Offshore Wind Energy Market Share, Size, Trends, Industry Analysis Report

By Component (Turbines, Electrical Infrastructure, Substructure, Others); By Location; By Region; Segment Forecast, 2025 - 2034

- Published Date:Sep-2025

- Pages: 143

- Format: PDF

- Report ID: PM2291

- Base Year: 2024

- Historical Data: 2020 - 2023

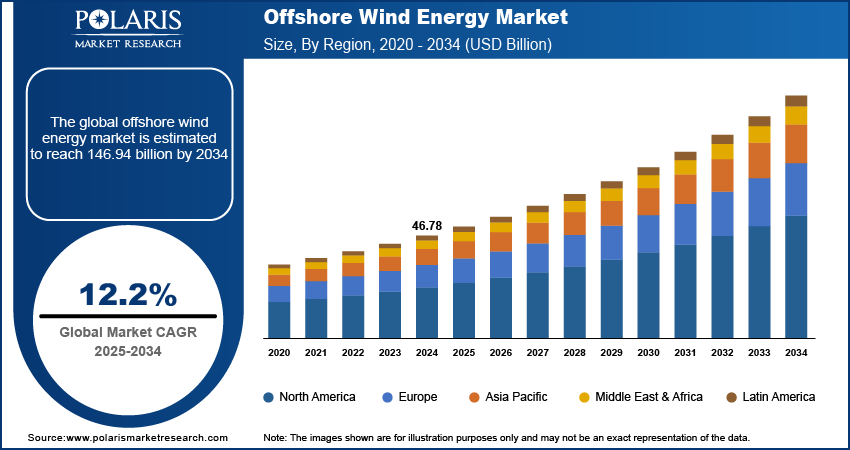

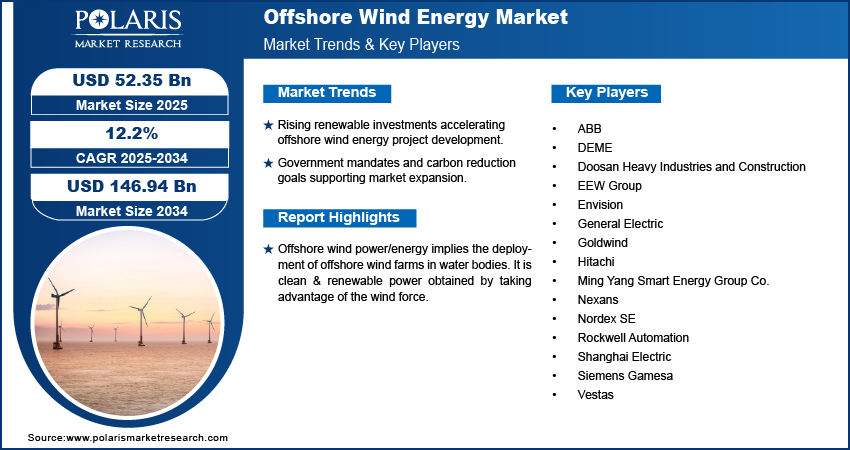

The global offshore wind energy market was valued at USD 46.78 billion in 2024 and is expected to grow at a CAGR of 12.2% during the forecast period. Key factors driving the demand includes rising investment in renewable energy, increasing government initiatives, rising demand for renewable power sources, and the increased focus on lowering the global carbon footprint.

Key Insights

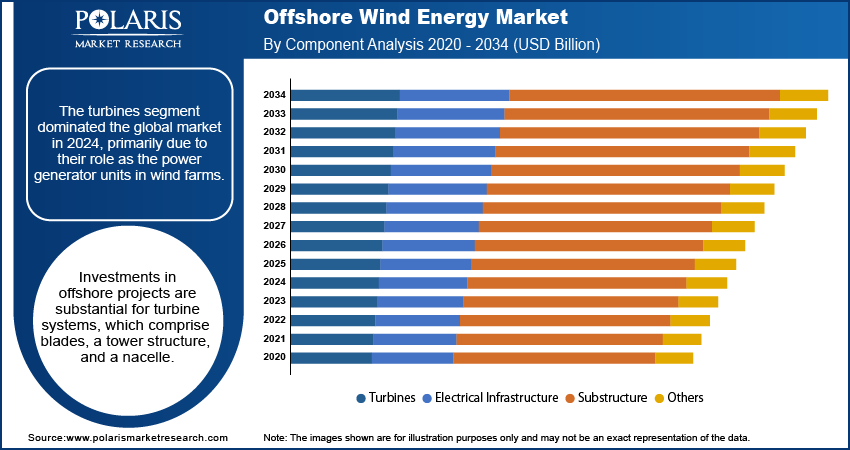

- The turbines segment dominated the global market in 2024, primarily due to their role as the power generator units in wind farms.

