High Strength Steel Market Size, Share, Trends, Industry Analysis Report

: By Product (High Strength Low Alloy, Dual Phase, Transformation Induced Plasticity, Bake Hardenable, Martensitic, and Others), Tensile Strength, Application, and Region (North America, Europe, Asia Pacific, Latin America, and Middle East & Africa) – Market Forecast, 2025–2034

- Published Date:Aug-2025

- Pages: 129

- Format: PDF

- Report ID: PM1758

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The global high strength steel market size was valued at USD 39.82 billion in 2024, growing at a CAGR of 6.8% during 2025–2034. The market is driven by increased vehicle production, innovations in steel manufacturing, growing urbanization, and the rising adoption in the marine industry for enhanced safety, durability, and cost-effectiveness.

Key Insights

- High strength low alloy steel dominated the market in 2024 due to its cost efficiency, strength, and versatility in multiple industries.

- The construction sector will grow due to urbanization and demand for durable, sustainable materials in infrastructure projects.

- Asia Pacific had the largest market share in 2024, driven by industrial growth, infrastructure development, and vehicle production in China and India.

- North America will experience significant growth due to advancements in automotive manufacturing and infrastructure renovation projects.

Industry Dynamics

- Rising vehicle production and innovations in steel manufacturing are boosting demand for high-strength steel in automotive and aerospace applications.

- Urbanization and increased adoption in the marine industry are driving demand for high-strength steel in construction and shipbuilding.

- Growing demand for lightweight, energy-efficient materials creates potential for the further use of high-strength steel in various sectors.

- High production costs and competition from alternative materials such as aluminum and carbon fiber may hinder the market growth of high-strength steel.

Market Statistics

2024 Market Size: USD 39.82 billion

2034 Projected Market Size: USD 76.45 billion

CAGR (2025–2034): 6.8%

Asia Pacific: Largest market in 2024

To Understand More About this Research: Request a Free Sample Report

High-strength steel (HSS) is a specialized category of steel characterized by its enhanced mechanical properties, specifically high yield and tensile strength. HSS has a yield strength ranging from 210 to 550 MPa (30 to 80 ksi) and a tensile strength between 270 to 700 MPa (40 to 100 ksi). The unique properties of HSS are achieved through specific alloying elements and controlled manufacturing processes that result in fine-grained microstructures, allowing for better formability and weldability compared to conventional steels.

The rising production of motor vehicles is projected to boost the global high strength steel market demand. According to data published by the European Automobile Manufacturers' Association, 85.4 million motor vehicles were produced globally in 2022, a 5.7% increase from 2021. High-strength steel enables the production of safer motor vehicles that withstand higher impact forces while being lighter and more energy-efficient. This steel further offers a more cost-effective solution compared to alternative materials such as sum or carbon fiber for mass vehicle production. This makes it attractive for automobile manufacturers across different vehicle segments, from economy cars to luxury vehicles. Therefore, as the production of motor vehicles increases, the demand for high strength steel also spurs.

The rising innovations in steel manufacturing processes propel the high strength steel market development. Innovations in steel manufacturing processes are enhancing high-strength steel (HSS) performance, versatility, and affordability. Advances such as hot stamping improved alloying techniques, and the development of advanced high-strength steel (AHSS) grades have enabled the production of stronger, lighter, and more ductile steel. These innovations make HSS suitable for complex designs and applications, thereby propelling adoption in industries such as automotive, construction, and aerospace, where lightweight and durable materials are crucial.

High Strength Steel Market Dynamics

Growing Urbanization Worldwide

The growing urbanization worldwide is projected to propel the global high strength steel market demand during the forecast period. As per the data published by the United Nations, 55% of the world's population lives in urban areas, and is expected to increase to 68% by 2050. Urban areas require durable and sustainable materials for constructing skyscrapers, bridges, and transportation systems, where HSS is used majorly due to its superior strength-to-weight ratio and resilience. Its ability to support innovative architectural designs and withstand dynamic loads makes it an essential material for modern construction in urban areas.

Increasing Adoption in Marine Industry

Ships, offshore platforms, and marine structures require materials that withstand high loads, corrosive saltwater environments, and extreme weather while maintaining structural integrity. HSS meets these requirements by enabling lighter and stronger constructions, which improve fuel efficiency and reduce operational costs. It is particularly favored in shipbuilding for hulls, decks, and other critical components, as it allows for increased cargo capacity without compromising safety or performance. Furthermore, as the marine industry focuses on sustainability and efficiency, the use of HSS aligns with goals to optimize designs and reduce emissions, further driving its adoption. Therefore, the increasing adoption of high strength steel in the marine industry is driving the high strength steel market growth.

