Transportation Analytics Market Share, Size, Trends, Industry Analysis Report

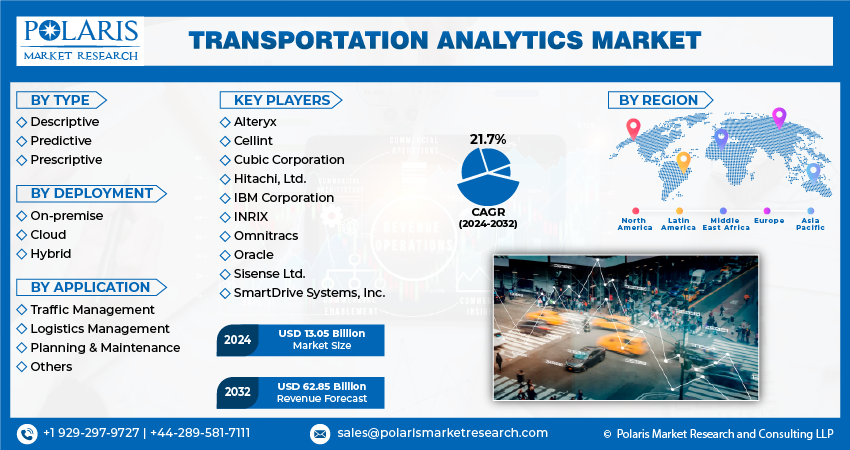

By Type (Predictive, Descriptive, Prescriptive), By Application, By End-User, By Region; Segment Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 118

- Format: PDF

- Report ID: PM4188

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

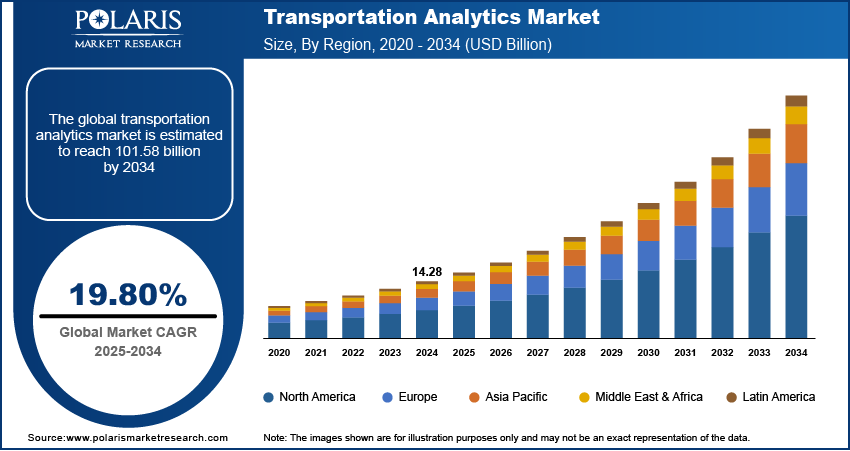

The global transportation analytics market was valued at USD 14.28 billion in 2024 and is expected to register a CAGR of 19.8% from 2025 to 2034. The expansion is driven by smart city initiatives and intelligent transportation systems. The integration of AI and IoT in logistics and fleet management is expected to boost the market growth in the coming years.

Key Insights

- The descriptive analytics segment held the largest share in 2024. This dominance is attributed to the growing integration of big data, resulting in increased data volumes and advancements in digital technology.

- In 2024, the traffic management segment accounted for the largest share. Solutions, including video management software integrated with video analytics, play a crucial role in addressing traffic congestion and accidents resulting from inadequate traffic management.

- The cloud segment held the largest share in 2024 due to its scalability, flexibility, and security features.

- North America dominated the revenue share in 2024. The rising demand for efficient logistics and supply chain management in the region's dynamic business landscape propels the market growth.

- The Asia Pacific industry is projected to grow at a rapid pace during the forecast period. This growth is attributed to the increasing implementation of smart cities and smart transportation initiatives.

Industry Dynamics

- Government initiatives aimed at developing smart cities foster the adoption of transportation analytics solutions within intelligent transport systems.

- Rising urban population fuels the demand for efficient traffic control, which contributes to the market growth.

- Integration of advanced technologies in transportation systems is expected to provide lucrative opportunities during the forecast period.

- Rising data security and privacy concerns in transportation analytics hinder the industry expansion.

