Insect Repellent Market Share, Size, Trends & Industry Analysis Report

By Product Type (Sprays, Creams, Oils, Others); By Ingredient Type; By Distribution Channel; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 118

- Format: PDF

- Report ID: PM4272

- Base Year: 2024

- Historical Data: 2020-2023

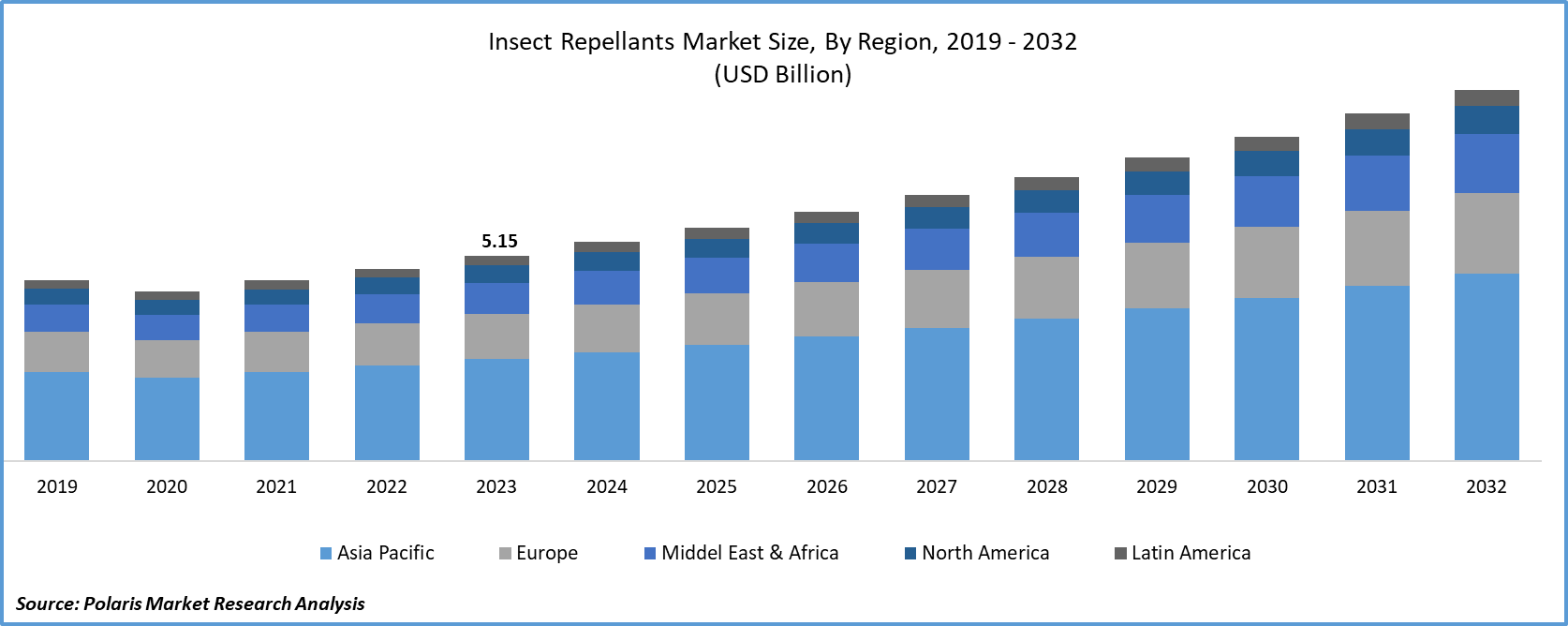

The global Insect Repellent Market was valued at USD 5.57 billion in 2024 and is forecasted to grow at a CAGR of 6.80% from 2025 to 2034. Increasing outdoor recreational activities, travel to tropical regions, and public health campaigns against vector-borne diseases are supporting market expansion.

The wide array of the insect repellents, such as sprays, coils, mats, & creams, has significantly boosted their appeal among consumers. This diverse selection caters to various preferences and requirements, whether indoors or outdoors. The global rise in insect populations has contributed to the spread of various diseases. Mosquitoes are significant carriers of diseases such as malaria, dengue, & yellow fever. They also transmit illnesses like lymphatic filariasis & Japanese encephalitis.

To Understand More About this Research: Request a Free Sample Report

The global urban population is showing increased health awareness and a growing concern about the risks associated with mosquito bites. In developing countries, where mosquito-borne diseases are on the rise, even rural communities are becoming more health-conscious. According to a March 2020 report from the World Health Organization (WHO), viral diseases account for over 17% of all the infectious diseases, resulting in more than 700,000 annual deaths. These diseases can be caused by parasites, or viruses.

In recent years, world suffered with many outbreaks of lethal infections, including chikungunya, influenza, zika virus, & dengue, primarily transmitted by the insect vectors. With the increase in vector-borne diseases, there is a growing demand for insect-repellent products, leading to a rise in the insect repellent market for insect-repellent active chemicals. Moreover, these diseases & new viruses can spread to different regions through travel and the transportation of goods.

The Insect Repellent Market report details key market dynamics to help industry players align their business strategies with current and future trends. It examines technological advances and breakthroughs in the industry and their impact on the market presence. Furthermore, a detailed regional analysis of the industry at the local, national, and global levels has been provided.

Additionally, other insects like the tsetse fly cause sleeping sickness, sandflies lead to the leishmaniasis group of diseases, blackflies cause Onchocerciasis or river blindness, and fleas are responsible for plague. According to an article published in The New England Journal of Medicine in November 2022, the Intergovernmental Panel on Climate Change has reported a high level of certainty that diseases spread by vectors have increased significantly in recent years.

For Specific Research Requirements, Request for a Customized Research Report

Industry Dynamics

Growth Drivers

Technological Advancements:

Advancements in technology are reshaping the way insect repellents are adopted and embraced, marking a significant impact on the market's future. Affordable and environmentally friendly products are anticipated to present substantial growth prospects for industry participants. Organic insect repellents are emerging as a safer option compared to synthetic counterparts like DEET and Picaridin. This shift broadens the market's potential for expansion.

The rising prevalence of insect-borne diseases has led to greater awareness among consumers, driving the increased usage of insect repellents. In 2020, data from the U.S. Census and Simmons National Consumer Survey (NHCS) indicated that 195.5 Mn individuals in the U.S. used insect repellents. Enhanced product visibility through online platforms and advertising campaigns continues to boost the adoption of insect repellents.

Report Segmentation

The market is primarily segmented based on insect type, product type, and region.

|

By Insect Type |

By Product Type |

By Region |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Insect Type Analysis

Mosquito repellent segment accounted for the noteworthy share in 2024

Mosquito repellent segment accounted for largest market. This dominance is attributed to the escalating prevalence of mosquito-borne diseases like malaria, dengue, Zika virus, and chikungunya. Heightened awareness about these diseases has driven the demand for effective mosquito repellents. The introduction of novel and efficient products has further propelled the segment's growth. Notably, the approval of the new mosquito repellent product, AM 601 Pod containing transfluthrin, by the U.S. Environmental Protection Agency (EPA) in July 2023 signifies the market's continuous expansion and innovation.

Bugs repellent segment will grow at rapid pace. The demand for these products is being propelled by odorless & non-sticky repellents. In March 2023, Zevo, introduced its latest On-Body Mosquito + Tick Repellents, providing odorless & non-sticky protection against ticks for up-to 8 hours. This launch aligns with the concerned consumer preferences for formulas for being both non-sticky & odorless.

By Product Type Analysis

Insect repellent vaporizers segment held the majority market share in 2024

Vaporizers segment held the majority market share. This is primarily due to the convenience they provide. Unlike topical applications like sprays or lotions, vaporizers offer continuous and passive protection. Upon being plugged in, these devices release repelling vapors, establishing a protective barrier for the indoor spaces. This ensures that users are shielded from the insects without the hassle of frequent re-application.

Spray segment will grow at substantial pace. The demand for the insect repellent sprays is propelled by their effectiveness, portability, & ability to offer precise applications, catering to both outdoor activities & daily use. In June 2023, Shubug introduced a new brand, Shubug Active & Shubug Natural, providing potent insect protection. The natural formula ensures 10 hours of defense against mosquitoes and pests with just 1 spray, while Shubug Active offers 12 hrs of protection. These products also emphasize quality ingredients and safety, addressing the needs of outdoor enthusiasts as consumers increasingly prioritize health and safety by seeking efficient and convenient insect repellent solutions.