High Strength Steel Market Segment Analysis

Assessment by Product

Based on product, the high strength steel market is categorized into high strength low alloy, dual phase, transformation induced plasticity, bake hardenable, martensitic, and others. The high strength low alloy segment dominated the market in 2024 due to its superior mechanical properties, cost efficiency, and versatility across various industries. HSLA steels offer excellent strength-to-weight ratios, which make them highly suitable for automotive, construction, and infrastructure applications where lightweight and durable materials are essential. The enhanced corrosion resistance of high strength low alloy further drives their adoption in environments exposed to moisture and harsh weather conditions, such as bridges and pipelines. The rising demand for energy-efficient and environmentally friendly materials also contributes to the growth of this segment, as HSLA steels reduce material consumption and improve fuel efficiency in automotive manufacturing.

The dual-phase (DP) steel segment is projected to hold a dominant share during the forecast period due to its blend of strength and ductility. This unique combination is achieved through a microstructure consisting of a soft ferrite matrix and hard martensite, enabling superior crash absorption in automotive applications. DP steels are becoming increasingly indispensable as automotive manufacturers focus on vehicle safety and lightweight to comply with stringent emission standards and safety regulations. Furthermore, advancements in manufacturing technologies, such as hot-stamping and tailored blanks, are making these steels more accessible and cost-effective. The growing adoption of electric vehicles (EVs), which require lightweight and strong materials to enhance battery efficiency, also boosts demand for dual-phase steel.

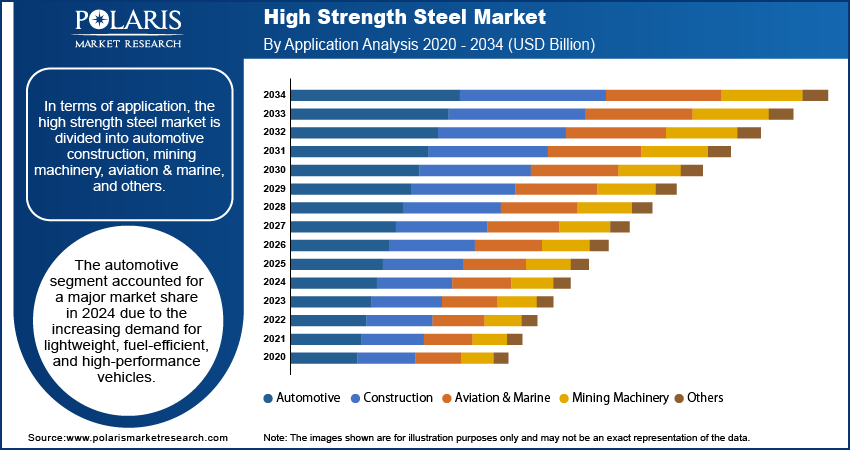

Evaluation by Application

In terms of application, the high strength steel market is divided into automotive, construction, mining machinery, aviation & marine, and others. The automotive segment accounted for a major market share in 2024 due to the increasing demand for lightweight, fuel-efficient, and high-performance vehicles. Automakers prioritize HSS as it offers high strength-to-weight ratios to enhance vehicle safety, improve fuel economy, and comply with stringent emission standards. High strength steel finds extensive use in manufacturing critical components such as body panels, structural reinforcements, and crash zones due to their ability to withstand high stress while reducing overall vehicle weight. The rise in electric vehicle (EV) production further amplifies this demand, as lightweight materials play a crucial role in improving battery efficiency and vehicle range.

The construction segment is projected to witness significant growth in the coming years due to rapid urbanization and infrastructure development across the globe. Governments and private investors are allocating substantial resources to build sustainable and resilient infrastructure, including bridges, high-rise buildings, and transportation networks. Steel with high strength properties supports these efforts by offering exceptional load-bearing capacity, durability, and resistance to environmental stressors such as corrosion and seismic activity. The push for green building practices and energy-efficient structures further increases the reliance on advanced materials such as HSS, as they help reduce material usage without compromising performance. Additionally, innovations in fabrication and joining technologies simplify the integration of high strength steels into complex architectural designs, driving their adoption in construction projects.

Regional Analysis

By region, the study provides the high strength steel market insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Asia Pacific held the largest share of the high strength steel market revenue in 2024 due to rapid industrial growth; urbanization; and the expansion of key end-use sectors such as automotive, construction, and manufacturing. Countries such as China, India, and Japan significantly contributed to this dominance. China emerged as the largest market in the regional market, driven by its massive infrastructure development projects, high vehicle production rates, and substantial investments in renewable energy. The region’s strong focus on industrialization and government-backed initiatives to modernize infrastructure further fueled the demand for advanced materials such as HSS.

