Patient Monitoring Devices Market Size, Share, & Industry Analysis Report

: By End Use (Hospitals, Ambulatory Surgery Centers, Home Care Settings, and Other), By Product, and By Region – Market Forecast, 2025–2034

- Published Date:Oct-2025

- Pages: 120

- Format: PDF

- Report ID: PM2840

- Base Year: 2024

- Historical Data: 2020-2023

What is the patient monitoring devices market size?

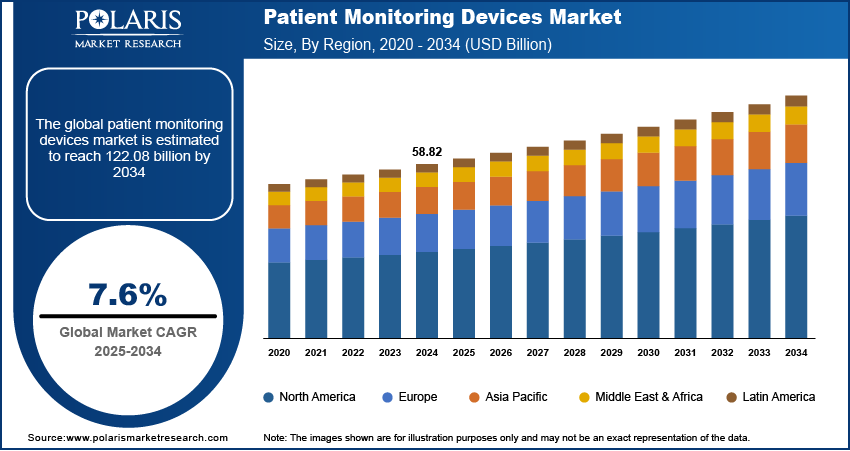

The patient monitoring devices market size was valued at USD 58.82 billion in 2024. It is projected to grow from USD 63.15 billion in 2025 to USD 122.08 billion by 2034, exhibiting a CAGR of 7.6% during 2025–2034.

Key Insights

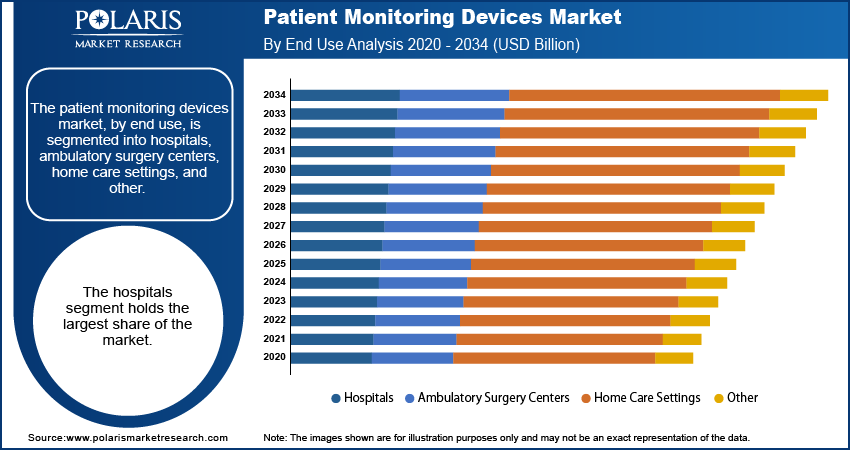

- By end use, the hospitals segment held the largest share in 2024 due to the extensive utilization of a wide array of patient monitoring devices for critical and continuous surveillance within hospital settings.

- By product, the cardiac monitoring devices segment held the largest share in 2024 as this includes devices like ECG devices, implantable loop recorders, and mobile cardiac telemetry monitors, which are essential for diagnosing and managing heart-related conditions.

