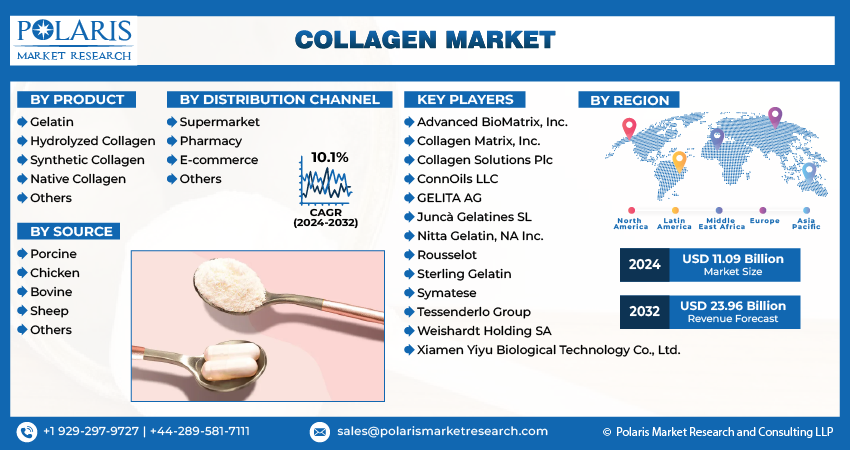

Collagen Market Size, Share, Trends & Industry Analysis Report

: By Product (Gelatin, Hydrolyzed Collagen, Synthetic Collagen, Native Collagen, and Others), Source, Distribution Channel, and Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 130

- Format: PDF

- Report ID: PM4288

- Base Year: 2024

- Historical Data: 2020-2023

Market Overview

The collagen market size was valued at USD 9.96 billion in 2024, exhibiting a CAGR of 11.2% during 2025–2034. The collagen market is driven by rising demand in cosmetics, healthcare, and food industries, increasing aging population, growing awareness of collagen benefits, advancements in extraction technology, and expanding applications in wound care and supplements.

Key Insights

- Gelatin is the largest contributor, as it is used in a wide range of applications in food and pharmaceutical products, and is economical due to the existence of well-established production processes.

- Chicken collagen is also increasingly being used as an alternative because it is versatile for people with religious/dietary limitations, and it's beneficial for the joints.

- Supermarkets and pharmacies continue to be significant sales points due to their convenience and consumers' trust in them for health-related shopping.

- North America dominates the market, holding the highest market share, driven by substantial expenditure on healthcare products and robust research and development (R&D) efforts in collagen-based developments.

- Asia Pacific is the region with the most rapid growth, driven by growing incomes, aging populations, and rising demand for wellness and beauty supplements.

Industry Dynamics

- The high digestibility and bioavailability of hydrolyzed collagen are the drivers of its demand as a functional food and supplement.

- Gelatin predominates due to its low cost and extensive applications across the food, pharmaceutical, and film industries.

- Collagen in bovines is supported by a stable supply and high content of Type I & III for bone, hair, and skin.

- eCommerce enhances collagen availability through reviews, diversity, and convenience, thereby favoring direct-to-consumer brand expansion.

- Ethical issues and diet limitations regarding animal-based sources of collagen limit adoption among some demographic and cultural segments.

Market Statistics

2024 Market Size: USD 9.96 billion

2034 Projected Market Size: USD 28.72 billion

CAGR (2025-2034): 11.2%

North America: Largest Market Share

To Understand More About this Research: Request a Free Sample Report

Collagen provides connective tissues such as skin, bones, tendons, and ligaments with structural integrity. It builds and enables support with bodily systems, while also enhancing strength and elasticity throughout the body. The construction and marketing of collagen, as well as its derivatives, like hydrolyzed collagen and gelatin, obtained chiefly from animal by-products such as bovine, porcine, and marine sources, make up the collagen market. These ingredients are extensively useful throughout a variety of nutraceuticals, personal care and cosmetics, food and beverages, and healthcare. Just like most products, the expanding demand for collagen products is fueled by increasing consumer awareness, and with the recognized benefits for skin health, joint function, and overall vitality, it is no surprise.

