Veterinary Diagnostics Market Share, Size, Trends, Industry Analysis Report

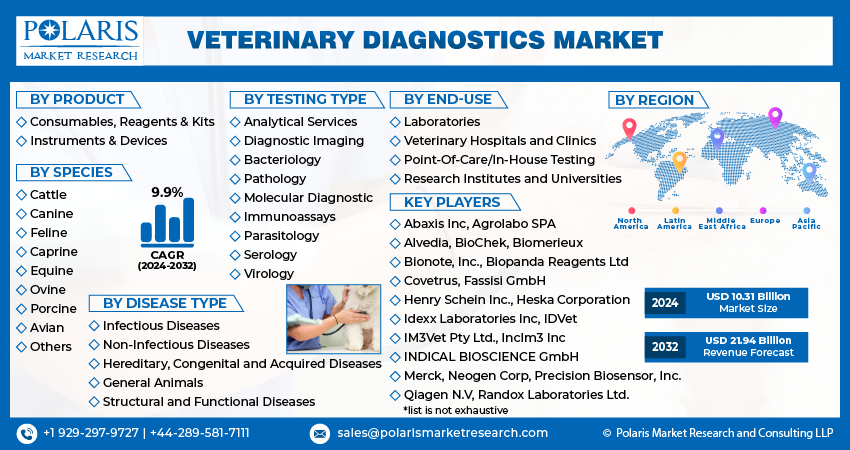

By Product (Consumables, Reagents & Kits, Instruments & Devices); By Species; By Testing Type; By Disease Type; By End-Use; By Region; Segment Forecast, 2025 - 2034