Market Statistics

2024 Market Size: USD 14.28 billion

2034 Projected Market Size: USD 62.85 billion

CAGR (2025–2034): 19.80%

North America: Largest market in 2024

AI Impact on Transportation Analytics Market

- Artificial intelligence (AI) platforms use satellite data, traffic indicators, and GPS telemetry to reroute vehicles. It helps save fuel and improve delivery times.

- The technology enhances safety and automation in semi-autonomous trucks and smart traffic systems.

- AI-based tools facilitate automated fuel optimization, vehicle inspection, and driver behavior analysis.

- These tools support congestion reduction, traffic flow prediction, and multimodal transport integration.

- AI improves port scheduling, container tracking, and demand forecasting.

To Understand More About this Research: Request a Free Sample Report

The market is experiencing growth due to the increasing adoption of smart transportation initiatives and Advanced Traffic Management Systems (ATMs) globally. These analytics solutions contribute to benefits such as reduced fuel consumption, travel time, and air pollution. The market is further propelled by a shift towards automating operational processes through the integration of Artificial Intelligence (AI) and Machine Learning (ML).

Contemporary data collection and analytics solutions offer diverse functionalities such as traffic volume counts, vehicle classification counts, travel time and delay studies and parking studies. City planners are leveraging these capabilities to enhance connectivity and ensure the safety of commuters. They record traffic volume and other relevant parameters to construct models aimed at optimizing public transportation and facilitating efficient traffic flow.

The market research report offers an in-depth analysis of the industry to support informed decision-making. It offers a meticulous breakdown of various market niches and keeps readers updated on the latest industry developments. Along with tracking Transportation Analytics Market on the basis of SWOT and Porter’s Five Forces models, the research report includes graphs, tables, charts, and other pictorial representations to help readers understand the key insights and important data easily.

For instance, in the collaborative project between Citi Logik, Vodafone, and Transport for London (TfL), more than 10 billion data points were gathered. These data points were employed in various algorithms to generate journey matrices encompassing approximately 1.2 billion trips. Additionally, the same data complemented the existing data from roadside sensor networks, contributing to other operational aspects. Consequently, analytics applications are poised to bring swift advantages to operational and managerial functions in the transportation industry throughout the forecast period.

Growth Drivers

Integration of advanced technologies in transportation systems

Transportation analytics systems offer efficient traffic monitoring, contributing to a reduction in road accidents and carbon emissions compared to Intelligent Transportation Systems (ITS). According to the Texas Transportation Institute, U.S. drivers waste over 3 billion gallons of fuel annually, with the average commuter spending approximately 42 hours per year stuck in traffic. This results in a regional expenditure of USD 160 billion, equivalent to USD 960 per commuter. The increasing population and urbanization in emerging economies will play a significant role in driving the demand for traffic solutions soon.

Market expansion in transportation analytics is fueled by government initiatives aimed at developing smart cities, fostering the adoption of transportation analytics solutions within intelligent transport systems. For example, the U.S. Department of Transportation allocated over USD 63 billion to major transportation infrastructure projects across the country. The growing number of passenger and commercial vehicles has intensified traffic congestion. Leveraging analytics in intelligent transport systems is crucial for mitigating traffic jams, redirecting traffic flow, and reducing collision risks. Nevertheless, addressing challenges related to data security and privacy remains imperative for analytics vendors.

Report Segmentation

The market is primarily segmented based on type, deployment, application, and region.

|

By Type |

By Deployment |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

Descriptive analytics segment held the largest share of the market in 2024

The descriptive analytics segment held the largest share. This dominance is attributed to the growing integration of big data, resulting in increased data volumes and advancements in digital technology. While many vendors provide integrated suites encompassing descriptive, predictive, and prescriptive analytics solutions, some transportation companies, particularly those prioritizing sales and operations optimization without significant investments, opt for deploying only descriptive analytics.

The prescriptive segment is projected to grow at the fastest rate. Transport companies and other stakeholders leverage advanced analytics to gain a competitive edge by forecasting future trends. This enables informed decision-making, leading to increased profitability, alleviated traffic congestion, reduced carbon emissions, and enhanced road safety. Additionally, traffic information plays a central role in the evolving Advanced Traffic Management Systems (ATMS) marketplace. The analysis of the commercial traffic data and information industry can offer valuable insights into the future types and service prospects of ATMS.

By Application Analysis

Traffic management segment registered the largest market share in 2024

The traffic management segment accounted for the largest share. Solutions, including video management software integrated with video analytics, play a crucial role in addressing traffic congestion and accidents resulting from inadequate traffic management. Furthermore, the application of analytics in traffic management contributes to the reduction of vehicle carbon emissions, offering environmentally friendly traffic solutions.

