Advanced Carbon Materials Market Size, Share, Trends, Industry Analysis Report

: By Product (Fibers, Special Graphite, Nanotubes, Graphene, Foams, and Others), Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 119

- Format: PDF

- Report ID: PM1166

- Base Year: 2024

- Historical Data: 2020-2023

Advanced Carbon Materials Market Overview

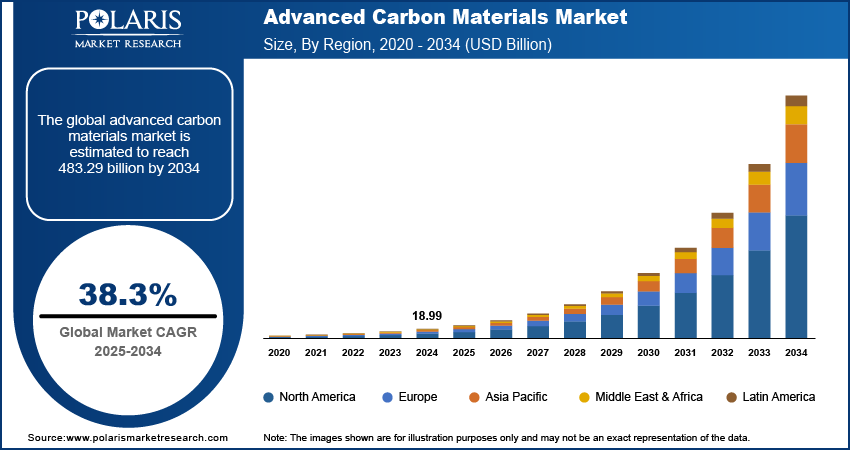

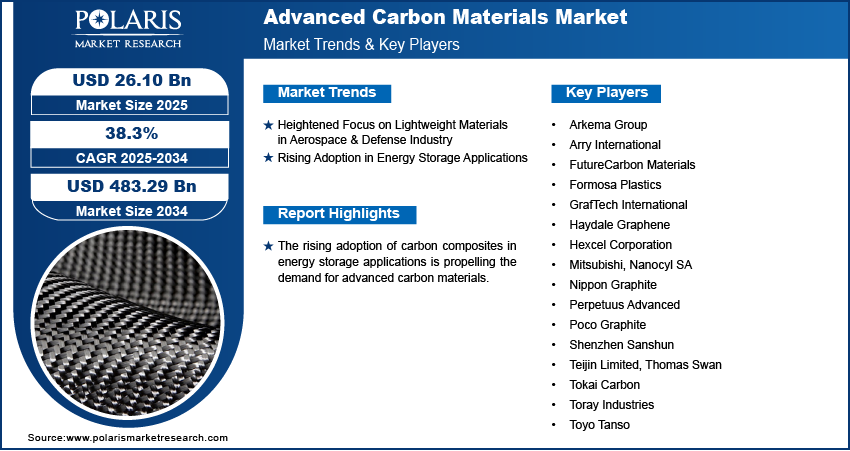

The global advanced carbon materials market size was valued at USD 18.99 billion in 2024. The market is projected to grow from USD 26.10 billion in 2025 to USD 483.29 billion by 2034. It is projected to exhibit a CAGR of 38.3% from 2025 to 2034. Rising demand in energy, aerospace, and automotive sectors, along with tech advancements and sustainability focus, is driving market growth.

Key Insights

- The fibers segment led the market with a robust revenue share in 2024.

- The aerospace & defense segment accounted for a notable revenue share due to advanced carbon substances growingly being opted over aluminum by aerospace and defense makers due to growing instances of galvanic aluminum corrosion in aerospace parts.

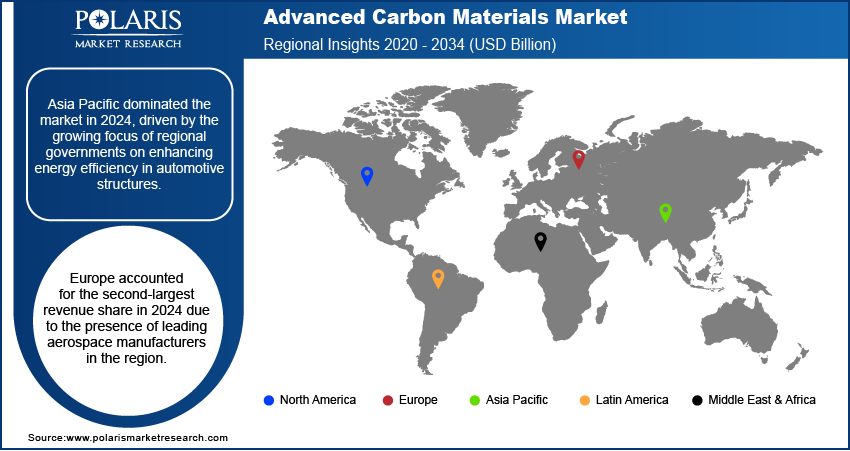

- Asia Pacific advanced carbon materials market held a large revenue share in 2024 because of concentration of regional governments on improving energy efficacy in automotive frameworks and surging funding in advancement of weightless sturdy substances pushing the market growth in the region.