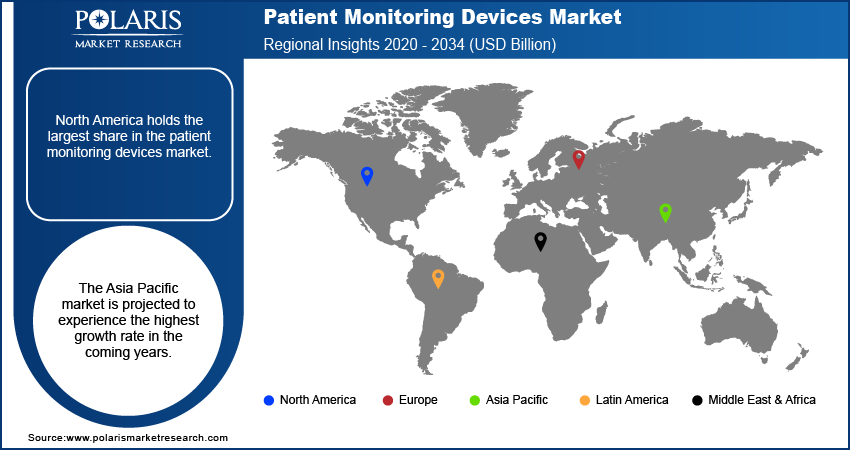

- By region, North America held the largest share in 2024 due to the region's well-established, technologically advanced healthcare infrastructure, high healthcare expenditure, and the early adoption of innovative medical technologies.

Industry Dynamics

- Growing elderly populations worldwide are a major driver, as they are more susceptible to chronic illnesses like cardiovascular diseases and diabetes.

- The rise in prevalence of various chronic diseases, such as Chronic Obstructive Pulmonary Disease (COPD) and heart failure, significantly fuels the demand.

- Advancements in wireless and sensor technology are key growth factors, leading to the development of sophisticated, portable, and user-friendly systems.

Market Statistics

- 2024 Market Size: USD 58.82 billion

- 2034 Projected Market Size: USD 122.08 billion

- CAGR (2025-2034): 7.6%

- North America: Largest market in 2024

Impact of AI on Market

- AI algorithms analyze vast amounts of patient data from sources like wearables, remote patient monitoring (RPM) devices, and electronic health records (EHRs).

- AI helps create tailored treatment and care plans by processing a patient's unique health profile, including vital signs, lifestyle data, and medical history.

- By automating the analysis of complex data and prioritizing high-risk patients for follow-up, AI helps reduce the workload on clinical staff.

To Understand More About this Research:Request a Free Sample Report

The patient monitoring devices industry encompasses a range of medical tools and systems designed to continuously or periodically measure and record patients' vital signs and physiological functions. These devices are essential in various healthcare settings, including hospitals, clinics, and home care, enabling healthcare professionals to monitor patients' conditions in real-time. The industry is driven by the increasing prevalence of chronic diseases such as cardiovascular diseases, diabetes, and respiratory disorders, which require continuous monitoring devices such as ambulatory blood pressure monitoring devices. The growing geriatric population also contributes significantly to the expansion, as older adults are more susceptible to chronic ailments.

Technological advancements play a crucial role in the growth. Innovations in wireless and wearable technology have led to the development of devices that offer continuous health monitoring with minimal disruption to daily activities. These devices such as patient temperature monitoring can track various health parameters, including heart rate, sleep quality, and physical activity. The increasing adoption of remote patient monitoring (RPM) is another key driver, allowing healthcare providers to monitor patients' health from a distance, reducing the need for frequent hospital visits. This trend is further supported by the growing emphasis on early diagnosis and preventive care, which encourages the use of handheld multi-parameter monitoring devices for regular health assessments.

Market Dynamics

Which are the major driving factors in patient monitoring devices market?

