Industrial Cleaning Solvents Market Size, Share, Trends, Industry Analysis Report

By Product (Hydrocarbon Solvents, Oxygenated Solvents, Bio-Based Solvents, Chlorinated Solvents, Other Products), By End Use, By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5839

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

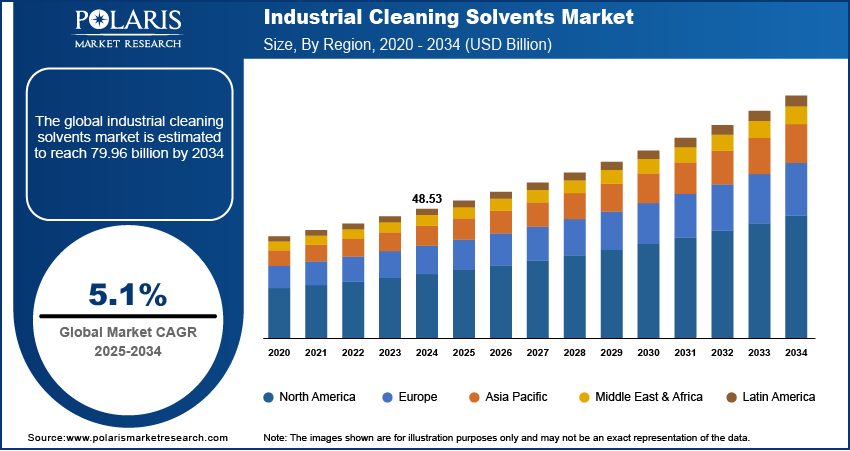

The global industrial cleaning solvents market size was valued at USD 48.53 billion in 2024, growing at a CAGR of 5.1% from 2025 to 2034. The market expansion is driven by the growth of the manufacturing sector and the expansion of the automotive and aerospace industries.

Industrial cleaning solvents are chemical substances used to dissolve, remove, and clean contaminants such as grease, oil, dirt, and residues from machinery, equipment, and surfaces in industrial settings. They are essential for maintaining equipment efficiency, safety, and regulatory compliance across sectors such as manufacturing, automotive, and energy.

Governments and regulatory bodies have set strict standards for cleanliness and worker safety in industrial environments. Industries need to follow these rules to avoid fines and ensure a safe workplace. Cleaning solvents play a major role in meeting these requirements by effectively removing harmful substances and reducing the risk of accidents caused by slippery surfaces or chemical buildup. Companies are investing more in high-quality cleaning solvents that comply with regulations as safety and cleanliness become higher priorities in industrial settings, driving the growth of the industry.

To Understand More About this Research: Request a Free Sample Report

Advances in chemical technology are leading to the development of more effective, safer, and specialized cleaning solvents. Modern formulations can clean more thoroughly, work faster, and target specific contaminants while being less toxic and easier to handle. For example, some solvents are engineered to be non-flammable or biodegradable, making them safer for both users and the environment. These innovations allow industries to choose products that meet their exact cleaning needs while also improving safety and efficiency. This improvement offers better and more tailored cleaning solutions, which, in turn, is driving the market growth.

Industry Dynamics

Growth of Manufacturing Sector

The demand for industrial cleaning solvents is increasing as the manufacturing sector is expanding in major regions such as Asia Pacific. According to the Japan Ministry of Economy, Trade, and Industry, the production index in April 20025 in Japan alone was 101.0. Manufacturing plants, automotive facilities, and heavy machinery industries require regular cleaning and maintenance to ensure smooth operation and long equipment life. Cleaning solvents are essential in removing grease, oil, and dirt that accumulate during production. The need for effective and reliable cleaning solutions is increasing, as more factories and equipment are being utilized, driving the adoption of industrial cleaning solvents.

Expansion of Automotive and Aerospace Industry

The automotive and aerospace sector is expanding globally, due to which the demand for advanced and specialized cleaning solutions is rising. According to the US Bureau of Labor Statistics, as of 2024, 1,022.1 thousand people were employed in the automotive industry in the US alone. The automotive and aerospace industries require highly specialized cleaning processes for parts, tools, and engines. These industries use a wide range of materials, including metals, composites, and plastics, which need precise cleaning before assembly or maintenance. Industrial cleaning solvents are vital for removing oils, grease, and particulate matter from surfaces without damaging sensitive components. The need for efficient cleaning solvents rises due to the increasing demand for cars, aircraft, and related technologies, thereby driving the market growth.

