Glass Fiber Yarn Market Share, Size, Trends, Industry Analysis Report

Glass Fiber Yarn Market Share, Size, Trends, Industry Analysis Report By Grade Type; By Product Type; By Application; By End-Use Industry; By Region; Segment Forecast, 2022 - 2030

- Published Date:Dec-2022

- Pages: 118

- Format: PDF

- Report ID: PM2886

- Base Year: 2021

- Historical Data: 2018-2020

Report Outlook

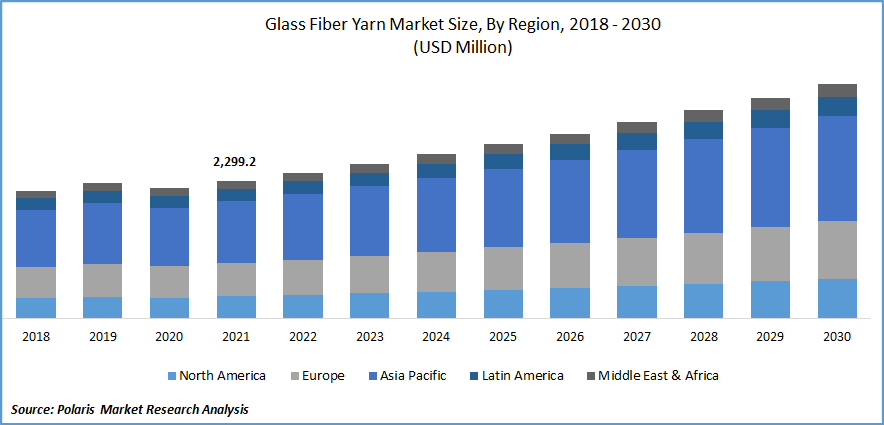

The global glass fiber yarn market was valued at USD 2,299.2 million in 2021 and is expected to grow at a CAGR of 6.1% during the forecast period.

The increasing utility of fiberglass yarn in various industries such as power generation, aerospace, food processing, and the automotive industry to aid manufacturing processes is one of the key reasons responsible for market growth. In addition, increasing investments in the renewable energy sector, requiring fiberglass assemblies for efficient functionality, are anticipated to support the market's growth.

Know more about this report: Request for sample pages

Fiberglass is known for being anticorrosive and highly strong while having less weight than other materials. This makes it ideal for fabricating aeronautical and construction materials for building lightweight structures that are efficient in their use. Therefore, the high adoption rate of fiberglass in fabricating aeronautical composite parts, along with growth in the aerospace industry, is predicted to foster the market's growth. For instance, according to an article published by Houstex, in 2022, the annual spending on research and development in Texas, U.S., was estimated to be USD 5 billion among 1,400 across the state.

Moreover, the growing investments in new transportation projects with countrywide infrastructure development, such as metro rail projects, is expected to increase the demand for fiberglass assemblies owing to key advantages such as fire resistance, and high tensile strength, among others. This, coupled with the rising demand for glass fiber in the locomotive industry, is expected to drive the uptake of glass fiber yarn and promote market growth.

The COVID-19 pandemic impeded the market's growth due to economic decline in major industries such as construction, textiles, locomotives, and aerospace. The disruption in production activities, shortages in raw materials, demand shock, and decline in the availability of labor are some of the major reasons for the market decline during the pandemic. Moreover, major governments executing healthcare restrictions to contain the spread of the virus demanded cancellations in trade activities. Furthermore, stalling of expansion projects by major market players to enhance production capacities due to the adherence to emergency protocols hampered the growth of the glass fiber yarn market.

Know more about this report: Request for sample pages

Know more about this report: Request for sample pages

Industry Dynamics

Growth Drivers

The increasing demand for printed circuits and semiconductors, along with the growth of the telecommunications industry, is anticipated to drive the demand for glass fiber production. This, combined with the key advantages of glass fiber to have exceptional electric conduction and the ability to enable high-speed data transfers, is anticipated to drive the market's growth.

