Smart City Platforms Market Share, Size, Trends, Industry Analysis Report

By Offering (Services, Platforms); By Delivery Model; By Application; By Region; Segment Forecast, 2024 - 2032

- Published Date:Jan-2024

- Pages: 116

- Format: PDF

- Report ID: PM3956

- Base Year: 2023

- Historical Data: 2019-2022

Report Outlook

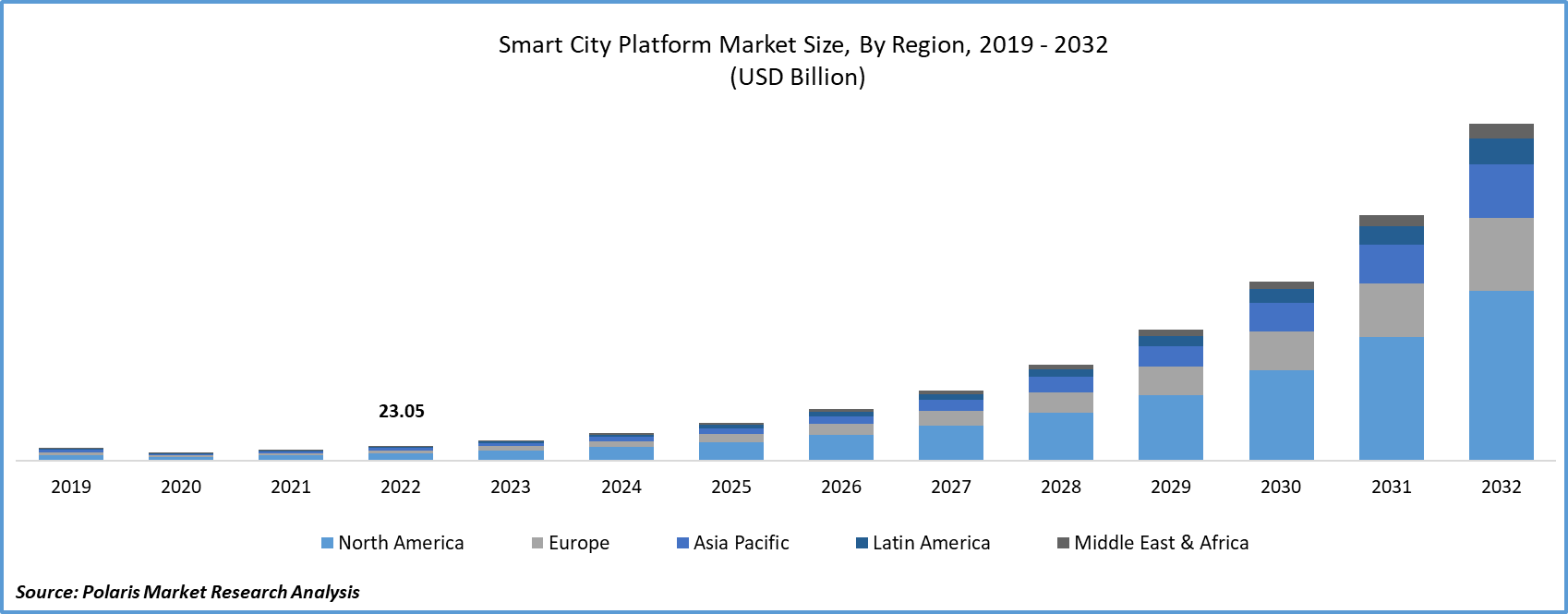

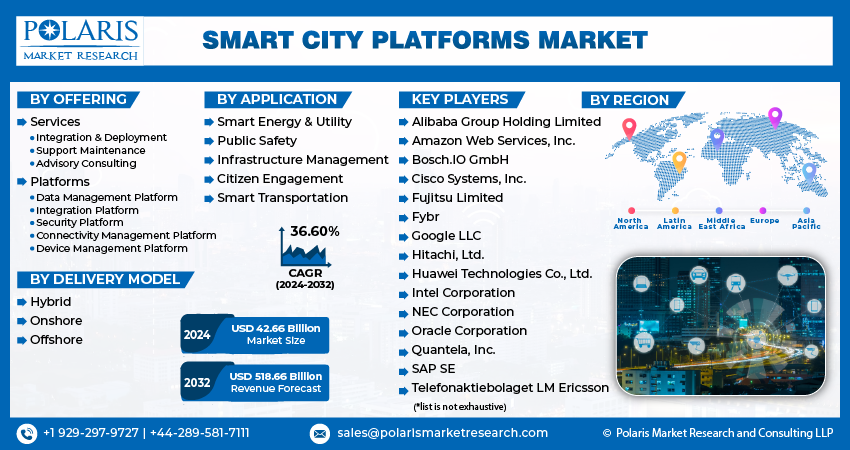

The global smart city platforms market size and share was valued at USD 31.34 billion in 2023 and is expected to grow at a CAGR of 36.60% during the forecast period.

