Carbon-Neutral Products Market Size, Share, & Industry Analysis Report

: By Product Type (Carbon-Neutral Fuels, Carbon-Neutral Consumer Goods, Carbon-Neutral Packaging, and Others), By Activity, By End-Use Industry, and By Region – Market Forecast, 2025–2034

- Published Date:Jun-2025

- Pages: 129

- Format: PDF

- Report ID: PM5685

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

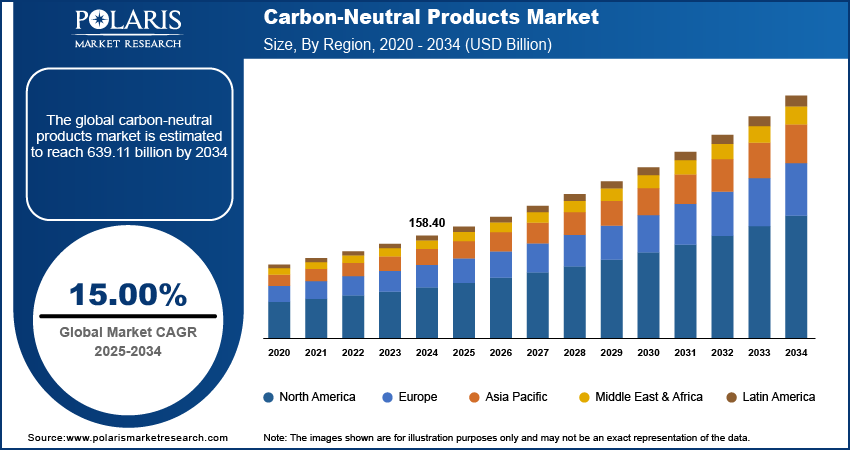

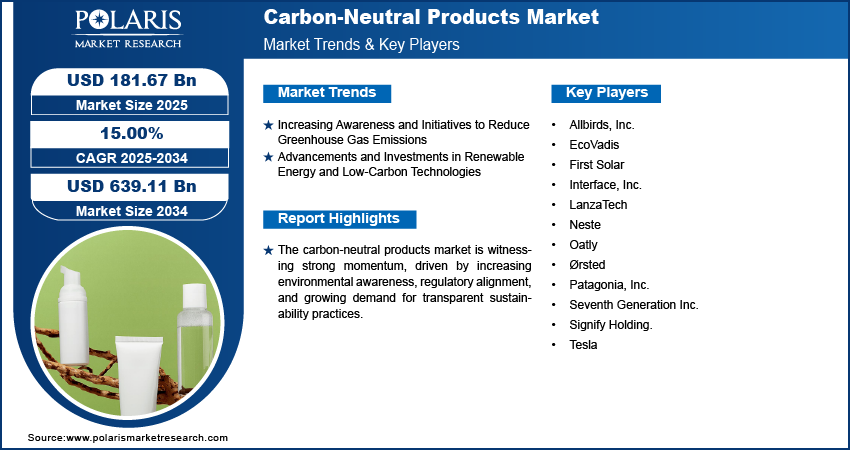

The global carbon-neutral products market was valued at USD 158.40 billion in 2024 and is expected to register a CAGR of 15.00% from 2025 to 2034. The carbon-neutral products market is growing rapidly, driven by rising environmental awareness, government regulations, and corporate sustainability goals aimed at reducing carbon footprints and promoting eco-friendly consumer choices globally.

The adoption of carbon pricing mechanisms propels the demand for carbon-neutral products. Carbon-neutral products are goods whose total carbon emissions, generated throughout their lifecycle, are offset by equivalent carbon savings or removals, resulting in a net-zero carbon footprint. The carbon-neutral products market is gaining considerable traction as industries and consumers become increasingly aware of their environmental impact. The implementation of stringent government regulations worldwide further contributes to the use of carbon-neutral products. Governments across regions are mandating carbon accounting and emissions reduction targets, compelling companies to invest in sustainable production, supply chain transparency, and carbon offset mechanisms. According to a March 2025 report by the SBTi, companies must split emissions by 2030 and cut >90% by 2050 to limit warming to 1.5°C. Net-zero requires neutralizing residual emissions via permanent carbon removal, achieved only after meeting these targets. These regulations promote environmental responsibility and also serve as a compliance framework, pushing manufacturers and service providers to develop and commercialize carbon-neutral offerings.