- Europe accounted for the second largest revenue share in 2024 because of the existence of leading aerospace manufacturers, including Augusta Westland, Boeing, and Bell Helicopters, pushing the demand for these substances in Europe.

Industry Dynamics

- Leading makers in aerospace & defense industry are continuously working on weight reduction of the aircraft and vehicles to enhance performance, range and fuel productivity is propelling the market forward.

- Advanced carbon materials have elevated surface area, outstanding electrical conductivity, and a prolonged lifecycle fueling the market expansion.

- The growing focus on sustainability, which has caused increased R&D efforts in carbon materials is providing ample opportunity for the market to grow.

- Health risks associated with progressive carbon materials are factors that can pull the market down.

Market Statistics

2024 Market Size: USD 18.99 billion

2034 Projected Market Size: USD 483.29 billion

CAGR (2025-2034): 38.3%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

Carbon materials refer to a broad class of ordered or disordered solids made from elemental carbon. These materials have high potential in several applications, including energy, electronics, automotive, and construction. Advanced carbon materials outperform conventional varieties in heat durability and mechanical properties, such as tensile strength. The most commonly used advanced carbon materials include activated carbon, graphene, carbon fibers, structural graphite, and nanotubes.

The high demand for carbon materials in key sectors such as automotive, healthcare, and construction sectors primarily drives the advanced carbon materials market growth. The rising adoption of carbon composites in energy storage applications, such as lithium-ion batteries, is also propelling the demand for advanced carbon materials. Further, the continuous development of advanced manufacturing techniques and improvements in material properties have opened up new applications for advanced carbon materials, impacting the market development favorably.

The rising emphasis on sustainability, which has led to increased R&D efforts in carbon materials, is anticipated to propel the advanced carbon materials market expansion in the coming years. The ability of advanced carbon materials to reduce weight in high-performance sports and recreational equipment is expected to create several opportunities for advanced carbon materials manufacturers in the sports sector.

Advanced Carbon Materials Market Dynamics

Heightened Focus on Lightweight Materials in Aerospace & Defense Industry

Leading manufacturers in the aerospace & defense industry are constantly working on weight reduction of aircraft and vehicles to improve performance, range, and fuel efficiency. Advanced carbon materials are known for their high strength-to-weight ratio. Also, these materials exhibit excellent thermal stability and have high corrosion resistance. These characteristics make them an ideal choice for aircraft structures and engine components that require lightweight, durable materials, including wings, tailpipes, and fuselages. Thus, the increased emphasis on lightweight materials in aerospace parts manufacturing boosts the advanced carbon materials market revenue.

Rising Adoption in Energy Storage Applications

Advanced carbon materials have a high surface area, excellent electrical conductivity, and a long life cycle. They are increasingly used in several energy storage devices, including supercapacitors, batteries, and fuel cells. For instance, the excellent adsorption properties of activated carbon make it suitable for storing liquids and gases. Similarly, graphene is used in lithium-ion batteries and ultracapacitors due to its unique thermal and chemical properties. Thus, the increasing adoption of advanced carbon materials in energy storage applications propels the advanced carbon materials market development.

Advanced Carbon Materials Market Segment Insights

Advanced Carbon Materials Market Assesment Based on Product

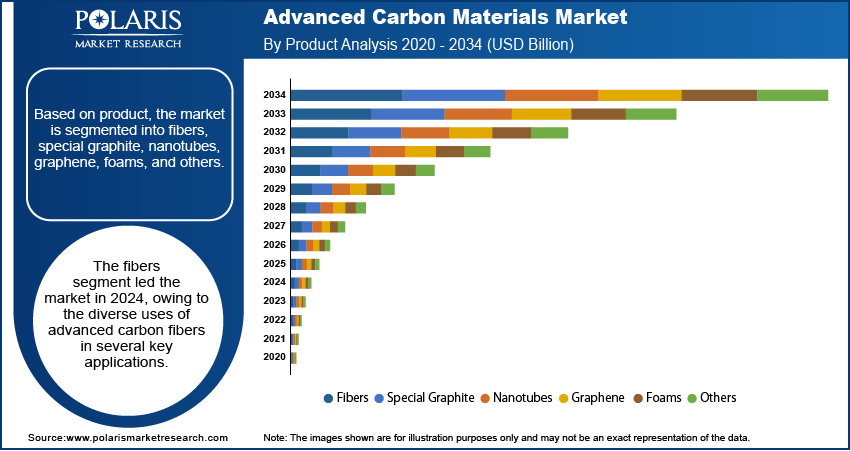

The advanced carbon materials market segmentation, based on product, includes fibers, special graphite, nanotubes, graphene, foams, and others. The fibers segment led the market with an 89.1% revenue share in 2024. Advanced carbon fibers have low density and high strength as compared to steel or aluminum materials. These materials also exhibit high tensile strength and have a natural resistance to oxidation. This makes advanced carbon fibers an ideal material for a diverse range of uses in automotive, construction, electronics, and energy applications. As a result, fibers dominate the market for advanced carbon materials.

