Home Solar System Market Share, Size, Trends, Industry Analysis Report

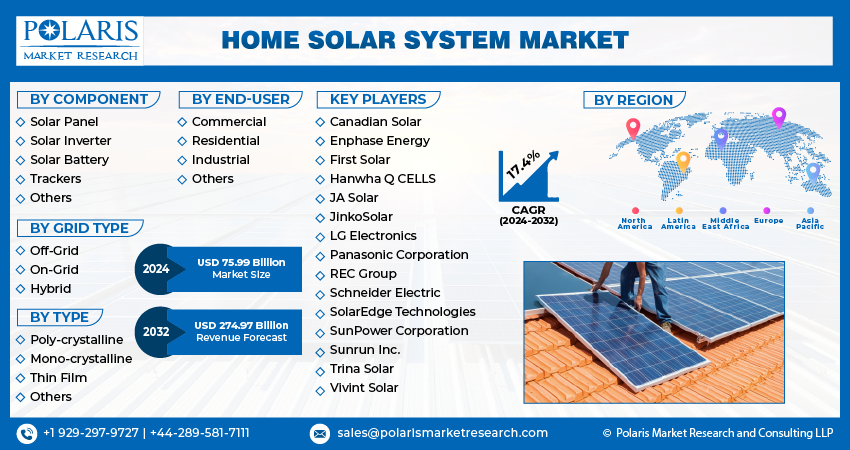

By Component (Solar Panel, Solar Inverter, Solar Battery, Trackers, Others); By Grid Type; By Type; By End-User; By Region; Segment Forecast, 2024- 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM4058

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

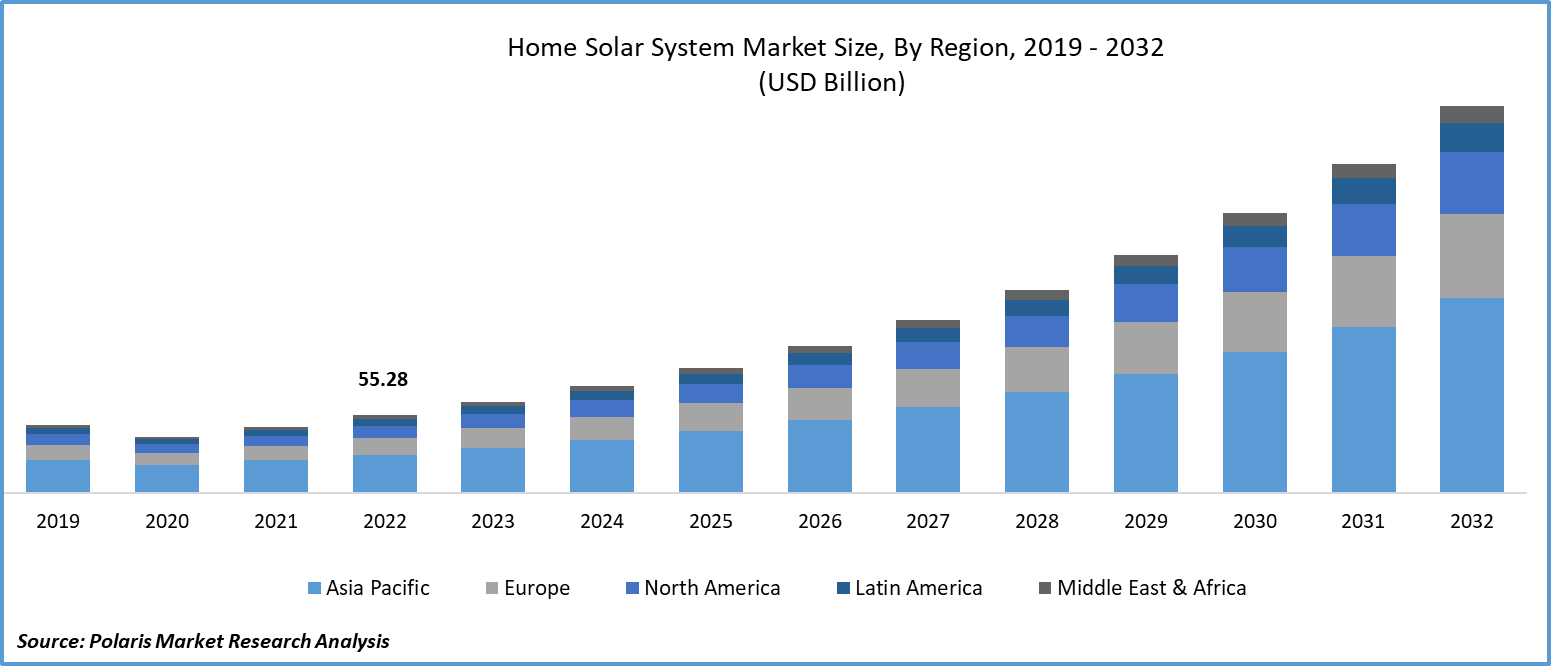

The global home solar system market was valued at USD 64.80 billion in 2023 and is expected to grow at a CAGR of 17.4% during the forecast period.

