U.S. Phenolic Resins Market Size, Share, Trends, Industry Analysis Report

By Product (Novolac, Resols, Other Phenolic Resins), By Application, By End Use – Market Forecast, 2025–2034

- Published Date:Sep-2025

- Pages: 126

- Format: PDF

- Report ID: PM6379

- Base Year: 2024

- Historical Data: 2020-2023

Overview

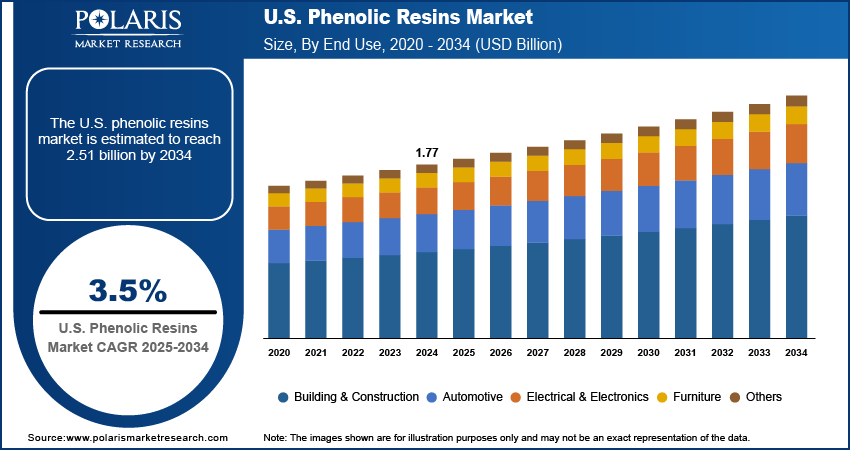

The U.S. phenolic resins market size was valued at USD 1.77 billion in 2024, growing at a CAGR of 3.5% from 2025 to 2034. Key factors driving demand include the development of sustainable and bio-based phenolic resins, growth in industrial & wood adhesives, increasing use of phenolic resins in electronics and electrical applications, and growing demand in industrial and wood adhesives.

Key Insights

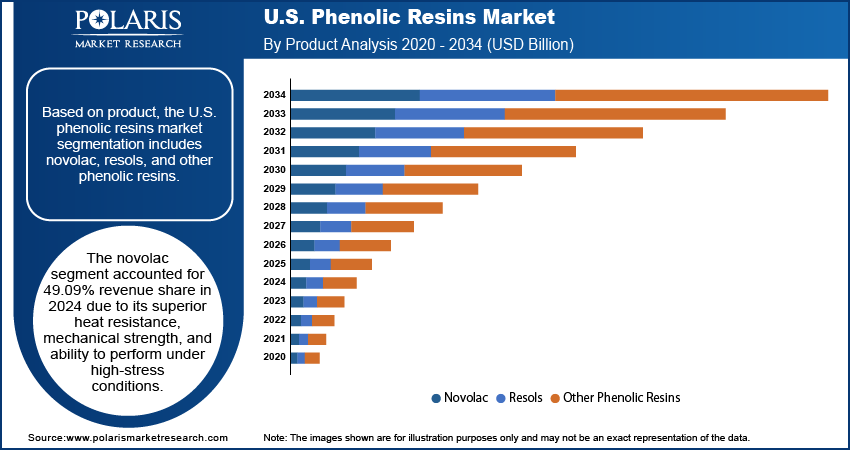

- In 2024, the novolac resins segment held 49.09% revenue share, driven by exceptional heat resistance, mechanical strength, and reliability in high-stress applications.

- The molding segment is projected to register a CAGR of 4.6% during the forecast period, fueled by rising demand for phenolic molding compounds in automotive, electronics, and consumer goods.

- The automotive segment held 42.48% revenue share in 2024, as phenolic resins are primarily used in brake systems, clutch components, filters, and engine compartment applications.

Industry Dynamics

- The demand for phenolic resins is rising in circuit boards, switches, and connectors due to their superior insulation, thermal stability, and flame resistance, ensuring reliability in critical electrical applications.

- Industrial & wood adhesives durable, moisture-resistant bonding properties make phenolic resins essential for plywood, LVL, and engineered wood, fueling growth in construction and furniture industries.

- Stricter environmental regulations on formaldehyde emissions pressure manufacturers to reformulate phenolic resins, increasing R&D costs and compliance complexities.

- Growing demand for bio-based phenolic resins in sustainable construction and electronics presents a high-growth niche, driven by green building trends.

