Composites Market Share, Size, Trends, Industry Analysis Report

By Fiber Type (Glass Fiber, Carbon Fiber, Others); By Resin Type; By Manufacturing Process; By End Use; By Region; Segment Forecast, 2024- 2032

- Published Date:Apr-2024

- Pages: 116

- Format: PDF

- Report ID: PM4827

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

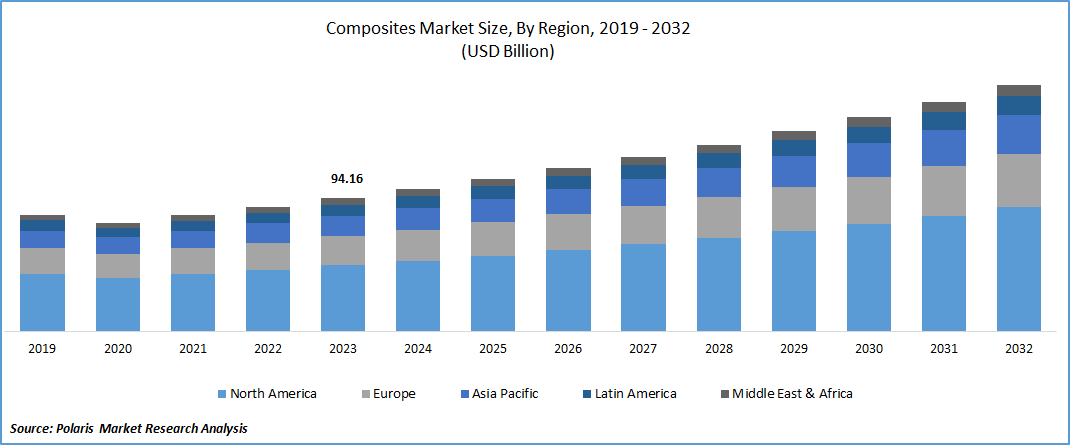

Composites Market size was valued at USD 94.16 billion in 2023. The market is anticipated to grow from USD 100.72 billion in 2024 to USD 173.84 billion by 2032, exhibiting the CAGR of 7.1% during the forecast period.

Market Introduction

Composites offer versatility in design, allowing for the creation of intricate shapes and structures not achievable with traditional materials. This flexibility caters to diverse industries such as aerospace, automotive, marine, and construction, where customized solutions are essential. Furthermore, lightweight properties of composites enhance their appeal, promoting fuel efficiency in transportation and enabling innovative architectural designs. As industries prioritize innovation and differentiation, the design adaptability of composites becomes increasingly valuable, fueling market expansion and driving advancements in materials science and engineering.

To Understand More About this Research:Request a Free Sample Report

In addition, companies operating in the market are introducing new products to expand market reach and strengthen presence.

For instance, in March 2024, Hexcel Corporation introduced a novel HexTow continuous carbon fiber named IM9 24K, offering the market a lightweight, robust, and resilient carbon fiber with added benefits for cutting-edge aerospace composite applications.

Investments in research and development are driving significant advancements in the composites market size. R&D efforts focus on improving composite properties, performance, and production processes. Novel formulations like nanocomposites and bio-based composites have emerged from these initiatives, offering enhanced strength and sustainability. Researchers are also tackling challenges related to cost reduction, scalability, and recycling, making composites more feasible for widespread adoption. Collaborative R&D projects involving academia, government, and industry promote innovation and knowledge exchange.

Industry Growth Drivers

Increasing Demand for Lightweight Properties is Projected to Spur the Product Demand

The composites market share is witnessing a surge in demand due to the increasing need for lightweight properties across industries. Lightweight materials, such as carbon fiber reinforced polymers (CFRP) and glass fiber reinforced polymers (GFRP), offer exceptional strength-to-weight ratios, enhancing fuel efficiency and performance in transportation, aerospace, and automotive sectors. Additionally, composites provide corrosion resistance, durability, and design flexibility, making them ideal for construction and wind energy applications. With a growing emphasis on sustainability and stringent regulatory standards, industries are increasingly adopting composites to meet lightweighting objectives.

