Latin America Industrial Pumps Market Share, Size, Trends, Industry Analysis Report

By Type (Centrifugal Pump, Positive Displacement Pump, Dosing/Metering Pumps, Others), By End-use, By Country, And Segment Forecasts, 2024 - 2032

- Published Date:Jan-2024

- Pages: 117

- Format: PDF

- Report ID: PM4292

- Base Year: 2023

- Historical Data: 2019 – 2022

Report Outlook

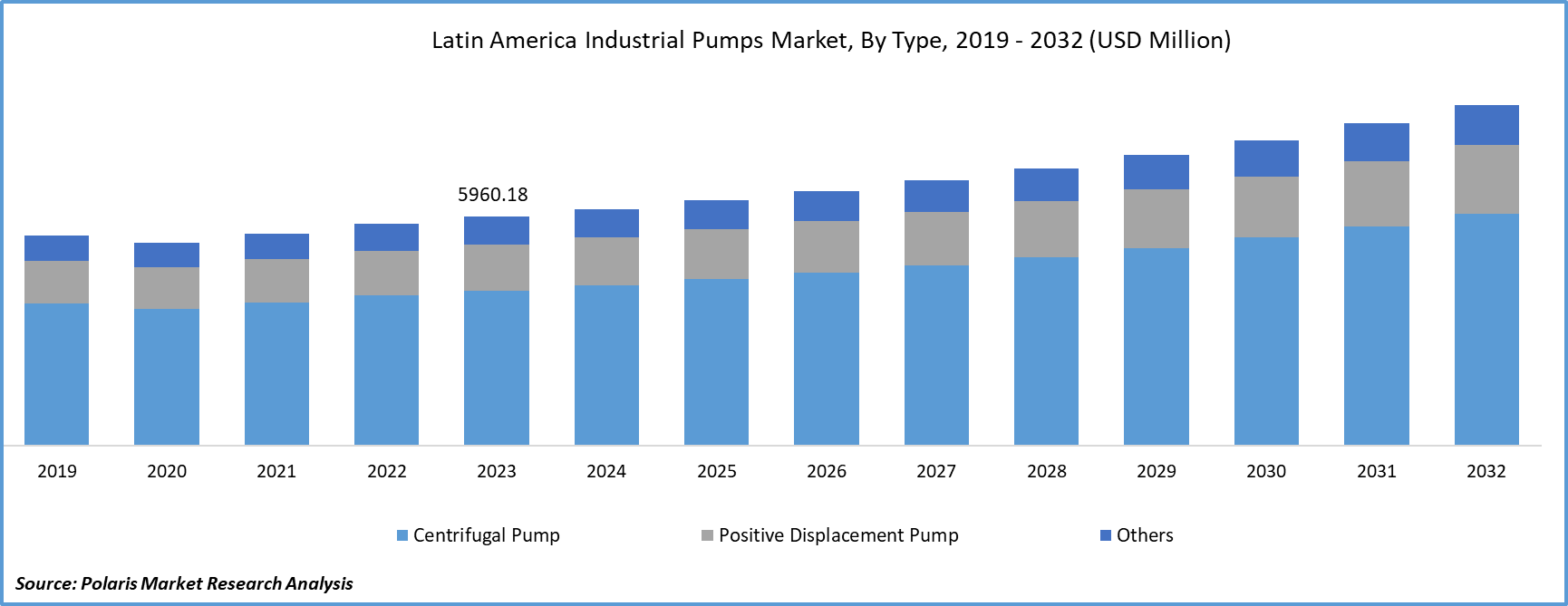

The Latin America industrial pumps market was valued at USD 5,960.18 million in 2023 and is expected to grow at a CAGR of 4.5% during the forecast period.

The market dynamics are propelled by various factors, including the rapid pace of industrialization and urbanization, heightened investments in the oil & gas and mining sectors, stringent regulatory policies regarding energy and the environment, and a focus on energy-efficient products. Additionally, the rising demand for water supply and pressure augmentation across diverse activities is anticipated to drive the usage of pumps in sectors such as chemicals, metal production, marine, food and beverage, among others. Over time, the increasing demand from these industries is expected to fuel the market's expansion.

In South America, increased investments in exploration and production by oil and gas companies are foreseen to boost pump demand in the sector. The ongoing infrastructure modifications, such as the installation or alteration of pipelines, are poised to contribute to market growth. Presently, the oil and gas, mining, and power generation industries are at the forefront of demand in South America, owing to the region's abundant natural resources. Dosing/metering pumps are predominantly utilized in chlorination processes for water treatment, with additional demand for anti-incrustants and pH regulators.

Across Latin America, efforts are underway to transition to lower sulfur gasoline, with countries like Chile, Suriname, Brazil, Uruguay, Argentina, Guyana, Mexico, Bolivia, Colombia, and Paraguay making strides in this direction. Initiatives such as Argentina's distribution of Ultra Grado 3 gasoline with minimal sulfur content exemplify this trend. The implementation of the IMO 2020 regulation has further intensified the demand for low sulfur fuels, prompting refinery upgrades and subsequently increasing the need for centrifugal pumps.

To Understand More About this Research: Request a Free Sample Report

In response to heightened competition among manufacturing companies in the region to enhance productivity, the demand for industrial pumps is expected to rise. End-users are anticipated to explore and select optimal pumps for challenging tasks, driven in part by an increased awareness of environmental considerations, further propelling the Latin America industrial pumps market.

Growth Drivers

- Increasing investments in renewable power generation along with technological advancements in industrial pumps

There has been an increase in demand for industrial pumps used in various renewable energy applications as countries pursue sustainable energy sources. Hydroelectric, solar, wind and geothermal power projects require efficient and reliable pumping systems for processes such as water circulation, cooling, and fluid transfer. The increasing focus on reducing carbon emissions and transitioning to cleaner energy sources has driven the growth of renewable energy infrastructure in Latin America. This, in turn, has increased the demand for industrial pumps specifically designed to meet the needs of these projects.