Rising Prevalence of Chronic Diseases

Chronic conditions such as cardiovascular diseases, diabetes, and respiratory illnesses often require continuous or frequent monitoring to manage effectively and prevent complications. According to the National Center for Biotechnology Information (NCBI), a research paper published in 2023 highlighted the substantial global burden of chronic diseases, noting that they are the leading cause of mortality and disability worldwide. The World Health Organization (WHO) states that chronic diseases, such as cardiovascular diseases, cancer, chronic respiratory diseases, and diabetes, are the leading causes of death and disability worldwide, accounting for 71% of all deaths globally. The Centers for Disease Control and Prevention (CDC) reports that in the US, 6 in 10 adults have a chronic disease, and 4 in 10 adults have two or more, indicating a substantial burden on the healthcare system. The need for regular monitoring of vital signs and disease-specific parameters in these patients fuels the demand for a wide range of monitoring devices, including blood glucose monitors, cardiac monitors, and respiratory monitoring systems. This growing prevalence of chronic diseases directly contributes to the rising adoption of patient monitoring devices by increasing the need for tools that facilitate proactive health management and timely intervention.

Growing Geriatric Population

Older adults are more prone to various age-related health conditions and chronic diseases, necessitating regular health monitoring. Data from the United Nations Department of Economic and Social Affairs, published in 2022, projects a significant increase in the global population aged 65 years and above in the coming decades. The United Nations projects that the global population aged 65 years and above is set to double within the next thirty years. By 2050, one in six people in the world will be over age 65, up from one in 11 in 2019. Moreover, WHO states that the number of people aged 60 years and above worldwide is projected to increase from 1 billion in 2020 to 1.4 billion by 2030, and further to 2.1 billion by 2050. This demographic shift is increasing the demand for patient monitoring devices that can be used in home healthcare settings and long-term care facilities, enabling continuous surveillance of their health status. The rising number of elderly individuals requiring constant health supervision and transplant monitoring kits is a significant factor propelling the development of patient monitoring devices.

Technological Advancements and Remote Patient Monitoring

Technological advancements, particularly in wireless communication and sensor technology, are fostering the penetration of patient monitoring devices. These advancements have enabled the development of sophisticated, user-friendly devices capable of continuous and remote monitoring. A study published in the National Institutes of Health (NIH) in 2021 discussed the growing adoption and benefits of remote patient monitoring (RPM) technologies, which allow healthcare providers to track patients' health data remotely, improving patient outcomes and reducing healthcare costs. The ability to monitor patients outside of traditional clinical settings, facilitated by these technological innovations, is significantly boosting the demand for patient monitoring devices and driving the overall outlook.

Segmental Insights

Market Assessment By End Use

The patient monitoring devices market, by end use, is segmented into hospitals, ambulatory surgery centers, home care settings, and other. The hospitals segment holds the largest share. This is attributed to the extensive utilization of a wide array of patient monitoring devices within hospital settings. Hospitals require sophisticated equipment for continuous monitoring in critical care units, operating rooms, and general wards. The high volume of patients requiring constant surveillance for various medical conditions and surgical procedures contributes significantly to the substantial penetration of monitoring devices in this segment. Furthermore, the presence of advanced healthcare infrastructure and skilled professionals in hospitals facilitates the adoption and widespread use of these technologies.

The home care settings segment is anticipated to exhibit the highest growth rate in the foreseeable future. This growth is fueled by the increasing preference for home-based healthcare, advancements in remote monitoring technologies, and the rising geriatric population requiring long-term care. The availability of user-friendly and portable monitoring devices enables patients to manage their health conditions conveniently at home, reducing the need for frequent hospital visits. Moreover, the growing emphasis on cost-effective healthcare solutions and the increasing adoption of telehealth services further contribute to the expanding potential of patient monitoring devices in home care settings. This shift toward remote and personalized healthcare is expected to drive significant development in this segment.