Increasing Inclination Towards Environmental Sustainability and Reducing Carbon Footprint is Expected to Drive Composites Market Growth

The composites market trends is experiencing growth driven by increasing concerns about environmental sustainability and efforts to reduce carbon footprints. Industries and consumers are favoring composites over traditional materials due to their lightweight, durable, and eco-friendly properties. This preference spans sectors such as aerospace, automotive, construction, and renewable energy. Advanced manufacturing techniques, including the use of recycled and bio-based materials, further enhance their appeal. Governments worldwide are also incentivizing the adoption of composites through policies aimed at curbing greenhouse gas emissions.

Industry Challenges

High Manufacturing Costs are Likely to Impede the Market Growth

High manufacturing costs present a challenge for the market. Despite their benefits like lightweight properties and strength, composite production involves intricate and expensive processes. Specialized equipment, materials, and skilled labor are required, contributing to elevated expenses. Moreover, the use of advanced resins, fibers, and additives further escalates production costs. These factors can deter potential adopters, especially in cost-sensitive industries. Additionally, stringent quality control measures add to expenses.

Report Segmentation

The composites market analysis is primarily segmented based on fiber type, resin type, manufacturing process, and end use, and region.

|

By Fiber Type |

By Resin Type |

By Manufacturing Process |

By End Use |

By Region |

|

|

|

|

|

To Understand the Scope of this Report:Speak to Analyst

By Fiber Type Analysis

Glass Fiber Segment Held Significant Market Revenue Share in 2023

The glass fiber segment held significant revenue share in 2023. Glass fibers offer versatility, being adaptable to diverse composite materials and applications. Additionally, they are cost-effective compared to alternative reinforcing materials, aiding in cost reduction for manufacturers. With an impressive strength-to-weight ratio, glass fibers provide structural reinforcement without adding substantial weight. They also offer corrosion resistance, making them suitable for use in challenging environments like marine or chemical industries. Moreover, glass fibers are widely available in the market, ensuring consistent supply and accessibility.

By Resin Type Analysis

Thermoset Composites Segment Held Significant Market Revenue Share in 2023

The thermoset composites segment held significant revenue share in 2023. These composites offer superior mechanical properties, including high strength and impact resistance, catering to diverse industries like aerospace and automotive. They also exhibit exceptional chemical resistance and dimensional stability, ensuring reliability in harsh environments. Their design flexibility allows for the production of intricate parts, while established manufacturing processes like resin transfer molding offer cost-effective production. Although thermoset composites may initially entail higher processing costs, their long-term durability and performance result in lower lifecycle expenses, making them a preferred choice for end-users across various sectors.

By Manufacturing Process Analysis

Layup Process Segment Held Significant Market Revenue Share in 2023

The layup process segment held significant revenue share in 2023. Its versatility accommodates a diverse array of composite part shapes and sizes, meeting the needs of industries like aerospace and automotive. Precise control over layer orientation enables tailored mechanical properties for specific performance demands. Layup manufacturing proves cost-effective for custom or low-volume production runs, mitigating tooling expenses. Enhanced quality control ensures consistent, defect-free products.

By End Use Analysis

Automotive & Transportation Segment Held Significant Market Revenue Share in 2023

The automotive & transportation segment held significant revenue share in 2023. Composites offer substantial weight reduction, enhancing fuel efficiency and reducing emissions in vehicles. Their high strength-to-weight ratios improve overall vehicle performance, including acceleration and handling. Moreover, composites enable design flexibility, allowing manufacturers to create sleeker, aerodynamic vehicles with enhanced aesthetics and functionality. Resistant to corrosion, composites also extend the lifespan of vehicle components and reduce maintenance costs. Additionally, their ability to dampen vibrations and noise contributes to quieter and more comfortable vehicle interiors. With stringent regulatory standards and the growing adoption of electric vehicles, the demand for lightweight composites in the automotive sector continues to rise.

