companion diagnostics.

Post-COVID-19 pandemic, the oncology companion diagnostic market has undergone significant shifts. Telemedicine's accelerated adoption continues to play a pivotal role, offering more accessible diagnostic testing and consultations. Emphasizing early cancer detection persists as a priority, with companion diagnostics being instrumental in this endeavor. Increased research and development efforts have led to innovations in biomarkers and diagnostic tools. The concept of personalized treatment, driven by companion diagnostics, gains traction as it demonstrates superior patient outcomes. Regulatory adaptations remain to streamline approval processes, while the integration of companion diagnostics into telehealth platforms enhances patient care.

For Specific Research Requirements: Request for Customized Report

Growth Drivers

Rising Cancer Cases, Growing Availability of Targeted Cancer Therapies, and Precision Medicine Advancements

The global surge in cancer incidence remains a fundamental driver. The growing prevalence of various cancer types underscores the need for advanced diagnostic tools that enable precise patient stratification, enhancing the potential for successful treatments.

The rapid progress in precision medicine, which hinges on the individualized treatment of patients, serves as a compelling driver. The increasing understanding of the genomic and molecular underpinnings of cancer promotes the adoption of companion diagnostics to tailor therapies to each patient's unique profile.

The growing availability of targeted cancer therapies also drives the market. These therapies, often guided by companion diagnostics, deliver highly effective treatments while minimizing the side effects associated with broad-spectrum approaches. This, in turn, encourages the demand for companion diagnostics that identify ideal candidates.

Report Segmentation

The market is primarily segmented based on offering, technology, disease type, end user, and region.

|

By Offering |

By Technology |

By Disease type |

By End User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Offering Analysis

Product Emerged as the Largest Segment in 2022

The product emerged as the largest segment in 2022. Instruments and consumables for oncology companion diagnostics are fundamental to the precise analysis of patient samples. These tools encompass a range of sophisticated instruments, including automated stainers for immunohistochemistry, PCR machines for DNA/RNA amplification, NGS platforms for comprehensive genomic profiling, FISH instruments for genetic visualization, mass spectrometers for proteomic analysis, and various automated liquid handlers. Microscopes, flow cytometers, and fluorescence readers are essential for examination and cell analysis. In parallel, consumables encompass antibodies, PCR reagents, sequencing kits, FISH probes, and embedding materials. These materials, together with assay plates, quality control samples, and collection kits, empower the accurate and efficient analysis of patient samples for personalized oncology companion diagnostics.

By Technology Analysis

Immunohistochemistry Emerged as the Largest Segment in 2022

The immunohistochemistry segment accounted for the largest market share in 2022. Its primary role is to provide critical information about a patient's tumor tissue. IHC detects specific biomarkers within the tissue, aiding in the categorization of cancer subtypes and treatment decisions. It is instrumental in classifying tumors into distinct subtypes, such as hormone receptor-positive or HER2-positive breast cancer, guiding therapy choices. IHC reveals predictive markers, indicating the likelihood of a patient's response to certain treatments. It also identifies prognostic markers, offering insights into disease progression and patient survival. IHC results guide the selection of therapies and enable treatment monitoring, ensuring optimal patient care and adherence to clinical guidelines.

By Disease Type Analysis

Breast Cancer is Expected to Experience Significant Growth During the Forecast Period

The breast cancer segment is expected to experience significant growth during the forecast period. Companion diagnostics for breast cancer have revolutionized oncology by facilitating precise and personalized care. These tests identify specific genetic and molecular characteristics within breast cancer cells, categorizing them into subtypes such as HER2-positive or hormone receptor-positive. This information guides treatment selection, enabling oncologists to administer targeted therapies with higher efficacy and fewer side effects. Companion diagnostics also track treatment responses, ensuring timely adjustments if necessary. They assess genetic risk factors for breast cancer, support clinical trial eligibility, offer prognostic insights, and even aid in early detection. By aligning treatments with established guidelines, these diagnostics enhance patient outcomes and safety, marking a significant advancement in breast cancer management.

By End-User Analysis

Hospitals Segment Held the Significant Market Revenue Share in 2022

The hospitals segment held a significant market share in revenue share in 2022. Hospitals employ oncology companion diagnostics to improve cancer care in numerous ways. These diagnostics play a central role in patient stratification, ensuring treatments are tailored to an individual's genetic or molecular profile, thus enhancing treatment efficacy. They guide the selection of targeted therapies, reducing the use of ineffective treatments and minimizing side effects. Hospitals also rely on companion diagnostics for monitoring patient responses during treatment and for identifying suitable candidates for clinical trials. These tests aid in early cancer detection and diagnosis, offering a patient-centric approach that optimizes treatment plans, reduces costs, and ensures compliance with healthcare regulations, ultimately improving patient outcomes and overall care quality.

Regional Insights

North America Region Dominated the Global Market in 2022

The North American region has asserted its dominance in the global market and is expected to continue leading throughout the forecast period. The market has seen an upsurge in targeted therapies, immunotherapies, and the integration of companion diagnostics for patient stratification. Liquid biopsies have gained prominence as a non-invasive diagnostic method. Regulatory oversight from the FDA ensures the safety and efficacy of these diagnostics. Collaboration between pharmaceutical companies, diagnostics developers, and healthcare institutions has fostered innovation. Continuous biomarker discovery efforts have expanded diagnostic applications, and patient awareness of the importance of tailored cancer treatments has grown. Insurance coverage plays a vital role in making companion diagnostics more accessible.

The Asia Pacific region is anticipated to experience significant growth during the projected period. Companion diagnostics is pivotal in Asia-Pacific, particularly in countries with advanced healthcare infrastructure. The prevalence of targeted cancer therapies, often accompanied by companion diagnostics, has improved treatment outcomes while minimizing side effects. Regulatory approvals are streamlined, enhancing the safety and efficacy of these diagnostics. Robust clinical trial activity, government support, international collaborations, growing awareness among healthcare professionals and patients, insurance coverage, and a competitive landscape have contributed to the industry's expansion. Emerging economies, such as China and India, have exhibited notable growth in companion diagnostic utilization.

Key Market Players & Competitive Insights

The oncology companion diagnostic market is fragmented and is anticipated to witness competition due to several players' presence. Major market players are constantly introducing new products to strengthen their position in the market. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Abbott Laboratories

- Agilent Technologies

- Bio-Rad Laboratories

- Biocartis

- Exact Sciences

- Genedrive

- Genomic Health

- Guardant Health

- Illumina

- Invivoscribe

- Myriad Genetics

- QIAGEN

- Roche Diagnostics

- Sysmex Corporation

- Thermo Fisher Scientific

Recent Developments

- In November 2022, Roche revealed the approval of the VENTANA FOLR1 (FOLR1-2.1) RxDx Assay by the US Food and Drug Administration (FDA). This marks a significant milestone as it is the inaugural immunohistochemistry (IHC) companion diagnostic test designed to assist in the identification of eligible epithelial ovarian cancer (EOC) patients who can benefit from targeted ELAHERE treatment.

- In July 2021, Labcorp introduced the therascreen KRAS PCR Mutation Analysis, a companion diagnostic designed to identify individuals with non-small cell lung cancer (NSCLC) who qualify for treatment with LUMAKRAS (sotorasib), a therapeutic solution developed by Amgen.

Oncology Companion Diagnostic Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 3.90 billion |

|

Revenue forecast in 2032 |

USD 10.57 billion |

|

CAGR |

13.3% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019-2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Offering, By Technology, By Disease Type, By End User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

FAQ's

The oncology companion diagnostic market report covering key segments are offering, technology, disease type, end user, and region.

Oncology Companion Diagnostic Market Size Worth $10.57 Billion By 2032

The global oncology companion diagnostic market is expected to grow at a CAGR of 13.2% during the forecast period.

North American is leading the global market

key driving factors in oncology companion diagnostic market are Growing emphasis on personalized medicine