Segmental Insights

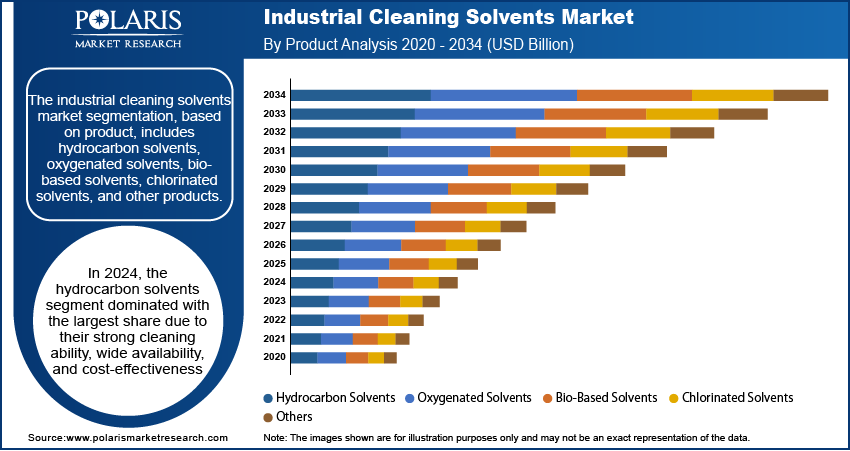

Product Analysis

The segmentation, based on product, includes hydrocarbon solvents, oxygenated solvents, bio-based solvents, chlorinated solvents, and other products. In 2024, the hydrocarbon solvents segment dominated with the largest share due to their strong cleaning ability, wide availability, and cost-effectiveness. These solvents are commonly used to remove heavy grease, oil, and dirt from machinery, tools, and equipment in various industries. Their compatibility with multiple surfaces and strong solvency power made them a preferred choice for industrial cleaning operations. Many manufacturers rely on hydrocarbon-based solutions for tough cleaning jobs, thereby driving the segment growth.

The bio-based solvents segment is expected to witness significant growth due to increasing awareness of environmental safety and regulatory compliance. Made from renewable sources such as plants and natural oils, Green and bio-solvents offer an eco-friendly alternative to traditional petrochemical-based products. Their low toxicity and biodegradability make them attractive to companies looking to reduce environmental impact while maintaining effective cleaning performance. The demand for bio-based solvents is increasing as industries strive for greener operations and align with global sustainability targets. Moreover, ongoing innovation in green chemistry is improving their efficiency, accelerating adoption across various industrial sectors, thereby driving the segment growth.

End Use Analysis

The segmentation, based on end use, includes healthcare, manufacturing & commercial offices, retail & food services, hospitality, automotive & aerospace, and other end use. The healthcare segment held the largest share in 2024, driven by strict hygiene standards and the critical need for infection control. Hospitals, laboratories, and medical device manufacturers require frequent and thorough cleaning of equipment and surfaces to ensure patient safety and meet regulatory requirements. Industrial cleaning solvents are used to disinfect tools, clean workspaces, and maintain sterile environments. Due to the sector's continuous demand for high-performance, reliable cleaning agents, it remains a leading consumer of industrial solvents. The rise in global healthcare facilities and services further fuels the segment growth.

The automotive segment is expected to record significant growth during the forecast period, due to increased production, innovation, and maintenance needs. Precision cleaning is essential for engines, components, and tools to ensure performance and safety. The demand for specialized cleaning solutions rises as these industries expand globally and adopt advanced manufacturing processes. Industrial solvents help remove oil, dust, and residues without damaging sensitive materials. Additionally, the focus on quality control and performance standards drives the use of efficient and eco-friendly solvents, boosting the segment growth.