Market Evaluation By Product

The segmentation, by product, includes blood glucose monitoring systems, cardiac monitoring devices, multi-parameter monitoring devices, respiratory monitoring devices, temperature monitoring devices, hemodynamic/pressure monitoring devices, fetal & neonatal monitoring devices, neuromonitoring devices, weight monitoring devices, and others. The cardiac monitoring devices segment commands the largest share, due to the high prevalence of cardiovascular diseases globally and the critical need for continuous and accurate monitoring of cardiac activity for diagnosis and management. The increasing incidence of heart-related ailments, coupled with advancements in cardiac monitoring technologies such as electrocardiography (ECG) and Holter monitors, contributes significantly to the substantial penetration of these devices. The essential role of cardiac monitoring in critical care and routine diagnostics solidifies its leading position.

The neuromonitoring devices segment is anticipated to experience the highest growth rate in the coming years. This rapid growth is driven by the increasing awareness and diagnosis of neurological disorders, advancements in neuroimaging and monitoring technologies, and the growing demand for continuous brain monitoring in critical care settings and for research purposes. The development of sophisticated electroencephalography (EEG) systems, intracranial pressure monitors, and cerebral oximetry devices is expanding the clinical applications of neuromonitoring. Furthermore, the rising prevalence of conditions such as epilepsy, stroke, and traumatic brain injuries necessitates advanced neuromonitoring solutions, thereby fueling significant development and presenting substantial potential for this segment.

Regional Analysis

The global market exhibits significant regional variations in market dynamics, size, and demand. North America and Europe have historically held a substantial share, especially the Italy patient monitoring devices market, attributed to their well-established healthcare infrastructure, high healthcare expenditure, and early adoption of advanced medical technologies. Asia Pacific is emerging as a high-growth region, driven by increasing healthcare awareness, a growing geriatric population, rising disposable incomes, and improving healthcare access. Latin America and the Middle East & Africa represent markets with increasing potential, witnessing gradual adoption of patient monitoring devices due to improving healthcare infrastructure and rising healthcare investments.

North America holds the largest share, owing to the region's sophisticated healthcare system, high prevalence of chronic diseases, and strong presence of major players. Furthermore, favorable reimbursement policies and significant investments in research and development contribute to the widespread adoption of advanced monitoring technologies across various healthcare settings, including hospitals and home care. The emphasis on continuous patient surveillance and the integration of advanced technologies boost the North America patient monitoring devices market expansion.

The Asia Pacific patient monitoring devices market is projected to experience the highest growth rate in the coming years. This rapid expansion is fueled by a large and aging population, increasing healthcare expenditure, and a rising awareness of the benefits of continuous patient monitoring. Furthermore, the growing prevalence of chronic diseases, coupled with improving healthcare infrastructure and increasing government initiatives to enhance healthcare access, is creating significant demand trends. The region's increasing adoption of advanced medical technologies and the growing focus on home healthcare solutions contribute to its high growth trajectory.

Key Players and Competitive Insights

Who are the key player in patient monitoring devices market?

A few of the major players in the patient monitoring devices market include Medtronic plc; GE HealthCare; Koninklijke Philips N.V.; Nihon Kohden Corporation; Abbott Laboratories; Mindray Medical International Ltd.; Masimo Corporation; Omron Healthcare, Inc.; Drägerwerk AG & Co. KGaA; and Baxter International Inc. These companies offer a wide range of patient monitoring solutions, including cardiac monitors, blood glucose monitoring systems, multi-parameter monitors, respiratory monitoring devices, and neuromonitoring devices, among others, catering to diverse healthcare needs across various settings.

The competitive analysis reveals a landscape characterized by intense rivalry and continuous innovation. Key players are consistently focusing on technological advancements to enhance the accuracy, portability, and connectivity of their devices. This includes the integration of wireless capabilities, remote monitoring features, and artificial intelligence to improve patient outcomes and streamline healthcare workflows. The industry also sees strategic collaborations, partnerships, and new product launches as companies strive to expand their penetration and address the increasing demand driven by the rising prevalence of chronic diseases and the growing geriatric population.