The smart city platform serves as a foundation for fostering citizen engagement, open discourse, and cooperative efforts between the public and government using cutting-edge technologies and digital channels. Furthermore, not only have smaller municipalities implemented smart meters to gauge electricity usage, but larger metropolises have also embraced an extensive range of systems and technologies for overseeing crucial operations and monitoring functions, thus facilitating the operation of intricate smart city applications. These encompass various aspects such as smart city illumination, building automation, emergency response management, security and access control, advanced energy grids, sustainable energy sources, water treatment and distribution, transportation solutions, and much more.

A smart city is a technologically urban area that makes use of different types of electronic methods and sensors to improve operational efficiency and share information with the public. The main aim of a smart city is to improve city operations and support economic growth by using smart technologies and data analysis. Also, it aims at improving the quality of life for its citizens. The value of a smart city is based on its implementation of technology, not just how much technology it may have.

Several characteristics, including a technology-based infrastructure, environmental initiatives, and an effective public transportation system, determine a city’s smartness. Smart city platforms act as a way to unify data and information from siloed systems in place. These platforms offer a way to visualize and manage data and optimize overall city operations. The rising usage of IoT technology for urban surveillance and infrastructure supervision is anticipated to support the smart city platforms market growth.

To Understand More About this Research: Request a Free Sample Report

The smart city platform serves as a foundation for fostering citizen engagement, open discourse, and cooperative efforts between the public and government using cutting-edge technologies and digital channels. Furthermore, not only have smaller municipalities implemented smart meters to gauge electricity usage, but larger metropolises have also embraced an extensive range of systems and technologies for overseeing crucial operations and monitoring functions, thus facilitating the operation of intricate smart city applications. These encompass various aspects such as smart city illumination, building automation, emergency response management, security and access control, advanced energy grids, sustainable energy sources, water treatment and distribution, transportation solutions, and much more.

- For instance, in January 2022, the Indian government has allocated a sum of INR 28,413.6 crore for the development of 100 smart cities.

The global proliferation of smart cities is driven by ongoing urbanization, contributing to smart city platforms market expansion. As per United Nations projections, by 2050, India is expected to see an addition of 404 million urban residents, China 292 million, and Nigeria 212 million to their existing populations.

The research study offers an in-depth analysis of the competitive landscape in the industry. It examines the top players in the smart city platforms market on the basis of multiple factors, including market position, sales, new developments and products/services offered. Also, it details the key strategies like mergers, partnerships and collaborations that have been taken by smart city platforms industry key players to improve their position in the market.

Government initiatives and investments are increasingly emphasizing platform providers over independent, smart solutions due to the scalability and the ability to integrate various other smart solutions.

Industry Dynamics

Growth Drivers

- Increasing usage of IoT technology for urban surveillance and infrastructure supervision will facilitate market growth

IoT facilitates seamless connectivity between businesses and governmental bodies, offering a multitude of smart possibilities, including smart utilities, smart transportation, and smart cities. Through IoT, these entities gain access to real-time location-based data. Additionally, IoT generates vast volumes of real-time data from numerous sources. The successful implementation of IoT solutions in smart city initiatives requires collaborative efforts from a diverse range of stakeholders, including telecom operators, manufacturers, infrastructure vendors, service providers, user communities, and public sectors. Governments worldwide endorse the use of the Public-Private Partnership (PPP) model to advance smart city projects.

Report Segmentation

The market is primarily segmented based on offering, delivery model, application, and region.

|

By Offering |

By Delivery Model |

By Application |

By Region |

|

|

|

|

To Understand the Scope of this Report: Speak to Analyst

By Offering Analysis

- The Services segment held the largest revenue share in 2022

In the forecasted period, the services sector is anticipated to display a notably higher growth rate. Additionally, smart city platform providers offer a range of services aimed at enhancing the efficient setup, progression, and continuous maintenance of organizational operations. These services provide assistance to customers, support teams, partners, employees, and marketing teams, creating opportunities for individual development and training.