- The deep water segment is expected to witness growth during the forecast period. This is due to water depths that exceed 30 meters.

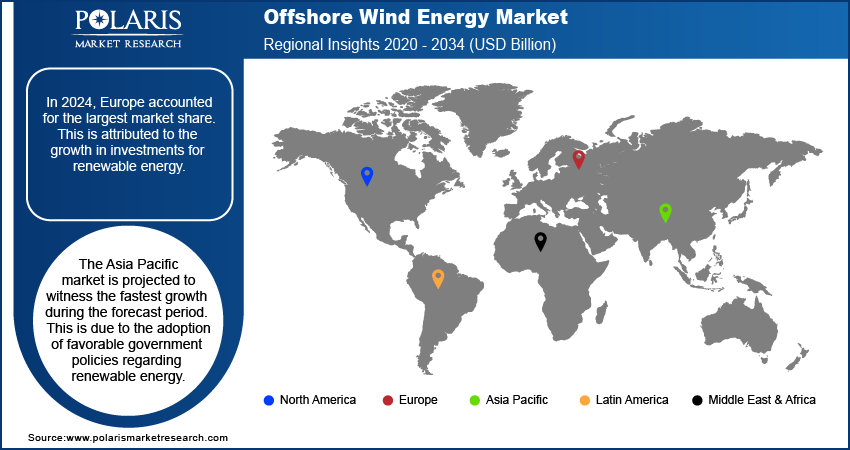

- In 2024, Europe accounted for the largest market share. This is attributed to the growth in investments for renewable energy.

- The Asia Pacific market is projected to witness the fastest growth during the forecast period. This is due to the adoption of favorable government policies regarding renewable energy.

Industry Dynamics

- The increased investment in renewable power boosted the expansion of offshore wind energy projects. This is due to the power industry which has shifted toward green and renewable energy sources.

- Government mandates are being implemented to support renewable energy programs. This is due to industrial businesses which are making efforts to lower their carbon emissions, driving the expansion opportunities.

- High capital investment and longer development cycles, which involve supply chain logistics, maritime construction, and grid connection, create substantial challenges.

- The expansion of floating offshore wind technology creates growth opportunities for harnessing vast, unexplored deep-water wind sources for power generation.

Market Statistics

- 2024 Market Size: USD 46.78 billion

- 2034 Projected Market Size: USD 146.94 billion

- CAGR (2025-2034): 12.2%

- Largest market in 2024: Europe

To Understand More About this Research: Request a Free Sample Report

Offshore wind power/energy implies the deployment of offshore wind farms in water bodies. It is clean & renewable power obtained by taking advantage of the wind force. The market for offshore wind power is expected to expand due to the rising demand for renewable power sources and the increased focus on lowering the global carbon footprint. The market’s growth is projected to be boosted by the expanding attempts by governmental organizations and power corporations to reduce carbon emissions.

According to IRENA (International Renewable Energy Agency), renewables must increase from 25% to 86% by 2050 in the yearly global power generation to satisfy the Paris Agreement's objective. Further, Bloomberg BNEF estimates that over USD 13.3 trillion will be spent on new production assets. According to BNEF, wind & solar is expected to account for half of the global electricity generation by 2050. Additionally, the rising installation of turbines globally is anticipated to drive the growth of the offshore wind energy market.

These disruptions in the supply chain, lockdown measures, and limited corporate spending are anticipated to hamper offshore wind market development. However, the industry is projected to bounce back as governments lift lockdown restrictions across nations. According to the International Energy Agency, the offshore renewable power industry is predicted to grow fast post-pandemic.