Koninklijke Philips N.V. (Netherlands): Headquartered in Amsterdam, Netherlands, Philips Healthcare offers a comprehensive portfolio of patient monitoring solutions that span various medical domains. Their offerings include advanced multi-parameter monitors, cardiac monitoring systems, fetal and neonatal monitoring devices, and sleep monitoring solutions. Philips focuses on integrating its monitoring technologies with other healthcare informatics and digital platforms, emphasizing connectivity and data management to support clinical decision-making and improve patient care in hospital, home, and ambulatory settings. Their continuous innovation and broad product range make them a significant player in addressing the diverse needs of the patient monitoring devices industry.

Medtronic plc (Ireland): With its operational headquarters in Dublin, Ireland, Medtronic has been in medical technology, offering an extensive range of healthcare solutions, including sophisticated patient monitoring devices. Their product portfolio includes advanced cardiac monitors, respiratory monitoring systems, and neuromonitoring devices, often integrated with their therapeutic devices.

List of Key Companies in Patient Monitoring Devices Market

- Abbott Laboratories

- Baxter International Inc.

- Drägerwerk AG & Co. KGaA

- GE HealthCare

- Koninklijke Philips N.V.

- Masimo Corporation

- Medtronic plc

- Mindray Medical International Ltd.

- Nihon Kohden Corporation

- Omron Healthcare, Inc

Patient Monitoring Devices Industry Developments

- April 2025: BD unveiled the HemoSphere Alta, an advanced hemodynamic monitoring platform equipped with AI-powered predictive algorithms such as the Cerebral Autoregulation Index (CAI) and Hypotension Prediction Index (HPI).

- May 2024: Omron Healthcare India partnered with AliveCor to launch AI-enabled portable ECG devices, including India’s first FDA-cleared device that integrates blood pressure and ECG monitoring.

- February 2024: Philips received the US Food and Drug Administration (FDA) 510(k) clearance for its latest IntelliVue patient monitor software. This software is designed to reduce patient monitoring alarm noise by modifying alarm intervals and softening the tones.

- May 2024: Medtronic announced that its HealthCast intelligent patient monitoring solution won the "Best New Technology Solution - Monitoring" award at the 8th annual MedTech Breakthrough Awards. HealthCast is a portfolio of remote monitoring, connectivity, and interoperable solutions designed to enable clinicians to continuously monitor patients from any location within a hospital.

Patient Monitoring Devices Market Segmentation

By End Use Outlook (Revenue – USD Billion, 2020–2034)

- Hospitals

- Ambulatory Surgery Centers

- Home Care Settings

- Other

By Product Outlook (Revenue – USD Billion, 2020–2034)

- Blood Glucose Monitoring Systems

- Self-monitoring Blood Glucose Systems

- Continuous Glucose Monitoring Systems

- Cardiac Monitoring Devices

- ECG Devices

- Implantable Loop Recorders

- Event Monitors

- Mobile Cardiac Telemetry Monitors

- Smart/Wearable ECG Monitors

- Multi-parameter Monitoring Devices

- Low-acuity Monitoring Devices

- Mid-acuity Monitoring Devices

- High-acuity Monitoring Devices

- Respiratory Monitoring Devices

- Pulse Oximeters

- Spirometers

- Capnographs

- Peak Flow Meters

- Temperature Monitoring Devices

- Handheld Temperature Monitoring Devices

- Table-top Temperature Monitoring Devices

- Wearable Continuous Monitoring Devices

- Invasive Temperature Monitoring Devices

- Smart Temperature Monitoring Devices

- Hemodynamic/Pressure Monitoring Devices

- Hemodynamic Monitors

- Blood Pressure Monitors

- Disposables

- Fetal & Neonatal Monitoring Devices

- Fetal Monitoring Devices

- Neonatal Monitoring Devices

- Neuromonitoring Devices

- Electroencephalography Machines

- Electromyography Machines

- Cerebral Oximeters

- Intracranial Pressure Monitors

- Magnetoencephalography Machines

- Transcranial Doppler Machines

- Weight Monitoring Devices

- Digital

- Analog

- Others

By Regional Outlook (Revenue – USD Billion, 2020–2034)