By Application Analysis

- The Infrastructure Management segment accounted for the highest market share during the forecast period

In 2022, the smart infrastructure sector held a dominant position in the smart cities market, and this trend is anticipated to persist throughout the forecast period. The increasing impact of digital transformation on people's daily lives is a key driver of the rising demand for smart infrastructure solutions. Furthermore, the disruptions in the supply chain caused by the pandemic have further fueled the growth of this segment, as businesses increasingly rely on smart infrastructure solutions to manage their resources effectively.

However, the smart energy sector is projected to experience the most substantial growth in the coming years, primarily due to the increasing demand for IoT-powered energy applications, including smart energy grids and smart meters. Additionally, various government initiatives that endorse the implementation of smart energy solutions are expected to propel the smart energy market segment.

By Delivery Model Analysis

- The Onshore segment accounted for the highest market share during the forecast period

Onshore services refer to services provided to end-users within the same legal jurisdiction. These services are experiencing increased demand as companies increasingly favor partnering with service providers operating within their own country. Additionally, outsourcing to organizations within the same country brings advantages associated with shared regulations.

Regional Insights

- North America dominated the largest market in 2022

North America has established itself as the predominant regional market for smart cities in terms of revenue, primarily due to the widespread adoption of smart city solutions, substantial ICT investments by government organizations, and a high demand for interconnected solutions across the region.

This region is at the forefront of smart city platform development. IoT technology for smart cities empowers cities with cutting-edge intelligence and flexibility, enabling them to optimize resource utilization and enhance various aspects, ranging from air and water quality to transportation, energy, and communication systems. According to Smart America, U.S. city governments are projected to invest approximately USD 41 trillion over the next two decades to modernize their infrastructure and harness the advantages of IoT technology.

The Asia-Pacific region is poised for substantial growth in the forecasted period, driven by a combination of government initiatives and the prevailing digital transformation trends in the region, which are anticipated to boost market expansion in this area.

Key Market Players & Competitive Insights

The market is characterized by intense competition, with established players relying on advanced technology, high-quality products, and a strong brand image to drive revenue growth. These companies employ various strategies such as research and development, mergers and acquisitions, and technological innovations to expand their product portfolios and maintain a competitive edge in the market.

Some of the major players operating in the global market include:

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Bosch.IO GmbH

- Cisco Systems, Inc.

- Fujitsu Limited

- Fybr

- Google LLC

- Hitachi, Ltd.

- Huawei Technologies Co., Ltd.

- Intel Corporation

- International Business Machines Corporation (IBM)

- KaaIoT Technologies, LLC.

- Microsoft Corporation

- NEC Corporation

- Oracle Corporation

- Quantela, Inc.

- SAP SE

- Telefonaktiebolaget LM Ericsson

Recent Developments

- In May 2022, Datumate entered into a strategic distribution partnership with Hitachi Solutions to broaden digital transformation efforts in Japan and worldwide. Under this multi-year agreement, Hitachi Solutions, Ltd. will incorporate Datumate's construction analytics platform into its portfolio of professional services.

- In March 2022, Juganu, an Israeli company specializing in LED lighting and communication solutions, teamed up with Qualcomm, Nokia, and Abdi to present its 5G and smart city solutions. Juganu and Qualcomm have a longstanding partnership in the smart city and communication sectors, having previously worked together on projects in Brazil and the United States.

- In October 2021, Huawei has introduced GreenSite and PowerStar2.0 as part of its SRAN product lineup. This release is designed to support network operators in constructing environmentally friendly and low-carbon 5G networks.

- In May 2021, IBM introduced enhancements in artificial intelligence (AI), hybrid cloud, and quantum computing. These upgrades are intended to assist its partners and clients in accelerating their digital transformation, adopting more intelligent return-to-work strategies, and fostering strategic ecosystems to drive improved business outcomes.

Smart City Platforms Market Report Scope

|

Report Attributes |

Details |

|

Market size value in 2024 |

USD 42.66 billion |

|

Revenue Forecast in 2032 |

USD 518.66 billion |

|

CAGR |

36.60% from 2024 – 2032 |

|

Base year |

2023 |

|

Historical data |

2019 – 2022 |

|

Forecast period |

2024 – 2032 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2024 to 2032 |

|

Segments Covered |

By Offering, By Delivery Model, By Application, By Region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America; Middle East & Africa |

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

Navigate through the intricacies of the 2024 smart city platforms market with precision, thanks to the comprehensive statistics on market share, size, and revenue growth rate assembled by Polaris Market Research Industry Reports. This thorough analysis not only provides a glimpse into the historical context but also extends its reach with a market forecast outlook until 2032. Immerse yourself in the richness of this industry analysis by securing a complimentary PDF download of the sample report.