Market Statistics

- 2024 Market Size: USD 1.77 billion

- 2034 Projected Market Size: USD 2.51 billion

- CAGR (2025–2034): 3.5%

Phenolic resins, a class of synthetic polymers formed by the reaction of phenol with formaldehyde, are widely recognized for their excellent thermal stability, mechanical strength, and resistance to chemicals. In the U.S., the market is driven by the rising focus on sustainability and the development of bio-based phenolic resins. Bio-based alternatives are being increasingly integrated into manufacturing processes, offering reduced environmental impact without compromising performance, with industries shifting toward eco-friendly solutions. This transition aligns with broader sustainability goals, as these resins are sourced from renewable feedstocks, making them a viable choice for companies looking to balance efficiency with environmental responsibility. As a result, the adoption of bio-based phenolic resins is expected to strengthen their role in diverse industrial applications.

Sustainability and regulatory influence contribute to the growth opportunities, as industries face growing pressure to adopt environmentally responsible materials while adhering to strict compliance standards. Regulatory bodies are increasingly emphasizing the reduction of carbon emissions, formaldehyde content, and overall environmental impact, which has encouraged manufacturers to innovate with greener formulations and bio-based alternatives. A May 2025 report from the U.S. EPA stated that U.S. energy-related CO₂ emissions decreased by less than 1%, 23 million metric tons, in 2024. Phenolic resins, known for their durability, fire resistance coating, and recyclability, align well with these evolving requirements, making them a preferred choice in industries seeking sustainable solutions. This dual push from regulatory frameworks and corporate sustainability goals accelerates the adoption of eco-friendly phenolic resins and also strengthens their long-term role as essential materials in modern industrial practices.

Drivers & Opportunities

Increasing Use in Electronics & Electrical Applications: The increasing use of phenolic resins in electronics and electrical applications is boosting the growth opportunities, owing to their excellent insulating properties, thermal stability, and flame resistance. These characteristics make them ideal for use in circuit boards, switches, connectors, and insulation materials where reliability and safety are critical. The demand for materials that resist high temperatures and electrical stress continues to rise as electronic devices become more compact and powerful. Phenolic resins address these needs effectively, ensuring performance durability while meeting strict safety standards. This growing reliance on phenolic resins in the electronics sector strengthens their market position by supporting advancements in consumer electronics, automotive electronics, and industrial electrical systems.

Growing Demand in Industrial and Wood Adhesives: The U.S. phenolic resins market is driven by the growing demand in industrial and wood adhesives, where their strong bonding properties, durability, and resistance to moisture make them highly preferred. Phenolic resins are extensively used in plywood, laminated veneer lumber, and other engineered wood products, supporting the growth of the construction and furniture industries. According to an August 2025 report from the U.S. Census Bureau, in the U.S., total construction spending reached USD 2.136 trillion in June 2025, an increase of 0.4%, highlighting growth opportunities for plywood, OSB, and laminated veneer lumber. In addition, their application extends to industrial adhesives in sectors such as automotive and electronics, where high performance under extreme conditions is required. This expanding use across critical sectors enhances product performance and also reinforces the versatility of phenolic resins, positioning them as an important material driving innovation and reliability in adhesive technologies.

Segmental Insights

Product Analysis

Based on product, the U.S. phenolic resins market segmentation includes novolac, resols, and other phenolic resins. The novolac segment accounted for 49.09% revenue share in 2024 due to its superior heat resistance, mechanical strength, and ability to perform under high-stress conditions. These properties make novolac resins highly suitable for applications such as coatings, abrasives, and insulation materials, where durability and thermal stability are essential. Their consistent performance and compatibility with various additives further enhance their adoption across industries. Additionally, their versatility in manufacturing processes makes them a preferred choice for sectors seeking reliable materials with long service life.

The resols segment is expected to witness the highest CAGR of 5.0% during the forecast period, owing to its wide applicability in adhesives, laminates, and molding compounds. Resols cure under heat and pressure without requiring additional hardeners, making them cost-effective and efficient for large-scale applications. Their strong adhesion, water resistance, and flame-retardant properties add to their appeal in industries such as construction, automotive, and electrical. Resols are positioned as a major growth driver in the U.S. phenolic resins market with the rising demand for advanced composites and high-performance adhesives.

Application Analysis

In terms of application, the U.S. phenolic resins market segmentation includes wood adhesives, molding, insulation, laminates, paper impregnation, coatings, refractory materials, friction material, rubber & tire, electronics, and abrasives. The wood adhesives segment held 22.82% of the revenue share in 2024 due to the extensive use of phenolic resins in engineered wood products such as plywood, particleboard, and laminated veneer lumber. Their strong bonding strength, resistance to moisture, and long-lasting performance make them a reliable choice in the woodworking and construction industries. Wood adhesives based on phenolic resins continue to gain prominence in both residential and commercial projects as demand for durable and sustainable building materials rises.