The logistics segment will grow rapidly. Transportation analytics solutions provide real-time visibility and tracking for goods in transit, offering organizations precise information regarding the location, condition, and status of shipments. This enhanced visibility enables logistics managers to make informed decisions, tackle potential bottlenecks, and proactively address exceptions or delays.

By Deployment Analysis

Cloud segment held the significant market revenue share in 2024

The cloud segment held the largest share. The scalability, flexibility, security features, and data center control inherent in cloud technology are significant factors that will enhance the applicability of cloud deployment technology in transportation analytics solutions.

In the transportation sector, data is sourced from diverse outlets, including data collection points and onboard sensors integrated into vehicle location systems, counting systems, as well as ticketing & fare collection systems. Cloud computing & analytics hold unparalleled potential for extracting insights related to the planning and management of transportation networks over an extended period.

The on-premise segment will grow at a substantial pace. Given the sensitivity of logistics, operations, and customer information data in the transportation industry, some organizations opt to retain this data within their infrastructure. This choice allows for greater control over security measures and ensures compliance with data protection regulations, as on-premise deployment provides direct control over data security and maintains privacy.

Regional Insights

North America region held the largest share of the global market in 2024

The North America region dominated the market. As a pivotal global trade and commerce center, the region boasts intricate logistics and supply chain networks. Transportation analytics serves as a crucial tool, offering insights to optimize supply chain operations, plan routes, forecast demand, and manage inventory effectively. Companies in the region leverage transportation analytics to improve efficiency, shorten delivery times, allocate resources optimally, and streamline logistics operations. The demand for efficient logistics and supply chain management in the region's dynamic business landscape propels the growth of the transportation analytics market.

The Asia Pacific region is projected to grow at a rapid pace. This growth is attributed to the increasing implementation of smart cities and smart transportation initiatives. Governments in the region are actively endorsing smart city initiatives, investing in transportation infrastructure, and embracing technology. Initiatives include the deployment of Intelligent Transportation Systems (ITS), smart traffic management, and the implementation of data-driven decision-making processes. Transportation analytics play a pivotal role in supporting these initiatives by furnishing data-driven insights, thereby enhancing planning, optimization, and the management of transportation networks.

Key Market Players & Competitive Insights

Partnerships, strategic mergers, and acquisitions are expected to emerge as highly effective strategies for industry players seeking rapid entry into emerging markets and the augmentation of technological capabilities. Additionally, differentiating and upgrading product types are anticipated to be key avenues for the growth of developing companies in the market.

Some of the major players operating in the global market include:

- Alteryx

- Cellint

- Cubic Corporation

- Hitachi, Ltd.

- IBM Corporation

- INRIX

- Omnitracs

- Oracle

- Sisense Ltd.

- SmartDrive Systems, Inc.

Recent Developments

-

In May 2025, Bengaluru-based enterprise commute platform MoveInSync acquired fellow commute-tech provider eFmFm, enhancing its solution suite and strengthening its foothold in India’s enterprise transportation analytics space

-

In September 2024, Hitachi Ltd. launched HMAX, a smart asset management platform by Hitachi Rail. Built for transport operators, it uses AI to streamline train operations, signaling, and maintenance in one integrated system.

-

In June 2023, AFWERX and the Air Force Research Lab introduced a drone traffic management system at Eglin Air Force Base. The system aims to improve safety for drones and eVTOL aircraft by creating a structured, secure flight environment.

-

In May 2022, as part of the "Make in India" initiative, the Airports Authority of India (AAI) achieved a significant milestone through a partnership with Bharat Electronics Limited (BEL), a Navratna Defence Public Sector Undertaking (PSU). This collaboration is geared towards jointly developing indigenous systems for air traffic management and aircraft surface movement at airports across the country.

Transportation Analytics Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 13.05 billion |

|

Revenue forecast in 2034 |

USD 62.85 billion |

|

CAGR |

19.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 – 2034 |

|

Segments covered |

By Type, By Deployment, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

The analysis of Transportation Analytics Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Research Grade Proteins Market Size, Share 2024 Research Report

Insect Repellent Market Size, Share 2024 Research Report

Canopy Market Size, Share 2024 Research Report

FAQ's

The transportation analytics market report covering key segments are type, deployment, application, and region.

Transportation Analytics Market Size Worth $101.58 Billion By 2034

The global transportation analytics market is expected to grow at a CAGR of 19.80% during the forecast period.

North America is leading the global market

key driving factors in transportation analytics market are integration of advanced technologies in transportation systems