Moreover, the increasing adoption of knitted fabrics and the utility of glass fiber in developing laminates for marbles and other natural stone slabs is a growing trend in the glass fiber market. The properties of fiberglass yarn in weaving fabrics offering excellent elasticity and endurance to various kinds of forces, along with the high demand for stone laminated, are expected to foster the market's growth. Additionally, the utility of fiberglass in various types of building industries, such as the development of heat and water-resistant insulation, production of fiberglass window panes, wall panels, and bridge anchoring, among others, is projected to bolster the demand for fiberglass yarn market.

Report Segmentation

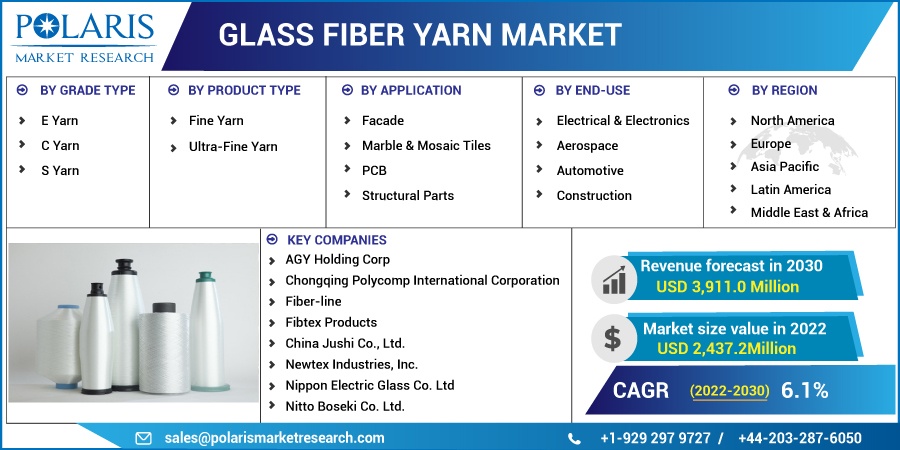

The market is primarily segmented based on grade type, product type, application, end-use industry and region.

|

By Grade Type |

By Product Type |

By Application |

By End-Use industry |

By Region |

|

|

|

|

|

Know more about this report: Request for sample pages

E Yarn segment is expected to witness the fastest growth

The increasing demand for innovative electronics is resulting in high demand for printed circuit boards with high-performance chipsets. This is causing major market players to invest in electrical glass fiber yarn production to meet commercial consumers' supply standards and requirements. Therefore, the rising uptake of electrical fiberglass due to the high conductance of electricity well suited for modern telecommunications and data processing systems is expected to drive the segment's growth.

For instance, in August 2022, Semiconductor Manufacturing International Corporation announced an investment of USD 7.5 billion to develop and expand its manufacturing facility for a new 12-inch wafer in China. The project involves the construction integrated circuit, expected to be completed by the end of 2024. Therefore, the rising demand for integrated circuit boards, along with the rising adoption of printed circuit boards in the electronics industry supports the growth of the segment.

Ultra fine yarn accounted for the largest market share in 2021

The trend of miniaturization in the fields of telecommunication, electronics, and other industries, along with the rising need for ultrathin printed circuit board (PCB) substrates to accommodate high-performance chipsets, is anticipated to support the growth of the segment. Moreover, the increasing popularity of multi-layer circuit boards in the semiconductor industry and rising demand for wearable gadgets requiring small high-performance integrated circuits (IC) is anticipated to drive the segment's growth.

For instance, in June 2022, Apple announced the launch of the M2 MacBook Air and M2 MacBook Pro. Moreover, the company plans to update the Mac mini with an M2 chip, improving its performance. The emphasis of key stakeholders in developing microprocessors with a smaller size is anticipated to surge the uptake of ultra-fine yarn owing to compatibility advantages. Additionally, the emergence of new applications through research in the field of material and chemistry to develop new forms of ultra-fine yarn with increasing applications is projected to grow the segment.

Facade segment is expected to hold the significant revenue share

The façade segment is anticipated to grow through the forecast segment due to the growing demand for glass fiber yarn to build key structures in large-scale projects such as shopping malls, museums, and monuments, among others. Moreover, increasing infrastructure projects in the medical sector, such as hospitals, along with key market players investing in increasing production to cater to the rising demand for fiberglass material in building various types of façades, is expected to support the growth of the market.

For instance, according to an article published by the JEC group, in February 2022, Advanced Fiberglass Industries, in collaboration with Sicomin, announced the completion of the Museum of the Future infrastructure project in Dubai. The company manufactured 230 double-curved panels with a distinctive double-helix structure staircase. These, along with 228 Glass fiber-reinforced plastic light structures, were delivered to the museums. The increasing numbers of such projects requiring glass fiber structures are anticipated to drive the growth of the market.

The demand in Asia-Pacific is expected to witness significant growth

The growth in the infrastructure and automotive industry among key countries is one of the primary reasons driving the demand for glass fiber yarn in the Asia Pacific market. This, coupled with the increasing demand for building and construction, along with the high uptake of glass fiber parts in these markets, positively influences the market's growth. For instance, in September 2021, Semiconductor Manufacturing International Corporation announced a USD 8.87 billion worth of chip manufacturing plant in Shanghai, China.

The expansion strengthens the company's supplying capacity in response to the bolstering growth of the semiconductor market. The growing number of such large-scale projects increases the demand for fiberglass parts as part of the infrastructure. Such a factor, along with growing applications of fiberglass yarn in the production of cost-effective, durable products, is anticipated to drive the market's growth.

North America is estimated to grow through the study period owing to the growth of locomotive industries along with increasing demand for lightweight parts with structural durability is anticipated to create an upsurge in demand for molded fiberglass products. This, coupled with key advantages of glass fiber over other building materials such as the anti-corrosion, heat resistance, and fireproof nature of the material, supports the adoption of fiberglass yarn as a material of choice and thus augments the growth of the market.

Competitive Insight

Some of the major players operating in the global market include AGY Holding, Chongqing Polycomp, Fiber-line, Fibtex Products, China Jushi, Newtex Industries, Nippon Electric Glass, Nitto Boseki, PFG Fiber Glass, Saint-Gobain Performance, and Taiwan Glass Industry.

Recent Developments

In May 2022, Jushi Group announced an investment of USD 698.0 million to expand a new glass fiber manufacturing unit with an annual output of up to 400,000 tons. The development improves the production capacity to cater to the rising demand of fibre- glass exports of China being one of the largest producers of glass fiber yarn across the globe. The investment strengthens the industrial presence in the highly competitive market of fiberglass yarn, along with providing pricing control in the market.

Furthermore, in February 2022, Nitto Boseki announced the production of the next-generation low-dielectric glass fiber to meet the 5G standards of the telecommunication industry. The new launch provides the company a competitive edge in the glass fiber yarn market owing to the increasing demand for telecommunication hardware and supportive infrastructure along with a strong market presence in the glass fiber yarn industry.

Glass Fiber Yarn Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2022 |

USD 2,437.2 million |

|

Revenue forecast in 2030 |

USD 3,911.0 million |

|

CAGR |

6.1% from 2022 – 2030 |

|

Base year |

2021 |

|

Historical data |

2018 – 2020 |

|

Forecast period |

2022 – 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2022 to 2030 |

|

Segments covered |

By Grade Type, By Product type, By Application, By End-Use Industry and By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Key companies |

AGY Holding Corp, Chongqing Polycomp International Corporation, Fiber-line, Fibtex Products, China Jushi Co., Ltd., Newtex Industries, Inc., Nippon Electric Glass Co. Ltd, Nitto Boseki Co. Ltd., PFG Fiber Glass Corporation, Saint-Gobain Performance Plastics, Taiwan Glass Industry Corporation among others. |