Industry Dynamics

Growth Drivers

The increased investment in renewable power is fueling the expansion. The power industry has shifted toward green and renewable energy sources to, among other things, slow the depletion of fossil fuels, mitigate climate change, and reduce carbon emissions due to the increased emphasis on environmental sustainability. Additionally, several government rules are being implemented to support renewable energy programs. Many industrial businesses are making efforts to lower their carbon emissions. For instance, one of Norway's top power companies, Equinor, plans to reduce its carbon emissions by more than 50% by 2025. The company plans to develop its renewable power business, which is estimated to grow to 6,000 megawatts within six years and to over 16,000 megawatts within 15 years. Additionally, another energy giant, Total, acquired a 51% stake in SSE Renewable's Seagreen 1 offshore renewable farm project. The company is further estimated to invest over EUR 70 million in this project.

Report Segmentation

The market is primarily segmented on the basis of component, location, and region.

|

By Component |

By Location |

By Region |

|

|

|

Know more about this report: Request for sample pages

Segmental Insights

Component Analysis

The turbines segment dominated the global market in 2024, primarily due to their role as the power generator units in wind farms. Investments in offshore projects are substantial for turbine systems, which comprise blades, a tower structure, and a nacelle. Advances in technology have focused on the development of larger and more powerful turbines that can generate greater wind energy with improved capacity. This trend towards upgrading reduces the cost of energy with maximum output per turbine. Thus, increasing investments and revenue are supporting the segment's dominant position.

Location Analysis

The shallow water segment held the largest revenue share in 2024, as most energy projects are launched in shallow water. Installing the offshore wind tower in shallow water is more accessible and requires less capital investment. This location is the most popular offshore renewable farm development due to the ideal weather conditions and ease of maintenance. Additionally, building an electrical infrastructure in this sector is much simpler. It is predicted that these advantages of shallow water settings would boost the segment's expansion. However, turbines with smaller Megawatt capacities are placed in this area due to the lower offshore wind speed in shallow water.

Deep water segment is expected to witness significant growth during the forecast period, due to the water depth which exceeds 30 meters, are becoming increasingly popular nowadays. It is projected that rising investments in deep-water, floating offshore wind-generating projects would accelerate the segment's growth.

Regional Analysis

Europe accounted for the highest offshore wind energy market shares in 2024. This huge market share is attributed to the growing investments in renewable energy coupled with favorable government policies. Various key offshore renewable power companies in Europe, such as Vestas, ABB, Siemens, and Nordex SE, are anticipated to boost the market's growth.

Furthermore, EWI supports offshore wind energy market development and a research & development program for renewable power. Additionally, various countries across Europe are increasing their focus on upgrading their electrical infrastructure, and the government in these nations is promoting the use of renewable energy for power generation. Thus, driving the growth of the market.

Additionally, the Asia Pacific market is projected to witness highest CAGR over the forecasted years. The adoption of favorable government policies regarding renewable energy throughout rising nations such as China, India, and Japan, among others, might be linked to the market expansion in the Asia Pacific region.

Competitive Insight

Some of the major players operating in the global offshore wind energy market include ABB, DEME, Doosan Heavy Industries and Construction, EEW Group, Envision, General Electric, Goldwind, Hitachi, Ming Yang Smart Energy Group Co., Nexans, Nordex SE, Rockwell Automation, Shanghai Electric, Siemens Gamesa, and Vestas.

Offshore Wind Energy Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 46.78 billion |

| Market size value in 2025 | USD 52.35 billion |

|

Revenue forecast in 2034 |

USD 146.94 billion |

|

CAGR |

12.2% from 2025 - 2034 |

|

Base year |

2024 |

|

Historical data |

2020 - 2023 |

|

Forecast period |

2024 - 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Component, By Location, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Key companies |

ABB, DEME, Doosan Heavy Industries and Construction, EEW Group, Envision, General Electric, Goldwind, Hitachi, Ming Yang Smart Energy Group Co., Nexans, Nordex SE, Rockwell Automation, Shanghai Electric, Siemens Gamesa, and Vestas. |

FAQ's

• The global market size was valued at USD 46.78 billion in 2024 and is projected to grow to USD 146.94 billion by 2034.

• The global market is projected to register a CAGR of 12.2% during the forecast period.

• Europe dominated the global market share in 2024.

• A few key market players are ABB, DEME, Doosan Heavy Industries and Construction, EEW Group, Envision, General Electric, Goldwind, Hitachi, Ming Yang Smart Energy Group Co., Nexans, Nordex SE, Rockwell Automation, Shanghai Electric, Siemens Gamesa, and Vestas.

• The turbines segment dominated the global market in 2024.

• The deep water segment is expected to witness growth during the forecast period.