Regional Insights

Asia-Pacific Region Dominated the Global Market in 2023

In 2023, Asia-Pacific region dominated the global market. Rapid industrialization, coupled with a strong manufacturing base and skilled labor, drives demand across various sectors such as automotive, construction, and aerospace. Additionally, substantial infrastructure investments, particularly in transportation and renewable energy, fuel the need for lightweight and durable composite materials. The expanding automotive industry, especially in countries like China and India, further boosts demand for composites due to regulatory requirements for fuel efficiency. Moreover, technological advancements in composite manufacturing and supportive government policies promoting industrial growth and sustainability contribute to the region's leadership in the market.

The market in North America is expected to grow due to its advanced manufacturing infrastructure, technological advancement, and robust R&D capabilities. The aerospace industry, led by giants like Boeing and Lockheed Martin, extensively employs composites to enhance aircraft performance and fuel efficiency. In the automotive sector, manufacturers such as Ford and Tesla are integrating composites into vehicle structures to meet stringent regulations on fuel efficiency and emissions. Infrastructure projects, including bridges and buildings, drive demand for composites due to their durability and lightweight properties. Moreover, the region's focus on renewable energy sources, like wind power, further propels the composites market analysis, particularly in wind turbine blade manufacturing.

Key Market Players & Competitive Insights

The composites market includes various players, with the expected arrival of new contenders intensifying competition. Leading companies continuously enhance their technologies to maintain a competitive advantage, emphasizing efficiency, reliability, and safety. They prioritize strategic actions such as forging partnerships, improving product portfolios, and participating in collaborative ventures to outperform rivals. Their ultimate goal is to secure a significant composites market share.

Some of the major players operating in the global composites market include:

- Compagnie de Saint-Gobain S.A.

- Gurit Holding AG

- Hexcel Corporation

- Hexion Inc.

- Huntsman Corporation

- Mitsubishi Chemical Corporation

- Owens Corning

- SGL Carbon SE

- Solvay S.A.

- Teijin Limited

- Toray Industries, Inc.

- Weyerhaeuser Company

Recent Developments

- In November 2022, Solvay unveiled a new product to enhance its extensive range of composite materials tailored for the automotive sector. SolvaLite 714 Prepregs represent a cutting-edge line comprising unidirectional carbon-fiber and woven-fabric variants infused with SolvaLite 714 epoxy resin. These prepregs are engineered for rapid curing, extended shelf life, and optimized performance in automotive component manufacturing.

- In July 2023, Toray Advanced Composites revealed its strategy to enlarge its operations at the Morgan Hill facility in California, USA. The expansion will encompass an additional 74,000 square feet to accommodate the rising demand for high-quality advanced composites.

- In February 2024, Mitsubishi Chemical Group disclosed the development of a ceramic matrix composite (CMC) with exceptional heat resistance, utilizing pitch-based carbon fibers. Capable of withstanding temperatures up to 1,500°C, this CMC is developed for utilization primarily in space industry applications.

Report Coverage

The composites market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, fiber types, resin types, manufacturing processes, and end uses, and their futuristic growth opportunities.

Composites Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 100.72 billion |

|

Revenue forecast in 2032 |

USD 173.84 billion |

|

CAGR |

7.1% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

|

|

Regional scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

Composites Market report covering key segments are fiber type, resin type, manufacturing process, and end use, and region.

Composites Market Size Worth $ 173.84 Billion By 2032

Composites Market exhibiting the CAGR of 7.1% during the forecast period.

Asia-Pacific is leading the global market.

The key driving factors in Composites Market are Increasing inclination towards environmental sustainability and reducing carbon footprint is expected to drive composites market growth