Regional Analysis

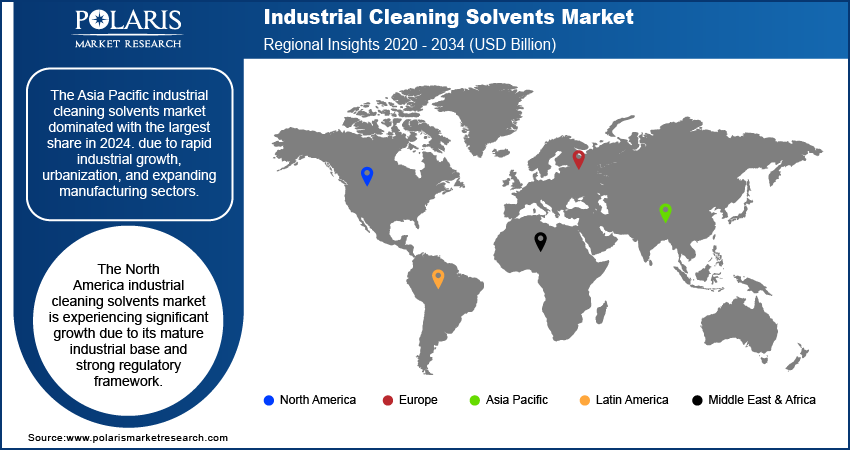

Asia Pacific Industrial Cleaning Solvents Market Trends

The Asia Pacific market dominated with the largest share in 2024, due to rapid industrial growth, urbanization, and expanding manufacturing sectors. Countries such as India, South Korea, Japan, and Southeast Asian nations are seeing increased activity in the automotive, electronics, and heavy machinery industries. These industries require frequent equipment cleaning and maintenance, driving strong demand for cleaning solvents. Government investments in infrastructure and industrial zones further support growth. Additionally, rising awareness of workplace hygiene and safety regulations has pushed industries to adopt high-performance cleaning solutions, thereby driving the industry growth in the region.

China Industrial Cleaning Solvents Market Outlook

The market in China is expected to witness significant growth in the coming years as the country houses a wide range of industries, including automotive, electronics, chemicals, and heavy machinery. These industries require regular cleaning to maintain efficiency and product quality. Strong domestic production capabilities, combined with growing environmental awareness, are shifting focus toward both traditional and eco-friendly solvent solutions. Additionally, China’s government policies promoting industrial modernization and green chemistry are encouraging the adoption of safer and more sustainable cleaning products, thereby driving the growth in the country.

North America Industrial Cleaning Solvents Market Overview

The North America market is projected to witness substantial growth during the forecast period due to its large industrial base and strong regulatory framework. Industries such as healthcare, aerospace, automotive, and energy require high-performance cleaning agents for maintenance and operational safety. The region is further known for its early adoption of eco-friendly, low-VOC, and bio-based solvents, driven by strict environmental and occupational safety standards. Technological advancements, along with the rising demand for sustainable solutions, are shaping product innovation in the region. Established players and growing demand from end-user industries fuel the growth of the region.

U.S. Industrial Cleaning Solvents Market Insights

The U.S. market is expected to experience significant growth in the future due to its large and diverse industrial sectors. Industries from advanced manufacturing and aerospace to healthcare and energy are demanding reliable cleaning solutions for machinery, tools, and sensitive components. Stringent regulations from agencies such as the EPA and OSHA encourage the use of safer, environmentally friendly solvents. Many US-based companies are investing in research and development (R&D) to develop next-generation, sustainable cleaning technologies. Additionally, a strong focus on worker safety, environmental compliance, and industrial efficiency is driving the growth of the U.S. industrial cleaning solvents industry.

Europe Industrial Cleaning Solvents Market Analysis

The market in Europe is expected to experience significant growth, driven by strict environmental regulations and a strong focus on sustainability. The region is home to well-established industries such as automotive, aerospace, pharmaceuticals, and chemicals. All these industries require high standards of cleanliness and equipment maintenance. European regulations encourage the use of low-VOC and bio-based solvents, prompting companies to shift toward eco-friendly alternatives. Innovation in green chemistry and advanced cleaning technologies is widespread, supported by government policies and funding. Demand for high-performance, sustainable cleaning solvents continues to rise across the region as industries adopt cleaner and safer practices, thereby driving the growth of the region.