The home solar system market represents a pivotal component of the global transition towards renewable energy sources. While initial costs and regulatory hurdles remain challenges, the environmental, economic, and societal benefits of adopting solar power are undeniable. As technological advancements continue to drive innovation in the sector, coupled with supportive government policies and growing consumer awareness, the home solar system market is poised for sustained growth, playing a crucial role in shaping a more sustainable energy future.

To Understand More About this Research: Request a Free Sample Report

Home solar systems notably diminish dependence on traditional fossil fuels, leading to a reduction in greenhouse gas emissions. These systems harness solar energy, making a substantial contribution to a cleaner and more environmentally sustainable world.

Furthermore, the installation of a residential solar system decreases reliance on grid electricity, leading to decreased energy expenses for homeowners. This cost-efficient approach can result in considerable long-term savings, making the adoption of solar power an appealing and financially incentivizing choice.

- For instance, in September 2023, Tigo Energy, Inc. unveiled their latest line of energy products under the brand name GO. This cutting-edge series provides advanced energy solutions, employing modular components known for their user-friendly nature and adaptability for effortless installation. These products are meticulously optimized to ensure seamless integration within existing systems.

While government incentives and financing options exist, the initial expense of procuring and installing a home solar system remains a substantial hurdle for many homeowners. Furthermore, the effectiveness of such a system hinges on factors like location, climate, and sunlight availability. Regions with limited sun exposure may not reap as many benefits from solar installations.

As solar technology advances swiftly, homeowners may be apprehensive about investing, fearing potential obsolescence. Staying abreast of the latest developments is pivotal for informed decision-making.

Continued government backing through tax credits, rebates, and feed-in tariffs presents a compelling opportunity for the home solar system market. Additionally, integrating solar systems with smart home technology enhances energy management efficiency. This encompasses automated load-shifting and real-time monitoring, amplifying the advantages of solar power.

Growth Drivers

- Increased focus on renewable energy sources is projected to spur the product demand.

The primary driving factor of the home solar system market is the increasing awareness and prioritization of renewable energy sources. As concerns about climate change and environmental sustainability intensify, homeowners are seeking eco-friendly alternatives to conventional energy sources. The potential for substantial long-term cost savings also serves as a compelling incentive. Additionally, government incentives, tax credits, and favorable policies further encourage the adoption of home solar systems. Progress in solar panel efficiency and energy storage solutions is enhancing the accessibility and effectiveness of solar power, playing a pivotal role in the market's expansion. Additionally, the aspiration for energy autonomy and resilience against grid failures is spurring the demand for home solar systems

Report Segmentation

The market is primarily segmented based on component, grid type, type, end-user, and region.

|

By Component |

By Grid Type |

By Type |

By End-User |

By Region |

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Component Analysis

- Solar panel segment is expected to witness highest growth during forecast period

The solar panel segment is projected to grow at a CAGR during the projected period, mainly driven by the reduced costs. A major catalyst for the growth of solar panels is the diminishing cost of the technology. Advancements in manufacturing, technological efficiency, and economies of scale have significantly lowered prices, rendering solar panels more accessible and cost-effective for homeowners.

Moreover, numerous governments provide incentives, tax credits, and rebates to encourage the adoption of solar panels. These financial perks offset initial expenses, making solar systems an attractive and financially viable choice for homeowners. Solar panels empower homeowners to generate their own electricity, reducing reliance on conventional power grids. This leads to substantial, long-term savings on energy costs, presenting a compelling financial motive for homeowners to adopt solar technology.

By Grid Type Analysis

- Off-Grid segment accounted for the largest market share in 2022

The off-grid segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. The off-grid segment in the home solar system market caters to areas without access to a reliable power grid. It provides self-sufficiency by generating, storing, and managing electricity independently. Off-grid systems typically incorporate solar panels, batteries for energy storage, and inverters for converting DC power to AC for household use. These systems are crucial in remote locations, rural areas, and for emergency preparedness. They offer energy independence, reducing dependence on traditional utilities. The off-grid segment addresses the energy needs of a diverse range of consumers seeking reliable and sustainable power solutions, making it a vital component of the evolving home solar system market.

