Research Grade Proteins Market Share, Size, Trends, Industry Analysis Report

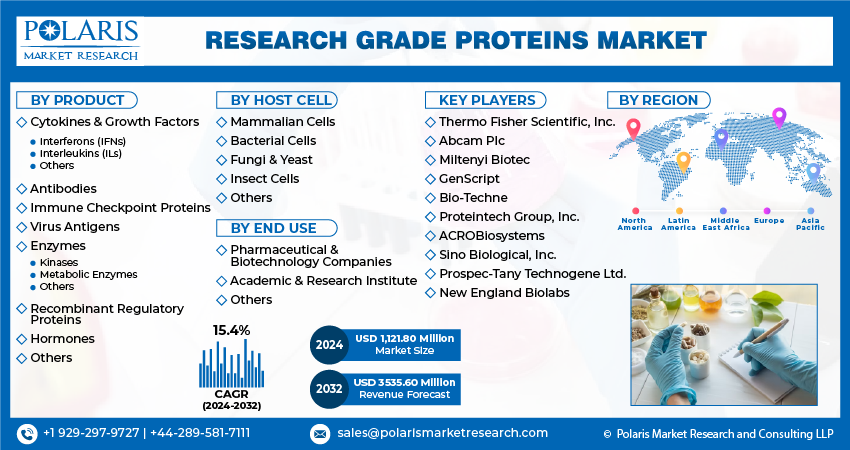

By Product (Cytokines & Growth Factors, Antibodies, Immune checkpoint proteins, Virus Antigen, Enzymes, Others), By Host Cell (Mammalian Cells, Bacterial Cells, Others), By End-use, By Region, And Segment Forecasts, 2024 - 2032

- Published Date:Jun-2025

- Pages: 116

- Format: PDF

- Report ID: PM4271

- Base Year: 2024

- Historical Data: 2020-2023

The global Research Grade Proteins Market was valued at USD 985.25 Million in 2024 and is projected to grow at a CAGR of 10.8% from 2025 to 2034. Expanding life sciences research, biopharmaceutical development, and personalized medicine initiatives are fueling demand for high-quality proteins.

Progress in proteomics research, heightened R&D endeavors in pharmaceutical and biotechnology sectors, and the growing need for personalized medicine are poised to drive market expansion in the forecast period. Additionally, increased funding from governments and academic institutions is anticipated to further bolster market growth. According to Global Genes, as of October 2019, over 400 million individuals worldwide are affected by rare and genetic diseases. This highlights the urgent requirement for treatments, improved clinical environments, and enhanced health awareness. Advanced research and knowledge of precise drug targeting mechanisms are essential for the development of effective medicines.

To Understand More About this Research: Request a Free Sample Report

There are concerted efforts across various entities to innovate swiftly in therapeutics, aiming to expedite revolutionary treatments for patients. Additionally, the pursuit of safe, effective, and efficient drugs has elevated the prominence of biopharmaceuticals. The swift research and development processes involved in creating the COVID-19 vaccine, coupled with ongoing commercial manufacturing efforts, have exerted a positive influence, spurring research activities in biologics and consequently enhancing research grade proteins market growth.

Additionally, the growing inclination towards recombinant proteins in research can be attributed to their inherent advantages. Recombinant proteins can be produced with high yields, ensuring no presence of animal contaminants, and offering controlled batch-to-batch consistency. Furthermore, their amino acid sequences can be readily modified, allowing the incorporation of unnatural amino acids as needed. Commonly utilized recombinant proteins in research contexts encompass proteins from the growth factor family, such as fibroblast growth factors, vascular endothelial growth factors, and neurotrophins.

Cytokines like interferons, interleukins, & pro-inflammatory cytokines, along with enzymes such as recombinant proteases, kinases, & nucleases, are vital for the research based active proteins. Hence, the rising utilization of recombinant proteins in research endeavors is expected to drive the expansion of the market for research-grade proteins in the foreseeable future.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

Increasing Research Activities

The growth of research-grade proteins market is closely tied to the overall expansion of research activities in fields such as biotechnology, pharmaceuticals, and life sciences. As research in these areas expands, the demand for high-quality research-grade proteins rises.

