Green & Bio-Solvents Market Share, Size, Trends, Industry Analysis Report

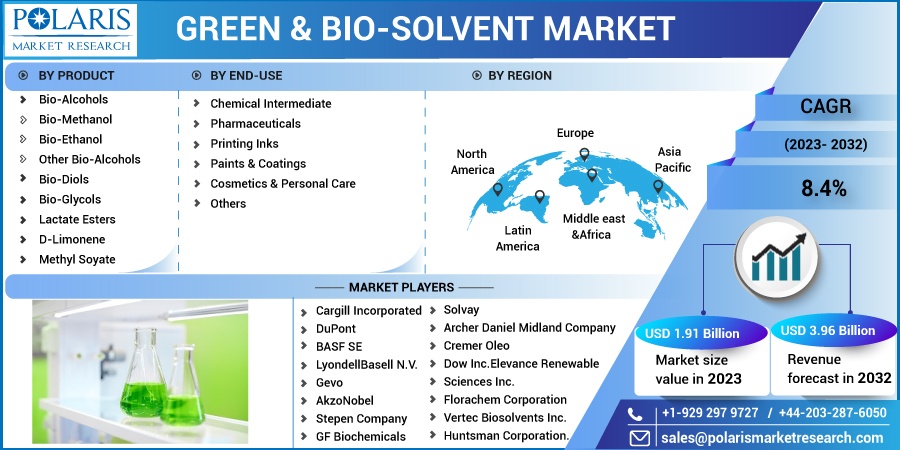

By Product (Bio-Alcohols, Bio-Glycols, Lactate Esters, D-Limonene, Methyl Soyate, and Others); By End-Use, By Region; Segment Forecast, 2023 - 2032

- Published Date:Jan-2023

- Pages: 119

- Format: PDF

- Report ID: PM2659

- Base Year: 2022

- Historical Data: 2019-2021

Report Outlook

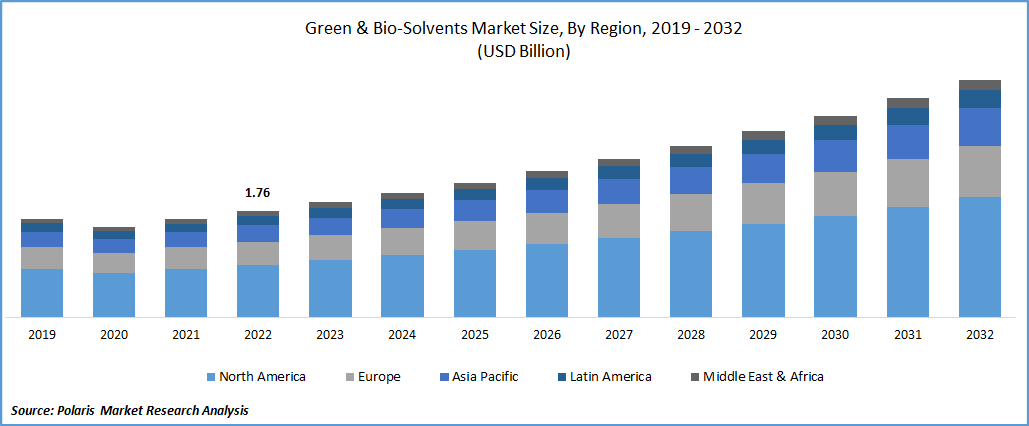

The global green & bio-solvents market was valued at USD 1.76 billion in 2022 and is expected to grow at a CAGR of 8.4% during the forecast period.

The high employment of green solvents in the packaging industry, for the purpose of effective bonding of various types of applications and the growing prevalence of the product across several end-use industries including pharmaceuticals, paints & coatings, and cosmetics & personal care all over the world are key factors boosting the growth of the global market. In addition, growing advancements in production technologies and numerous product innovations by key market players are further impacting the market demand and growth positively.

Know more about this report: Request for sample pages

For instance, in April 2022, Solvay announced the production of its new generation biodegradable solvent Rhodiasolv IRIS, which offers efficient and safe solutions in various agro and industrial applications and also reduces the environmental impact.

Furthermore, the extensively growing demand for eco-friendly paints and coatings due to an increased number of favorable government regulations and rules enforced by the Eco-Product Certification Scheme, European Commission, and many others for the purpose to disperse the harmful compounds used in the production of paint is further fueling the adoption and demand for the product over the coming years.

However, growing uncertainty about the adequate supply and reliability of feedstocks is a major factor hindering the growth of the global market. Raw material availability and sufficient supply are crucial for the effective and undisturbed production of green solvents. Moreover, the economics of green solvents are complex given the extensive range of product variables along with securing profitability in the current competitive market. These are likely to emerge as major challenges that manufacturers will have to tackle.

The outbreak of the COVID-19 pandemic has significantly impacted the growth of the green solvents market. Since, the market is highly dependent on applications like paints & coatings, industrial cleaners, printing inks, and others, and the demand and production for these products were negatively impacted owing to temporary closures of production facilities and high disruptions in the global supply chain.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The usage of various hazardous substances and solvents formed with harmful chemicals has a wide range of negative effects on the environment and impacts human health over time as well in the form of asthma, cancer, TB, and many other ailments, which results in higher adoption of green solvents across several industries as an alternative for traditional industrial and chemical solvents and driving the growth of the global market.