Germany Industrial Cleaning Solvents Market Assessment

The market in Germany is expected to experience significant growth during the forecast period, due to its strong manufacturing base and technological leadership. Various major sectors such as automotive, engineering, and pharmaceuticals rely heavily on industrial cleaning solvents for precise and efficient cleaning of machinery and components. Germany’s commitment to sustainability and environmental safety has led to increased adoption of bio-based and low-emission solvents. Regulations under the EU’s REACH program and national green initiatives support this transition. The country's focus on innovation, industrial efficiency, and worker safety drives the demand for advanced, high-quality cleaning solvents, thereby driving the market growth in the country.

Key Players and Competitive Analysis

The field of industrial cleaning solvents is highly competitive, driven by innovation, sustainability, and performance. Major players such as AkzoNobel N.V., Dow, and Eastman Chemical Company lead with advanced formulations that meet stringent environmental and safety standards. Arkema, Evonik Industries, and Ashland focus on specialty solvents, targeting niche industrial applications with customized solutions. ExxonMobil and Shell Plc leverage their strong petrochemical capabilities to supply high-volume, cost-effective solvent solutions. LyondellBasell and The Lubrizol Corporation emphasize performance efficiency and compatibility across various industries, including automotive, manufacturing, and energy. Solvay SA is advancing bio-based solvents, aligning with growing demand for eco-friendly alternatives. The competitive landscape is shaped by product innovation, regulatory compliance (especially VOC limits), and strategic collaborations and acquisitions. As sustainability and safety gain prominence, companies increasingly invest in green chemistry and R&D to retain market share, creating a dynamic environment with opportunities for differentiation and expansion.

Key Players

- AkzoNobel N.V.

- Arkema

- Ashland

- Dow

- Eastman Chemical Company

- Evonik Industries

- ExxonMobil Corporation

- LyondellBasell Industries Holdings B.V.

- Shell Plc

- Solvay SA

- The Lubrizol Corporation

Industry Developments

In February 2025, Jelmar launched its CLR PRO MAX Industrial Degreaser, a powerful, non-flammable, water-based solution designed to cut through heavy grease and grime.

In March 2025, CleanGo Innovations launched CG-Industrial, a powerful new industrial cleaning solution.

In October 2024, Actemium Oil & Gas Offshore in Brazil launched a solvent recycling process that reduces 30 tons of CO₂ emissions, prevents 9,000 kg of hazardous waste, conserves water and solvent, and saves up to USD 14,586.75 million annually.

Industrial Cleaning Solvents Market Segmentation

By Product Outlook (Volume, Kilotons, Revenue, USD Billion, 2020–2034)

- Hydrocarbon Solvents

- Oxygenated Solvents

- Bio-Based Solvents

- Chlorinated Solvents

- Other Products

By End Use Outlook (Volume, Kilotons, Revenue, USD Billion, 2020–2034)

- Healthcare

- Manufacturing & Commercial Offices

- Retail & Food Services

- Hospitality

- Automotive & Aerospace

- Other End Use

By Regional Outlook (Volume, Kilotons, Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Industrial Cleaning Solvents Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 48.53 Billion |

|

Market Size in 2025 |

USD 50.96 Billion |

|

Revenue Forecast by 2034 |

USD 79.96 Billion |

|

CAGR |

5.1% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Volume Forecast, Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 48.53 billion in 2024 and is projected to grow to USD 79.96 billion by 2034.

The global market is projected to register a CAGR of 5.1% during the forecast period.

Asia Pacific dominated the market share in 2024.

A few of the key players in the market are AkzoNobel N.V., Arkema, Ashland, Dow, Eastman Chemical Company, Evonik Industries, ExxonMobil Corporation, LyondellBasell Industries Holdings B.V., Shell Plc, Solvay SA, and The Lubrizol Corporation.

The hydrocarbon solvent segment dominated the market share in 2024.

The automotive & aerospace segment is expected to witness the significant growth during the forecast period.