Healthcare sector's shift toward biologics can be attributed to the advancements in synthetic biology. Progress in recombinant DNA technology has paved the way for producing recombinant proteins, applicable in drug discovery, therapeutics, diagnostics, vaccines, and advanced therapies like cell & gene therapy, known for their reduced side effects and increased accuracy. Furthermore, the diverse applications of recombinant proteins in both research and industry have spurred the development of inventive bioprocessing technologies. This trend toward biologics is evident in the growing number of licensed products available.

Report Segmentation

The market is primarily segmented based on product, host cell, end use, and region.

|

By Product |

By Host Cell |

By End Use |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Product Analysis

Cytokines & Growth Factors Segment Accounted for the Noteworthy Market Share in 2024

Cytokines & growth factors segment accounted for largest market. These proteins play a crucial role in biomedical research and drug development, especially in comprehending diseases, pinpointing potential therapeutic targets, and creating drugs or treatments to regulate specific biological processes. Additionally, they find extensive applications in diverse research fields including cell culture, immunology, oncology, and regenerative medicine.

Antibodies segment will grow at rapid pace. Antibodies play a vital role in the immune system and are extensively utilized across diverse research domains. Their adaptable nature enables scientists to detect and measure specific proteins in biological samples. Common techniques employing antibodies include Western blotting, ELISA, immunoprecipitation, & immunohistochemistry. Researchers rely on antibodies to comprehend protein expression and functions, making them a fundamental element in numerous experimental procedures.

By Host Cell Analysis

Mammalian Cells Segment Held the Majority Market Share in 2024

Mammalian cells garnered the largest share. These cells, possessing a biological similarity to human cells, find extensive use in bio-pharmaceutical production, including monoclonal antibodies, vaccines, & therapeutic proteins. In a clinical study published in March 2023, researchers from Karolinska Institute and Karolinska University Hospital identified a potential mechanism for enhancing cardiac pump function using ghrelin. This discovery was made by the studying by isolating mice heart cells in the laboratory settings.

Bacterial cells segment will grow at rapid pace. The increased utilization of bacterial cells as host cells in biotechnology and research has substantially contributed to the market's expansion. Bacterial cells, particularly E. coli, are preferred for protein expression due to their fast growth, well-understood genetics, and easy handling. The rising need for diverse applications, including drug development and antibodies, is expected to drive the growth of bacterial cells in the coming years.

By End-User Analysis

Pharmaceutical & Biotech Companies’ Segment Garnered the Largest Share in 2024

Pharmaceutical & biotech segment held the maximum market revenue share. The segment's growth is expected to be driven by increasing drug discoveries & development, a rising demand for personalized medicines, and a growing number of clinical trials in the forecast period. Additionally, ongoing government investments to support the escalating R&D activities are contributing to this growth.