The North America high strength steel market is expected to witness significant CAGR during the forecast period due to advancements in automotive manufacturing, increasing infrastructure renovation projects, and the adoption of energy-efficient building materials. The US, as the leading market in the region, drives this growth with its focus on lightweight vehicle production to meet stringent fuel efficiency and emission standards. Additionally, substantial investments in modernizing aging infrastructure, including bridges, roads, and public buildings, have created a strong demand for durable, high-performance materials. The growing adoption of electric vehicles, coupled with the rising development of wind energy projects, further accelerates the adoption of high strength steel in the region.

Key Players and Competitive Analysis Report

Major market players are investing heavily in research and development to expand their offerings, which will help the high strength steel market grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments such as innovative launches, international collaborations, higher investments, and mergers and acquisitions between organizations.

The high strength steel market is fragmented, with the presence of numerous global and regional market players. A few major players in the market include ArcelorMittal; China Ansteel Group Corporation Limited; JSW; NIPPON STEEL CORPORATION; Steel Authority of India Limited; Nucor Corp; thyssenkrupp AG; SSAB AB; POSCO; voestalpine AG; Tata Steel; AK Steel International B.V.; Baoshan Iron & Steel Co., Ltd.; Steel Technologies LLC; and SMS group GmbH.

ArcelorMittal, headquartered in Luxembourg, stands as the second largest steel producer globally, with an impressive annual crude steel production of 78 million metric tonnes as of 2022. The company emerged from the merger of Arcelor and Mittal Steel in 2006, creating a powerhouse that accounts for approximately 10% of the world's steel output. Among its extensive product offerings, ArcelorMittal specializes in high-strength steels (HSS), which are crucial in various industries, particularly automotive and construction. The range of high-strength steels produced by ArcelorMittal includes conventional HSS and advanced high-strength steels (AHSS). In August 2024, ArcelorMittal Nippon Steel India announced the launch of Optigal, a world-class color coated steel brand with an innovative Zinc-Aluminum-Magnesium (ZAM) metallic coating.

Nippon Steel Corporation, based in Tokyo, Japan, is the largest steel producer in the country. Established through the merger of Yawata Iron & Steel and Fuji Iron & Steel in 1970, Nippon Steel has evolved significantly over the decades, adapting to market demands and technological advancements. The company operates across various segments, including steelmaking, engineering, chemicals, and system solutions, with a strong emphasis on innovation and sustainability.

List of Key Companies

- AK Steel International B.V.

- ArcelorMittal

- Baoshan Iron & Steel Co., Ltd.

- British Steel

- China Ansteel Group Corporation Limited

- JSW

- NIPPON STEEL CORPORATION

- Nucor Corp

- POSCO

- SMS group GmbH

- SSAB AB

- Steel Authority of India Limited

- Steel Technologies LLC

- Tata Steel

- thyssenkrupp AG

- voestalpine AG

High Strength Steel Industry Developments

May 2024: Jindal Stainless, India’s largest stainless steel manufacturer, supplied the tempered 201LN grade of high-strength stainless steel to India’s first Vande Metro trains.

May 2021: ArcelorMittal launched Granite HDXtreme, a new steel product for extreme climates. It has high levels of protection against UV and corrosion and is designed for roofs and façades on buildings near the sea.

December 2020: British Steel launched a new high-strength S460M structural steel grade for use in multi-story and high-rise buildings.

High Strength Steel Market Segmentation

By Product Outlook (Revenue, USD Billion, 2020–2034)

- High Strength Low Alloy

- Dual Phase

- Transformation Induced Plasticity

- Bake Hardenable

- Martensitic

- Others

By Tensile Strength Outlook (Revenue, USD Billion, 2020–2034)

- Upto 600 MPa

- 600–900 MPa

- 900–1200 MPa

- 1200–1500 MPa

- Above 1500 MPa

By Application Outlook (Revenue, USD Billion, 2020–2034)

- Automotive

- Construction

- Mining Machinery

- Aviation & Marine

- Others

By Regional Outlook (Revenue, USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

High Strength Steel Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 39.82 billion |

|

Market Size Value in 2025 |

USD 42.43 billion |

|

Revenue Forecast by 2034 |

USD 76.45 billion |

|

CAGR |

6.8% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

• The global high strength steel market size was valued at USD 39.82 billion in 2024 and is projected to grow to USD 76.45 billion by 2034.

• The global market is projected to register a CAGR of 6.8% during the forecast period

• Asia Pacific held the largest share of the global market in 2024.

• A few of the key market players are ArcelorMittal; China Ansteel Group Corporation Limited; JSW; NIPPON STEEL CORPORATION; Steel Authority of India Limited; Nucor Corp; thyssenkrupp AG; SSAB AB; POSCO; voestalpine AG; Tata Steel; AK Steel International B.V.; Baoshan Iron & Steel Co., Ltd.; Steel Technologies LLC; and SMS group GmbH.

• The high strength low alloy segment dominated the market in 2024

• The automotive segment dominated the high strength steel market in 2024.