- Published Date:Oct-2025

- Pages: 119

- Format: PDF

- Report ID: PM2832

- Base Year: 2024

- Historical Data: 2020-2023

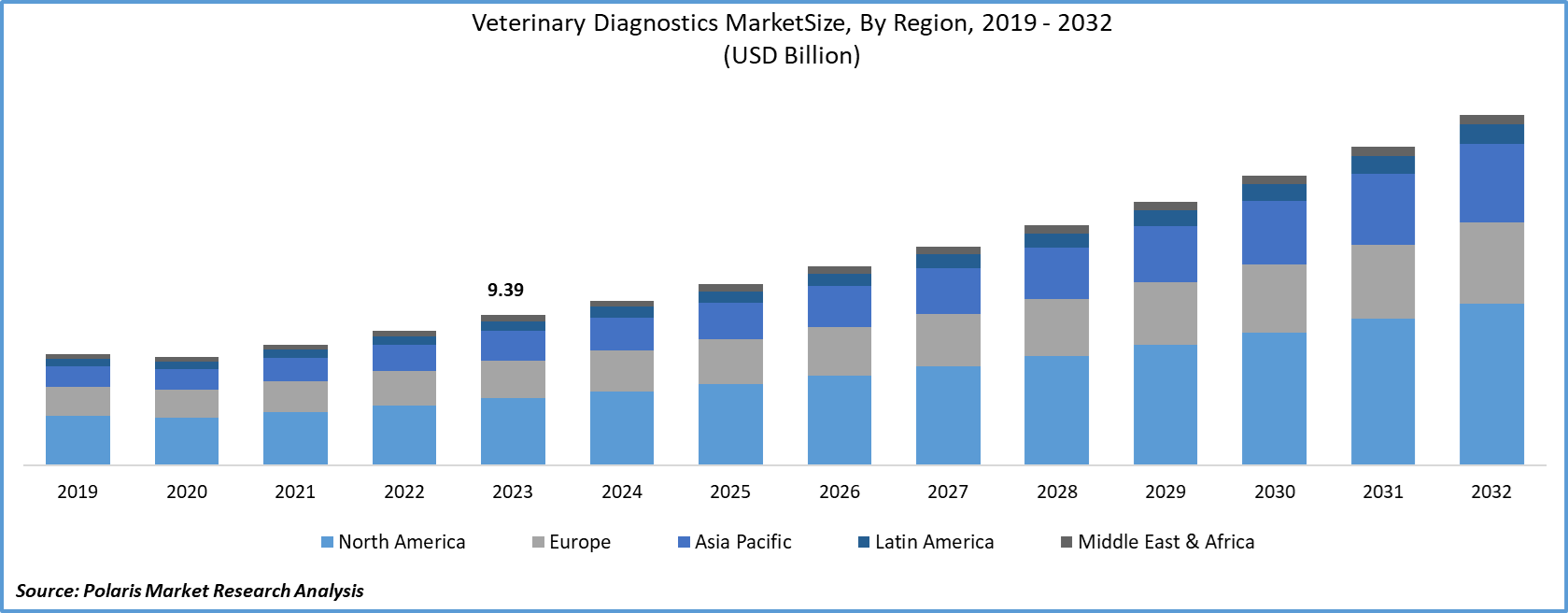

The veterinary diagnostics market size was valued at USD 10.21 billion in 2024, exhibiting the CAGR of 9.5% during the forecast period. Increased spending on animal health, an increase in the prevalence of zoonotic diseases and the number of veterinarians, improvements in point-of-care diagnostic technology, and rising levels of disposable income in developing countries are all factors that have contributed to the growth of the veterinary diagnostic market.

Key Insights

- By product, the consumables, reagents & kits subsegment held the largest share in 2024 because of the increasing need for frequent repeat purchases of these items for every diagnostic procedure conducted.

- By species, the canine species segment held the largest share in 2024. The key driving factor for this dominance is the rising trend of pet humanization and the corresponding colossal expenditure by owners on pet healthcare.

- By testing type, the pathology testing type subsegment held the largest share in 2024. This is majorly driven by its widespread application in the rapid and effective detection of various infectious diseases.

- By disease type, the non-infectious diseases subsegment held the largest share in 2024. The high prevalence and rapid transmission of infectious and zoonotic diseases are crucial factors driving the demand for early and precise diagnostic tools.

- By end-use, the laboratory subsegment held the largest share in 2024 due to the high volume of samples processed and the broad range of advanced diagnostic services they offer.

- By region, North America held the largest share in 2024. The dominance of this region is driven by a well-established and sophisticated veterinary healthcare infrastructure and high pet adoption rates.

Industry Dynamics

- The increasing trend of pet humanization is a major driver, leading owners to spend more on advanced healthcare.

- A growing concern over zoonotic diseases, which can spread from animals to humans, significantly propels the need for robust and rapid diagnostic solutions.

- Continuous technological advancements, such as the introduction of point-of-care testing devices, molecular diagnostics, and the integration of artificial intelligence, are vital growth factors.

Market Statistics

- 2024 Market Size: USD 10.21 billion

- 2034 Projected Market Size: USD 25.24 billion

- CAGR (2025-2034): 9.5%

- North America: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

AI Impact on the Market

- AI systems, particularly machine learning models, are being used to analyze medical images like X-rays, CT scans, and MRIs much faster and with greater accuracy.

- By analyzing large amounts of data, including an animal's medical history, genetic information, and lab results, AI can help suggest treatment plans tailored to the individual animal.

Veterinary diagnostics involves identifying and measuring chemicals in non-human animal source materials. Veterinary diagnostics must include a clinical evaluation. It gives the veterinarian the knowledge necessary to pinpoint the disease or conditions producing the clinical abnormalities.

Additionally, the clinical examination results should assist the veterinarian in judging the pathophysiological processes' seriousness. Veterinarians use different veterinary technologies to identify diseases, track disease development or treatment response, and check for underlying problems in animals that appear to be in good health.

The demand for veterinary diagnostics is further expected to increase due to the rising prevalence of infectious animal diseases. Additionally, improvements in diagnostics and an increasing adoption of novel procedures in most laboratories fuel market expansion.

The Veterinary Diagnostics Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

f

Industry Dynamics

Growth Drivers

The veterinary diagnostics market is driven by the rising rate of pet adoption and increasing disposable income among pet owners. The demand for advanced veterinary care and diagnostic services has surged as more households around the world embrace pet ownership. Pet owners are increasingly treating pets as family members and are willing to invest significantly in their health and well-being. This rising shift has led to increased spending on preventive healthcare, early disease detection, and regular veterinary check-ups.

Furthermore, diagnostic tools such as blood tests, imaging, molecular diagnostics, and point-of-care testing are witnessing heightened demand. Also, the growing awareness about zoonotic diseases and the importance of early diagnosis is further driving veterinary diagnostics market expansion.

Report Segmentation

The market is primarily segmented based on product, species, testing type, disease type, end-use, and region.

|

By Product |

By Species |

By Testing Type |

By Disease Type |

By End-Use |

By Region |

|

|

|

|

|

|

Know more about this report: Request for sample pages

Consumables, reagents & kits to account for the largest market share in 2024

The consumables, reagents & kits segment acquired the most considerable market share in 2024 due to the increasing number of infectious diseases, such as SAR-CoV-2 viral infections worldwide, and increasing demand for rapid diagnostics in the animal.

The whole market is ascertained by carefully analyzing the demand for these products from veterinary clinics, hospitals, and labs. Additionally, pet owners are demanding point-of-care diagnostics at a higher rate.

Furthermore, blood glucose meters, pregnancy kits, urinalysis strips, and other point-of-care diagnostics are frequently utilized in companion animals. However, due to the stringent standards for sensitivity and efficacy in disease testing for livestock, the tests are primarily restricted to laboratories. Veterinary diagnostics has increased the pace at which consumables and reagents are used in diagnosis. This can be ascribed to rising zoonotic disease awareness, increased pet adoptions, and growing pet health awareness.

Canine accounted for a significant market share in 2024

Canine species accounted for the largest market share during the forecast period due to spending on veterinary care for animals has increased, especially in developed regions. One of the key factors influencing the market is the rising prevalence of severe disorders, including obesity, diabetes, cancer, and others.

For instance, around 57% of dogs in the United States were found to be obese, according to an APOP survey from 2019. The risk of joint problems, diabetes, cancer, and other chronic illnesses is significantly increased by obesity.

Moreover, the porcine species maintained a sizeable proportion of the market in 2021 due to the rising demand for better diagnostic techniques and the expanding consumption of pigs. MatMaCorp launched MYRTA, a hand-held real-time polymerase chain reaction device, in March 2021 to identify the virus causing pig reproductive and respiratory disease. MYRTA is a point-of-care and over-the-counter molecular diagnostics solution for human and animal health.

Pathology testing type captured a significant market share in 2024

Pathology testing type obtained considerable market revenue in 2024 due to its broad range of service offerings, which include numerous lab tests, imaging, and specialized tests. Additionally, the cells are from animal biopsy samples, which are processed and given to pathologists for the additional assessment using different and specialized staining named Hematoxylin, and Eosin (H&Es) with cutting-edge tools. In small and large animals, such as humans, BVD and IBR viruses, and other viruses, immunohistochemistry provides markers for neoplastic and infectious disorders which drives the market during the forecast period.

Non-infectious disease type dominated the market in 2024

Non-infectious disease type obtained the most significant market revenue during the forecast period. The number of diagnostics using cutting-edge technologies to find animal ailments has increased. For instance, body fluids, including urine, blood, and milk, can be examined for electrolytic imbalance using Lab on Chip technology.

The hereditary, congenital, and acquired disease type is supposed to increase at the quickest rate during the forecast period. Since the genetic condition is initially invisible, it is difficult to detect. For such circumstances, molecular screening is advised. Animal infectious diseases pose a serious threat to both the health and population of humans and other animals globally. To stop outbreaks and the transfer of infections from animals to animals or from animals to humans, these diseases should be successfully controlled.

Laboratories accounted for a significant market share in 2024

The laboratories segment is projected to account largest market revenue in 2024. Only a few big reference labs worldwide undertake intricate and highly specialized diagnostic procedures. Reference labs offer a broad range of testing services that may not be available in clinics and hospitals, giving them the highest market share in the veterinary diagnostic sector.

The second-largest end-use segment was veterinary hospitals and clinics, which can offer a wide range of diagnostic choices. Additionally, the market is being driven by the increased use of sophisticated analyzers for diagnostic reasons in veterinary hospitals.

North America dominated the regional market

North America dominated the veterinary diagnostics regional market due to the cost of veterinary treatment that has significantly increased in the region. Additionally, it is projected that the presence of healthcare programs and the development in the number of efforts to enhance animal health would boost this region's growth potential. For instance, the North American Pet Health Insurance Association is working to raise public awareness of pet health insurance.

Moreover, the Asia Pacific regional market is expected to develop fastest. Increasing numbers of middle-class families, more disposable money, adoption of pets, and a strong need for animal proteins are just a few of the major drivers anticipated to propel regional market expansion.

Competitive Insight

Some of the major players operating in the global market include Abaxis Inc, Agrolabo SPA, Alvedia, BioChek, Biomerieux, Bionote, Inc., Biopanda Reagents Ltd, Covetrus, Fassisi GmbH, Henry Schein Inc., Heska Corporation, Idexx Laboratories Inc, IDVet, IM3Vet Pty Ltd., IncIm3 Inc, INDICAL BIOSCIENCE GmbH, Merck, Neogen Corp, Precision Biosensor, Inc., Qiagen N.V, Randox Laboratories Ltd., Shenzhen Bioeasy Biotechnology Co., Ltd, SKYER, Inc., Thermo Fisher Scientific Inc, VCA Antech, Virbac Corp, and Zoetis.

Recent developments

September 2024, Zoetis Inc. launched Vetscan OptiCell, a cartridge-based hematology analyzer that utilizes AI-driven technology to provide accurate Complete Blood Count (CBC) results at the point of care. It delivers laboratory-level precision while improving time, cost, and space efficiency for veterinary practices.

July 2024, EKF Diagnostics introduced the Biosen C-Line, a next-generation glucose and lactate analyzer focused on improved user experience. It includes a touch screen and advanced connectivity features that enable seamless integration with hospital and laboratory IT systems through EKF Link.

In September 2021, Heska Corporation acquired Biotech Laboratories to expand its line-up of point-of-care fast test diagnostics.

In June 2021, IDEXX Laboratories, Inc., acquired ezyVet, for expanding its world-class software offering that supports customers to raise the standard of care and improve practice efficiency, enabling more effective communication with pet owners.

Veterinary Diagnostics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 10.21 billion |

| Market size value in 2025 | USD 11.15 billion |

|

Revenue forecast in 2034 |

USD 25.24 billion |

|

CAGR |

9.5% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2025 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 - 2034 |

|

Segments covered |

By Product, By Species, By Testing Type, By Disease Type, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

Abaxis Inc, Agrolabo SPA, Alvedia, BioChek, Biomerieux, Bionote, Inc., Biopanda Reagents Ltd, Covetrus, Fassisi GmbH, Henry Schein Inc., Heska Corporation, Idexx Laboratories Inc, IDVet, IM3Vet Pty Ltd., IncIm3 Inc, INDICAL BIOSCIENCE GmbH, Merck, Neogen Corp, Precision Biosensor, Inc., Qiagen N.V, Randox Laboratories Ltd., Shenzhen Bioeasy Biotechnology Co., Ltd, SKYER, Inc., Thermo Fisher Scientific Inc, VCA Antech, Virbac Corp, and Zoetis. |

FAQ's

? The global market size was valued at USD 10.21 billion in 2024 and is projected to grow to USD 25.24 billion by 2034.

? The global market is projected to register a CAGR of 9.5% during the forecast period

? North America dominated the market share in 2024.

? The consumables, reagents & kits segment accounted for the largest share of the market in 2024.