The expansion of the collagen segment is driven by a few key dynamics. One of the most impactful is the surging demand for anti-aging supplements and solutions owing to skin mobility and joint concerns from the globally aging population. Moreover, the growing interest in functional foods, along with dietary supplements, enhanced with collagen peptides, also adds significantly to the growth due to their bioavailability and health advantages. Besides these, the personal care and cosmetic industry is one of the leading users of collagen due to its perceived anti-aging properties, which leads to the increasing use of collagen in skincare products. The growing refinement of extraction and processing technologies for collagen is enabling an enhancement in the quality and versatility of collagen products, deepening the effectiveness across numerous end-use industries, and expanding the overall scope of this primal protein.

Industry Dynamics

Rising Demand from the Aging Population

The global aging population is a significant factor driving the demand for collagen products. As people age, their bodies produce less natural collagen, which leads to visible signs of aging, such as wrinkles, reduced skin elasticity, and joint discomfort. This demographic shift has created a substantial market for products aimed at alleviating these effects.

For example, data from the NCBI indicates that the U.S. population aged 65 and older is expected to nearly double by 2060, rising from approximately 56 million in 2020 to around 95 million. This increase represents a larger consumer base actively seeking solutions for age-related concerns, particularly those addressed by collagen supplementation.

The growing demand among older adults to maintain a youthful appearance and an active lifestyle directly drives the demand for collagen-based products. This demographic trend is expanding the market for anti-aging and joint health solutions.

Growing Health and Wellness Awareness

Increased consumer awareness of the significant health benefits of collagen is a key factor driving its growing popularity. Research has consistently shown that collagen supports skin hydration, elasticity, and overall joint health. A systematic review published in Heliyon in 2023 indicated that hydrolyzed collagen supplementation leads to positive changes in the skin, including reduced wrinkle formation and enhanced skin elasticity and hydration. Additionally, a study from Nutrients in 2023 reported improvements in pain relief and joint function related to collagen supplementation for joint health. These scientific findings, readily accessible through research platforms like PubMed and NCBI, enable consumers to make informed choices, resulting in a greater acceptance of collagen as an essential supplement for holistic well-being. This increased awareness of collagen's diverse health benefits is significantly contributing to its market growth.

Expansion of Functional Foods and Beverages

The growing popularity of functional foods and beverages, which are enhanced with health-promoting ingredients, is significantly contributing to market expansion. Consumers are increasingly looking for everyday food and drink options that provide additional nutritional value and specific health benefits beyond basic sustenance. Collagen is particularly suitable for this category due to its neutral taste and ease of incorporation into various formats, such as protein bars, enhanced beverages, and fortified snacks. This trend encourages manufacturers to innovate and launch new collagen-infused products, making collagen more accessible to a wider consumer base. The integration of collagen into convenient and health-focused products is a strong driver of demand trends.

Segmental Insights

Market Assessment By Product

Gelatin holds the largest market share during the forecast period. In the food and beverage industry, gelatin is commonly used in confectionery, dairy products, and desserts due to its gelling, binding, and stabilizing properties. Additionally, gelatin's popularity is supported by its wide-ranging applications in the pharmaceutical sector and its role in photographic films. Most gelatin is produced using a well-established production infrastructure, making it relatively inexpensive compared to other, more processed forms of collagen. This affordability helps sustain gelatin's market presence and overall size.

The hydrolyzed segment experiencing the highest growth rate during the forecast period. The increased demand for hydrolyzed collagen can be attributed to its high bioavailability and ease of digestion, making it a preferred ingredient in the rapidly growing nutraceutical and functional food sectors. Its rising popularity among consumers seeking health benefits is largely due to the proven advantages of hydrolyzed collagen for skin, joint, and gut health. Its versatile nature allows for easy integration into various formulations, such as powdered supplements, beverages, and protein bars. The shift in consumer focus toward proactive health management, combined with the continuous development of new applications, is significantly enhancing market opportunities for hydrolyzed collagen.

Market Evaluation By Source

Bovine collagen is expected to dominate the market during the forecast period. This dominance is primarily due to the abundant supply of raw materials from the cattle industry, including hides, bones, and cartilage byproducts from meat processing. The established infrastructure for sourcing and processing bovine collagen provides easy access to this type of vertebrate collagen, which is widely utilized in the food, pharmaceutical, and cosmetic industries. This extensive market use contributes significantly to its strong market penetration. Bovine collagen is particularly noteworthy because it contains high concentrations of type I and type III collagen, which are essential for maintaining the health of skin, hair, nails, and bones, reinforcing its important position in the market.