To Understand More About this Research: Request a Free Sample Report

The demand for carbon-neutral products is increasing as consumers seek environmentally friendly and sustainable options. Consumers are more conscious of the environmental implications of their purchases and are increasingly seeking alternatives that align with their values. This behavioral shift is encouraging brands to innovate and communicate their sustainability efforts transparently. Coupled with rising corporate sustainability targets, businesses are proactively incorporating carbon neutrality into their product strategies, not as a marketing tactic but as a core business objective. This confluence of consumer pressure and corporate commitment is fostering a dynamic market landscape that favors carbon-neutral products across diverse sectors.

Market Dynamics

Increasing Awareness and Initiatives to Reduce Greenhouse Gas Emissions

Increasing awareness and initiatives to reduce greenhouse gas (GHG) emissions reinforce the urgency of climate action across all sectors. According to an April 2025 EEA report, EU emissions fell 37% by 2023, with an 8% annual reduction. New targets aim for ≥55% cuts below levels by 2030 and climate neutrality by 2050, requiring an accelerated transition from fossil fuels to renewable energy. Both public and private stakeholders are prioritizing emission reduction strategies with the mounting scientific consensus on the environmental and socio-economic impacts of global warming. This growing consciousness is leading to increased adoption of carbon-neutral products as a tangible step toward mitigating individual and organizational carbon footprint management. These initiatives are encouraging producers to evaluate their lifecycle emissions and invest in carbon offsetting or emission-reducing practices, thereby aligning product offerings with broader climate goals and sustainability expectations. Thus, increasing awareness and initiatives to reduce greenhouse gas (GHG) emissions are driving the adoption of carbon-neutral products.

Advancements and Investments in Renewable Energy and Low-Carbon Technologies

Advancements and investments in renewable energy and low-carbon technologies accelerate the development and adoption of carbon-neutral products by providing the necessary infrastructure and innovations to support sustainable production. According to a 2024 IEA report, global energy investment is projected to surpass USD 3 trillion in 2024, with ∼USD 2 trillion allocated to clean energy technologies and infrastructure development. Manufacturers are able to transition away from fossil fuels and reduce embedded emissions in goods and services as clean energy sources become more accessible and cost-effective. Simultaneously, the integration of energy-efficient technologies and carbon capture solutions allows for more precise control of emissions along the value chain. These technological developments enhance operational sustainability and also facilitate the scaling of carbon-neutral product lines, strengthening their viability in the mainstream sectors.

Segment Insights

Market Assessment by Product Type

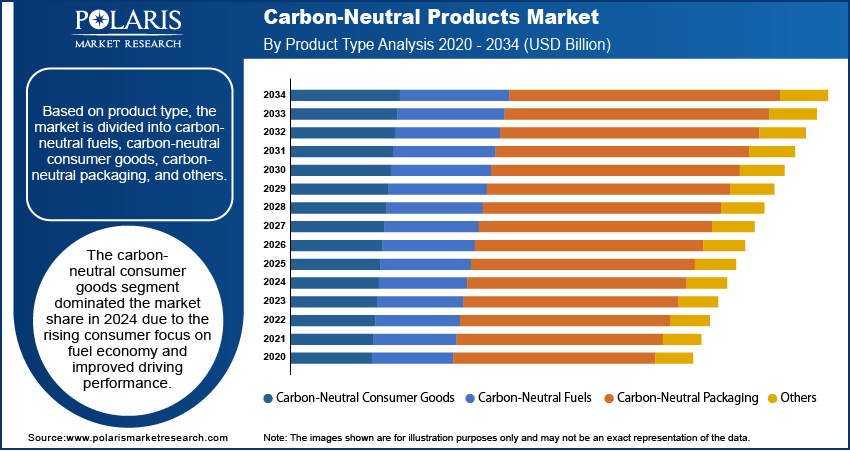

The global carbon-neutral products market segmentation, based on product type, includes carbon-neutral fuels, carbon-neutral consumer goods, carbon-neutral packaging, and others. The carbon-neutral consumer goods segment dominated the market in 2024 due to their widespread availability, high consumer visibility, and direct impact on sustainable purchasing behaviors. The increasing consumer preference toward eco-conscious lifestyles has driven demand for everyday products such as clothing, electronics, personal care items, and food that demonstrate verified carbon neutrality. Brands are responding to this trend by integrating carbon-neutral certifications and sustainable sourcing practices, thereby influencing purchase decisions and improving brand loyalty. The accessibility and relatability of consumer goods make them an effective channel for promoting carbon-neutral initiatives on a broad scale, solidifying their leading role in the market.