The molding segment is expected to witness the highest CAGR of 4.6% during the forecast period due to the increasing adoption of phenolic molding compounds in automotive, electronics, and consumer goods. These resins offer excellent dimensional stability, thermal resistance, and mechanical strength, making them ideal for manufacturing precision components. Their ability to replace traditional metals and plastics in high-stress applications drives their usage. Moreover, the growing demand for lightweight and durable materials across industries is expected to propel the expansion of phenolic resin-based molding applications.

End Use Analysis

The U.S. phenolic resins market segmentation, based on end use, includes building & construction, automotive, electrical & electronics, furniture, and other end uses. The automotive segment held 34.94% share in 2024, attributed to the extensive use of phenolic resins in brake pads, clutches, filters, and under-the-hood components. Their heat resistance, mechanical stability, and ability to perform in high-friction environments make them indispensable in ensuring vehicle safety and efficiency. Phenolic resins are increasingly being adopted in both conventional and electric vehicles with the shift toward lightweight yet durable materials, further consolidating their dominance in the automotive sector.

The building & construction segment is expected to witness a substantial CAGR of 3.4% during the forecast period due to the rising demand for engineered wood, laminates, and insulation materials. Phenolic resins provide excellent durability, fire resistance, and strong bonding properties, which are highly valued in modern construction practices. Their role in energy-efficient insulation products also aligns with the industry’s focus on sustainable and environmentally friendly building solutions. Continued infrastructure development and residential projects will further support the segment’s steady expansion in the coming years.

Key Players & Competitive Analysis

The U.S. phenolic resins industry is shaped by strategic investments, emerging market segments, and sustainable value chains, with players such as Hexion, SI Group, and Kolon Industries driving revenue growth through innovation. Disruptions and trends, such as bio-based resin development and stricter environmental regulations, are reshaping competitive positioning, pushing companies to adopt future development strategies. Small and medium-sized businesses are leveraging technological advancements to capture niche demand in high-performance adhesives and electronics. Economic and geopolitical shifts, including supply chain disruptions, influence pricing insights and vendor strategies, while expansion opportunities in the construction and automotive sectors fuel long-term growth projections. Leading firms are also exploring joint ventures and mergers and acquisitions to strengthen their regional footprint and meet latent demand. Industry trends highlight a shift toward eco-friendly formulations, creating revenue opportunities for agile competitors as sustainability becomes a priority. Expert insights suggest that business transformation and supply chain management will be critical in maintaining dominance in this evolving landscape.

A few major companies operating in the U.S. phenolic resins industry include Arclin Inc., Ashland Inc., Bakelite Synthetics, Eastman Chemical Company, Hexcel Corp., Hexion, Kraton Corporation, Olympic Panel Products LLC, Owens Corning, and SI Group.

Key Players

- Arclin Inc.

- Ashland Inc.

- Bakelite Synthetics

- Eastman Chemical Company

- Hexcel Corp.

- Hexion

- Kraton Corporation

- Olympic Panel Products LLC

- Owens Corning

- SI Group

U.S. Phenolic Resins Industry Developments

- June 2025: Sumitomo Bakelite commercialized the world's first solid Novolac-type phenolic resin modified with lignin from non-edible biomass. Targeting automotive applications, this innovation supports GHG reduction and resource circulation while maintaining performance standards, aligning with global sustainability goals.

U.S. Phenolic Resins Market Segmentation

By Product Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Novolac

- Resols

- Liquid Resols

- Solid Resols

- Other Phenolic Resins

By Application Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Wood Adhesives

- Molding

- Insulation

- Laminates

- Paper Impregnation

- Coatings

- Refractory Materials

- Friction Material

- Rubber & Tire

- Electronics

- Abrasives

By End Use Outlook (Volume, Kilotons; Revenue, USD Billion, 2020–2034)

- Building & Construction

- Automotive

- Electrical & Electronics

- Furniture

- Other End Uses

U.S. Phenolic Resins Market Report Scope

|

Report Attributes |

Details |

|

Market Size in 2024 |

USD 1.77 Billion |

|

Market Size in 2025 |

USD 1.83 Billion |

|

Revenue Forecast by 2034 |

USD 2.51 Billion |

|

CAGR |

3.5% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Volume, Kilotons; Revenue in USD Billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Competitive Landscape, Growth Factors, and Industry Trends |

|

Segments Covered |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

|

FAQ's

The market size was valued at USD 1.77 billion in 2024 and is projected to grow to USD 2.51 billion by 2034.

The market is projected to register a CAGR of 3.5% during the forecast period.

A few of the key players in the market are Arclin Inc., Ashland Inc., Bakelite Synthetics, Eastman Chemical Company, Hexcel Corp., Hexion, Kraton Corporation, Olympic Panel Products LLC, Owens Corning, and SI Group.

The novolac segment accounted for 49.09% revenue share in 2024.

The molding segment is expected to witness the highest CAGR of 6.7% during the forecast period.