Chicken collagen is experiencing the highest growth rates in the coming years. This growth is driven by consumer preferences for alternatives to traditional sources like porcine and bovine collagen, which are influenced by dietary restrictions, religious beliefs, and concerns about zoonotic diseases. Among the various collagen sources, marine collagen is gaining popularity due to its superior bioavailability and its strong association with skin and beauty benefits. Additionally, chicken collagen is expected to see significant growth because of its natural type II collagen content, which is particularly beneficial for joint health formulations. The increasing preference for more diverse and specialized sources of collagen represents one of the most significant trends affecting demand dynamics in the market.

Market Evaluation By Distribution Channel

Supermarkets and pharmacies account for a significant portion of collagen product sales. This is largely due to their high availability, which allows consumers to easily purchase collagen supplements and products while shopping. Pharmacies, in particular, benefit from consumer trust and offer professional guidance, which is essential for health-related purchases. The immediate access to products and the opportunity for consumers to examine them in person contribute to the popularity of these outlets.

Meanwhile, the rise of eCommerce platforms has made online shopping the fastest-growing segment for collagen product sales. Consumers can now conveniently search for a variety of collagen products from different brands from the comfort of their homes. Factors such as competitive pricing, detailed product descriptions, and easy access to customer reviews influence purchasing decisions significantly. As shoppers become more proficient with technology and manufacturers increasingly sell directly to consumers, the growth of eCommerce accelerates, establishing it as a primary and rapidly expanding channel for distributing collagen products.

Regional Analysis

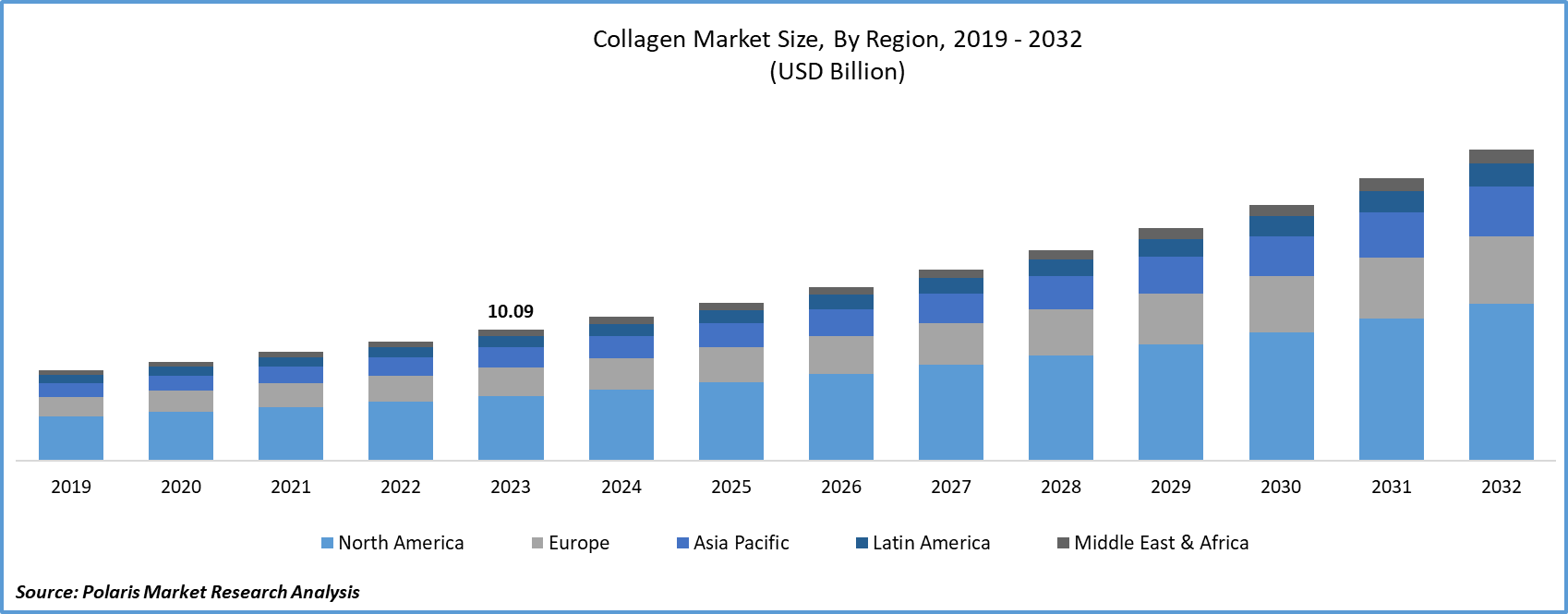

The North America collagen market holds the largest share of the global collagen market. This region benefits from a well-developed nutraceutical and dietary supplement industry, an advanced healthcare system, and a high per capita income, which leads to increased spending on health products, particularly collagen. Additionally, significant research and development investments from various North American companies foster continuous innovation in functional foods and personal care products, thereby expanding the range of nutrition and beauty items enhanced with collagen.