By Type Analysis

- Polycrystalline segment held the significant market revenue share in 2022

The polycrystalline segment held a significant market share in revenue share in 2022, which is highly accelerated due to better efficiency, low operating costs. In addition, the polycrystalline segment in the home solar system market has witnessed significant growth. This technology, characterized by multiple crystal structures, offers a cost-effective alternative to monocrystalline cells. Polycrystalline solar panels have gained popularity for their commendable efficiency and durability, making them a favored choice for residential installations. While slightly less efficient than monocrystalline panels, they excel in various environmental conditions. The affordability and versatility of polycrystalline panels have contributed to their prominence, as homeowners seek reliable and cost-efficient solar solutions. This growth reflects a broader trend towards accessible and sustainable energy options in the residential sector.

By End-User Analysis

- Residential segment accounted for the largest market share in 2022

The residential segment accounted for the largest market share in 2022 and is likely to retain its market position throughout the forecast period. Increasing environmental consciousness, coupled with rising energy costs, has driven homeowners to seek sustainable and cost-effective energy solutions. Government incentives and favorable policies further boost adoption rates. Technological progress has significantly enhanced the efficiency and affordability of solar panels, rendering them an enticing investment for homeowners. Moreover, the aspiration for energy self-sufficiency and the opportunity to sell surplus energy to the grid have played pivotal roles in driving the segment's growth. As solar power continues to achieve grid parity in more regions, the residential segment is expected to remain a pivotal driver in the home solar system market.

Regional Insights

- Asia Pacific region dominated the global market in 2022

The Asia Pacific region dominated the global market with the largest market share in 2022 and is expected to maintain its dominance over the anticipated period. Factors such as increasing environmental awareness, government incentives, and abundant sunlight make solar energy an attractive option. Rapid urbanization and a surge in residential construction further fuel the demand for home solar systems. Technological advancements and a competitive market landscape have led to more accessible and cost-effective solutions. Additionally, the region's expanding middle class seeks sustainable energy sources, driving further adoption. With a concerted effort towards renewable energy, the Asia-Pacific home solar system market is poised for sustained expansion, contributing significantly to the global shift towards cleaner, more sustainable energy solutions.

The North America region is expected to be the second largest region with a healthy CAGR during the projected period, owing to federal and state incentives, environmental consciousness, and the desire for energy cost savings, has propelled this expansion. Advancements in solar technology and falling installation costs have made solar panels an increasingly attractive investment for homeowners. Net metering policies also enable residents to sell excess energy back to the grid, further enhancing the appeal of home solar systems. As the U.S. continues to focus on renewable energy and sustainability, the home solar system market remains a pivotal player in reshaping the nation's energy landscape, with continued growth on the horizon.

Key Market Players & Competitive Insights

The home solar system market is fragmented and is anticipated to witness competition due to several players' presence. Major service providers in the market are constantly upgrading their technologies to stay ahead of the competition and to ensure efficiency, integrity, and safety. These players focus on partnership, product upgrades, and collaboration to gain a competitive edge over their peers and capture a significant market share.

Some of the major players operating in the global market include:

- Canadian Solar

- Enphase Energy

- First Solar

- Hanwha Q CELLS

- JA Solar

- JinkoSolar

- LG Electronics

- Panasonic Corporation

- REC Group

- Schneider Electric

- SolarEdge Technologies

- SunPower Corporation

- Sunrun Inc.

- Trina Solar

- Vivint Solar

Recent Developments

- In April 2023, the Pinnacle of Home Energy Storage Solutions BLUETTI unveiled the EP900 Energy Storage System (ESS) following the success of their inaugural ESS, the EP600, which was launched in 2022.

- In February 2023, ZOLA Electric, by Tesla, introduced FLEX MAX. This groundbreaking off-grid solar home solution boasts the largest battery capacity and cutting-edge solar panel technology worldwide. This launch expanded ZOLA's reach by providing a product tailored for customers in both off-grid and on-grid regions, solidifying its position in the energy solutions market

Home Solar System Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 75.99 billion |

|

Revenue forecast in 2032 |

USD 274.97 billion |

|

CAGR |

17.4% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments covered |

By Component, By Grid Type, By Type, By End-User, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |