Aerospace Riveting Equipment Market Share, Size, Trends & Industry Analysis Report

By Type (Pneumatic, Hydraulic, Electric); By Application; By Region; Segment Forecast, 2025 - 2034

- Published Date:Jun-2025

- Pages: 125

- Format: PDF

- Report ID: PM4289

- Base Year: 2024

- Historical Data: 2020-2023

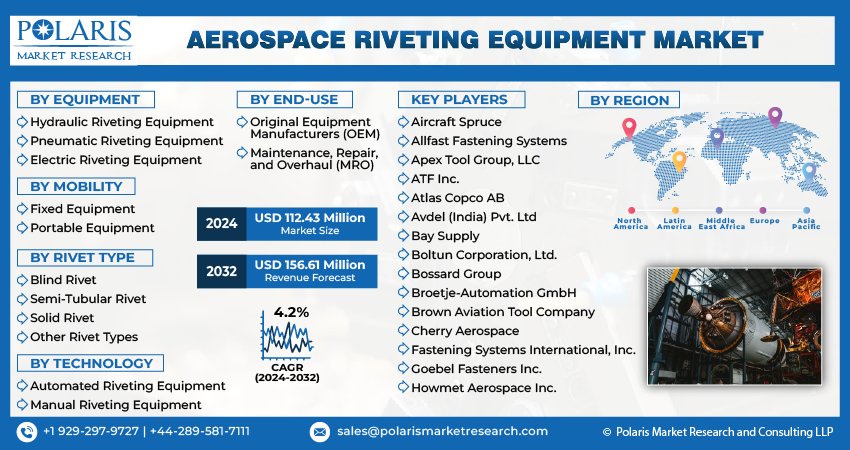

The global Aerospace Riveting Equipment Market was valued at USD 131.27 billion in 2024 and is projected to grow at a CAGR of 4.85% from 2025 to 2034. Recovery in aircraft manufacturing, maintenance, and structural assembly requirements are key growth drivers.

Aerospace Riveting Equipment Market Overview

Aerospace riveting equipment is the specialized tools and machinery used in aircraft structure fabrication and maintenance. Rivets are long-lasting mechanical fasteners that secure sheets of metal, composites, and other materials used in the aerospace industry. The aerospace industry is experiencing a surge in demand for aircraft due to a worldwide increase in demand, paired with a greater emphasis on lightweight and fuel-efficient aircraft structures. This has led to an increase in aircraft production, ultimately driving the growth of the market.

The rising demand for new aircraft to cater to the increasing air passenger traffic and the improvement of lighter and stronger riveting tools utilized in the aircraft will drive the growth of the market. Moreover, technological advancements are driving the development of advanced riveting machines in the aerospace industry, enhancing precision and efficiency.

Advancements in aerospace manufacturing processes are contributing to the growth of the market. Modern machines are equipped with intelligent automation, increased accuracy, and shorter cycle times, which enable higher productivity and shorter aircraft assembly times. These features are crucial in meeting the rising demand for aircraft and reducing operational costs. Riveting machines are responsible for joining metal components through riveting, which is essential for ensuring the structural stability and integrity required for safe flight or space missions. They are vital to the production processes of aircraft frames, fuselages, wings, missile bodies, and other critical components. The precision and reliability offered by these machines are indispensable to the aerospace industry, ensuring the meticulous construction of aerospace vehicles and equipment.

Orbital riveting is a technique that involves a riveting tool or head rotating while a fixed peen set applies a peening action to shape the rivet. This technique is known for its ability to create sturdy joints through a precise and controlled process, making it particularly suitable for aerospace assemblies where precision and durability are crucial. Another resilient joining method commonly used in the aerospace sector is radial riveting, which is distinguished by its radial peening action. Radial riveting machinery applies a force outward from the center of the rivet, resulting in a robust rivet with a polished surface.

To Understand More About this Research: Request a Free Sample Report

Orbital and radial riveting are commonly used in the aerospace manufacturing industry to create high-quality joints that are crucial for safety-critical applications. Radial riveting is known for its high production speeds and is usually used for internal or non-visible components. Orbital riveting is highly preferred for external riveting tasks because of its superior aesthetic results and precise tolerance control. Orbital riveting is especially useful for joints that are visible and require a high-quality finish.

COVID-19 has had a significant impact on the aerospace riveting equipment market. Due to the restrictions on travel, lockdowns, and a decrease in passenger demand, the aviation industry has been experiencing a decline. This, in turn, has caused disruptions in production schedules for aerospace manufacturers. As a result, the demand for aerospace riveting equipment has declined as many manufacturers have shut down their aircraft production plans.

Supply chain disruptions and labor shortages have affected the production and delivery of aerospace riveting equipment. However, as travel restrictions ease, the aviation industry is slowly recovering. This presents an opportunity for aerospace riveting equipment manufacturers to rebound as they resume and adapt their production strategies to meet the changing demands of the post-pandemic aviation landscape.

Aerospace Riveting Equipment Market Dynamics

Market Drivers

- Technical advancements in the aerospace manufacturing industries drive the growth of the market

The aerospace manufacturing industry is experiencing a growth in demand for advanced riveting equipment owing to the advancement of manufacturing technologies. As aircraft designs continue to develop with the use of lightweight materials and intricate structures, it has become increasingly important to have precise component joining. The use of innovative technologies such as laser riveting and friction stir welding have become essential in elevating the strength, durability, and efficiency of aircraft structures. This has boosted riveting equipment manufacturers to create advanced solutions specifically tailored to meet the rigorous demands of modern aerospace applications.

The aerospace manufacturing industry has made significant advancements in technology, such as laser riveting and friction stir welding. These innovations have fundamentally changed the methodology of constructing aircraft structures. Laser riveting involves the use of powerful lasers for precise joining, while friction stir welding is a solid-state welding technique that creates strong joints without melting materials. For instance, in August 2023, Bond Technologies, Inc. launched the PM2 Friction Stir Welding machine, a unique solution for high-volume production with advanced features designed for small to medium-sized aluminum alloy parts, offering reliability and efficiency in demanding production environments.

These advanced technologies surpass conventional riveting approaches, delivering superior strength, reduced weight, and enhanced fatigue resistance in various aircraft components.

Market Restraints

- Strict regulation compliance and certification standards hamper on the market growth

Strict regulatory compliance and certification standards pose significant limitations to the aerospace riveting equipment market. The aviation industry prioritizes safety, and manufacturers must comply with rigorous regulations set by aviation authorities. Meeting these standards involves extensive certification processes, which lead to longer development timelines and higher costs. This creates a bottleneck, preventing aerospace riveting equipment providers from innovating and entering the market quickly.

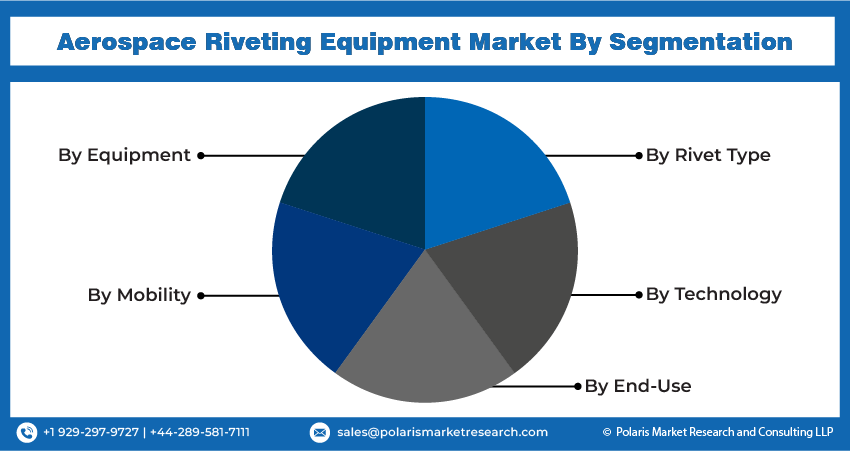

Report Segmentation

The market is primarily segmented based on equipment, mobility, rivet type, technology, end-use, and region.

|

By Equipment |

By Mobility |

By Rivet Type |

By Technology |

By End-Use |

By Region |

|

|

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

Aerospace Riveting Equipment Market Segmental Analysis

By Equipment Analysis

- The pneumatic riveting segment held the largest revenue share in the aerospace riveting equipment market, owing to its versatility and efficiency. The aerospace industry needs sturdy and lightweight joints, which has led to a surge in the use of pneumatic riveting tools. These tools are popular due to their ability to provide consistent force, speed, and precision when fastening materials like plastics and metals. Additionally, their ease of use and lower maintenance costs have contributed to their increasing popularity among manufacturers. This is because there is a need for reliable and high-performing riveting solutions in the assembly and fabrication processes.

By Mobility Analysis

- The fixed equipment segment accounted for the highest revenue share. The need for stability and precision in aircraft assembly drives this segment in the aerospace riveting equipment market. Aerospace manufacturers need reliable and stationary riveting solutions to assist in crucial assembly processes. Stationary riveting equipment enhances precision, consistency, and structural integrity, which are all crucial aspects in the fabrication of aircraft components. The equipment's dependability ensures the production of high-quality, uniform joints that fulfil strict aviation safety and quality standards. As aerospace companies strive for streamlined and perfect assembly, stationary riveting equipment remains essential, ensuring the seamless production of aircraft parts that are accurate and dependable in the dynamic aerospace sector.

By End-Use Analysis

- Based on the end-use the market has been segmented on the basis of Original Equipment Manufacturers, Maintenance, Repair, and Overhaul (MRO). Original equipment manufacturers held the largest market share in the aerospace riveting equipment market. Original Equipment Manufacturers (OEMs) are crucial in the development and production of specialized components or systems, with a focus on factors such as type, mobility, riveting, and automation solutions. They design unique products or parts and supply them primarily to other companies, such as integrators or aircraft manufacturers. OEMs maintain strict quality standards to ensure product excellence by conducting comprehensive testing, implementing stringent quality control measures, and complying with industry standards, which drive the growth of the market.

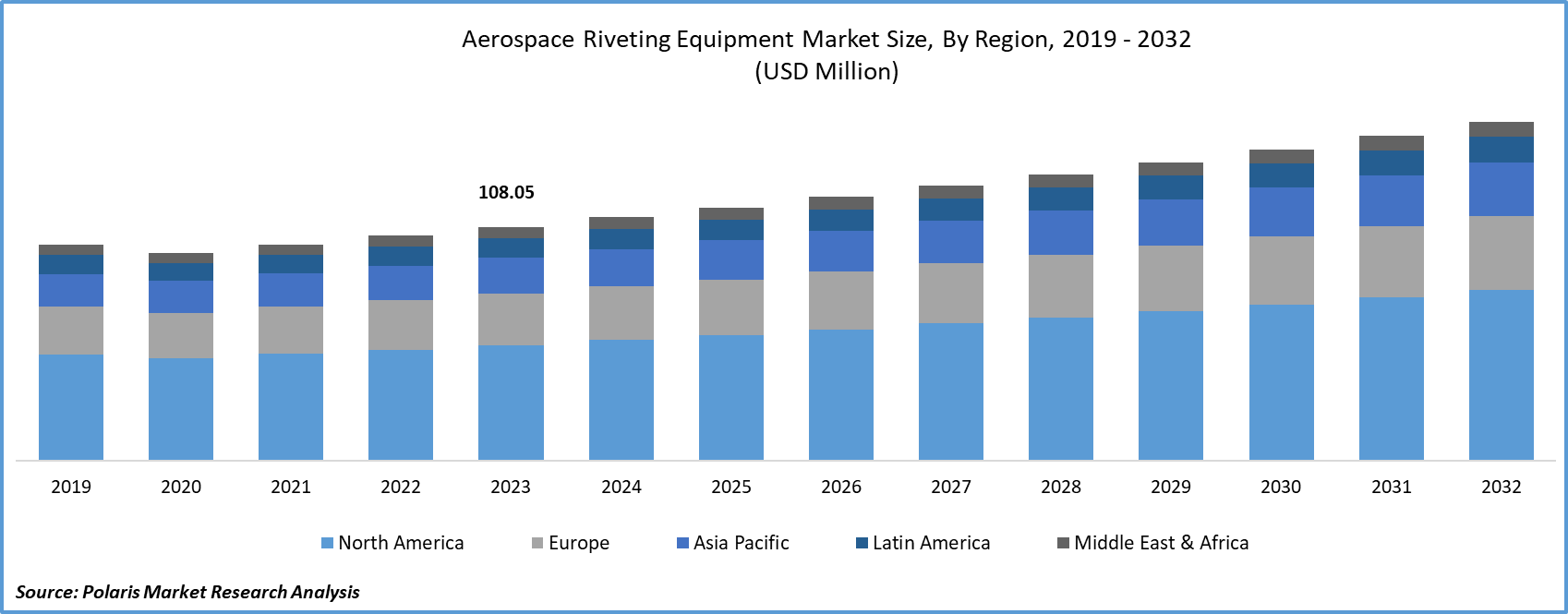

Aerospace Riveting Equipment Market Regional Insights

- North America dominated the largest market in 2024

North America region dominated the aerospace riveting equipment market, and a number of aircraft manufacturers and suppliers have a presence in North America, which creates a high demand for precision assembly tools. Strict safety regulations, as well as the desire for innovative, efficient manufacturing methods, drive the demand for advanced aerospace riveting equipment. North America's significant investment in aerospace research and development, as well as infrastructure, propels market growth. The region's dedication to quality, adherence to standards, and emphasis on technological innovation position it as a key market influencer, meeting the changing needs of the aerospace industry and propelling ongoing progress in riveting equipment technologies.

Asia Pacific has witnessed the fastest growth in the market. Countries such as Japan, China, and India are increasingly investing in the aerospace and defense industries, which is leading to a higher demand for aerospace riveting equipment. The growing civil aviation sector, along with the increasing activities in maintenance, repair, and overhaul (MRO), is having a significant impact on the regional market. Furthermore, the expanding local manufacturing infrastructure for aerospace components emphasizes the need for effective and reliable riveting tools.

Competitive Landscape

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Aircraft Spruce

- Allfast Fastening Systems

- Apex Tool Group, LLC

- ATF Inc.

- Atlas Copco AB

- Avdel (India) Pvt. Ltd

- Bay Supply

- Boltun Corporation, Ltd.

- Bossard Group

- Broetje-Automation GmbH

- Brown Aviation Tool Company

- Cherry Aerospace

- Fastening Systems International, Inc.

- Goebel Fasteners Inc.

- Howmet Aerospace Inc.

Recent Developments

- In June 2025, Wipro Infrastructure Engineering announced its plan to acquire a majority stake in France-based Lauak Group, aiming to strengthen its aerospace manufacturing operations in Europe and expand its capabilities in advanced riveting and structural components.

- In October 2023, Atlas Copco AB launched a cordless drill named EBB16, which has been designed for aircraft manufacturing.

- In July 2023, Cherry Aerospace launched a new lightweight rivet designed for aircraft structures, featuring increased joint strength and fatigue resistance. This development aligns with the industry's push towards more fuel-efficient materials and designs.

Report Coverage

The aerospace riveting equipment market report emphasizes on key regions across the globe to provide better understanding of the product to the users. Also, the report provides market insights into recent developments, trends and analyzes the technologies that are gaining traction around the globe. Furthermore, the report covers in-depth qualitative analysis pertaining to various paradigm shifts associated with the transformation of these solutions.

The report provides detailed analysis of the market while focusing on various key aspects such as competitive analysis, equipment, mobility, rivet type, technology, end-use, and their futuristic growth opportunities.

Aerospace Riveting Equipments Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2025 |

USD 137.65 billion |

|

Revenue forecast in 2034 |

USD 211.03 billion |

|

CAGR |

4.85% from 2025 – 2034 |

|

Base year |

2024 |

|

Historical data |

2020 – 2023 |

|

Forecast period |

2025 – 2034 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Segments Covered |

By Equipment, By Mobility, By Rivet Type, By Technology, By End-Use, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, region and segmentation |