The Asia Pacific collagen market is recognized as the fastest-growing segment. This growth is primarily driven by a health-conscious consumer base in developing countries such as China and India, where rising incomes are increasing spending on dietary supplements and "beauty-from-within" products. The region also has a strong cultural emphasis on traditional health and wellness practices, coupled with an aging population seeking effective anti-aging solutions. Furthermore, there is growing domestic innovation surrounding traditional and herbal sources of collagen, which aligns more closely with regional demand and enhances market penetration.

Key Players and Competitive Insights

The competition environment in the collagen sector comprises a small number of dominating international players along with an emerging diverse group of niche and local operators. Old segments still focus on developing new products such as hydrolyzed collagen and collagen extracted from marine sources to fulfill specific consumer demands related to health and beauty. These firms are changing marketing strategies to make the product more soluble and palatable while sustaining ethical and responsible sourcing and manufacturing policies. These conditions encourage alternatives in collagen technology and applications.

List of Key Companies:

- Amicogen Inc.

- Collagen Solutions Plc (a Rosen's Diversified Inc. company)

- Gelita AG

- Nippi Incorporated

- Nitta Gelatin Inc.

- PB Leiner (part of Tessenderlo Group)

- Rousselot (a Darling Ingredients brand)

- Weishardt International

Industry Developments

- April 2025: Rousselot, a Darling Ingredients brand, received Upcycled Certified® status for its Peptan® collagen peptides.

- April 2025: Leiner announced it would showcase its cutting-edge collagen peptides, including SOLUGEL® Supra, at Vitafoods Europe 2025.

Market Segmentation

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Gelatin

- Hydrolyzed Collagen

- Synthetic Collagen

- Native Collagen

- Others

By Source Outlook (Revenue – USD Billion, 2020–2034)

- Porcine

- Chicken

- Bovine

- Sheep

- Others

By Distribution Channel Outlook (Revenue – USD Billion, 2020–2034)

- Supermarket

- Pharmacy

- E-commerce

- Others

By Regional Outlook (Revenue-USD Billion, 2020–2034)

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Vietnam

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Brazil

- Argentina

- Rest of Latin America

Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 9.96 billion |

|

Market Size Value in 2025 |

USD 11.05 billion |

|

Revenue Forecast by 2034 |

USD 28.72 billion |

|

CAGR |

11.2% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

FAQ's

The global market size was valued at USD 9.96 billion in 2024 and is projected to grow to USD 28.72 billion by 2034.

The market is projected to register a CAGR of 11.2% during the forecast period, 2024-2034.

North America had the largest share of the market.

Key players include Gelita AG, Rousselot (a Darling Ingredients brand), PB Leiner (part of Tessenderlo Group), Nitta Gelatin Inc., Nippi Incorporated, Weishardt International, Amicogen Inc., and Collagen Solutions Plc (a Rosen's Diversified Inc. company).

The gelatin segment accounted for the largest share of the market in 2024.

The following are some of the market trends: ? Increase in demand for tailored collagens: There is a growing demand not just for general collagen, but for specific types like type I, II, and III collagen, which are designed to aid skin, joints, and gut wellness. ? Emergence of eco-friendly and marine sources: Even though animal collagen still holds its market dominance, demand for marine collagen is increasing due to perceived greater bioavailability and sustainability.

Collagen can be described as a protein that is most prevalent in the human body, as it is one of the primary constituents of connective tissue. With regard to the body, collagen is a fibrous protein of great importance, responsible for strength, elasticity, and support to the skin, blood vessels, bones, cartilage, ligaments, tendons, and more. Its principal constituents are amino acids, including glycine, proline, and hydroxyproline, which are uniquely arranged in a triple helix, which provides collagen great rigidity and tensile strength.