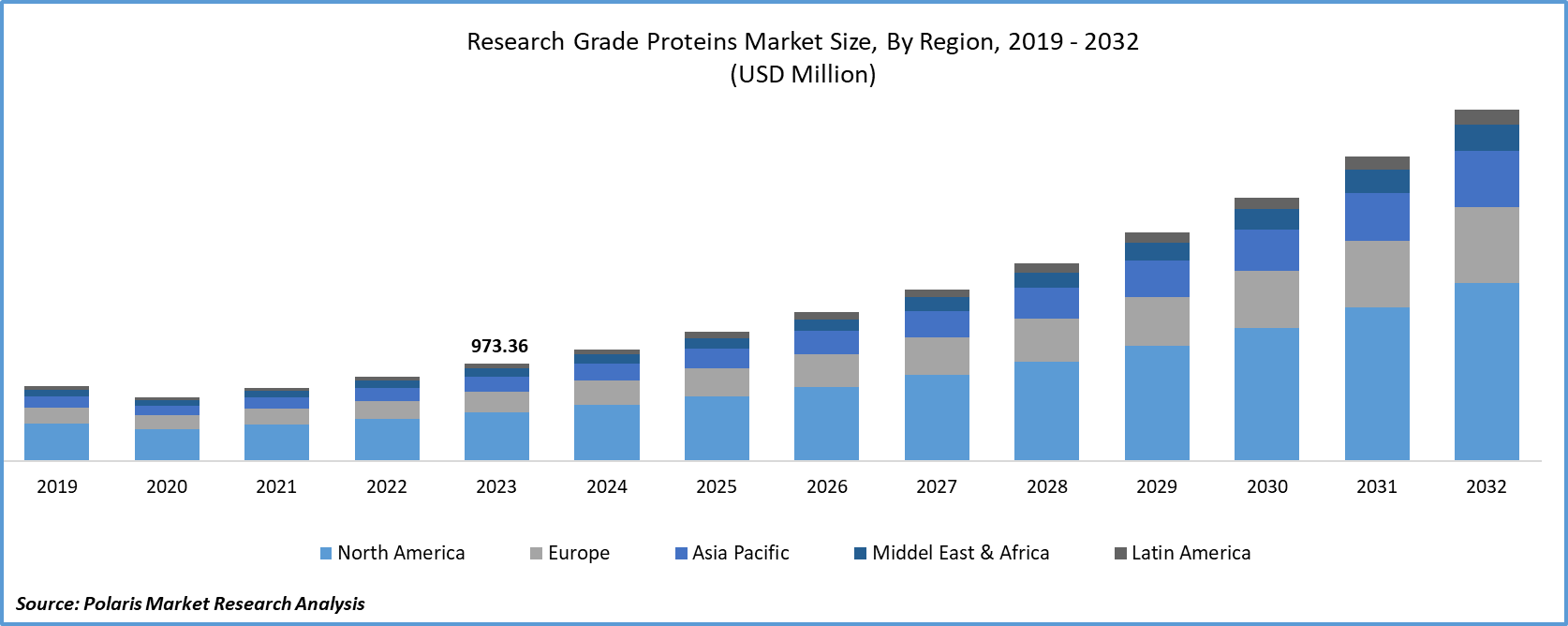

Regional Insights

North America Region Dominated the Global Market in 2024

The North America region dominated the global market. Region’s growth is attributed to increased research funding, the presence of key industry players, and a robust healthcare infrastructure in the region. Notably, initiatives like the Department of Health and Human Services' USD 40 million investment in September 2022 to bolster bio-manufacturing for essential medications and pandemic response have significantly contributed to this market strength. Ongoing advancements and growing investments are expected to further propel the region’s growth.

Asia Pacific will grow at rapid pace. This accelerated growth can be attributed to growing awareness of innovative technologies, the development of healthcare infrastructure, and a heightened demand for cutting-edge diagnostics and effective therapeutic solutions. Additionally, emerging economies in the region are investing in research facilities and biotechnology infrastructure. The increasing number of clinical studies focused on cancer research and drug development further augments the potential of the region, making it a key area for growth in the coming years.

Key Market Players & Competitive Insights

Industry frontrunners are dedicating substantial efforts to research and development aimed at producing products that are not only cost-effective but also technologically sophisticated. These organizations are implementing a variety of strategies, including mergers and acquisitions, to broaden their market reach. These initiatives are expected to open substantial avenues for growth in the foreseeable future.

Some of the major players operating in the global market include:

- Thermo Fisher Scientific, Inc.

- Abcam Plc

- Miltenyi Biotec

- GenScript

- Bio-Techne

- Proteintech Group, Inc.

- ACROBiosystems

- Sino Biological, Inc.

- Prospec-Tany Technogene Ltd.

- New England Biolabs

Recent Developments

-

In September 2024, ScaleReady and Bio-Techne Corporation introduced G-Rex optimized ProPak™ GMP Cytokines, designed specifically to enhance closed-system manufacturing for cell and gene-modified therapies.

-

In May 2023, GenScript Biotech recently expanded its primary manufacturing facility for oligonucleotides and peptides in Zhenjiang, China. This company has been a global supporter of scientists by delivering top-notch oligo and peptide products.

-

In August 2023, PeptiGrowth, partnered with the Orizuru Therapeutics, to explore and creating regenerative medicine derived from the induced Pluripotent Stem Cells (iPSCs).

-

In August 2023, Danaher Corporation announced a deal to acquire Abcam Plc for $24.00 per share in cash, valuing the company at approximately $5.7 billion, including debt and net of acquired cash.

Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 1,091.66 million |

|

Revenue forecast in 2034 |

USD 2,771.32 million |

|

CAGR |

10.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD million and CAGR from 2025 to 2034 |

|

Segments covered |

By Product, By Host Cell, By End Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

key companies in research grade proteins market are Thermo Fisher Scientific, Abcam, Miltenyi Biotec, GenScript, Bio-Techne

The global research grade proteins market is expected to grow at a CAGR of 15.4% during the forecast period.

The research grade proteins market report covering key segments are product, host cell, end use, and region.

key driving factors in research grade proteins market are Increasing Research Activities

The global research grade proteins market size is expected to reach USD 3.53 billion by 2032