Market Evaluation by Activity

The global carbon-neutral products market segmentation, based on activity, includes emissions reduction management, renewable energy management, waste management, product life cycle management, and others. The renewable energy management segment is expected to witness the fastest growth during the forecast period due to its foundational role in decarbonizing operations and reducing emissions at scale. Renewable energy adoption through solar, wind, hydro, and bioenergy becomes central to achieving carbon neutrality across production and distribution chains as organizations transition away from fossil fuel dependency. Investments in renewable energy infrastructure, coupled with innovations in battery energy storage system and grid integration, are allowing more efficient and reliable energy management systems. Owing to its critical function in boosting sustainable operations, the segment would experience growth opportunities during the forecast period.

Regional Analysis

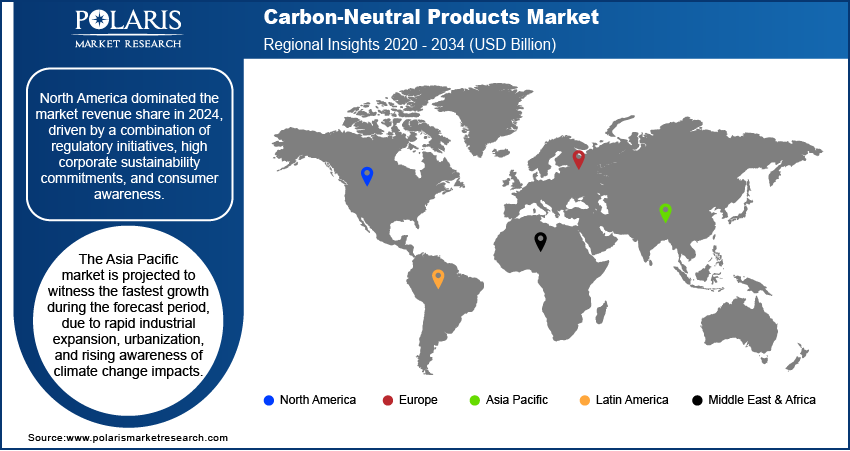

By region, the report provides the industry insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The North America carbon-neutral products market dominated in 2024, driven by a combination of regulatory initiatives, high corporate sustainability commitments, and consumer awareness. The presence of mature markets with strong environmental policies has boosted the early adoption of carbon-neutral strategies across various industries. Additionally, leading corporations in the region are actively investing in de-carbonization, product innovation, clean energy investments, and verified offset programs to meet stringent environmental targets. According to a February 2025 Clean Investment Monitor report, the US clean energy investment reached USD 272 billion in 2024, reflecting a 16% annual increase and representing 4.9% of total private investment in structures, equipment, and durable goods. The region's well-developed infrastructure, access to renewable energy sources, and increasing demand for sustainable goods contribute to its dominant position in the global landscape.

The Asia Pacific carbon-neutral products market is projected to witness the fastest growth during the forecast period due to rapid industrial expansion, urbanization, and rising awareness of climate change impacts. Governments across the region are introducing supportive policies and sustainability frameworks to encourage low-carbon practices and clean energy adoption. According to a September 2023 report by India's Ministry of Science & Technology, the country is on track to meet its targets, such as 500 GW non-fossil capacity by 2030, 50% renewable energy use, 1 billion ton CO2 reduction, and net-zero emissions by 2070. Additionally, increasing consumer demand for environmentally responsible products, particularly in emerging economies, is prompting businesses to invest in carbon-neutral solutions. The region's growing focus on renewable energy deployment, technological innovation, and sustainable manufacturing practices is expected to drive robust regional market expansion in the coming years.

Key Players & Competitive Analysis Report

The carbon-neutral products sector is witnessing dynamic competition, driven by evolving sustainability strategies and emerging market segments. Developed markets lead in adoption, with strategic investments in renewable energy and circular supply chains, whereas emerging economies present latent demand fueled by regulatory pushes and consumer awareness. Major players are leveraging disruptive technologies to decarbonize production, with revenue opportunities concentrated in sectors such as FMCG, apparel, and self-healing construction materials. Competitive analysis reveals a surge in partnerships, with SMEs and corporates adopting sustainable value chains to align with net-zero targets. Geopolitical shifts, such as carbon pricing mechanisms, are reshaping region-wise market potential, with Europe and North America currently dominating. Vendor strategies prioritize lifecycle assessments and carbon offset integrations, though supply chain disruptions pose challenges. Expert insights indicate that future development strategies will rely on scalable green technologies and cross-industry collaborations, with revenue growth tied to the premiumization of climate-conscious products. A few of the key players in the market are Allbirds, Inc.; EcoVadis; First Solar; Interface, Inc.; LanzaTech; Neste; Oatly; Ørsted; Patagonia, Inc.; Seventh Generation Inc.; Signify Holding; and Tesla.