Advanced Carbon Materials Market Evaluation Based on Application

The advanced carbon materials market, based on application, is segmented into aerospace & defense, electronics, sports, automotive, construction, energy, and others. The aerospace & defense segment accounted for a significant revenue share of 36.1% in 2024. Advanced carbon materials are being increasingly preferred over aluminum by aerospace & defense manufacturers owing to the rising cases of galvanic aluminum corrosion in aerospace components. Additionally, the increased emphasis on the production of lightweight aircraft has led to the development of composite-based wing boxes and other aircraft parts. This shift towards innovative carbon materials due to their superior characteristics drives the segment’s growth in the global market.

Advanced Carbon Materials Market Regional Analysis

By region, the market report offers advanced carbon materials market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific dominated the market for advanced carbon materials, with a revenue share of 35.4% in 2024. The growing focus of regional governments on enhancing energy efficiency in automotive structures and rising investments in the development of lightweight, durable materials drive robust market growth in the region. Further, the booming electrical and electronics sectors in major countries such as China and India contribute to the regional market demand.

The advanced carbon materials market in Europe accounted for the second-largest revenue share in 2024. The presence of leading aerospace manufacturers, including Augusta Westland, Boeing, and Bell Helicopters, drive the need for advanced carbon materials in Europe. Stringent government regulations and rules on environmental sustainability and emissions has further encouraged the use of these materials in the region’s manufacturing sector.

Advanced Carbon Materials Market – Key Players and Competitive Insights

The advanced carbon materials industry is characterized by intense competition, driven by factors such as innovative product offerings, technological advancements, mergers and acquisitions, and other strategic partnerships. The key players in the market strive to differentiate themselves in terms of pricing, quality, offering, and customer service. Also, they are making significant investments in R&D initiatives to introduce new materials to cater to diverse consumer needs.

Several market participants are prioritizing the development of sustainable and eco-friendly advanced carbon materials that comply with stringent government regulations. The advanced carbon materials market research report offers market assessment of all the major players, including Arkema Group, Arry International, FutureCarbon Materials, Formosa Plastics, GrafTech International, Haydale Graphene, Hexcel Corporation, Mitsubishi, Nanocyl SA, Nippon Graphite, Perpetuus Advanced, Poco Graphite, Shenzhen Sanshun, Teijin Limited, Thomas Swan, Tokai Carbon, Toray Industries, and Toyo Tanso.

List of Key Players in Advanced Carbon Materials Market

- Arkema Group

- Arry International

- FutureCarbon Materials

- Formosa Plastics

- GrafTech International

- Haydale Graphene

- Hexcel Corporation

- Mitsubishi

- Nanocyl SA

- Nippon Graphite

- Perpetuus Advanced

- Poco Graphite

- Shenzhen Sanshun

- Teijin Limited

- Thomas Swan

- Tokai Carbon

- Toray Industries

- Toyo Tanso

Advanced Carbon Materials Market Developments

May 2024: Haydale displayed its new automotive seat heating solution labeled the ‘Hot Seat’ at the Advanced Materials Show 2024 in Birmingham. According to Haydale, the new solution uses less energy, is faster to heat, and provides an eco-friendly alternative to existing solutions.

October 2023: Hexcel showcased its innovative advanced lightweight material technologies at METS 2023. The company stated that the new technologies, which include the High Modulus Fiber HexPly M79 Prepregs, are primarily aimed at the marine market.

Advanced Carbon Materials Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Fibers

- Special Graphite

- Nanotubes

- Graphene

- Foams

- Others

By Application Outlook (Revenue – USD Billion, 2020–2034)

- Aerospace & Defense

- Electronics

- Sports

- Automotive

- Construction

- Energy

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of the Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Advanced Carbon Materials Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 18.99 billion |

|

Market Size Value in 2025 |

USD 26.10 billion |

|

Revenue Forecast by 2034 |

USD 483.29 billion |

|

CAGR |

38.3% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The market was valued at USD 18.99 billion in 2024 and is projected to grow to USD 483.29 billion by 2034.

The market is projected to register a CAGR of 38.3% from 2025 to 2034.

Asia Pacific accounted for the largest region-wise market size in 2024.

A few of the key players in the market are Arkema Group, Arry International, FutureCarbon Materials, Formosa Plastics, GrafTech International, Haydale Graphene, Hexcel Corporation, Mitsubishi, Nanocyl SA, Nippon Graphite, Perpetuus Advanced, Poco Graphite, Shenzhen Sanshun, Teijin Limited, Thomas Swan, Tokai Carbon, Toray Industries, and Toyo Tanso.

The fibers segment accounted for the largest market share in 2024.

The aerospace & defense segment held a significant market share in 2024.