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Netherlands

- Russia

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- Malaysia

- South Korea

- Indonesia

- Australia

- Rest of Asia Pacific

- Middle East & Africa

- Saudi Arabia

- UAE

- Israel

- South Africa

- Rest of Middle East & Africa

- Latin America

- Mexico

- Brazil

- Argentina

- Rest of Latin America

Patient Monitoring Devices Market Report Scope

|

Report Attributes |

Details |

|

Market Size Value in 2024 |

USD 58.82 billion |

|

Market Size Value in 2025 |

USD 63.15 billion |

|

Revenue Forecast by 2034 |

USD 122.08 billion |

|

CAGR |

7.6% from 2025 to 2034 |

|

Base Year |

2024 |

|

Historical Data |

2020–2023 |

|

Forecast Period |

2025–2034 |

|

Quantitative Units |

Revenue in USD billion and CAGR from 2025 to 2034 |

|

Report Coverage |

Revenue Forecast, Market Competitive Landscape, Growth Factors, and Industry Insights |

|

Segments Covered |

|

|

Regional Scope |

|

|

Competitive Landscape |

|

|

Report Format |

|

|

Customization |

Report customization as per your requirements with respect to countries, regions, and segmentation. |

How is the report valuable for an organization?

Workflow/Innovation Strategy

The patient monitoring devices market has been segmented into detailed segments of end use and product. Moreover, the study provides the reader with a detailed understanding of the different segments at both the global and regional levels.

Market Entry Strategies

Growth and marketing strategies in the field of patient monitoring devices are increasingly focused on technological integration and expanding penetration across diverse healthcare settings. Companies are emphasizing the development of user-friendly, connected devices that can seamlessly integrate with existing healthcare IT infrastructure, enhancing remote patient monitoring capabilities. A key strategy involves targeting the growing home healthcare market with portable and cost-effective solutions. Furthermore, strategic collaborations with healthcare providers and technology partners are crucial for expanding reach and building trust. Educational initiatives and digital marketing efforts are also employed to highlight the benefits of continuous monitoring and early disease detection, driving demand trends and fostering development.

FAQ's

The global market size was valued at USD 58.82 billion in 2024 and is projected to grow to USD 122.08 billion by 2034.

The market is projected to register a CAGR of 7.6% during the forecast period.

North America had the largest share of the market.

A few of the major players are Medtronic plc (Ireland), GE HealthCare (US), Koninklijke Philips N.V. (Netherlands), Nihon Kohden Corporation (Japan), Abbott Laboratories (US), Mindray Medical International Ltd. (China), Masimo Corporation (US), Omron Healthcare, Inc. (Japan), Drägerwerk AG & Co. KGaA (Germany), and Baxter International Inc. (US).

The hospitals segment accounted for the largest share of the market in 2024.

Following are a few of the trends: ? Increasing Prevalence of Chronic Diseases: The rising incidence of conditions such as cardiovascular diseases, diabetes, and respiratory disorders is driving the demand for continuous and remote monitoring solutions. ? Growing Geriatric Population: With an increasing global elderly population more susceptible to chronic ailments, the need for patient monitoring devices, especially in home care settings, is on the rise. ? Technological Advancements: Innovations in sensor technology, wireless connectivity (such as Bluetooth and Wi-Fi), and the internet of medical things (IoMT) are leading to the development of more sophisticated and user-friendly monitoring devices.

Patient monitoring devices are medical instruments and systems used to continuously or periodically measure and record a patient's vital signs (such as heart rate, blood pressure, temperature, respiratory rate, and oxygen saturation) and other physiological parameters. These devices play a crucial role in healthcare by providing real-time data that helps healthcare professionals assess a patient's condition, detect changes, and make timely interventions. They are utilized in various settings, including hospitals, clinics, ambulatory surgery centers, and patients' homes, contributing significantly to improved patient care and management.