Regional Insights

Asia Pacific region dominated the Global Insect Repellent Market in 2024

Region’s growth is primarily due to its warm and humid climate, creating ideal conditions for mosquitoes and other insects to thrive. As people search for ways to alleviate discomfort and reduce the risk of disease transmission from insects, the demand for insect repellents is expected to rise. Except for the Democratic People's Republic of Korea, all countries in this region are dengue-endemic, collectively contributing to around half of the global dengue cases. India, Indonesia, Sri Lanka, & Thailand are among the 30 most affected countries across the world.

As per the estimates of the WHO, prevalence of the dengue estimated to be around 3.9 Bn people are at risk of infection with the dengue viruses. In 2022, there were 2,33,251 dengue cases in India, up from 44,585 in 2020. In the first 10 months of 2022, there were 110,473 cases.

Middle East & Africa will grow at rapid pace. The increasing awareness about health risks has made consumers more proactive in safeguarding their health. This proactive approach includes the use of insect repellents as a preventive measure. Africa, according to the Africa Health Organization, is responsible for about 90% of the world's malaria cases. In the Middle East, governments and health organizations frequently conduct awareness campaigns about diseases transmitted by vectors. These initiatives stress the significance of using insect repellents as a crucial preventive measure.

Key Market Players & Competitive Insights

The market comprises global and local players. Major companies employ tactics like mergers, acquisitions, and establishing new operations in various regions to expand their market offerings.

Some of the major players operating in the global market include:

- Reckitt Benckiser Group PLC

- Godrej Consumer Products Ltd

- Dabur India Limited

- Coghlan's Ltd.

- S.C. Johnson & Sons Inc

- Johnson & Johnson

- Spectrum Brands, Inc.

- Sawyer Products

- Henkel AG & Co. KGaA

- Jyothy Laboratories Ltd.

Recent Developments

- In May 2022, Henkel Korea has initiated the 'Zero Mosquito' campaign along-with the “Korean Red Cross”. This campaign aims to raise awareness about the risks associated with mosquitoes. Henkel plans to expand the campaign by introducing limited-edition insect repellents by the end of 2022.

- In October 2022, Spectrum Brand's subsidiary, Hot Shot, introduced its Ant, Roach & Spider Killer aerosols. These new sprays come in scents like Crisp Linen, Fresh Floral, and Lemon, a response to consumer feedback. They aim to address concerns about the strong chemical odor usually linked with traditional insect control products.

- In May 2023, Reckitt Benckiser, through its subsidiary brand Mortein, has launched its latest liquid vaporizer, Mortein Smart+, in India. This scientifically advanced product was extensively tested at the Mortein Advanced Research Lab in Gurugram, India. The tests confirmed its accelerated effectiveness, providing enhanced protection against disease-causing mosquitoes for up to two hours after deactivation.

- In August 2024, Safex Chemicals’ specialty arm introduced Renofluthrin, a patented mosquito-repellant molecule, marking a significant product innovation and expanding its portfolio of vector-control solutions

Insect Repellent Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 5.94 billion |

|

Revenue forecast in 2034 |

USD 10.68 billion |

|

CAGR |

6.80% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments covered |

By Product Type, Insect Type, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation. |

The analysis of Insect Repellent Market extends to a comprehensive market forecast up to 2032, coupled with a retrospective examination. Avail yourself of a complimentary PDF download to sample this in-depth industry analysis.

Browse Our Top Selling Reports

Collagen Market Size, Share 2024 Research Report

Aerospace Riveting Equipment Market Size, Share 2024 Research Report

Latin America Industrial Pumps Market Size, Share 2024 Research Report

UV Nail Gel Market Size, Share 2024 Research Report

Radiation Dose Management Market Size, Share 2024 Research Report

FAQ's

The global insect repellent market size is expected to reach USD 10.68 billion by 2034

Key players in the market are Reckitt Benckiser, Godrej Consumer, Dabur, Coghlan’s, Johnson & Johnson

Asia Pacific contribute notably towards the global insect repellent market

The global insect repellent market is expected to grow at a CAGR of 6.8% during the forecast period.

The insect repellent market report covering key segments are insect type, product type, and region.