EcoVadis is a global sustainability ratings provider dedicated to guiding companies toward a more sustainable world by delivering independent, trusted, and actionable sustainability ratings and insights across supply chains. EcoVadis evaluates businesses on environmental impact, labor and human rights, ethics, and procurement practices, offering a reliable benchmark for sustainability performance in various industries, such as those producing carbon-neutral products with a mission in their bylaws. The platform’s methodology aligns with international standards such as the UN Global Compact and ISO 26000, ensuring strict and comparable assessments. EcoVadis has taken important steps to address climate change internally, committing to reduce Scope 1 and 2 greenhouse gas emissions by 50% and Scope 3 emissions per unit value added by 55% by 2030, as well as sourcing 100% renewable electricity by the same year. Externally, EcoVadis supports companies in their carbon-neutral journeys through tools such as the Product Carbon Footprint (PCF) Data Exchange, which enables precise tracking and management of product-level emissions using global standards. This solution helps organizations and their suppliers identify emissions reduction opportunities and accelerate decarbonization efforts.

Neste is into renewable fuels and sustainable solutions, headquartered in Finland and operating in over a dozen countries. Originally an oil refiner, Neste has transformed its business to focus on producing renewable diesel, sustainable aviation fuel (SAF), and renewable feedstocks for plastics and chemicals, all primarily from waste, residues, and other innovative raw materials. The company’s proprietary NEXBTL technology enables the conversion of a wide variety of renewable inputs-including used cooking oil, animal fat waste, and residues from vegetable oil processing-into high-quality renewable fuels. Neste’s flagship carbon-neutral products include Neste MY Renewable Diesel and Neste MY Sustainable Aviation Fuel, both of which reduce greenhouse gas emissions by up to 90% compared to fossil-based alternatives over their lifecycle. Neste is committed to ambitious climate goals as it aims to achieve carbon-neutral production by 2035 and to help its customers reduce their greenhouse gas emissions by at least 20 million tons annually by 2030. The company’s renewable products are certified by international standards such as ISCC. They are produced at refineries in Finland, the Netherlands, and Singapore latter being the world’s largest renewable diesel refinery. Beyond fuels, Neste is innovating in renewable and recycled solutions for the plastics and chemicals sectors, including products such as RE, a feedstock made from chemically recycled plastic waste, further supporting carbon neutrality and circular economy objectives. Through these efforts, Neste is at the forefront of providing scalable, carbon-neutral product solutions for transportation, aviation, and industrial applications worldwide.

List of Key Companies in Carbon-Neutral Products Market

- Allbirds, Inc.

- EcoVadis

- First Solar

- Interface, Inc.

- LanzaTech

- Neste

- Oatly

- Ørsted

- Patagonia, Inc.

- Seventh Generation Inc.

- Signify Holding.

- Tesla

Carbon-Neutral Products Industry Developments

April 2025: Solvay collaborated with Cavalinho in Brazil to cut transport emissions by 90% by 2030, deploying 60 biofuel trucks starting in 2026. The initiative supports Solvay’s Scope 3 reduction goals and complements Paulínia’s 97% CO₂ cut via biomass steam replacement.

April 2023: Apple launched its first carbon-neutral products with select Apple Watch models, cutting emissions by over 75% per unit. This aligns with its 2030 goal to make all products carbon-neutral, including supply chains and device lifecycle emissions.

Carbon-Neutral Products Market Segmentation

By Product Type Outlook (Revenue, USD Billion, 2020–2034)

- Carbon-Neutral Fuels

- Carbon-Neutral Consumer Goods

- Carbon-Neutral Packaging

- Others

By Activity Outlook (Revenue, USD Billion, 2020–2034)

- Emissions Reduction Management

- Renewable Energy Management

- Waste Management

- Product Life Cycle Management

- Others

By End-Use Industry Outlook (Revenue, USD Billion, 2020–2034)

- Manufacturing

- Energy & Utilities

- Transportation & Logistics

- Food & Beverages

- Construction

- Automotive

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Carbon-Neutral Products Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 158.40 Billion |

|

Market Size Value in 2025 |

USD 181.67 Billion |

|

Revenue Forecast by 2034 |

USD 639.11 Billion |

|

CAGR |

15.00% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 158.40 billion in 2024 and is projected to grow to USD 639.11 billion by 2034.

The global market is projected to register a CAGR of 15.00% during the forecast period.

North America dominated the market share in 2024.

A few of the key players in the market are Allbirds, Inc., EcoVadis, First Solar, Interface, Inc., LanzaTech, Neste, Oatly, Ørsted, Patagonia, Inc., Seventh Generation Inc., Signify Holding, and Tesla.

The carbon-neutral consumer goods segment dominated the market share in 2024.

The renewable energy management segment is expected to witness the fastest growth during the forecast period.