Investing in renewable energy generation is suitable for the environment and also presents a promising opportunity for suppliers and manufacturers in the industrial pump industry. Pump technology companies are positioning themselves to cater to the specific requirements of renewable energy projects and offer solutions that enhance sustainability, reliability, and efficiency. The energy landscape in Latin America is rapidly changing, with a growing inclination towards cleaner and greener sources.

Technological advancements in industrial pumps have been transformative, enhancing efficiency, reliability, and sustainability across various sectors. The integration of smart technologies and the Industrial Internet of Things (IIoT) in pump systems. Smart pumps equipped with sensors and connectivity features enable real-time monitoring and data collection. This allows for predictive maintenance, reducing downtime, and optimizing performance.

Additionally, advanced control systems and automation technologies contribute to precise and adaptive pump operation, responding dynamically to changing process conditions. Such innovations not only improve operational efficiency but also support industries in achieving energy savings and reducing overall maintenance costs.

Report Segmentation

The market is primarily segmented based on type, end use, and region.

|

By Type |

By End Use |

By Country |

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Type Analysis

- Centrifugal Pump segment held the largest share in 2023

Centrifugal pumps play a pivotal role in a wide range of domestic and industrial processes, serving diverse applications. Whether facilitating water supply in residential structures or contributing to industrial processes in sectors such as food, beverage, and chemical manufacturing, different types of centrifugal pumps are indispensable for efficient pumping operations.

These hydraulically operated machines are recognized for their capacity to impart energy to fluids, especially liquids, by harnessing centrifugal forces. Their primary function is to elevate fluid pressure for seamless transfer. While centrifugal pumps may exhibit diverse structural designs, their fundamental operating principle and fluid dynamic characteristics remain consistent. The impeller, a crucial component, comes in various shapes and sizes, tailored to meet specific performance requirements and the nature of the pumped liquids.

By End Use Analysis

- Oil & gas segment held the significant market revenue share in 2023

Industrial pumps play a crucial role in every stage of oil and gas operations, facilitating the transfer of process fluids from one location to another. Centrifugal, positive displacement, diaphragm, oil transfer, and petrochemical pumps are vital components in the journey of oil, from extraction to storage. For instance, these pumps are instrumental in moving crude oil from storage tanks to pipelines. Mud pumps, on the other hand, circulate drilling mud into the annulus of a drill bit and then back to a storage tank for re-purification during drilling operations.

In oilfields, centrifugal pumps are utilized to transfer crude oil from wellheads to storage tanks or transport it through pipelines. Offshore oil and gas production platforms also rely on centrifugal pumps to transfer liquids between various process USD Million and inject chemicals into production wells.

Country Insights

- Brazil held the largest share of the global market in 2023

The manufacturing sector in Brazil, which includes industries like automotive and chemicals, depends on pumps for various processes such as fluid transfer, cooling, and circulation. Vikas Pump is emerging as a prominent player, establishing itself as a prominent Industrial Pump manufacturer in Brazil. It offers a diverse range of Industrial Pumps, including Centrifugal pumps, Monoblock pumps, High-Pressure pumps, Submersible pumps, and more, which exemplify the increasing demand for pumps in Brazil.

Moreover, various contracts for manufacturing pumps using different materials underscore the escalating market demand and contribute to the broadening scope of the pump industry in Brazil. For instance, in September 2020, EBAS received an order for a vertical pump from steelmaker Companhia Siderurgica Nacional, marking the first order of this kind for Ebara in Brazil in almost 50 years. This development in pump technology are instrumental in driving the demand and market growth in the country.

Key Market Players & Competitive Insights

Manufacturers employ a range of strategies, such as acquisitions, mergers, joint ventures, advancements in new materials, and geographical expansions, to augment market penetration and address the evolving needs of diverse end-use industries. Several major companies have taken initiatives like technological upgrades and increased investments in research and development activities to establish a stronger foothold in the market.

Some of the major players operating in the global market include:

- Baker Hughes Company,

- Ebara Corporation

- Franklin Electric Co., Inc.

- Grundfos

- Hidrostal Holding AG

- IMBIL

- Ingersoll Rand

- ITT Inc.

- KSB Ltd.

- ProMinent

- Pulsafeeder

- Ruhrpumpen

- Schlumberger Limited

- SEKO

- Sulzer Ltd

- The Weir Group PLC

- WILO SE

Recent Developments

- In February 2022: Wilo SE launched submersible pump Wilo-Actun ZETOS versatile solution for efficient raw water intake, water extraction and supply while simultaneously reducing the ecological footprint in Latin America.

- May 2020: EBARA CORPORATION has inaugurated Ebara Pumps Mexico, S.A. de C.V. (EPMX) to sell, service, and support standard pumps in Mexico.

Latin America Industrial Pumps Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 6,161.01 million |

|

Revenue forecast in 2032 |

USD 8855.10 million |

|

CAGR |

4.5% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2032 |

|

Segments covered |

By Type, By End Use, By Country |

|

Customization |

Report customization as per your requirements with respect to countries, region, and segmentation. |

FAQ's

The latin america industrial pumps market report covering key segments are type, end use, and region.

Latin America Industrial Pumps Market Size Worth $8,855.10 Million By 2032

The Latin America industrial pumps market is expected to grow at a CAGR of 4.5% during the forecast period.

Key players in the market are Baker Hughes Company, Ebara Corporation, ITT Inc., The Weir Group PLC, Grundfos, Sulzer Ltd

key driving factors in latin america industrial pumps market are Increasing investments in renewable power generation along with technological advancements in industrial pumps