For instance, according to our findings, around 2 million died, as a result of exposure to hazardous chemicals in 2019, a significant rise of 29% from 2016 with a total number of deaths accounting for 1.56 million. Between 4,270 and 5,400 people are likely to die every minute because of unintentional exposure to harmful chemicals.

Moreover, increase in the use of green solvents in the agriculture sector to increase crop yield, reduce the overall production cost, and enhance product quality coupled with the growing penetration of personal care & cosmetics products including perfumes, skin care creams, and moisturizers and enhanced focus of manufacturers on sustainable product development are projected to fuel the market growth in the near future.

Report Segmentation

The market is primarily segmented based on product, end-use, and region.

|

By Product |

By End-Use |

By Region |

|

|

|

Know more about this report: Request for sample pages

Lactate Esters Accounted for the Largest Market Share in 2021

The lactate esters garnered more than a significant global market share & are expected to maintain their position over the study period. The market's growth is mainly driven by increased demand and consumption of the product in several end-use industries such as personal care, industrial solvent applications, and pharmaceuticals. In addition, lactate esters are highly utilized as an alternative to traditional petroleum-based solvents and consist a wide range of beneficial features such as non-corrosive, biodegradable, ozone depletion free, and easily recyclable, which is positively influencing the segment market growth.

The d-Limonene segment is expected to grow significantly during the projected period owing to its ability to replace various types of unpleasant solvents like toluene, methyl ethyl ketone, acetone, and xylene and further take place of chlorinated solvents.

Paints & Coatings Segment Dominated the Market in 2021

The paints & coatings segment dominated the global market in 2021 with a holding of healthy market revenue share, which is mainly attributed to a rapid surge in the number of construction and infrastructure development activities, especially in emerging economies like India, China, and Indonesia. Moreover, the introduction of various bio-based environment-friendly paints & coatings formed by green solvents, which provide a glossy, durable, and decorative look for both outdoor and indoor paints are key reasons augmenting the growth and demand of the segment.

Furthermore, the pharmaceuticals segment is projected to witness the highest growth during the forecast period due to the high percentage of solvents employed in the pharmaceutical products varies from 80% to 90%, as it serves as the major process media and does not affect the reaction profile. Additionally, owing to growing worries about the negative impact on the environment and human health, several research institutes have increased their focus on using bio-based or green solvents and adopted as a renewable alternative to fossil chemicals. These efforts and development in the pharmaceutical industry will fuel market growth extensively around the world.

Asia Pacific Region is Anticipated to Emerge Fastest in the Global Market

The Asia Pacific region is expected to expand at the fastest growth rate throughout the projected period on account of rapidly growing industrialization and developments in industries like cosmetics, industrial, paints & coatings among others along with the increasing consumer awareness towards the numerous advantages of using green solvents. The continuously rising sales and demand for various types of drugs for the diagnosis of many diseases including cancer, asthma, diabetes, and many others where green solvents are widely used as intermediates is propelling the demand and market growth.

However, North America region accounted for the majority of market revenue share in 2021 and is likely to retain its position over the forecast period. Increased penetration and surge in demand for green solvents, that has significantly forced policymakers and governments to replace traditional solvents with new and eco-friendly alternatives. The United States and Mexico are the leading markets for green solvents owing to their various stringent regulation on the use of chemical solvents and the wide presence of key market players like The Dow Chemical Company, Cargill Inc., and Stepen Company.

Competitive Insight

Some of the major players operating in the global market include Cargill Incorporated, DuPont, BASF SE, LyondellBasell N.V., Gevo, AkzoNobel, Stepen Company, GF Biochemicals, Solvay, Archer Daniel Midland Company, Cremer Oleo, Dow Inc., Elevance Renewable Sciences Inc., Florachem Corporation, Vertec Biosolvents Inc., and Huntsman Corporation.

Recent Developments

- In May 2022, BTC Europe and NXTLEVVEL Biochem, entered into a strategic agreement for distribution of the bio-based & biodegradable solvents, sourced from levulinic acid across Europe. With this agreement, both companies are looking to leverage their expertise and quickly respond to the increasing demand for sustainable products.

- In July 2021, Merck introduced green solvents for photo-lithographic processes in semiconductor manufacturing. It is specially designed for the faster dissolution of the photo-resist patterns in a more cost-effective way & eating a huge impact on the semi-conductor wet chemical market.

Green Solvents Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2023 |

USD 1.91 billion |

|

Revenue forecast in 2032 |

USD 3.96 billion |

|

CAGR |

8.4% from 2023 – 2032 |

|

Base year |

2022 |

|

Historical data |

2019 – 2021 |

|

Forecast period |

2023 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2022 to 2030 |

|

Segments covered |

By Product, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

Cargill Incorporated, DuPont, BASF SE, LyondellBasell N.V., Gevo, AkzoNobel, Stepen Company, GF Biochemicals, Solvay, Archer Daniel Midland Company, Cremer Oleo, Dow Inc., Elevance Renewable Sciences Inc., Florachem Corporation, Vertec Biosolvents Inc., and Huntsman Corporation. |